- Home

- »

- Medical Devices

- »

-

U.S. Biopharmaceutical CMO & CRO Market Size Report 2030GVR Report cover

![U.S. Biopharmaceutical CMO & CRO Market Size, Share & Trends Report]()

U.S. Biopharmaceutical CMO & CRO Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Mammalian, Non-mammalian), By Service (Contract Manufacturing, Contract Research), By Product (Biologics, Biosimilars), And Segment Forecasts

- Report ID: GVR-4-68040-039-2

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

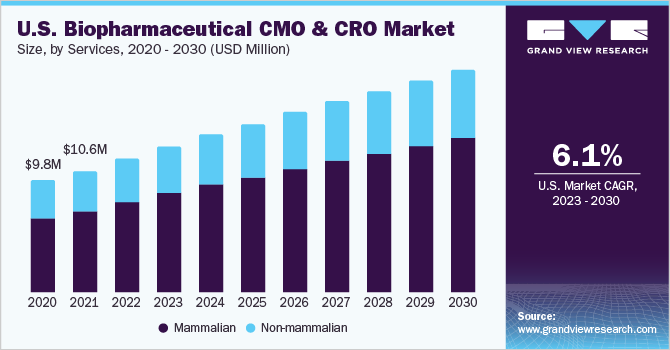

The U.S. biopharmaceutical CMO & CRO market size was valued at USD 10.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. Increasing adoption and investment in advanced research and manufacturing technologies by Contract Manufacturing Organizations (CMOs) & Contract Research Organizations (CROs) based in the U.S. is propelling the growth of the biopharmaceutical CMO & CRO market in the country. In addition, quality services offered by service providers are driving the biopharma and CMO partnerships in the country. In addition, the expansion of foreign CMOs and CROs into the country is expected to propel the growth.

Given the growing demand for high-quality biopharmaceutical products and services, many global companies are expanding their operations in the U.S. biopharmaceutical CMO and CRO market to tap into this lucrative market opportunity. This will likely further drive market growth and create new job opportunities in the U.S. biopharmaceutical industry.

For instance, in 2022, the CEO of Samsung Biologics announced that the company is considering the states of California, North Carolina, Washington, and Texas for its first overseas production facility. The South Korean contract manufacturing organization is exploring these locations as potential strong candidates for the new facility.

The pharmaceutical and biopharmaceutical industry has experienced significant supply chain disruptions due to the COVID-19 pandemic. However, the biopharmaceutical CMOs and CROs have been able to respond effectively to the crisis. These organizations have emerged as beneficiaries of the supply chain disruptions caused by the pandemic.

Not only are CMOs and CROs meeting the increasing demand for more flexible and scalable manufacturing capabilities, but they are also taking steps to reduce supply chain risks and costs by expanding their manufacturing facilities in the U.S. The pandemic has exposed the vulnerability of global supply chains, as critical raw materials and finished products experienced severe disruptions. By locating their manufacturing facilities in the U.S., CMOs, and CROs can mitigate the risks associated with geopolitical events, transportation delays, and other factors that could impact the supply chain.

In addition to reducing supply chain risks, locating manufacturing and research facilities in the U.S. can also enhance the efficiency of product delivery by minimizing shipping costs and lead times. This can enable organizations to deliver their products more quickly and efficiently, thereby enhancing their competitiveness in the market. As such, CMOs and CROs are proactively taking steps to adapt to the challenges posed by the pandemic and emerge as stronger players in the biopharmaceutical industry.

Source Insights

In 2022, the mammalian segment of the biopharmaceutical manufacturing market held the highest market share at 68.4%. This is primarily due to the lack of internal expertise in the biopharmaceutical industry to add human-like post-translational modifications to complex protein therapeutics. Mammalian cells are capable of performing such modifications, making them an attractive option for the production of biologics.

Moreover, advancements in technology have greatly benefited the mammalian cell line segment. The introduction of novel and robust enhanced expression systems, improved process monitoring solutions, cell line engineering tools, automated screening methods, and disposable devices have all contributed to a more efficient and productive manufacturing process of biologics using mammalian cells.

While mammalian cells dominate the biopharmaceutical manufacturing market, non-mammalian cell lines such as microbial cells are also gaining recognition as potent factories for biologics. Innovative strategies are being implemented to identify and explore the potential of various microbes, which is expected to contribute to the growth of the non-mammalian biopharmaceutical manufacturing segment. With the ongoing development of new technologies and approaches, the biopharmaceutical manufacturing market is expected to witness significant growth in the coming years, providing new opportunities for both mammalian and non-mammalian cell lines.

Service Type Insights

Over the forecast period, the contract research segment is expected to exhibit a higher CAGR of 6.9%, primarily due to the increasing trend of outsourcing research activities by biopharmaceutical companies. Furthermore, CROs are striving to capitalize on the potential avenues in the biopharmaceutical industry.

New market entrants and small participants that are focused on developing biopharmaceuticals are anticipated to opt for contract research services for their discovery programs of new candidates, which is expected to boost the revenue growth of CROs. As more biopharma companies and research firms seek to reduce costs and increase efficiency, outsourcing is likely to remain a key trend in the industry, providing ample opportunities for the contract research segment to expand its market share.

Many CMOs and opportunistic CMOs present in the market are engaged in providing biopharma entities with end-to-end coverage, from cell cultivation to fill/finish services. Moreover, clients are investing heavily in outsourcing the manufacturing aspect of their product development program, which has resulted in the largest share of this segment. With the presence of many CMOs and CROs providing a wide range of services, this segment is expected to continue to gain momentum in the coming years.

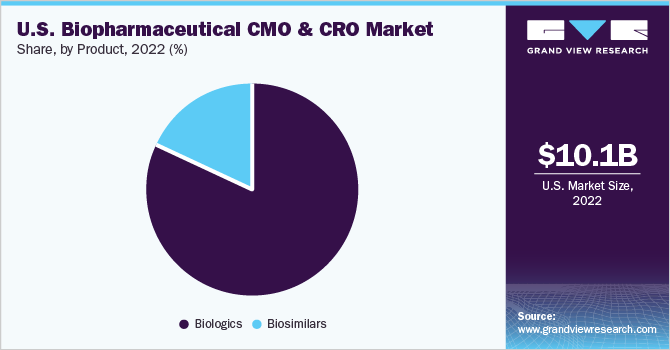

Product Insight

The biologics segment is expected to dominate the market with the largest revenue share of 82.4% in 2022. This growth is attributed to the high specificity of biologics, complex manufacturing steps, and higher success rates compared to other drug molecules, resulting in the dominance of this segment.

The use of innovative technologies such as single-use bioreactors, continuous purification processing, disposable plastic containers, and real-time quality analysis has enabled CMOs to meet the increasing demand for biologics production effectively. Additionally, several companies are investing in biosimilar development to outperform the safety, efficacy, disposition, or cost of earlier in-class innovator drugs. This has increased the level of competition among innovator manufacturers, which in turn, is likely to benefit the CMOs.

As the biologics market continues to grow and biosimilar development gains traction, CMOs are expected to play a critical role in the manufacturing process. The use of advanced technologies and techniques is likely to further enhance their ability to provide high-quality, efficient, and cost-effective manufacturing services. This, in turn, will drive the growth of the biologics segment and the overall CMO & CRO market.

Key Companies & Market Share Insights

To gain a competitive advantage over other players in the CMO & CRO market, companies are undertaking various strategic initiatives. Key parameters affecting the competitive nature of the market include acquisitions, geographic expansions, mergers and acquisitions, and product launches. For instance, in February 2023, Lonza announced the opening of a new laboratory in Cambridge, Massachusetts, as part of the Swiss CDMO’s plan to expand its early development services (EDS) division in North America.

The expanded services by Lonza are focused on helping customers identify and address potential problems with drug candidates during the early stages of development and before clinical trials to help reduce the risks of failure. The new facility will serve preclinical-stage small and mid-sized biotechs looking to develop biologic drugs. This expansion is expected to enhance Lonza's market presence in North America and strengthen its position in the CMO & CRO market. Such strategic initiatives by players in the market are likely to drive growth, promote innovation, and enhance their overall market competitiveness. Some prominent players in the U.S. biopharmaceutical CMO and CRO market include:

-

Catalent

-

Boehringer Ingelheim GmbH

-

Thermo Fisher Scientific Inc

-

Lonza

-

Rentschler Biopharma SE

-

FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

-

Samsung Biologics

-

AGC Biologics

-

WuXi Biologics

-

Abzena

U.S. Biopharmaceutical CMO & CRO Market Report Scope

Report Attribute

Details

Market Size value in 2023

USD 11.1 billion

Revenue forecast in 2030

USD 16.7 billion

Growth Rate

CAGR 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, service, product

Country scope

U.S.

Key companies profiled

Catalent; Lonza Group AG; Boehringer Ingelheim GmbH; Rentschler Biopharma SE; Thermo Fisher Scientific, Inc; AGC Biologics; Fujifilm Diosynth Biotechnologies U.S.A., Inc.; Samsung Biologics; WuXi Biologics; AbbVie Inc.; Charles River Laboratories International, Inc.; ICON Plc; Parexel International Corporation; Labcorp, Abzena

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biopharmaceutical CMO & CRO Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biopharmaceutical CMO & CRO market report based on source, service, and product:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian

-

Non-mammalian

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Manufacturing

-

Process Development

-

Downstream

-

Upstream

-

-

Fill & Finish Operations

-

Analytical & QC studies

-

Packaging

-

-

Contract Research

-

Oncology

-

Inflammation & Immunology

-

Cardiology

-

Neuroscience

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Monoclonal antibodies (MAbs)

-

Recombinant Proteins

-

Vaccines

-

Antisense, RNAi, & Molecular Therapy

-

Others

-

-

Biosimilars

-

Frequently Asked Questions About This Report

b. The U.S. biopharmaceutical CMO & CRO market size was estimated at USD 10.1 billion in 2022 and is expected to reach USD 11.1 billion in 2023.

b. The U.S. biopharmaceutical CMO & CRO market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 16.7 billion by 2030.

b. The mammalian segment of the U.S. biopharmaceutical CMO & CRO market held the highest market share of 68.4%. This is attributable to the introduction of novel and robust enhanced expression systems, improved process monitoring solutions, cell line engineering tools, automated screening methods, and disposable devices have all contributed to a more efficient and productive manufacturing process of biologics using mammalian cells.

b. Some key players operating in the U.S. biopharmaceutical CMO & CRO market include Catalent; Lonza Group AG; Boehringer Ingelheim GmbH; Rentschler Biopharma SE; Thermo Fisher Scientific, Inc; AGC Biologics, Fujifilm Diosynth Biotechnologies U.S.A., Inc.; Samsung Biologics; WuXi Biologics, AbbVie Inc., Charles River Laboratories International, Inc., ICON Plc, Parexel International Corporation; Labcorp, Abzena.

b. Key factors that are driving the biopharmaceutical CMO & CRO market growth include increasing adoption and investment in advanced research and manufacturing technologies by Contract Manufacturing Organizations (CMOs) & Contract Research Organizations (CROs) based in the U.S. is propelling the growth of biopharmaceutical CMO & CRO market in the country. In addition, quality services offered by service providers are driving the biopharma and CMO partnerships in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.