U.S. Biscuits Market Size & Trends

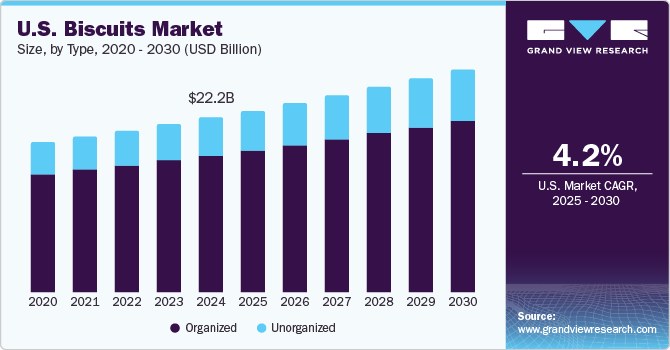

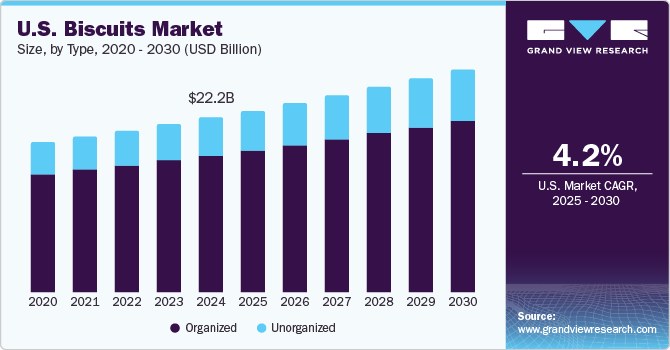

The U.S. biscuits market size was valued at USD 22.19 billion in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. The growth of this market is primarily influenced by changing consumer preferences and the increasing availability of diverse portfolios characterized by different flavors, shapes, sizes, tastes, and more. The inclusion of healthy ingredients such as oats, millet, and others in product formulation is also contributing to the surge in demand.

A large number of individual customers shifting towards healthy diets and wellness-oriented fitness regimes have stimulated major companies to diversify their existing portfolios. This includes low-sugar biscuits, low-calorie products, multigrain cookies, and fruit-flavored products specifically designed for children. Noteworthy enhancements in product innovations have influenced this market in recent years. For instance, in February 2024, VOORTMAN BAKERY, one of the market participants in the U.S. biscuits industry, introduced newly developed portfolio additions of reduced-sugar cookies. The company states that this new product line has 25% less sugar than some of the applauded cookies while maintaining taste and flavor.

Growing demand for premium range products such as gourmet cookies, handmade biscuits, and others also adds growth opportunities for this market. Products made with high-quality ingredients, real fruit contents, higher nutrition contents, and the lowest processing or use of complex machinery are in higher demand. Improved availability of such products and other biscuits offered by consumer goods companies or food & beverage industry participants through multiple channels such as supermarkets, online portals, convenience stores, and others also influences the growth of this market.

Type Insights

The organized segment dominated the U.S. biscuits industry based on type, with a revenue share of 78.3% in 2024. This is attributed to factors such as the availability of products through vast distribution networks effectively managed by supply chain experts and manufacturing companies. Increasing awareness regarding healthy lifestyles, growing inclination towards buying packaged goods, technology advancements, and availability of cost-effective tools have also encouraged multiple participants to move from the unorganized sector to an organized business environment.

The unorganized segment is projected to experience the fastest growth during the forecast period. The growth in this segment is mainly driven by the increasing development of in-house products by coffee shops and the availability of various appliances and kitchen technology. Additionally, there is a rising demand for handmade, gourmet, premium-range cookies from diverse consumer groups, along with improved access to information.

Product Insights

Crackers held the largest revenue share of the U.S. biscuits industry in 2024. This is attributed to growing demand from health-conscious customers, enhanced consumption stimulated by the growing inclination towards home entertainment, packaging innovations such as resalable bags, portion-controlled packets, and more. Increasing availability of crackers through online portals and product innovations such as the launch of novel flavors has also added significant growth opportunities. For instance, in January 2024, Kellanova introduced CHEEZ-IT extra crunchy, with two different varieties. This includes crunchy, bold cheddar and crunchy, sharp white cheddar.

The filled/coated biscuits segment is expected to experience significant growth during the forecast period. Changes in lifestyle and growing demand from household consumers have been driving the development of this segment. Additionally, product innovations are expected to develop a surge in demand. For instance, in January 2023, the well-applauded brand of Ferrero, Nutella, launched Nutella biscuits, baked crunchy outsides filled with Nutella chocolate.

Source Insights

Based on the source, wheat-based biscuits dominated the U.S. biscuits industry in 2024. This is attributed to factors such as enhanced awareness regarding the role of dietary preferences in well-being, increasing demand for healthy products, growing innovation, and efforts by major companies to align product portfolios with consumer preferences. Additionally, wheat requires a comparatively lower number of complex machinery for processing and offers convenience as a major advantage for the manufacturers.

The millet segment is projected to experience notable growth during the forecast period. Growing awareness regarding the benefits offered by millets, increasing encouragement by healthcare professionals to include millets in the diet, and a rise in demand from health-conscious consumers are adding to the growth of this market. The gluten-free nature of millet also plays a vital role in the increasing utilization of biscuit manufacturers.

Distribution Channel Insights

The supermarket segment held the largest revenue share of the U.S. biscuits industry in 2024. Companies and marketers prefer using supermarkets for offline distribution over others, as it ensures enhanced brand visibility facilitated by continuous footfall. The presence of multiple brands operating in the organized retail industry with a large network of supermarkets and hypermarkets adds to growth opportunities.

The e-commerce segment is projected to experience the fastest CAGR from 2025 to 2030. This is attributed to aspects such as increasing inclination towards online shopping and additional benefits offered by e-commerce businesses, such as doorstep delivery, display of product reviews, detailed product information and ingredient lists, and others.

Key U.S. Biscuits Company Insights

Some of the key companies in the U.S. biscuits market are Mondelēz International, Kellanova, Britannia Industries, General Mills Inc., Nestlé, and others. To address the growing demand from urban consumers and increasing competition, the market participants have adopted strategies such as improved distribution, enhanced focus on product innovation, new product launches, and collaborations with other brands in the food and beverage industry.

-

Mondelēz International, a company specializing in food product offerings, operates brands such as Oreo, Clif Bar, LU, Ritz, Tate's Bake Shop biscuits, and more. Its biscuit brands include Barni, Chips Ahoy, Honey Maid, Kinh Do, Oreo, Prince, Tiger, Wheat Thins, and others.

-

Ferrero offers multiple products from various product categories, such as confectionery, chocolates, cookies, and others. It operates multiple brands, such as Nutella, Murray Sugar Free Cookies, Little Brownie Bakers, Keebler, and more. Its global presence and diversified product portfolio, supported by strong distribution networks, have added significant value to its brand positioning in recent years.

Key U.S. Biscuits Companies:

- Mondelēz International

- Britannia Industries

- Kellanova

- United Biscuits

- PARLE

- General Mills Inc.

- Nestlé

- The Campbell's Company

- Ferrero

- PARTNERS

Recent Developments

-

In September 2024, Mondelēz International announced that for the packaging of one of its brands, Triscuit Crackers’ products, it will source chemical or molecular recycling technology-related plastics in the U.S. and Canada. By embracing innovation-based packaging technology, Triscuit plans to support the company’s long-term strategy to reduce waste while promoting sustainability in terms of packaging.

-

In October 2024, Ferrero-related company CTH Invest SA acquired Nonni’s Foods LLC, a brand offering products characterized by traditional taste and innovation, from Vestar Capital Partners. This is expected to enhance customer engagements facilitated by Ferrero's vast distribution networks.

U.S. Biscuits Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 23.11 billion

|

|

Revenue forecast in 2030

|

USD 28.40 billion

|

|

Growth Rate

|

CAGR of 4.2% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, product, source, distribution channel

|

|

Key companies profiled

|

Mondelēz International; Britannia Industries; Kellanova; United Biscuits; PARLE; General Mills Inc.; Nestlé; The Campbell's Company; Ferrero; PARTNERS

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Biscuits Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the U.S. biscuits industry report based on type, product, source, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cookies

-

Filled/Coated Biscuits

-

Crackers

-

Flat Crackers

-

Saltine Crackers

-

Filled Crackers

-

Graham Crackers

-

Cream Wafers

-

Others

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Oats

-

Wheat

-

Millets

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialist Retail Stores

-

E-commerce

-

Convenience Stores

-

Supermarkets

-

Others