- Home

- »

- Healthcare IT

- »

-

U.S. Burial Insurance Market Size And Share Report, 2030GVR Report cover

![U.S. Burial Insurance Market Size, Share & Trends Report]()

U.S. Burial Insurance Market (2023 - 2030) Size, Share & Trends Analysis Report By Coverage Type (Level Death Benefit, Guaranteed Acceptance), By Age Of End-user, By State, And Segment Forecasts

- Report ID: GVR-4-68039-975-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

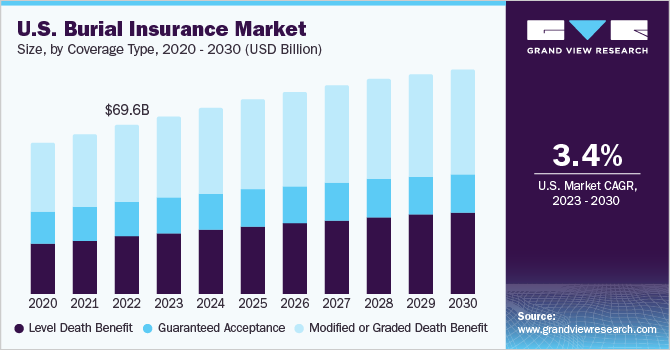

The U.S. burial insurance market size was estimated at USD 69.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. Key growth drivers include expanding the health insurance sector, digitization, and a rise in government initiatives. The demand for funeral services and their associated expenses is expanding as a result of people's increasing awareness of the need to “make wise decisions today for peace of mind tomorrow.” This trend is primarily supported by the fact that prices for many products and services are rising quickly, and while funeral costs are rising as well, but are not doing so at a rate that is keeping up with inflation. Moreover, even though funeral costs are not rising at the same rate as inflation, they have increased significantly in recent years.

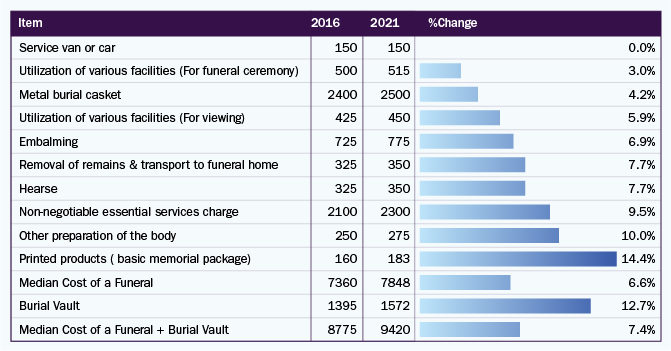

For instance, the 2021 National Funeral Directors Association (NFDA) Member General Price List Study found that while the median cost of a funeral climbed by 11.3 % to USD 6,970 over the previous five years, the cost of a funeral with cremation increased by just 6.6 % to USD 7,848. For the same period, the total inflation rate was 13.98 %.

Median Funeral Price in the Country

Furthermore, the market for burial insurance as a whole is benefiting from the growth of the health insurance sector including the increase in digitalization and internet use.

Surviving loved ones frequently feel financial hardship during a period of intense grief since they have no way to cover these costs. This, combined with the COVID-19 Pandemic, has drawn the attention of governments, and thus, from April 2021, FEMA begin to reimburse funeral costs up to USD 9,000, or about the average cost of a funeral. This will raise public awareness of funeral costs and spur increased government action, which will bring viewers to health insurers and boost the market over the forecast period.

In addition, noteworthy government initiatives and related acts have been put in place, such as the Affordable Care Act, to ensure that everyone receives acceptable comprehensive coverage regardless of their circumstances.

Additionally, according to a press release from the White House, US President Joe Biden stated on April 5, 2022, that his administration plans to expand the Affordable Care Act (ACA) to improve access to coverage and reduce costs, potentially raising the percentage of Americans who are insured. As a result, more Americans may decide to have their health insurance cover funeral costs, resulting in rising demand for burial insurance over the forecast period.

Age Of End-user Insights

Based on age of end-user, the market is segmented into over 50, over 60, over 70, and over 80. One of the main determinants of how much a policy would cost is age. Senior policyholders in particular start looking for plans that tend to cover all parts of expenses, including burial fees, because funeral prices are often greater in the U.S. and can burden families when loved ones die away. Therefore, incorporating a payment for funeral costs in insurance plans benefits both the individual policyholder and their family substantially.

The U.S. Census Bureau's International Database for Population by Age for the U.S. revealed that individuals between the ages of 60 and 69 are significantly more common than individuals in other older age categories. This shows that people in that age group may be more inclined to choose these sorts of policies since the U.S. is one of the more developed and health-conscious nations, where people are typically aware of their health status and the benefits of health insurance. As a result, the segment of people aged over 60 and over 70 is dominating the market and is expected to maintain its dominance throughout the forecast period.

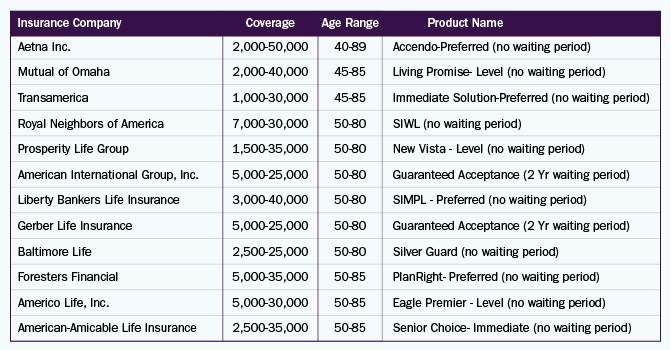

Here are a few well-known providers, their product names, and associated information

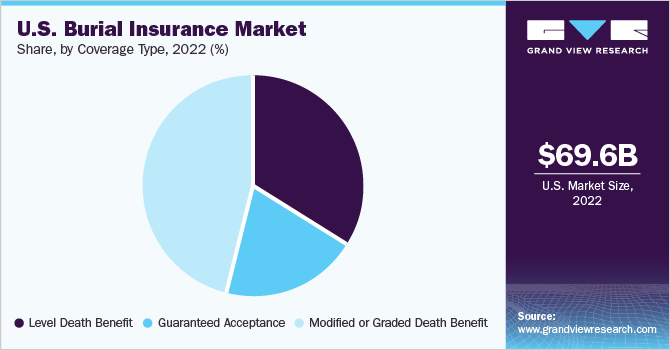

Coverage Type Insights

Most last expenditure life insurance plans don't need a medical check regardless of age. Based on coverage type, the market is segmented into level death benefit, guaranteed acceptance, and modified or graded death benefit.

A level death benefit option in an insurance policy guarantees coverage that immediately pays out the whole death benefit. Whether the insured individual dies in the first or last years of the policy's term, doesn't matter. Additionally, this is the only form of final cost insurance that offers the insured full and immediate pay. Consumer adoption of level-depth benefit plans, which would expand quickly owing to the similarly low rates, would be the segment's primary growth driver.

Moreover, the modified or graded death benefit market held the largest revenue share of over 46% in 2021. Modified or graded death benefits have disadvantages as do other insurance plans, but they are still an option for people with a variety of health problems because the insurance industry is exposed to substantial risk by excluding any medical examination and associated tests. It is also anticipated that this market segment will grow throughout the projection period, driven by a rise in the number of people who have serious illnesses preferring to buy such plans that also cover funeral costs.

State Insights

Because several insurance companies provide integrated health, life, and death insurance, in 2022 California, New York, and Texas owned the largest shares of the entire United States. Additionally, the Affordable Care Act in the US mandates the need for comprehensive coverage, which will act as one of the major drivers for the US industry and assist the market's growth throughout the course of the forecast period. As a result of the market's development, more providers are attempting to break into it by broadening its geographic reach and offering policies to a larger population. One such current market strategy is growing the Online Sales Strategy.

Key Companies & Market Share Insights

Strategic initiatives by key players, such as collaborations, acquisitions, and partnerships with emerging players also contribute to market growth. For instance, in an agreement with Sixth Street subsidiaries Talcott Resolution Life Insurance Company and Resolution Life, Allianz Life will reinsure a portfolio of fixed index annuities worth USD 35 billion on December 3, 2021. The transaction is in line with the Allianz Group's goal to improve balance sheet capital management to increase synergies with its wealth management business and build value in its life insurance firm.

Key market highlights for the year 2022 include:

-

In November 2022, Nassau Financial Group, L.P. stated that its subsidiary, Nassau Life Insurance Company, has purchased Delaware Life Insurance Company of New York from that company.

-

In February 2022, Fidelity Life purchased Westpac Life for USD 400 million. Westpac Life changed its name to Fidelity Insurance in line with the transaction and signed a 15-year agreement with Westpac NZ for the distribution of life insurance. As part of this deal, Westpac New Zealand will sell Fidelity Insurance products to its retail consumers for the next 15 years.

-

In October 2022, Allianz Life Insurance Company of North America contributed USD 500,000 to the Twin Cities' financial sustainability. Allianz Life's USD 50,000 contributions to ten groups assist people to achieve financial success by providing equal access to resources and chances for productive work

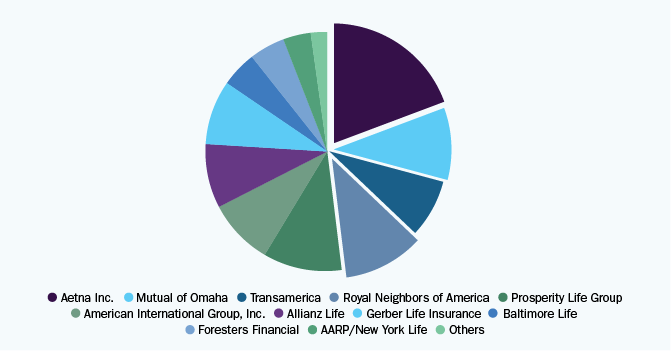

Notable Providers’ Market Presence in the U.S.

Some prominent players in the U.S. burial insurance market include:

-

Aetna Inc.

-

Mutual of Omaha

-

Transamerica

-

Royal Neighbors of America

-

Prosperity Life Group

-

American International Group, Inc.

-

Allianz Life

-

Gerber Life Insurance

-

Baltimore Life

-

Foresters Financial Services Inc (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’)

-

AARP/New York Life

-

Globe Life Inc. (Globe Life and Accident Insurance Company)

-

Colonial Penn

U.S. Burial Insurance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 92.59 billion

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage type, age of end-user, state

State scope

California; Texas; Florida; New York; Pennsylvania; Illinois; Ohio; Georgia; Rest of the U.S.

Key companies profiled

Aetna Inc.; Mutual of Omaha; Royal Neighbors of America; Allianz Life; Gerber Life Insurance; Baltimore Life; Foresters Financial Services Inc (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’); Globe Life Inc. (Globe Life and Accident Insurance Company); Fidelity Life Association; Colonial Penn

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Burial Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. burial insurance market report based on coverage type, age of end-user, and state:

-

Coverage Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Level Death Benefit

-

Guaranteed Acceptance

-

Modified Or Graded Death Benefit

-

-

Age of End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Over 50

-

Over 60

-

Over 70

-

Over 80

-

-

State Outlook (Revenue, USD Billion, 2018 - 2030)

-

California

-

Texas

-

Florida

-

New York

-

Pennsylvania

-

Illinois

-

Ohio

-

Georgia

-

Rest of the U.S.

-

Frequently Asked Questions About This Report

b. The global U.S. burial insurance market size was estimated at USD 69.60 billion in 2022 and is expected to reach USD 73.26 billion in 2023.

b. The global U.S. burial insurance market is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 92.59 billion by 2030.

b. The Modified or Graded Death Benefit coverage type segment in the U.S. burial insurance market accounted for 45.46% of the overall revenue in 2022 driven by a rise in the number of people who have serious illnesses preferring to buy such plans that also cover funeral costs.

b. Some key players operating in the U.S. burial insurance market include Aetna Inc., Mutual of Omaha, Royal Neighbors of America, Allianz Life, Gerber Life Insurance, Baltimore Life, Foresters Financial Services Inc (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’), Globe Life Inc. (Globe Life and Accident Insurance Company), Fidelity Life Association, Colonial Penn

b. Key factors that are driving the U.S. burial insurance market growth include the growing aging population and digitization, growing awareness of funeral insurance, the rising cost of funeral expenditure, and growing competition and related collaboration to bring in a better product for the policy seekers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.