- Home

- »

- Medical Devices

- »

-

U.S. Burn Care Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Burn Care Market Size, Share & Trends Report]()

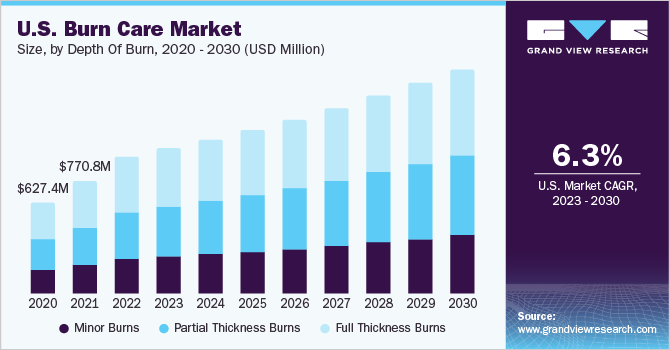

U.S. Burn Care Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Depth Of Burn (Minor Burns, Partial Thickness Burns, Full Thickness Burns), By Cause, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-064-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

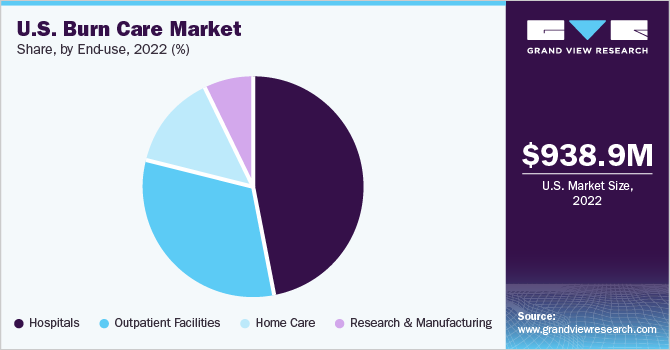

The U.S. burn care market size was valued at USD 938.9 million in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 6.33% from 2023 to 2030. The increasing incidence of burn-related injuries is a major factor likely to boost market growth over the forecast period. Rising demand for minimally invasive procedures to improve cosmetic appeal for patients suffering from burns is a key contributing factor to market growth. Rising concern regarding esthetic appearance among patients is a notable factor increasing the demand for burn care products. Moreover, associated advantages with the use of biologics to treat wounds, such as accelerated wound healing, cost-efficiency, and shorter length of hospital stay, are expected to propel market growth.

The COVID-19 pandemic had adversely impacted the burn care market in the U.S., with patients facing difficulties in accessing basic care management centers during lockdowns. During the pandemic, most of the burn care units were open; however, there was a shortage of standard resources and supplies. Low income was independently associated with reduced access to burn care.

Furthermore, the fear of COVID-19 infection led to lower hospital admissions related to minor burn injuries, as well as a decline in the number of minor burn care surgeries. Many hospitals postponed non-essential surgeries, including burn surgeries, to free up resources to treat COVID-19 patients. This resulted in a significant decrease in the number of burn surgeries performed in the U.S., which had a negative impact on the country’s burn care market.

In addition, with most of the people working from home and the shutdown of numerous industrial facilities, the number of fire accidents decreased significantly, leading to fewer cases of burn injuries. As the number of burn surgeries decreased, so did the demand for burn care products such as dressings, grafts, and topical agents. This led to a decrease in sales and revenue for companies that manufacture these products.

The rising geriatric population in the U.S. is one of the factors driving the growth of the burn care market. Older adults are at a higher risk of sustaining burn injuries, which can result in longer recovery times and a higher risk of complications. These disorders frequently result in skin disintegration, ulceration, and the development of persistent wounds. Moreover, wound treatment becomes more difficult in the elderly due to the increased risk of infection; and weak immune system, especially in case of severe wounds, thereby boosting the need for advanced wound care products.

The elderly population is more prone to burn injuries due to age-related issues, and with the growing geriatric population, the demand for burn injury treatment options is expected to increase. For instance, according to the U.S. Census Bureau, in 2020, there were approximately 56 million people aged 65 and older in the United States, representing 17% of the total population. By 2030, it is projected that this number will increase to 74 million, or 21% of the total population.

Technological advancements are projected to have a significant impact on the burn care industry in the coming years. The quality of life of patients suffering from chronic wounds improves as technology advances and becomes more affordable. Traditional wound care and closure products are gradually being replaced by advanced offerings due to their efficacy in wound management by allowing quicker healing.

The rising demand for skin grafts is yet another major factor boosting market growth. The recent trend of burn care and treatment has shifted to a more comprehensive approach, which not only focuses on recovery from burn injury but also improvement in long-term function & form of the healed injury and quality of life. Owing to this trend, the demand for skin grafts and other skin substitutes in the treatment & management of acute burns has increased and is rising at a constant pace.

Skin grafts are majorly used on partial & full thickness burns and have an important role in the treatment of burn injuries. Skin grafts can be biological or synthetic in nature. Biological sources of skin grafts include cadaver skin, skin from the patient itself, and skin obtained from another donor, either an allograft or xenograft.

As per a research study published in April 2022, titled “Skin Regeneration, Repair, and Reconstruction: Present and Future”, for covering burnt areas on the face, hands, and over big joints, the full-thickness skin graft has proven to be the most effective option, both functionally and visually. Considering that the robust dermal component prevents extensive scarring with subsequent shrinkage, the demand for skin grafts is predicted to increase, which is expected to boost the market growth.

Product Insights

The advanced dressings segment led the market with 42.27% of the revenue share in 2022. Moreover, this segment is expected to dominate the product segment and exhibit significant growth over the forecast period, owing to the availability of a wide product range and their extensive application in burn injury management. Advanced dressings are made to make it easier for fluid to move around a wound's surface and offer benefits such as less recuperation time, ease of use, and cost-effectiveness.

Furthermore, advanced wound dressings control the wound surface by maintaining moisture or absorbing exudate, thus protecting the wound base and tissue surrounding the wound. This is a major reason that they are used extensively in the burn care market and hence, this segment is projected to occupy a major share in the analyzed market over the projection period.

The biologics segment is expected to exhibit the fastest growth over the forecast period in the U.S. burn care market, owing to the introduction of new products and extensive R&D in this field. Biologics involve the application of active biological agents and molecules, such as monoterpenes (sulbogin, thymol, sericin), which are antioxidants, antimicrobials, and anti-inflammatory in nature.

Biologic dressings also include skin grafts (allografts, xenografts, autografts, or cadaveric human skin) and tissue-engineered products designed to replace the function & form of skin, either temporarily or permanently. A major advantage of biologic skin dressings or skin grafts is that the skin is readily available from the patient itself.

Depth of Burn Insights

The full-thickness burns segment dominated the market with a 40.76% revenue share in 2022 and is expected to witness moderate growth due to the rising number of patients. According to the U.S. FDA, approximately 2,760 patients having severe burn injuries of more than 30% of TBSA are hospitalized every year. Moreover, the rising number of government and non-government organizations for burn care treatment is driving the market.

Partial thickness burns, also known as second-degree burns, are burns that affect the outer layer of skin (epidermis) and the underlying layer of skin (dermis). These burns are usually caused by exposure to heat, such as flames, hot liquids, or hot objects. They include burns that are greater than 10% and less than 30% of TBSA.

These burns are serious and carry a high risk of infections, due to which they should be properly treated in consultation with a healthcare professional. The symptoms of partial thickness burns include pain, redness, blistering, and swelling. The skin may also appear wet or shiny, and there may be white or discolored areas on the burn.

Cause Insights

Thermal burns held the dominant revenue share of 75.57% of the burn care market in 2022, owing to the high incidence of fire-related burn injuries. Thermal burns include all burns caused by fires, steam, flash, hot objects, and hot liquids. Flame burns result from continuous exposure to intense heat due to accidents such as improper use of flammable liquids, house fires, and automobile accidents. According to ABA, fire burns are responsible for 43% of the total burn admissions to burn centers.

Scalding is caused by hot liquids or gases and commonly occurs from exposure to high-temperature tap water in baths or showers, hot cooking oil, steam, and hot drinks. Children are at a high risk of accidental burns. The number of affected skin layers shows the severity of the burn. Thermal burns lead to the immediate formation of blisters on the burnt area and are surrounded by areas of erythema. Primary treatment of thermal burns includes lowering skin temperature by putting water on the burnt area and then applying medicines prescribed by the physician.

Friction burns are caused due to abrasions owing to the skin rubbing against any hard surface. Friction burns are also referred to as carpet burns and rope burns. The incidence of friction burns is high; however, most of these burns are minor burns, and patients do not visit the hospital for treatment. Friction burns are most common with motorcycle riders and athletes who fall on tracks, courts, or floors.

Motorcycle and bicycle riders are recommended to wear protective clothing that helps in avoiding friction burns during road accidents. Burns due to abuse are more common in underdeveloped and developing countries. These types of burns include burns from child abuse, spousal abuse, assault, and self-immolation. Owing to these reasons, this segment is expected to exhibit growth over the forecast period.

End-use Insights

The hospitals segment accounted for the largest share of 46.93% of the overall burn care market in 2022. Hospitals are a major component in the burn care market, as they are responsible for providing acute care to burn patients, including emergency care, surgical interventions, and postoperative care. Burn centers within hospitals offer specialized care for burn patients, including advanced wound care, pain management, and psychological support.

The burn care outpatient facilities market in the U.S. is a subset of the broader outpatient facilities market and focuses specifically on the diagnosis, treatment, and management of burn injuries in an outpatient setting. They may include specialized clinics, burn centers, and wound care centers.

Key Companies & Market Share Insights

Market players are involved in the development of new products and the expansion of their distribution channels to capture a larger share of the market. They are inclined toward maintaining market competition, delivering economic products, and fulfilling unmet needs. They are also consistently striving to boost their profits through strategies such as geographical expansions, mergers & acquisitions, and new product launches, among others. Some of the prominent names involved in the U.S. burn care market include:

-

3M

-

Hollister Incorporated

-

Cardinal Health

-

Integra LifeSciences Corporation

-

Coloplast Corp.

-

DeRoyal Industries, Inc.

-

Smith & Nephew

-

Convatec Inc.

-

Mölnlycke Health Care AB.

-

Johnson & Johnson

-

PolyNovo Limited

-

Medline

-

Urgo

-

McKesson

-

Hydrofera

U.S. Burn Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,529.68 million

Growth Rate

CAGR of 6.33% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, depth of burn, cause, end-use

Key companies profiled

3M; Hollister Incorporated; Cardinal Health; Integra LifeSciences Corporation; Coloplast Corp; DeRoyal Industries, Inc.; Smith & Nephew; ConvaTec Inc.; Mölnlycke Health Care AB.; Johnson & Johnson; PolyNovo Limited; Medline; Urgo; McKesson; Hydrofera

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Burn Care Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. burn care market report based on product, depth of burn, cause, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Dressings

-

Alginate Dressing

-

Collagen Dressing

-

Hydrogel Dressing

-

Hydrocolloid Dressings

-

Wound Contact Layers

-

Film Dressings

- Foam Dressings

-

Others

-

-

Biologics

-

Traditional Burn Care Products

-

Wound Cleansing Products

-

Wetting Agents

-

Antiseptic

-

Moisturizers

-

Others

-

-

Bandages

-

Gauzes

-

Medical Tapes

-

Others

-

-

Others

-

-

Depth of Burn Outlook (Revenue, USD Million, 2018 - 2030)

-

Minor Burns

-

Partial Thickness Burns

-

Full Thickness Burns

-

-

Cause Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermal

-

Electrical

-

Radiation

-

Chemical

-

Friction

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

Research & Manufacturing

-

Frequently Asked Questions About This Report

b. The U.S. burn care market size was estimated at USD 938.94 million in 2022 and is expected to reach USD 995.75 million in 2023.

b. The U.S. burn care market is expected to grow at a compound annual growth rate of 6.33% from 2023 to 2030 to reach USD 1,529.68 million by 2030.

b. The advanced dressings segment dominated the product segment of burn care market, commanding over 42.49% revenue share in 2022.

b. Some key players operating in the U.S. burn care market include 3M, Hollister Incorporated, Cardinal Health, Integra LifeSciences Corporation, Coloplast Corp., DeRoyal Industries, Inc., Smith & Nephew, ConvaTec Inc., Mölnlycke Health Care AB., Johnson & Johnson, PolyNovo Limited, Medline, Urgo, McKesson Corporation.

b. Key factors that are driving the U.S. burn care market growth include increasing number of burn cases, introduction of innovative advanced wound products, increasing demand for skin grafts, increasing awareness regarding treatment options, and rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.