- Home

- »

- Consumer F&B

- »

-

Hot Drinks Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Hot Drinks Market Size, Share & Trends Report]()

Hot Drinks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Coffee, Tea, Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-3-68038-452-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hot Drinks Market Summary

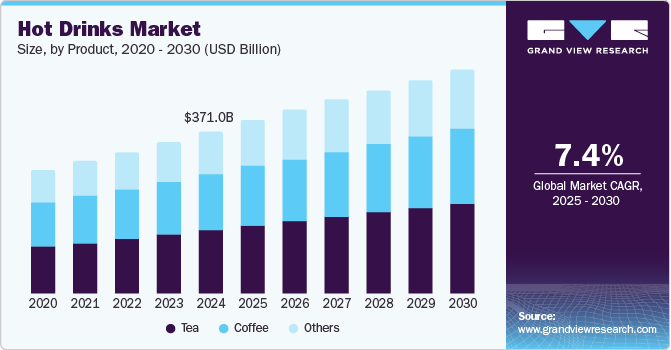

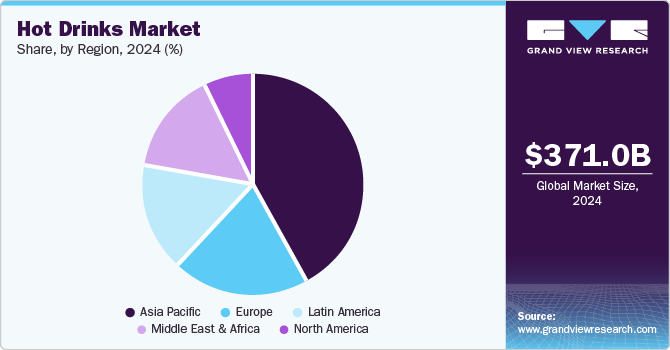

The global hot drinks market size was valued at USD 371.0 billion in 2024 and is projected to reach USD 567.7 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The increasing awareness of the health benefits associated with the consumption of hot beverages, such as green tea, lemon tea, and detox coffee and tea, is a primary driver of the global hot drinks market's growth.

Key Market Trends & Insights

- The Asia Pacific hot drinks dominated the global market with a revenue share of 41.6% in 2024.

- China held the largest revenue share of the regional industry in 2024.

- By product, the tea segment dominated the global hot drinks market with a revenue share of 39.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 371.0 Billion

- 2030 Projected Market Size: USD 567.7 Billion

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

Consumers are shifting their preferences away from carbonated beverages in favor of freshly prepared or brewed hot drinks. Furthermore, the proliferation of instant tea and coffee vending machines and the availability of coffee bars and kiosks in corporate offices and public spaces has significantly contributed to the increased consumption of hot beverages among consumers.

Consumers' daily habits drive a significant portion of hot drink consumption. Individuals often prefer their customary hot beverages, such as black tea or coffee or regular tea or coffee, during their commutes, working hours, and breaks. This consistent preference has sustained steady growth within the hot drinks industry over the years. However, factors such as social media and brand promotion of novel hot beverages encourage consumers to explore specialty hot coffee and tea options twice or thrice per week. Younger generations, including millennials and Gen Z, are particularly inclined to seek variety in their daily routine and experiment with new beverages. According to data published by the National Coffee Association (U.S.), specialty coffee consumption in the U.S. increased by 20% in 2022 compared to 2021. Similar trends were also observed in European and Asia-Pacific countries. Such trends are collectively boosting the overall hot drinks market

In addition to habitual consumption, consumers are also paying close attention to the ingredients in their hot drinks. A growing inclination towards healthy lifestyles and natural flavoring ingredients inspires hot beverage providers to introduce botanicals and flavorings into their beverages. These beverages are purported to help consumers stabilize their moods, improve sleep patterns, and mitigate digestive issues. Consumers are also seeking decaffeinated coffee and tea alternatives, as the number of individuals sensitive to caffeine is increasing. Moreover, the consumption of caffeine can lead to various health problems, including cardiovascular issues, digestive issues, dehydration, and pregnancy loss, among others. In response to these concerns, many cafes have begun offering their customers both caffeinated and decaffeinated options. For instance, leading global brands like Starbucks and Barista Coffee Company allow customers to choose between regular and decaffeinated beverages. Brands such as De'Longhi offer coffee machines capable of brewing decaffeinated hot beverages using specific beans. The hot beverages industry remains committed to adapting to consistently changing trends and offering products that align with the evolving expectations of its customers.

Post-pandemic, consumers were keen to resume social activities and preferred to visit cafes, restaurants, and QSR outlets with friends to enjoy hot beverages. Additionally, employees who were permitted to work remotely post-pandemic sought alternative workspaces in coffee shops and cafes. This shift away from traditional work-from-home setups positively impacted hot beverage demand, encouraging local cafes and multinational franchises to expand into tier 2 and tier 3 cities. As a result, the hot beverage industry recovered more rapidly from the COVID-19 downturn compared to fine-dining restaurants and fast-food joints

Product Insights

Based on product, the tea segment dominated the global hot drinks market with a revenue share of 39.0% in 2024. Tea is the second most consumed beverage globally, surpassed only by water, and the most widely consumed hot beverage worldwide. The United Nations Food and Agriculture Organization estimates that approximately six billion cups of tea are consumed daily. Tea is rich in antioxidants, which boost immunity, reduce inflammation, and prevent cancer. Due to these significant health benefits, tea has become a popular choice for many consumers. Several countries in Europe and Asia Pacific have a strong tea-drinking culture. For example, 90% of the Turkish population consumes tea regularly. Similarly, a substantial portion of the population in countries such as China, India, Vietnam, Ireland, the United Kingdom, Germany, and Spain regularly drinks tea. This widespread consumption has elevated the importance of tea among other hot beverages globally.

Consuming coffee has become a daily habit for many people worldwide. Countries like the U.S., Brazil, Germany, Japan, and Italy are major contributors to the global coffee market in terms of revenue. However, Nordic countries lead in coffee consumption by volume. Finnish consumers, for instance, consume 12 kg of coffee per person annually, followed by Norway (10 kg), Iceland (9 kg), Denmark (8.7 kg), and Sweden (8 kg). As coffee is predominantly consumed hot, it significantly contributes to the global hot drinks industry

Regional Insights

Asia Pacific Hot Drinks Market Trends

The Asia Pacific hot drinks dominated the global market with a revenue share of 41.6% in 2024. The Asia-Pacific region, home to approximately 4.3 billion people, constituting about 60% of the global population, has emerged as the most lucrative market for the hot beverage industry. Countries like China, India, and Indonesia play a significant role in driving this growth. The region has a high concentration of consumers who prefer hot tea or coffee. These beverages are commonly served in social gatherings, ceremonies, and meetings, deeply ingrained in the regional culture. In addition to traditional options, consumers are increasingly exploring specialty hot beverages. Factors such as urbanization and rising disposable incomes are further fueling the growth of the hot drinks market in the region

China held the largest revenue share of the regional industry in 2024. It is the world's largest consumer of both hot beverages and tea, accounting for approximately 40% of global tea consumption. Tea has been an integral part of Chinese culture and is a key component of social gatherings and cultural events. However, younger generations are increasingly drawn to coffee. With over 6,800 Starbucks and 800 Tim Hortons outlets, millennials and Gen Z consumers often prefer coffee over tea. Consequently, China has become dominant in the region's hot drinks industry.

North America Hot Drinks Market Trends

The North America hot drinks market is projected to experience a significant CAGR from 2025 to 2030. Coffee is the most preferred hot drink consumed across the U.S., Canada, and Mexico. The annual coffee consumption in Mexico, Canada, and the U.S. is 3.1, 3.9, and 27.3 million bags, respectively. Each bag weighs 60 kg, a standard unit of measurement. These figures demonstrate the consumption patterns of coffee, both hot and cold. Additionally, the prevalence of cafe culture and dining out further contributes to the growth of the hot beverage industry in North America

U.S. Hot Drinks Market Trends

The U.S. dominated the North American hot drinks market in 2024, primarily driven by coffee, tea, and hot chocolate consumption. Factors such as a diverse range of coffee and tea options and the increasing popularity of ready-to-use hot drink products and coffee are fueling market growth. Moreover, the growing consumer preference for health-conscious alternatives is shifting consumer behavior away from carbonated drinks towards tea and coffee. Given the rising popularity of hot beverages, cafes, and retail coffee franchises are continuously introducing new flavors, specialty options, and artisanal offerings while prioritizing sustainability.

The U.S. dominates the hot drinks market in the North American region and is centered around drinks such as coffee, tea, and hot chocolates. Factors such as a diverse range of coffee and tea options and the growing popularity of ready-to-use hot drink products and coffee are fueling the market growth in the country. Additionally, evolving consumer preference toward health-conscious alternatives is driving the consumer away from carbonated drinks and towards tea and coffee. Considering the growing popularity of hot beverages, cafés and retail coffee franchises continuously offer new flavors and specialty and artisanal options while taking care of sustainability.

Europe Hot Drinks Market Trends

The European hot drinks market is anticipated to experience significant growth during the forecast period. Hot beverage consumption in European countries is substantial. According to data published by the International Coffee Organization, Europe accounted for 31% of global coffee consumption in 2022, consuming approximately 55 thousand bags of coffee that year. While the demand for regular coffee is expected to remain steady, the demand for artisanal and specialty coffee made with higher-quality ingredients is anticipated to drive market growth. Although tea consumption in Europe trails coffee consumption, it remains a popular hot beverage choice across the region. Turkey, Ireland, and the UK are the largest tea-consuming countries in Europe. Other significant tea-consuming countries include Germany, Italy, France, and Spain

Key Hot Drinks Company Insights

Some of the key companies operating in the global hot drinks market are Tazo Tea Company, Tata Global Beverages, Keurig Green Mountain (KGM), Costa Coffee, Starbucks, Celestial seasoning, Inc., Caffe Nero, Ajinomoto General Foods, Inc., and Associated British Foods (ABF). The global hot drinks market is quite fragmented, comprising several international and local players. To stay relevant within this dynamic market, these players undertake strategies such as partnerships with local players, franchise expansion, and continuously introducing new flavors.

-

Starbucks, a U.S.-based global coffeehouse chain, operates over 35,000 stores in 80 countries. Recognized as an innovator in both hot and cold beverages, Starbucks offers a 'third place' between home and work, allowing customers to relax, socialize, or work. The company's customized offerings, tailored to local preferences, have significantly impacted global hot drinks culture.

-

Costa Limited, a European coffeehouse chain, is known for its wide range of coffee and tea beverages. The chain emphasizes quality, sustainability, ethical sourcing, and creating a relaxing customer experience. With over 4,000 Costa Coffee shops and 14,000 smart cafe machines installed worldwide, the chain is in 30 countries.

Key Hot Drinks Companies:

The following are the leading companies in the hot drinks market. These companies collectively hold the largest market share and dictate industry trends.

- Tazo Tea Company

- Tata Global Beverages

- Keurig Green Mountain (KGM)

- Costa Coffee

- Starbucks

- Celestial seasoning, Inc.

- Caffe Nero

- Ajinomoto General Foods, Inc.

- Associated British Foods (ABF)

- Tim Hortons

Recent Developments

-

In November 2024, Costa Coffee, one of the prominent hot drink companies, trialed its first 24-hour drive-thru store in Leicester, UK. The company is exploring the potential for extended opening hours with an objective of catering to night-shift workers, including healthcare professionals and delivery drivers. The company aims to gather feedback on the trials and implement a 24-hour drive-thru across 350 UK sites.

-

In August 2024, Tim Hortons, a Canadian coffee chain, opened its new store in Ahmedabad, India. The company is planning to add 30-40 stores across India and considers the country the fastest-growing market in the world. The brand has stores in 14 cities across the country.

Hot Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 397.3 billion

Revenue forecast in 2030

USD 567.7 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, ANZ, South Korea, Brazil, UAE

Key companies profiled

Tazo Tea Company, Tata Global Beverages, Keurig Green Mountain (KGM), Costa Coffee, Starbucks, Celestial seasoning, Inc., Caffe Nero, Ajinomoto General Foods, Inc., Associated British Foods (ABF)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hot Drinks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hot drinks market report based on product, and region:

-

Product (Revenue, USD Billion, 2018 - 2030)

-

Coffee

-

Tea

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.