- Home

- »

- Homecare & Decor

- »

-

U.S. And Canada Travel Market Size, Industry Report, 2030GVR Report cover

![U.S. And Canada Travel Market Size, Share And Trends Report]()

U.S. And Canada Travel Market (2025 - 2030) Size, Share And Trends Analysis Report By Type (Leisure Travel, Business Travel), By Age Group (21-30, 31-40), By Tourist Type (Domestic, International), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-953-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. And Canada Travel Market Trends

The U.S. and Canada travel market size was estimated at USD 1,537.7 billion in 2024 and is expected to grow at a CAGR of 7.8% from 2025 to 2030.This is attributed to the rebound of leisure and business travel post-pandemic, increased disposable income, and a rising preference for experiential and adventure tourism. The widespread adoption of digital platforms for booking and travel management and the growing demand for sustainable and eco-friendly travel options also play a key role in driving this market growth.

In addition, the effects of long-term issues, such as climate change and economic instability, are becoming more apparent. COVID-19 has resulted in uncertainty ranging from differing entry rules at global borders, such as the number of nationals that can be admitted, under what circumstances, and with what quarantine or related requirements, to refund policies (airfares, hotels, and business event planners. Expedia Group conducted a study of 2,200 Americans in the U.S. in March 2021 to understand the evolution of the travel industry since the onset of the COVID-19 pandemic.

The study concluded that 67% of families in the U.S. took a flexi-cation trip (working and schooling remotely) in 2021, and 13% of people in the U.S. booked an international trip that year. There has been an increasing popularity of value-driven trips that offer money’s worth and brands based on price and convenience, especially among millennial and younger travelers. However, travel has been one of the first and hardest-hit industries since the coronavirus outbreak. Strict lockdowns and shelter-at-home orders in most parts of the world have adversely impacted the travel industry and the assorted ecosystems that rely on it.

Personalized services, reliable transport, exclusivity, and positive and professional staff interaction set the travel benchmark. Traveling around the world is greatly influenced by favorable factors, such as growing political stability, improving attitudes toward gender, ethnicity, sexual orientation, and race, and more accommodating visa regulations. Travelers are looking to create their own unique experiences through flexible itineraries that combine entertainment and relaxation.

Type Insights

Leisure travel accounted for a revenue share of over 33% in 2024, driven by increased disposable spending by consumers in the U.S. and Canada. According to a report published by TripAdvisor in May 2023, high-income millennials in the U.S. were the key spenders on luxury trips, and a majority of them took purpose-driven travels mainly for self-care and relaxation. Such trends are likely to bode well for segment growth.

Business travel is projected to grow at a CAGR of 8.8% from 2025 to 2030. In 2022, U.S. business travel had a significant economic impact, contributing nearly 2% of the country's GDP and supporting 3.5% of total employment. The industry generated USD 421.1 billion in expenditures, leading to USD 119 billion in tax receipts and supporting 6 million jobs. For every dollar spent on business travel, USD 1.15 was added to the U.S. economy. The business travel sector is anticipated to grow further, with a projected increase of 7% above 2019 levels in 2023. The top states in terms of business travel spending included California and New York. "Bleisure" travel, where business and leisure are combined, accounted for over 33% of all trips.

Age Group Insights

The travel market for the 41-60 age group accounted for over 42% of the revenue share in 2024, driven by their significant disposable income and established travel preferences. This demographic, often at a peak in their careers, enjoys the flexibility to travel for leisure and business purposes. Baby boomers, typically aged around 58, take an average of 27 vacation days annually and are known for utilizing all their vacation days, often favoring longer more comfortable trips.Similarly, Generation X (ages 41-58) spends more on vacations, with an average expenditure of USD 914 per trip as of 2023, seeking quality experiences and higher-end accommodations.

The travel market for the 21-30 age group is projected to grow at a CAGR of 8.6% from 2025 to 2030. Although not the primary revenue drivers, millennials (ages 23-38) also significantly contribute to the market. Millennials take an average of 35 vacation days per year, and Generation Z averages 29 days, showing their preference for leisure travel. Both younger generations tend to favor experiential trips, with Millennials drawn to adventure travel and Generation Z increasingly interested in eco-tourism and digital nomad lifestyles.

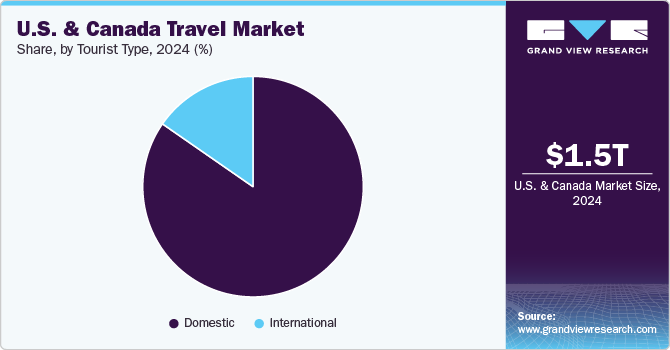

Tourist Type Insights

Domestic travel in the U.S. and Canada accounted for over 84% of the revenue share in 2024. economic stability, convenience, and a wide range of travel options within the countries. The U.S. and Canada have strong infrastructure and extensive domestic travel networks, making it easier for residents to explore their own countries without international travel. Economic factors, such as lower costs compared to international travel and greater accessibility, further encourage domestic tourism.

International travel in the U.S. and Canada is projected to grow at a CAGR of 8.5% from 2025 to 2030, driven by the increasing demand for cross-border travel, enhanced connectivity, and shifting travel trends. With global tourism recovering from the pandemic, U.S. and Canadian travelers are returning to international destinations, spurred by the rising popularity of multi-destination trips and off-the-beaten-path locations. Moreover, a shift toward experiential travel, including cultural exchanges, adventure tourism, and eco-tourism, is driving younger generations to explore international markets.

Country Insights

U.S. Travel Market Trends

The travel market in the U.S. accounted for a revenue share of over 95% in 2024. Due to several key factors, the United States will be the top destination for tourism in 2024. Its diverse landscapes, including national parks, iconic cities, and cultural attractions, offer a wide range of experiences, from beaches to mountains and deserts. Additionally, the U.S. benefits from robust infrastructure, such as well-connected air transport systems, and an active promotion of sustainable tourism and cultural heritage. Major cities like New York and Las Vegas and smaller destinations like Charleston have strong branding and targeted marketing efforts that attract international tourists. Events such as Coachella, the Super Bowl, Mardi Gras, and the U.S. National Park System's immense appeal further enhance its global tourism standing.

Canada Travel Market Trends

The travel market in Canada is projected to grow at a CAGR of 4.3% from 2025 to 2030.Canada has diverse attractions, offering vibrant cities, stunning natural beauty, and a rich cultural heritage. Cities like Vancouver, Toronto, Quebec City, and Ottawa provide a range of exciting experiences for tourists. Vancouver, set against mountains and the Pacific Ocean, is a year-round destination offering breathtaking landscapes and outdoor activities.There has been a notable rise in domestic travel spending, exceeding pre-pandemic levels by 15.16% in 2023. This reflects stronger local demand as Canadians opt to explore their own country.

Key U.S. And Canada Travel Company Insights

The market is highly competitive due to the presence of several companies. Market players are undertaking various strategic initiatives, such as agreements, partnerships, mergers, acquisitions, and the launch of new services to gain higher market share and strengthen their industry position.As traveler preferences evolve, companies explore sustainable travel solutions and niche markets like eco-tourism. This allows them to cater to environmentally-conscious consumers and differentiate their offerings in the highly competitive landscape.

Key U.S. And Canada Travel Companies:

- Expedia, Inc.

- Booking Holdings Inc.

- American Express Global Business Travel (GBT)

- TCS World Travel

- Abercrombie and Kent USA, LLC

- Exodus Travels Ltd.

- BCD Travel

- Intrepid Travel

- Topdeck Travel Ltd.

- Trafalgar

Recent Developments

-

In December 2021, American Express Global Business Travel (GBT) and Sabre formed a multi-faceted strategic relationship to create technologies that helped shape the future of corporate travel distribution. The company enhanced its commitment to Sabre and made a multi-million-dollar, long-term, yearly investment in cooperative technology development with Sabre under the terms of the agreement, which took effect in January 2022.

-

In December 2021, Booking Holdings Inc. announced that it had completed its previously announced acquisition of Getaroom from Court Square Capital Partners for USD 1.2 billion. Getaroom is a B2B hotel room distributor that merged with Booking Holdings Inc. The Priceline brand developed a new strategic partnerships business unit, which operates with the Priceline Partner Network.

-

In November 2021, Intrepid Travel announced the launch of 38 new tours in the U.S., with departures beginning in 2022. Each journey was created to allow travelers to form meaningful connections with the individuals who contribute to the cultural diversity of this vast country

U.S. And Canada Travel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,683.3 billion

Revenue forecast in 2030

USD 2,452.6 billion

Growth rate (revenue)

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD billion/trillion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, age group, tourist type

Country scope

U.S.; Canada

Key companies profiled

Expedia, Inc.; Booking Holdings Inc.; American Express Global Business Travel (GBT); TCS World Travel; Abercrombie and Kent USA, LLC; Exodus Travels Ltd.; BCD Travel; Intrepid Travel; Topdeck Travel Ltd.; Trafalgar

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

- Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Canada Travel Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. and Canada travel market based on type, age group, tourist type, and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Leisure Travel

-

Business Travel

-

Cruise

-

Specialty/Activity/Sports

-

VFR (Visiting Friends and Relatives)

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

21-30 Years

-

31-40 Years

-

41-60 Years

-

60 and Above

-

-

Tourist Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The U.S. and Canada travel market was estimated at USD 1,537.7 billion in 2024 and is expected to reach USD 1,683 billion in 2025.

b. The U.S. and Canada travel market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 2,452.6 billion by 2030.

b. The U.S. dominated the U.S. & Canada travel market with a share of around 95% in 2024. This is attributed to the increasing government steps to resuscitate the economy by funneling funds into the system is assisting various businesses in launching new ventures, which will have a beneficial impact on the expansion of this market.

b. Some key players operating in the U.S. and Canada travel market includes Expedia, Inc., Booking Holdings Inc., American Express Global Business Travel (GBT), TCS World Travel, Abercrombie & Kent USA, LLC, Exodus Travels Limited, BCD Travel, Intrepid Travel, Topdeck Travel Limited, Trafalgar.

b. Key factors that are driving the U.S. & Canada travel market growth include the evolving trend of transformational travel centered on wellness journeys to restore balance and transform the mind, spirit, and body is predicted to drive the U.S. and Canadian travel markets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.