- Home

- »

- Consumer F&B

- »

-

U.S. Candy Market Size & Share, Industry Analysis Report, 2018-2025GVR Report cover

![U.S. Candy Market Size, Share & Trends Report]()

U.S. Candy Market Size, Share & Trends Analysis Report By Product (Chocolate, Non-Chocolate Candy), By End Use, Competitive Landscape, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-076-7

- Number of Pages: 51

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Consumer Goods

Industry Insights

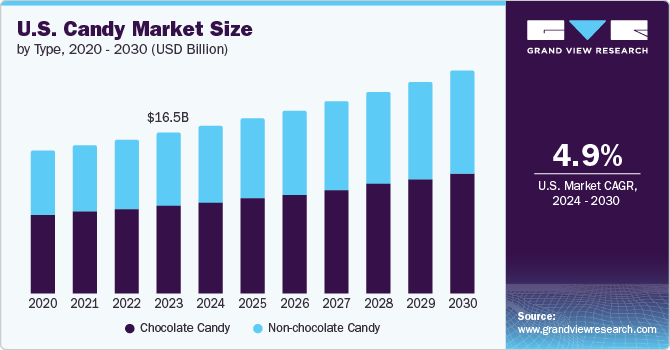

U.S. candy market was valued at over USD 12.73 billion in 2016 and is expected to witness an attractive growth over the forecast period. Increasing consumer spending and growing urbanization have led to a huge growth of the market in the U.S. In this country, consumer expenditure has increased from USD 11,852.96 billion in the second quarter to USD 11,916.58 billion in the third quarter of 2017. With rising consumer spending, there arises a huge demand for consumer goods. Growing urbanization is also a significant factor driving the growth of the candy market in the country. According to the International Organization for Migration in 2015, every week around 3 million people are migrating to cities. Hence, the aforementioned factors are driving the growth of the market.

The lucrative target population for the candy market is the children and the young population. According to the U.S. Census Bureau, in the year 2016, children aged 0-17 years accounted for 73.6 million populations. The growing availability of different varieties of candies, both chocolate as well as non-chocolate candies has led to their high demand among the children. Manufacturers also indulge in innovative marketing strategies to lure their target customers as children are considered as a very influential group of population.

A growing number of new product developments has contributed to the high growth of the candy market. There are different flavored candies in varied shapes available in the market. For instance, Big Red is a cinnamon-flavored gum manufactured by Mars Incorporated. Companies are also engaged in new product launch, which is further boosting the market demand for candies. Product innovation also aimed at addressing the growing health issues pertaining to candy consumption, such as diabetes. This has led the key players of the market to come up with sugar-free candies targeting the diabetic population and also lowering the risk for potential diabetes among their customers.

Product Insights

On the basis of product type, chocolate candies dominated the market in 2016 owing to the health benefits associated with it. Chocolate candies are highly preferred by all age groups. Chocolate flavor has many health benefits, such as it helps in reducing mortality rates, and also aids in treating diseases like bronchitis and depression. In addition, dark chocolates possess huge health benefits due to the cocoa content. It aids in proper blood flow in the body and facilitates overall blood vessel functionality.

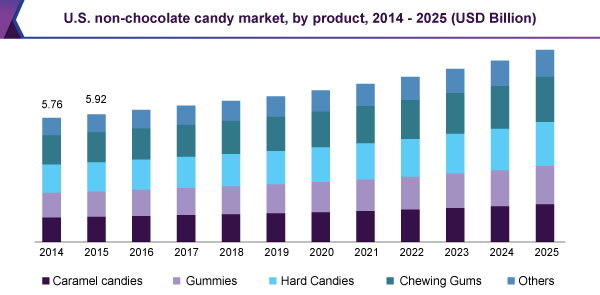

Non-chocolate candies held significant revenue of the market in 2016 due to the variety of flavors available in the form of hard candies, chewing gums, lollipops, gummies, caramel candies, jelly candies, and many others. Candies that are sweet and chocolate free are less prone to health hazards. Some of them include chewy candies, gummy candies, tart candies, and other dairy-free candies

Chewing gums are expected to show lucrative CAGR over the forecast period. This is due to their huge benefits in reducing stress. Research studies have shown that repeated chewing gum helps in brain stimulation and increases self-control and attention, thereby, minimizing stress. Peppermint candies aid in digestion and treatment of upset stomach.

According to CalorieKing.com, caramel candies contain around 7.8g of carbohydrates and 0.5g of protein, which provides energy to the body. Based on The American Heart Association, saturated fats block the arteries and are recommended to be a maximum of 7% of the overall daily calories. A caramel candy contains 0.3g of saturated fat. Thus, this segment generated significant revenue in 2016.

End-use Insights

On the basis of end use, the market is segmented into super/hypermarkets, convenience stores, online stores, and others. In 2016, super/hypermarkets held the largest market share owing to huge penetration of such stores in the U.S. These stores also offer a wide variety of candies for the customers to choose from a single store.

With a wide range of products being offered at online websites, individuals are more aware of the new products launched in the market. Thus, this alternative improves the cognizance of the customers, allowing them to enhance their awareness levels, thus, creating lucrative opportunities for this market segment. The primary factors that motivate people to buy products from online stores are the availability of discounted price and lucrative offers, thereby, facilitating a hassle-free shopping experience.

Convenience stores held significant shares in 2016. These stores are smaller in size as compared to the supermarkets. These stores are mainly opted due to the fact that they remain open 24 hours. However, these stores have high priced products as compared to other stores. Also, they offer a lesser number of varied products as compared to other stores.

The other end-use segment includes small-sized grocery stores and specialty stores. Grocery stores comprise a limited number of products, thus, pose to be disadvantageous as compared to the supermarkets. On the other hand, specialty stores offer only a single product category or related products. Customers prefer such stores depending on the product they tend to buy.

U.S. Candy Market Share Insight

Some of the key companies of the market include The Hershey Company; Ferrara Candy Co.; Mars Incorporated; Mondeléz International Inc.; DeMet’s Candy Co.; and Nestlé SA. With a wide portfolio of well-known brands, these companies are dominating the candy market.

The key players are focusing on strategic initiatives such as collaborations/partnerships, product innovations, and geographic expansions. For instance, In March 2017, Hershey singed a five-year extended agreement with Turner Sports, CBS Sports, and the NCAA in order to be their official confectionery partner. In May 2017, Ferrara Candy Company announced the grand re-opening of its candy store in the U.S. In May 2016, DeMet’s Candy Company launched a new product, TURTLES Double Chocolate.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historic data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Billion & CAGR from 2017 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. candy market on the basis of product, and end use:

-

Product Outlook (Revenue, USD Billion; 2014 - 2025)

-

Chocolate Candy

-

Non-chocolate Candy

-

Caramel candies

-

Gummies

-

Hard Candies

-

Chewing Gums

-

Others

-

-

-

End-Use Outlook (Revenue, USD Billion; 2014 - 2025)

-

Super /Hyper Markets

-

Convenience Stores

-

Online Stores

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."