- Home

- »

- Pharmaceuticals

- »

-

U.S. Cannabinoids Market Size, Share & Trends Report, 2030GVR Report cover

![U.S. Cannabinoids Market Size, Share & Trends Report]()

U.S. Cannabinoids Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Tetrahydrocannabinol (THC), Cannabidiol (CBD), Cannabigerol (CBG)), By Application (Inflammation, Pain Management), And Segment Forecasts

- Report ID: GVR-4-68039-255-9

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

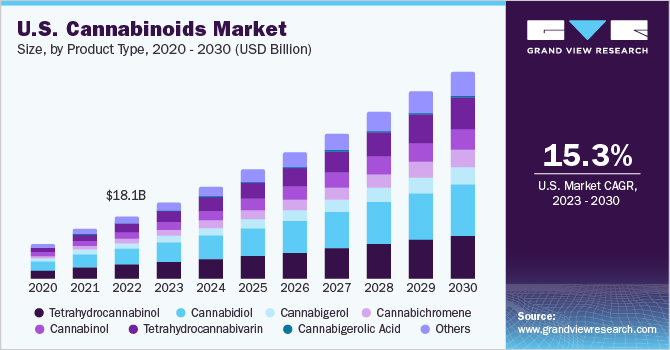

The U.S. cannabinoids market size was valued at USD 18.14 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.3% from 2023 to 2030. The growth of the U.S. cannabinoids industry is attributed to the increasing use of cannabinoids for the rising awareness about their health and therapeutic benefits. The characteristics associated with the presence of medicinal Phyto cannabinoids in cannabis increase the adoption of cannabinoids to be used for therapeutic purposes. Moreover, the increasing demand for cannabinoid-based products aided by expanding research in the field of cannabinoid use is further propelling the growth of the overall market.

The COVID-19 pandemic has had a mixed impact on the U.S. cannabinoids market. On the one hand, it has resulted in increased demand for natural remedies and alternative therapies, including minor cannabinoids, as people seek ways to boost their immune systems and manage stress & anxiety. This has led to increased sales and revenue for many companies in the industry, as well as an increase in investments and interest from investors & other stakeholders. However, the pandemic has also disrupted the global supply chain, leading to shortages of raw materials, delayed shipments, and increased costs. These factors have negatively impacted some companies in the cannabinoids market, especially smaller players who may not have the resources to absorb these additional costs.

Moreover, many companies operating in the country are keen on entering the cannabinoids market with their specialty cannabinoid products. For instance, in March 2023, Gene Pool Technologies, LLC. Announced the addition of the patent cannabis portfolio of Insectergy, LLC. With this collaboration, the company aims to expand and become one of the major players in manufacturing and producing of cannabis products in the market.Furthermore, with the sanctioning of cannabis for recreational purposes, the demand for THC products has increased, which has led to an increase in the number of companies in the country.

Furthermore, the launch of novel products with leading market players focusing on collaboration and partnerships is further anticipated to propel the U.S. cannabinoids market. Some of the recent launches include, such as, in March 2023, CannaAid launched H4-CBD products and has become the first company to introduce and sell the product within U.S. and globally. Moreover, in March 2023, Innocan Pharma Corporation LTD. received a patent grant in the U.S. which covers the company’s cannabis-based pain relief topical products.

However, one of the major factors restraining the growth of the market is the high cost associated with cannabinoid-based products. The minor cannabinoids such as CBG, CBC, & CBN are found in very small quantities and are extracted in very low quantities as compared to the major cannabinoids such as CBD & THC, which makes the minor component that has prominent health benefits highly expensive and unaffordable to the majority of the population.Furthermore, even if CBD and THC products are not as costly as minor cannabinoid products, they are yet costlier than alternative drugs available for treatment.

Product Type Insights

The cannabidiol (CBD) segment held the largest revenue share in the U.S. cannabinoids market in 2022 with a share of 26.7% and is anticipated to witness a steady CAGR over the forecast period. The dominance of the segment is attributed to the increasing therapeutic application of cannabidiol for a number of conditions such as neurological disorders, metabolic disorders, diabetes, arthritis, epilepsy, Alzheimer’s disease, and pain management.

CBD-based products are available in the market in various forms such as oil, tinctures, edibles, topicals, sprays, capsules, and softgels which further increases its adoption in the market. Furthermore, the launch of newer CBD-based products into the market is further increasing the demand for the product in the market. For instance, in November 2022, Stirling CBD Oil launched CBD Immunity Gummies and CBD Energy Gummies expanding itscannabidiol portfolio.

The THCV segment is expected to showcase the fastest CAGR over the forecast period owing to rising demand and growing awareness regarding the minor cannabinoid. The market has also seen unprecedented growth owing to the development of novel products concerning different minor cannabinoids by key players in the market. For instance, in September 2021, Rare Cannabinoid Company launched CBDV oil which is expected to be one of the purest forms of CBDV oil for sale in the market. The oil is being extensively researched for the pharmaceutical treatment of muscular dystrophy, autism, Rett syndrome, and seizures. Such initiatives are expected to enhance the knowledge and research on the therapeutic potential of CBDV to be used in pharmaceuticals.

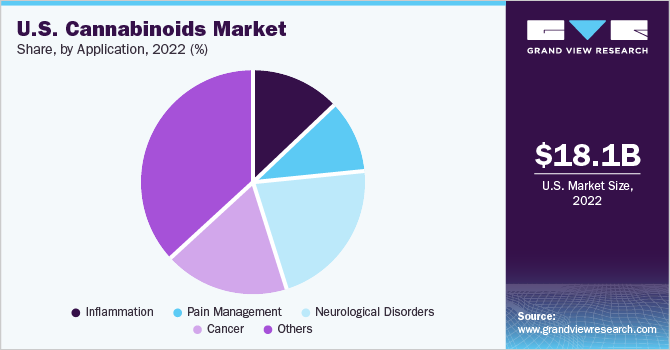

Application Insights

The neurological disorders segment captured the largest revenue share of 22.1% in the U.S. cannabinoids market in 2022 and is projected to exhibit a lucrative CAGR throughout the forecast period. The neurological disorders segment has shown growth potential in recent years. Cannabinoids, particularly CBD and CBG, have been found to have neuroprotective properties and may be effective in managing symptoms of neurological disorders such as epilepsy, Parkinson's disease, and multiple sclerosis.

Moreover, recent advancements in clinical studies and research to validate the benefits of cannabis as a medical treatment for Parkinson’s disease are one of the major factors contributing to the growth. For instance, in February 2023, a research team at Oxford are focusing on the trial of cannabis-based medicine for the treatment of neurological disorders such as psychosis and severe epilepsy.

The pain management segment is expected to showcase the fastest CAGR over the forecast period. Cannabinoids, particularly CBD, have been found to have analgesic properties, making them effective in managing pain caused by conditions such as neuropathy, fibromyalgia, and arthritis. The increasing prevalence of chronic pain, along with the opioid epidemic & concerns about their addictive properties, has fueled the demand for natural and plant-based alternatives for pain management.

For instance, in January 2023, Holistic Industries launched CANNACEUTICA, the first oral cannabis capsule for the management of chronic pain in Massachusetts. This launch is expected to enhance the acceptability and clinical evidence of cannabis in pain management.

Key Companies & Market Share Insights

The key players operating in the field of cannabinoids are constantly focusing on introducing and changing existing product lines that enhance patient outcomes and substantially increase the efficiency and effectiveness of healthcare in the U.S. For instance, in March 2023, Corganics entered into a partnership with OrthoLoneStar to provide the company access to clinical CBD therapies of Corganics. Some prominent players in the U.S. cannabinoids market include:

-

Mile High Labs International

-

Global Cannabinoids

-

GenCanna

-

CBD INC

-

Precision Plant Molecules

-

Rhizo Sciences

-

LaurelCrest

-

Fresh Bros Hemp Company

-

BulKanna

-

High Purity Natural Products

-

Zero Point Extraction

U.S. Cannabinoids Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.23 billion

Revenue forecast in 2030

USD 60.36 billion

Growth rate

CAGR of 15.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application

Country scope

U.S.

Key companies profiled

Mile High Labs; Global Cannabinoids; GenCanna; CBD Inc.; Precision Plant Molecules; Rhizo Sciences; LaurelCrest; Fresh Bros Hemp Company; BulKanna; High Purity Natural Products; Zero Point Extraction, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cannabinoids Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cannabinoids market report based on product type and application:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tetrahydrocannabinol (THC)

-

Cannabidiol (CBD)

-

Cannabigerol (CBG)

-

Cannabichromene (CBC)

-

Cannabinol (CBN)

-

Tetrahydrocannabivarin (THCV)

-

Cannabigerolic Acid (CBGA)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Inflammation

-

Pain Management

-

Neurological Disorders

-

Cancer

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cannabinoids market size was estimated at USD 18.14 billion in 2022 and is expected to reach USD 22.23 billion in 2023.

b. The U.S. cannabinoids market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 60.36 billion by 2030.

b. Cannabidiol (CBD) dominated the U.S. cannabinoids market with the highest share in 2022. This is attributable to the increasing demand for cannabidiol (CBD) for medical and wellness purposes due to its healing properties.

b. Some key players operating in the U.S. cannabinoids market include Mile High Labs International; Global Cannabinoids; Rhizo Sciences; GenCanna; SPARKCBD; CBD INC GROUP; and Maricann Group Inc.

b. Key factors driving the U.S. cannabinoids market growth include increasing awareness about the therapeutic benefits of cannabinoids, the growing legalization of cannabis and its derivatives in various countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.