- Home

- »

- Advanced Interior Materials

- »

-

U.S. Chalk Reel And Line Market Report, 2021-2028GVR Report cover

![U.S. Chalk Reel And Line Market Size, Share & Trends Report]()

U.S. Chalk Reel And Line Market Size, Share & Trends Analysis Report By Line Structure (Braided, Twisted), By Line Material (Cotton, Synthetic), By Distribution Channel (E-commerce, Retail Shops), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-712-8

- Number of Report Pages: 133

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

Report Overview

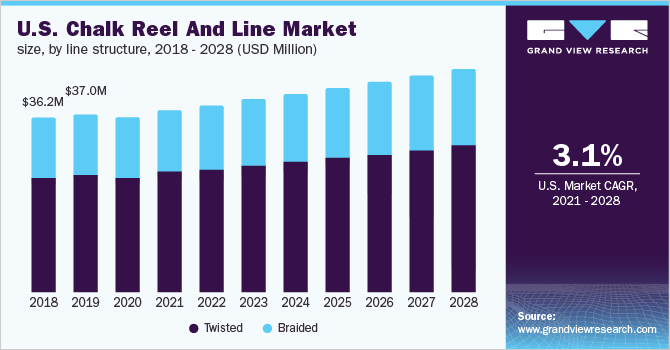

The U.S. chalk reel and line market size was estimated at USD 36.2 million in 2020 and is expected to expand at a compounded annual growth rate (CAGR) of 3.1% from 2021 to 2028. Rising government investment in the development of safe roads, owing to rapidly increasing road accidents and stringent transport regulations in the U.S. are the factors likely to fuel the market growth. The market is expected to witness substantial growth over the forecast period owing to its widespread usage in the construction, carpentry, and metallurgy industries. An increase in the number of construction and infrastructural development activities in the country is expected to open new growth opportunities for the chalk reel and line market.

The U.S. was one of the worst affected countries due to the outbreak of the COVID-19 pandemic in 2020. The country witnessed a peak of 2.5 hundred thousand COVID-19 cases per day. The threat of the spread of infections during the pandemic led to a slowdown in repair and renovation activities in U.S. households, thus impacting the demand for chalk reel and line products.

In addition, the global pandemic outbreak led to the global supply chain disruption which in turn led to a short-lived supply shortage of construction and furniture materials. As a result, it further slowed down the new constructions as well as the repair and renovation activities in the U.S. thus restricting the chalk reel and line market growth during the pandemic.

However, post-pandemic the market in the U.S. is expected to exhibit growth owing to the increasing investments in the construction of non-residential buildings and infrastructure. The rising number of offices, healthcare facilities, educational institutions, recreation centers, communication networks, streets, sewage and waste disposal, and religious places is likely to propel the product demand.

The growth of the renovation industry is expected to be driven by factors such as aging infrastructure, high per capita income, and the availability of various customization options in homebuilding. The renovation industry primarily involves activities such as alteration, conversion, modernization, improvement, replacement, and repair of a particular structure, thus exhibiting a high growth potential.

Marking systems are an integral part of maintenance and safety norms on highways as they help drivers and pedestrians in terms of better navigation and differentiation between driveways and walkways. In addition, marking systems are widely used in public places for demarcating different lanes for men, women, children, the physically disabled, and the elderly population.

Line Structure Insights

The twisted line structure segment led the market and accounted for more than 66.2% share of the global revenue in 2020. The growing use of twisted structure lines in industries such as constructions, masonry, carpentry, and metallurgy, owing to various important properties, such as high strength, elasticity, and less cost is anticipated to fuel the market growth.

The demand for low-cost and high-strength twisted structure lines is expected to grow over the forecast period owing to rapid investments toward infrastructural development in the U.S., such as the development of highways, airstrips, and amusement parks. However, chalk wastage and fraying, leading to the spreading of threads over time is a factor likely to limit its demand.

Braided structure lines are widely used in the construction sector for various finishing applications such as plastering, tile lining, and others, as it offers clear and crisp lines, for high accuracy levels. In addition, they are exclusively used in the metallurgy industry, for making crisp lines for applications such as welding, cutting, bending, to achieve clean shapes for accurate measurements.

The usage of braided lines is comparatively lesser as compared to twisted lines owing to the high cost and less stretchability of the former. However, the demand for braided lines is expected to rise over the forecast period, owing to high investments by builders and metallurgy companies toward achieving high precision levels.

Line Material Insights

The synthetic line material segment led the market and accounted for more than 84% share of the global revenue in 2020. Synthetic materials show properties such as high elasticity, water resistance, and high elastic recovery, to make accurate and straight lines. They are increasingly used in applications such as construction, carpentry, metallurgy, and others.

Synthetic materials such as polyester and nylon are used for making chalk lines. These strings made up of synthetic materials offer advantages such as less wastage of chalk, high strength, and durability as compared to cotton strings. Growing demand for synthetic line materials in construction and infrastructural development industries is expected to benefit the market growth.

Synthetic material strings exhibit properties such as high-speed moisture absorption, high elasticity, high impact resistance, and good elastic recovery. As a result, a synthetic material string is widely used in applications that require good elongation, strength, and elasticity. Thus, the use of synthetic materials in the manufacturing of chalk lines is projected to benefit the growth of the industry.

Cotton chalk lines are primarily used for small-level applications such as cutting woods at local carpentry shops and making brick linings in the construction industry. The usage of cotton lines is less, owing to less elasticity and strength of the material. In addition, cotton gets damp easily, making it unfit for use in wet conditions.

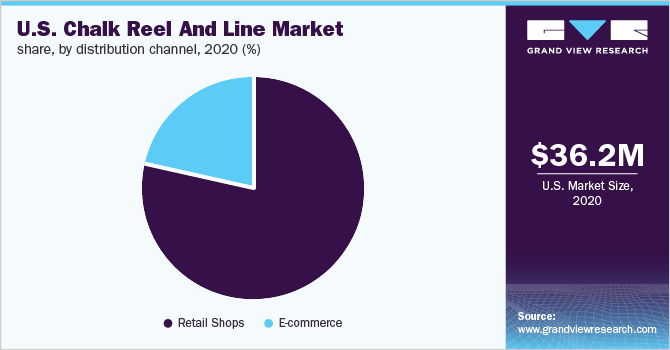

Distribution Channel Insights

The retail shop segment led the market and accounted for more than 79% of the global revenue share in 2020. The presence of retail shops at multiple locations allows easy accessibility and availability of goods. In addition, buying equipment in bulk quantity is easier, thus benefiting the growth of this distribution channel segment.

The waiting time for availability and delivery of technical equipment is much lesser in retail shops as compared to that on e-commerce platforms. In addition, retail shops offer services such as maintenance and training in collaboration with chalk reel & line equipment manufacturers to buyers from industries such as construction, carpentry, and metallurgy.

The distribution of chalk reels and lines via e-commerce channels is growing rapidly owing to the presence of various major e-commerce players such as Amazon, Grainger, Ace Hardware, and others. These companies collaborate with manufacturers and retail shops for supplying their products to customers from varied geographical locations.

The growth of the e-commerce distribution channel segment is expected to be driven by the increasing preference for online shopping by customers. E-commerce platforms help the manufacturers and sellers reach a wider customer base in different parts of the country, unlike in retail stores, where customer reach is limited.

Key Companies & Market Share Insights

The chalk reel and line market in the U.S. are competitive owing to the presence of several multinational companies as well as local players. Major players are investing in research and development and are focused on introducing new products in the market to enhance customer productivity, thereby attaining business growth in the market.

Key players in the market commonly use twisted and braided line structures primarily made from cotton or synthetic material. The manufacturer sticks to the cotton due to its fiber retaining ability that leaves a neat line on usage without stretching. However, commonly used fibers are synthetic chalk reel as it consumes fewer chalks and is more durable when compared to cotton. Some of the prominent players operating in the U.S. chalk reel and line market are:

-

Keson

-

Stanley Black & Decker, Inc.

-

DeWalt

-

Irwin Tools

-

Apex Tool Group, LLC.

-

Tajima Tool Corp.

-

CE Tools

-

C.H. Hanson Company

-

Milwaukee Tool

-

U.S. Tape

U.S. Chalk Reel And Line Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 37.9 million

Revenue forecast in 2028

USD 46.3 million

Growth Rate

CAGR of 3.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in thousand units, revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Line structure, line material, distribution channel

Regional scope

U.S.

Key companies profiled

Keson, Stanley Black & Decker, Inc., DeWalt, Irwin Tools, Apex Tool Group, LLC., Tajima Tool Corp., CE Tools, C.H. Hanson Company, Milwaukee Tool, U.S. Tape

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the U.S. chalk reel and line market report based on line structure, line material, and distribution channel:

-

Line Structure Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2028)

-

Braided

-

Twisted

-

-

Line Material Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2028)

-

Cotton

-

Synthetic

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2028)

-

E-commerce

-

Retail Shops

-

Frequently Asked Questions About This Report

b. The U.S. chalk reel and line market size was estimated at USD 36.2 million in 2020 and is expected to reach USD 37.9 million in 2021.

b. The U.S. chalk reel and line market is expected to grow at a compound annual growth rate of 3.1% from 2021 to 2028 to reach USD 46.3 million by 2028.

b. Retail shops distribution channel segment dominated the U.S. chalk reel and line market with a share of 79% in 2020, as it gives customers the independence to choose the best for the use, by practically using them on shops.

b. Some of the key players operating in the U.S. chalk reel and line market include Keson, Stanley Black & Decker, Inc., DeWalt, Irwin Tools, Apex Tool Group, LLC., Tajima Tool Corp., CE Tools, C.H. Hanson Company, Milwaukee Tool, U.S. Tape.

b. The key factors that are driving the U.S. chalk reel and line market include rising demand for high precision marking equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."