- Home

- »

- Next Generation Technologies

- »

-

U.S. Collaborative Robots Market Size, Industry Report, 2030GVR Report cover

![U.S. Collaborative Robots Market Size, Share & Trends Report]()

U.S. Collaborative Robots Market (2025 - 2030) Size, Share & Trends Analysis Report By Payload Capacity (Up To 5kg, 5kg To 10kg, Above 10kg), By Application (Assembly, Pick & Place, Handling, Packaging, Quality Testing), By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-061-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Collaborative Robots Market Trends

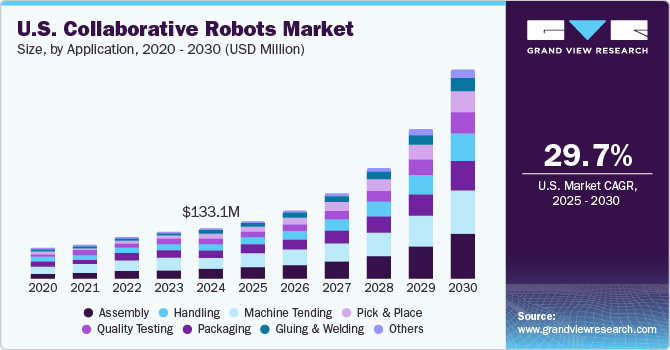

The U.S. collaborative robots market size was estimated at USD 133.1 million in 2024 and is expected to expand at a CAGR of 29.7% from 2025 to 2030. Collaborative robots, or cobots, represent a revolution where industries approach the concept of automation with human involvement, thus bettering productivity in addition to enhancing workplace security. The demand for cobots is mainly driven by the need for more flexible and cost-effective automation solutions, especially in small and medium-sized enterprises (SMEs) and industries such as automotive, electronics, and consumer goods.

Cobots are increasingly used in applications like assembly, pick and place, packaging, machine tending, and quality testing due to their ease of integration and adaptability in environments requiring human-robot collaboration. With the rapid development of artificial intelligence (AI) and machine learning technologies, cobots are getting smarter and more powerful while offering greater applications. In the U.S. market, adaptation is widespread across different sectors where businesses seek to improve operational efficiency, reduce labor costs, and optimize production workflows.

With its versatility in diverse applications across industries, the U.S. collaborative robots industry is also growing rapidly. These cobots are helpful in assembly operations, sorting, and fastening components in the automotive and electronics sectors. Cobots are useful in pick and place operations, moving items efficiently within logistics and manufacturing lines. Handling involves lifting and positioning materials, which cobots do in warehouses and production floors. They automate packaging processes, including sorting and packing, in food and beverage industries as well as in e-commerce. Cobots are also integrated into quality testing, inspecting for defects within manufacturing environments. They help enhance efficiency in machine tending by loading and unloading the machines, and they are used in tasks that involve gluing, welding, and even disinfection and sample handling in healthcare. Their increased flexibility and ability to enhance productivity, safety, and cost efficiency are promoting greater utilization across industries.

Payload Capacity Insights

The U.S. collaborative robots industry segments into payload capacity and is among the top factors affecting the industries and applications that serve, with the up to 5kg payload segment holding the largest market size share as cobots that fall in this category are widely used in electronics, automotive, and consumer goods, among other sectors, where tasks, such as assembly, pick and place, and quality testing, require lightweight and compact robots. Such cobots prove affordable, easy to integrate, and efficient in handling repetitive tasks; hence, they are extremely attractive for small and medium-sized enterprises (SMEs) as well as large enterprises looking to streamline their operations.

On the other hand, the above 10kg payload capacity segment is growing at the fastest pace during the forecast period from 2025 to 2030. Cobots with payloads above 10kg are increasingly used in demanding applications like machine tending, heavy-duty material handling, and welding, primarily in automotive, aerospace, and logistics industries. The growth of this segment is driven by the increasing need for more powerful robots that can handle complex, labor-intensive tasks with precision and reliability. In conclusion, while the up to 5kg payload capacity segment remains dominant, the above 10kg category is expanding rapidly, reflecting a shift towards more robust and versatile automation solutions for heavier industrial applications.

Application Insights

Material handling accounts for the largest market share due to the increased adoption of cobots in the automotive, manufacturing, logistics, and warehousing industries. Cobots in this application are used for palletizing, sorting, and moving items efficiently, significantly reducing labor costs and increasing operational productivity. Because they can perform many repetitive tasks precisely, they are very important for many industries that are looking at automation and making processes more streamlined.

On the other hand, the gluing and welding segment, although relatively smaller, is growing at the fastest rate during the forecast period from 2025 to 2030. Cobots in gluing and welding applications are gaining popularity in the automotive, aerospace, and electronics industries, where precision and repeatability are critical. The increasing demand for high-quality, consistent results in manufacturing is driving the rapid adoption of cobots in these specialized tasks. Advances in cobot technology, such as enhanced sensors and capabilities, are further driving the growth of the gluing and welding segment.

Industry Vertical Insights

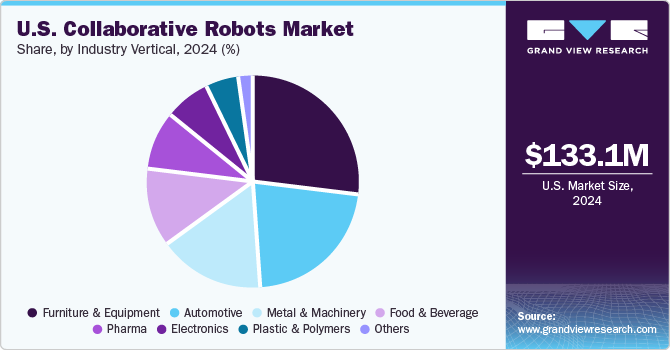

Furniture & equipment has the highest market share within the cobot market, which is mostly due to the growing demand for automation in the production of furniture and office equipment. In this industry, cobots are used for tasks such as assembly, handling, and packaging. These cobots offer flexibility and the ability to collaborate with human workers to improve efficiency and reduce production costs. The high demand for customized and mass-produced furniture and the trend towards automation in manufacturing processes have driven the widespread use of cobots in this industry.

The automotive industry is growing the fastest during the forecast period from 2025 to 2030. Automobile robots are increasingly used for tasks like assembly, material handling, welding, and painting. Their ability to work alongside human operators in complex and high-precision tasks is fueling their adoption in automotive manufacturing plants. As automotive manufacturers push toward greater efficiency and cost savings, cobots are becoming essential tools for improving production lines, reducing downtime, and maintaining high levels of safety.

Key U.S. Collaborative Robots Company Insights

The major players in the U.S. collaborative robots market are further shifting focus toward developing new innovative cobots that will attract customers and stand atop the competitive edge. For instance, in September 2023, ABB Robotics introduced the GoFa™ 150, a new collaborative robot designed to work alongside human operators in assembly, packaging, and material handling tasks. This robot is targeted at electronics, automotive, and food processing industries, with increased payload capacity and precision. With continuous innovations like these, the market is poised for strong growth, as new product offerings cater to evolving industry needs and drive increased adoption of cobots in various sectors.

Key U.S. Collaborative Robots Companies:

- ABB Group

- AUBO (BEIJING) Robotics Technology Co., Ltd

- Comau S.p.A

- DENSO Corporation

- Energid Technologies Corporation

- Epson America Inc.

- Fanuc Corporation

- KUKA AG

- MRK-SystemS GmbH

- Precise Automation, Inc.

- Rethink Robotics GmbH

- Robert Bosch GmbH

- Techman Robot Inc.

- Universal Robots A/S

- Yaskawa Electric Corporation

U.S. Collaborative Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 149.8 million

Revenue forecast in 2030

USD 534.0 million

Growth rate

CAGR of 29.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Payload capacity, application, industry vertical

Key companies profiled

ABB Group; DENSO Corporation; Epson America Inc.; AUBO (BEIJING) Robotics Technology Co., Ltd; Comau S.p.A; Energid Technologies Corporation; Fanuc Corporation; KUKA AG; Rethink Robotics GmbH; Robert Bosch GmbH; Techman Robot Inc.; Universal Robots A/S; Yaskawa Electric Corporation; Precise Automation, Inc.; MRK-SystemS GmbH

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Collaborative Robots Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. collaborative robots market report based on payload capacity, application, and industry vertical:

-

Payload Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 5kg

-

Up to 10kg

-

Above 10kg

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Assembly

-

Pick & Place

-

Handling

-

Packaging

-

Quality Testing

-

Machine Tending

-

Gluing & Welding

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Food & Beverage

-

Furniture & Equipment

-

Plastic & Polymers

-

Metal & Machinery

-

Electronics

-

Pharma

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. collaborative robots market size was estimated at USD 133.1 million in 2024 and is expected to reach USD 149.8 million in 2025.

b. The U.S. collaborative robots market is expected to grow at a compound annual growth rate of 29.0% from 2025 to 2030 to reach USD 534.0 million by 2030.

b. The upto 5kg segment dominated the U.S. collaborative robots market with a share of around 52% in 2024. The growth is attributed to their ability to offer flexibility, be lightweight, and work side-by-side with manufacturing unit employees.

b. Some key players operating in the U.S. collaborative robots market include Robert Bosch GmbH, KUKA AG, Fanuc Corporation, DENSO Corporation, AUBO (BEIJING) Robotics Technology Co., Ltd and many others.

b. The growing demand to enhance operational efficiency and product quality, coupled with a growing shift toward automation to improve employee safety and reduce operational costs is a key factor driving the adoption of collaborative robots in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.