- Home

- »

- Next Generation Technologies

- »

-

U.S. Computer-aided Engineering Market Size, Report, 2030GVR Report cover

![U.S. Computer-aided Engineering Market Size, Share, & Trends Report]()

U.S. Computer-aided Engineering Market Size, Share, & Trends Analysis Report By Component (Software, Services), By Deployment Model (On-premise, Cloud-based), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-205-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. CAE Market Size & Trends

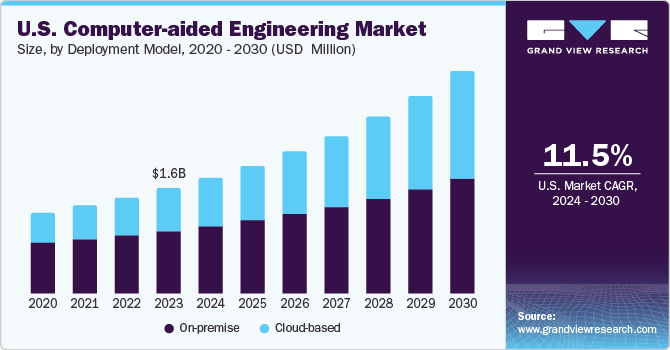

The U.S. computer-aided engineering market size was estimated at USD 1.56 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2030. The U.S. is the early adopter of this technology globally and with higher adoption rate of modern manufacturing techniques, including the use of robotics in various sectors such as aerospace & defense, electronics, and automotive, is driving its market growth. The market is also poised for unprecedented growth over the forecast period, as advancements in cloud computing, high computing, and parallel processing have made computer-aided engineering (CAE) tools more accessible and scalable, further fueling market expansion. The U.S. market accounts for approximately 15.3% share of the global computer aided engineering (CAE) market.

Emerging engineering technologies such as 3D printing, building information modeling, and concurrent engineering are gaining popularity in the market. 3D technology helps reduce production costs and develop new production methods by allowing users to print any object from a digital 3D model. The market is rapidly expanding due to the growing use of CAE software by companies in their product development phase, along with prototyping applications. Companies are increasingly investing in 3D metal printing for critical aviation applications. Application software is gaining traction in the cloud-based software-as-a-service market. The advent of cloud computing has enabled companies to reduce the costs involved in hardware acquisition, software licensing, installation, and support. The growing availability of cloud-based CAE software is expected to drive the CAE market. Market companies are increasingly adopting Hyper-Converged Infrastructure (HCI) platforms to build a private cloud, as it provides advanced computation and storage services.

Stringent regulations and budgetary limitations are encouraging companies in the aerospace and defense industry to seek more efficient and resilient ways to innovate and develop contemporary aerospace and defense technologies. Owing to their vast benefits in terms of cost savings and process optimization, computer-aided engineering tools are becoming increasingly important for these companies for streamlining and improving manufacturing processes. The use of CAE tools during the product design stage allows aerospace manufacturers to test multiple scenarios and optimize designs without incurring additional costs. CAE simulations also help mitigate the risk of product recalls and certification issues.

The availability of open-source software presents challenges for the computer-aided engineering (CAE) market. While open-source solutions offer cost-effective alternatives and foster collaboration, they also impose constraints on the growth and profitability of proprietary CAE software providers. One primary way in which the availability of open-source software restrains the CAE market is by introducing competition that can drive down prices. As users, particularly Small- and Medium-sized Enterprises (SMEs), seek cost-effective solutions, the availability of open-source alternatives can lead to a reduction in the market share of proprietary CAE software.

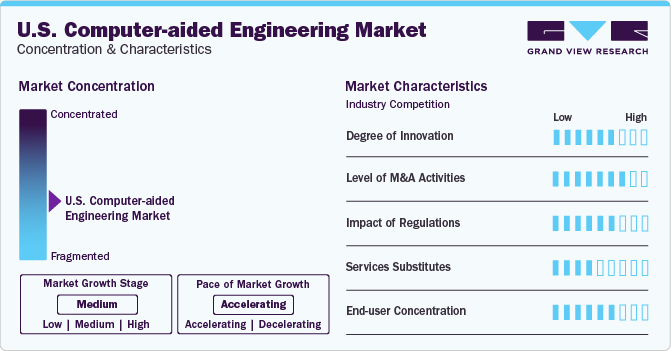

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The CAE market has witnessed substantial growth in recent years, driven by several key factors. The increasing demand for efficient product development processes presents a significant market opportunity for CAE solutions. By simulating and optimizing designs before physical prototypes are created, businesses can reduce costs and accelerate time-to-market.

Furthermore, the adoption of digital transformation initiatives and Industry 4.0 technologies has fueled market growth. Integration of CAE tools with other software platforms, such as ERP (Enterprise Resource Planning) and PLM (Product Lifecycle Management), enhances seamless data exchange and improves collaboration within organizations. The increased sales of electric vehicles are also driving market growth as CAE solutions are widely used in analyzing the key factors of vehicle development, such as Noise, Vibration, and Harshness (NVH) level analysis, thermal management, and durability & fatigue analysis.

The innovations are driving market growth, innovations in cloud-based simulation, which refers to using virtual/remote computing resources available on cloud platforms such as AWS, Google Cloud, Microsoft Azure, and IBM Cloud to conduct simulation and modeling tasks in Computational Fluid Dynamics (CFD), Finite Element Analysis (FEA), thermal simulations, and more. It offers advantages such as accessibility from anywhere, scalability to handle varying computational needs, reduced hardware costs, automatic updates, enhanced collaboration features, secure data storage, cost efficiency, faster time-to-results, and high-performance computing resources.

Regulatory policies play a crucial role in the market. These regulations aim to ensure product safety, reliability, and compliance with industry standards. In the aerospace and automotive industries, for example, CAE simulations must meet stringent regulatory requirements to ensure the structural integrity and performance of final products. Data security and privacy regulations are also important considerations in the CAE market. Given the sensitive nature of design and simulation data, stringent data protection measures and compliance with regulations such as the California Consumer Privacy Act (CCPA) are essential for CAE software providers.

In the CAE market, end-user concentration is notably pronounced across industries, with automotive, aerospace, defense, electronics, semiconductors, and energy sectors emerging as key companies. Automotive stakeholders leverage CAE for design optimization, safety compliance, and the transition to electric mobility, while aerospace relies on CAE for structural integrity and fluid dynamics. Electronics and semiconductors benefit from CAE in optimizing integrated circuits, and the energy sector employs CAE for system performance and operational efficiency. Recognizing both industry-specific and enterprise-size variations in CAE adoption is crucial for providers to tailor solutions, foster strategic partnerships, and effectively address the diverse needs of end-users.

Component Insights

In terms of component, the market is categorized into software and services segments. The software segment held the largest market share of 68.02% in 2023. The segment growth can be attributed to benefits such as data safety, reliability, and uninterrupted testing. Software is used to optimize engineering tasks and examine the robustness and performance of the components and assemblies.

The software segment is further sub-categorized into Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), multibody dynamics, and optimization & simulation. In 2023, the FEA segment held a market share of more than 51%. This large share is attributed to the use of FEA, as FEA simulates real components to analyze problems pertaining to heat transfer, structural analysis, electromagnetic potential, and mass transport. CFD sub-segment is anticipated to witness the fastest CAGR over the forecast period. CFD is used in analyzing turbulence, flow, and pressure distribution of gases & liquids and their interaction with different structures. The industry companies are aiming at developing application-specific software for customized process functions.

The services segment is anticipated to witness the fastest CAGR over the forecast period. The growth of the segment can be attributed to the growing awareness of virtually enabled processes used for product development among companies and governments. Services such as design and consulting, implementation, and maintenance are gaining popularity among various enterprises.

Deployment Model Insights

In terms of deployment model, the market is categorized into on-premise and cloud-based segments. The on-premise segment held the largest market share of 59.17% in 2023. On-premise deployment provides organizations with greater flexibility to customize the various operations performed such as testing, and analyzing of the data structures. Moreover, industries such as defense and government sectors have strict regulatory or compliance requirements that mandate on-premise data storage and management.

Cloud computing offers easy access to data, vast space for data storage, and security. Moreover, cloud-based CAE, offered as a Software-as-a-Service (SaaS), renders application-specific solutions to the CAE users. Hence, the cloud-based deployment model is anticipated to witness the fastest CAGR over the projected period. Cloud-based deployment enables faster distribution, minimal maintenance, reduction in cost, and increase in scalability.

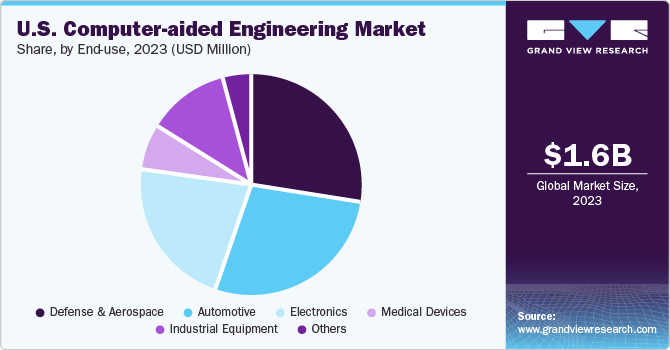

End-use Insights

In terms of end-use, the industry is categorized into defense & aerospace, automotive, electronics, medical devices, industrial equipment, and others segments. The defense & aerospace segment held the largest market share of 27.85% in 2023 and is expected to exhibit the fastest CAGR from 2024 to 2030. This growth is attributed to the emphasis on modernization has led to rising demand for CAE solutions in these sectors. CAE tools play a crucial role in designing, analyzing, and optimizing complex defense systems such as aircraft, missiles, submarines, and armored vehicles. Moreover, the growing concerns for security and surveillance, particularly in public places, is another factor fueling the demand for CAE in the defense & aerospace industry.

The automotive segment is anticipated to witness a substantial CAGR over the forecast period. This growth can be attributed to the CAE software’s various applications in the automotive industry. CAE is used in the automotive industry for structural analysis, crashworthiness and safety assessment, aerodynamics and thermal analysis, NVH analysis, powertrain and performance optimization, manufacturing and process simulation, design optimization, and virtual prototyping. CAE plays a critical role in enhancing vehicle performance, safety, and efficiency while reducing development time and costs in the automotive industry.

In addition, the medical imaging market is gaining traction in the market owing to its efficiency in diagnosing complex medical conditions. The rising prevalence of critical and chronic diseases, such as cardiovascular diseases & cancer, and increasing awareness of early diagnosis are the key factors driving the demand for imaging systems in healthcare facilities.

Key U.S. Computer-aided Engineering Company Insights

Some of the key companies in the U.S. market for computer aided engineering are Autodesk, Inc., Dassault Systemes, MSC Software Corporation, and Siemens.

-

ANSYS, Inc. is based in the U.S. The company develops and markets engineering simulation software. The company uses Workbench to build its simulation technologies. The software solutions provided by the company include 3D design software, electromagnetic field simulation, embedded software, computational fluid dynamics, optical simulation, semiconductors, structural analysis, and systems modeling, simulation, and validation.

-

MSC Software Corporation designs and develops simulation software. The company’s product offerings include MSC APEX, ACTRAN, ADAMS, CFD SOLUTIONS, DIGIMAT, EASY5, MARC, SIMUFACT, DYTRAN, MSC FATIGUE, MSC NASTRAN, SINDA, PATRAN, SIMXPERT, SIMMANAGER, and SIMDESIGNER. MSC Software Corporation caters its products to the incumbents of various industries and industry verticals, such as automotive, aerospace, defense, consumer products, machinery, heavy equipment, energy, electronics, rail, packaging, motorsports, medical, and shipbuilding.

Dassault Systemes and Hexagon AB. are some of the emerging market companies in the target market.

-

In February 2024, Dassault Systèmes and Cadence Design Systems, Inc. announced at 3DEXPERIENCE World an extension of their ongoing strategic partnership by integrating the AI-driven Cadence OrCAD X and Allegro X with Dassault Systèmes’ extended 3DEXPERIENCE Works portfolio, for SOLIDWORKS existing and future customers. This allows best-in-class collaboration for development across 3D mechanical design, simulation, and PCB. The cloud-enabled integration provides joint customers with an easy-to-use, end-to-end solution for next-generation product development, enabling an up-to-5X reduction in design turnaround time.

-

In February 2024, Hexagon’s Asset Lifecycle Intelligence division announced the release of HxGN EAM Databridge Pro, a new middleware and integration broker module. HxGN EAM Databridge Pro represents the next evolution in enterprise asset management technology from Hexagon. Powered by Apache NiFi, a leading open-source data flow automation platform, Databridge Pro provides enhanced data integration capabilities by introducing new features for configuring data pipelines, managing endpoint connections, and providing better visibility for efficient troubleshooting and debugging.

Key U.S. Computer-aided Engineering Companies:

- ANSYS, Inc.

- Altair Engineering

- Autodesk, Inc.

- Bentley Systems, Inc.

- Dassault Systemes

- Rockwell Automation

- The MathWorks, Inc

- IBM

- Hexagon AB

- Siemens

Recent Developments

-

In February 2024, Autodesk, Inc. announced it had entered into an agreement to acquire the PIX business of X2X. PIX is a production management solution for secure review and content collaboration between creatives and executives in the media and entertainment industry throughout the production process.

-

In October 2023, Altair, a global leader in computational science and artificial intelligence (AI), announced the release of Altair® HyperWorks® 2023. This update to Altair’s best-in-class design and simulation platform signifies a transformative leap in technology, offering an integrated solution that streamlines workflows, enhances user experiences, and enables innovation.

U.S. Computer-aided Engineering Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3,292.2 million

Growth rate

CAGR of 11.5% from 2024 to 2030

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment model, end-use

Country scope

U.S.

Key Companies Profiled

ANSYS, Inc.; Altair Engineering; Autodesk, Inc.; Bentley Systems, Inc.; Dassault Systemes; Rockwell Automation; The MathWorks, Inc; IBM; Hexagon AB; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Computer-aided Engineering Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. computer-aided engineering market report based on component, deployment model, and end-use:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Finite Element Analysis (FEA)

-

Computational Fluid Dynamics (CFD)

-

Multibody dynamics

-

Optimization & simulation

-

-

Services

-

Development Service

-

Training, Support & Maintenance

-

-

-

Deployment Model Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Defense & Aerospace

-

Electronics

-

Medical Devices

-

Industrial Equipment

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. computer-aided engineering market size was estimated at USD 1,559.6 million in 2023 and is expected to reach USD 1,717.8 million in 2024.

b. The U.S. computer-aided engineering market is expected to grow at a compound annual growth rate of 11.5% from 2024 to 2030 to reach USD 3,292.2 million by 2030.

b. The on-premise segment held the largest market share of 59.17% in 2023. On-premise deployment provides organizations with greater flexibility to customize the various operations performed such as testing, and analyzing of the data structures.

b. Some of the prominent companies in the U.S. Computer aided engineering (CAE) market include ANSYS, Inc., Altair Engineering, Autodesk, Inc., Bentley Systems, Inc., Dassault Systemes, Rockwell Automation, The MathWorks, Inc., IBM, Hexagon AB, and Siemens.

b. The growth of the U.S. Computer Aided Engineering (CAE) market is propelled by the increasing demand for simulation and analysis tools across industries, promoting innovation and reducing product development cycles. Furthermore, advancements in virtual prototyping, coupled with the emphasis on cost-effectiveness and efficiency in engineering processes, contribute to the expansion of the CAE market in the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."