- Home

- »

- Medical Devices

- »

-

U.S. Concierge Medicine Market Size, Industry Report, 2030GVR Report cover

![U.S. Concierge Medicine Market Size, Share & Trends Report]()

U.S. Concierge Medicine Market (2025 - 2030) Size, Share & Trends Analysis Report By Ownership (Group, Standalone), By Specialty (Primary Care, Internal Medicine, Pediatrics, Cardiology, Osteopathy, Psychiatry), And Segment Forecasts

- Report ID: GVR-4-68039-596-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Concierge Medicine Market Trends

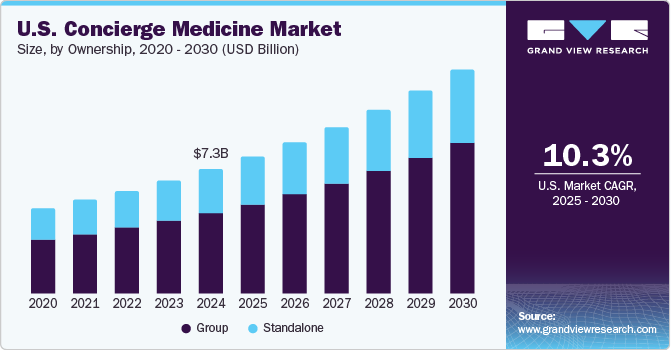

The U.S. concierge medicine market size was valued at USD 7.35 billion in 2024 and is projected to grow at a CAGR of 10.33% from 2025 to 2030. This growth is attributed to the increasing patient awareness of its benefits and the growing adoption of this model by physicians. Furthermore, the shortage of primary care physicians is also contributing to the market's expansion across the country.

The high influx of individuals visiting hospitals daily, coupled with a shortage of primary care physicians, has increased waiting times. Patients often wait hours to receive consultations in conventional healthcare settings. For instance, per the article published by the Association of Health Care Journalists in August 2024, the typical waiting period for new patients to secure an appointment with a physician in major U.S. cities varies between 27 and 70 days. In addition, physicians often have less time to spend with each patient due to the high volume of patients. Concierge medicine offers benefits not only to patients but also to healthcare providers. Thus, an increasing number of physicians are transitioning to this practice model. According to a survey conducted by the Robert Wood Johnson Foundation, the Harvard T.H. Chan School of Public Health, and NPR in 2020, approximately 22% of the top 1% of income earners in the U.S. were engaged in concierge medicine. The shift of physicians from conventional medicine to concierge medicine is underscored by large-scale initiatives undertaken by both healthcare providers and service organizations to collaborate in delivering optimal concierge healthcare services to patients.

Qualitative Analysis: Concierge Medicine Operating Model, by Identified Key Players

Name

Revenue Model

Description

MDVIP

Membership-Based System

MDVIP operates on a fee-for-access model where patients pay an annual fee to receive personalized healthcare services. This fee covers all primary care services, including office visits, diagnostic tests, and consultations.

Signature MD

Membership-Based System

-

Signature MD offers three operating models for its physicians:

-

Full Conversion Model: Physicians can see patients with membership, and they need to attract more patients to their panel

-

Hybrid Conversion Model: Physicians can provide services to members and non-members as well

-

Segmented Conversion Model: This model allows physicians to see non-members who do not opt for membership along with a panel of 100 patients from concierge members

-

PartnerMD

Membership-Based System

This fee covers all of the company's services and provides patients with unlimited access to their physicians. Members gain access to the company’s online portal, which allows them to schedule appointments, communicate with their healthcare providers, and access their medical records. The membership also provides access to wellness programs

Furthermore, concierge doctors typically see between 6 and 8 patients daily, representing a reduction of 80% to 90% compared to the patient volume in traditional medical practices. Despite this lower patient volume, physicians operating within the concierge model tend to earn higher incomes and generate greater profits than their counterparts in conventional medicine.

The market growth is also propelling due to the number of female physicians transitioning to concierge medicine. Research indicates that female doctors experience higher levels of burnout and stress compared to their male counterparts. According to the Medscape National Physician Burnout & Suicide Report 2020, 48% of physicians experiencing burnout were women. The appeal of concierge practice lies in having greater control over their work schedules, implementing equal membership fees with male colleagues, dedicating more time to family, and engaging in personal and professional interests. These factors are expected to drive growth in this market segment.

Moreover, a shortage of primary care physicians drives the demand for concierge medicine, as primary care is the first point of contact. Hence, primary care physicians (PCPs) are the most visited. According to data from March 2024 provided by the Association of American Medical Colleges (AAMC), the U.S. is expected to experience a shortage of up to 124,000 physicians by 2034. This situation is further complicated because two out of five physicians are considering leaving their practice within the next five years, which will intensify the existing shortage. Currently, the U.S. healthcare system faces a significant deficit of primary care physicians (PCPs). A major factor contributing to this trend is that many medical graduates opt for specialization training due to the higher compensation typically associated with specialist roles than those in primary care.

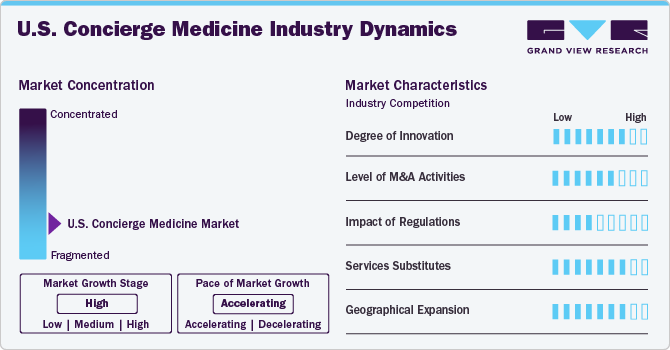

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of partnership & collaboration activities, and geographic expansion. The industry is highly fragmented, with numerous smaller, independent hospitals alongside a few larger players offeringa variety of specialized services and customized solutions. The degree of innovation is moderate, and the impact of regulations on industry is high. The level of partnership & acquisition activities is moderate, and the geographic expansion of the industry is high.

The degree of innovation in the market is moderate. Innovations are integrating technology, which allows for virtual consultations and telemedicine services, making healthcare more accessible and convenient for patients. In September 2024, AvaSure partnered with Oracle Cloud Infrastructure and NVIDIA to develop an AI-powered virtual concierge aimed at improving patient care and clinical workflows. Utilizing AvaSure's Intelligent Virtual Care Platform, Oracle's AI, and NVIDIA's Tensor Core GPUs, the initiative will create "smart rooms" that facilitate seamless voice-activated communication between patients and healthcare staff.

The regulation of the concierge medicine market in the U.S. is complex and varies by state, as there is no uniform federal legislation governing this model of care. Concierge practices must comply with existing healthcare laws, including those related to patient privacy (HIPAA), insurance regulations, and medical licensing requirements. Some states have raised concerns about potential discrimination against patients who cannot afford retainer fees, leading to scrutiny from health departments and insurance regulators. For instance, in New Jersey, officials have indicated that concierge agreements may conflict with regulations requiring network providers to offer non-discriminatory access to care. The primary legal consideration in concierge medicine is ensuring compliance with the Stark Law, which prohibits physician self-referral for Medicare patients, and the Anti-Kickback Statute, which prevents offering or receiving remuneration for referrals.

The merger & acquisition activity in the market is moderate, driven by increasing demand for personalized healthcare services, cost efficiency, and enhanced delivery service. Market players are forming strategic alliances with various stakeholders, including other healthcare providers, technology companies, and community organizations. For instance, in February 2024, Greenphire announced its acquisition of Clincierge with the aim of enhancing Greenphire’s offerings by integrating Clincierge’s capabilities into its existing suite of services. The acquisition is expected to improve the overall experience for patients participating in clinical trials by providing more comprehensive support throughout the trial process.

Geographic expansion in the market is high. Patients increasingly seek more personalized and accessible healthcare services that traditional models may not provide. This demand has led to a rise in membership-based practices where patients pay an annual fee for enhanced access to their physicians, including longer appointment times and direct communication channels. In November 2023, Concierge Choice Physicians (CCP) announced that seven additional physicians from the Medical Clinic of Houston, L.L.P. (MCH) are now participating in CCP’s Hybrid Choice program. This optional service enhances patient-doctor connectivity, providing patients with greater peace of mind. These new physicians join five others from MCH who are already offering both the Hybrid Choice and the traditional CCP full-model concierge program.

Ownership Insights

The group ownership segment dominated the market with a revenue share of 64.92% in 2024 and is anticipated to grow at the fastest CAGR of 10.97% over the forecast period. Group ownership includes companies with affiliated physicians as well as groups of doctors with their own membership medicine model. These groups help to reduce overhead costs through shared resources, such as administrative staff and facilities, which allows for more competitive pricing and improved profit margins which drives its demand across the country. Moreover, the rising number of specialists in concierge medicine is further propelling segment growth.

The standalone ownership segment is expected to experience significant growth at a lucrative CAGR over the forecast period. This growth is primarily driven by the reduced drudgery burden, career satisfaction, and higher compensation and profitability offered in this segment. Moreover, various regulations associated with Medicare and Medicaid require physicians to dedicate more time to electronic health records than direct patient care. By maintaining a smaller patient panel, physicians can spend more time with each patient, improving work-life balance. This shift is fueling the growth in this segment.

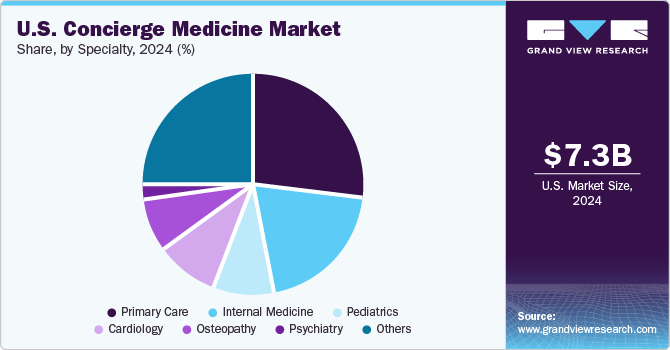

Specialty Insights

The primary care segment held the largest revenue share of 26.72% in 2024 and is anticipated to grow at the fastest CAGR of 10.78% over the forecast period. This growth is attributed to the rising patient awareness, the expectations of patients for quality healthcare services and convenient care provided by the personalized primary care in concierge medicine. Furthermore, many physicians are downsizing to membership-based medicine where they keep less patient volume to reduce their stress & maintain work-life balance.

In the U.S., PCPs predominantly operate in independent or small healthcare settings; however, there has been a noticeable trend in recent years where many physicians are joining larger physician groups or hospitals. According to the “Primary Care in the U.S. 2019” report by the Robert Graham Center (RGC), approximately 48% of PCPs are either partial or complete owners of their practices, while around 48% of these providers are employed by other physicians. Among those primary care providers who work in non-physician-owned practices, about 50% are affiliated with insurers, health maintenance organizations (HMOs), health plans, or corporate-owned practices. Additionally, roughly 47% work within community health, academic, or medical centers.

The internal medicine segment is projected to witness lucrative growth during the forecast period. Internal medicine is among the top 5 specialties in concierge care. This growth can be attributed to the increasing number of visits for digestive diseases and the rising prevalence of diabetes & hypertension. As per the National Diabetes Statistics Report, in 2021, 38.4 million people in the U.S. had diabetes. This increasing number of patients is contributing to the demand for healthcare services. Therefore, many internal medicine doctors, as well as patients, are showing less interest in traditional care, which is anticipated to propel segment growth.

Key U.S. Concierge Medicine Company Insights

The market is fragmented due to diverse service offerings and regulations. Companies such as MDVIP, Signature MD, and Crossover Health dominate the market due to the diverse network of doctors across the U.S. For instance, MDVIP comprises more than 1,000 affiliated physicians across the U.S. Companies such as MDVIP, Specialdocs Consultants LLC, Signature MD, and Castle Connolly Private Health Partners are focusing on converting more physicians to concierge medicine under their network by providing legal, operational, and marketing support. As companies continue to adapt to evolving healthcare needs and consumer preferences, their market shares may fluctuate based on strategic mergers and acquisitions or expansions into new regions.

Key U.S. Concierge Medicine Companies:

- MDVIP

- Signature MD

- Crossover Health

- Specialdocs Consultants, LLC

- PartnerMD

- Concierge Consultants & Cardiology

- Castle Connolly Private Health Partners

- Peninsula Doctor

- Campbell Family Medicine

- Destination HealthMDI

- Priority Physicians, Inc.

- U.S. San Diego Health

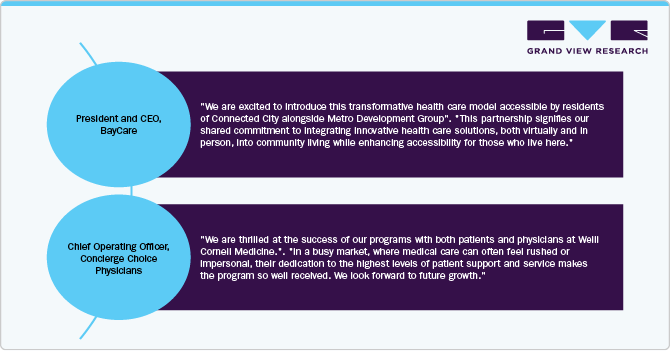

Key Opinions from Industry Leaders

Recent Developments

-

In September 2024, BayCare Health System announced a partnership with Metro Development Group to offer customized concierge medicine services specifically tailored for Pasco County communities. This collaboration aims to enhance healthcare accessibility and provide personalized medical care that meets the unique needs of residents in the area.

-

In July 2024, Dr. Keisha B. Ellis introduced a new primary care practice affiliated with MDVIP in the Metro Atlanta area. MDVIP is a network of primary care physicians that emphasizes personalized healthcare and preventive medicine, allowing doctors to spend more time with their patients compared to traditional practices.

-

In February 2024, Concierge Choice Physicians (CCP) announced that four additional physicians from the Primary Care Division at Weill Cornell Medicine are now participating in CCP’s Hybrid Choice program. This enhanced service aims to provide patients with improved connectivity and peace of mind through better communication between doctors and their patients.

U.S. Concierge Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.09 billion

Revenue forecast in 2030

USD 13.23 billion

Growth rate

CAGR of 10.33% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ownership, specialty

Country scope

U.S.

Key companies profiled

MDVIP; Signature MD; Crossover Health; Specialdocs Consultants, LLC; PartnerMD; Concierge Consultants & Cardiology; Castle Connolly Private Health Partners; Peninsula Doctor; Campbell Family Medicine; Destination Health MDI; Priority Physicians, Inc.; U.S. San Diego Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Concierge Medicine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. concierge medicine market report based on ownership and specialty:

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Group

-

Standalone

-

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Care

-

Internal Medicine

-

Pediatrics

-

Cardiology

-

Osteopathy

-

Psychiatry

-

Others

-

Frequently Asked Questions About This Report

b. Key factors that are driving the U.S. concierge medicine market growth include increasing demand for convenience care, advantages offered by concierge medicine to patients, and higher career satisfaction among concierge physicians.

b. The U.S. concierge medicine market size was estimated at USD 7.35 billion in 2024 and is expected to reach USD 8.09 billion in 2025.

b. The U.S. concierge medicine market is expected to grow at a compound annual growth rate of 10.33% from 2025 to 2030 to reach USD 13.23 billion by 2030.

b. The primary care segment dominated the U.S. concierge medicine market with a share of 26.72% in 2024. This is attributable to the rising demand for primary care and the shortage of primary care professionals.

b. Some key players operating in the U.S. concierge medicine market include MDVIP; Signature MD; Crossover Health; Specialdocs Consultants, LLC; PartnerMD; Concierge Consultants & Cardiology; Castle Connolly Private Health Partners; Peninsula Doctor; Campbell Family Medicine; Destination Health MDI; Priority Physicians, Inc.; U.S. San Diego Health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.