- Home

- »

- Consumer F&B

- »

-

U.S. Confectionery Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Confectionery Market Size, Share & Trends Report]()

U.S. Confectionery Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Chocolate Confectionery, Sugar Confectionery), By Distribution Channel (Specialty Chocolate Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-145-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

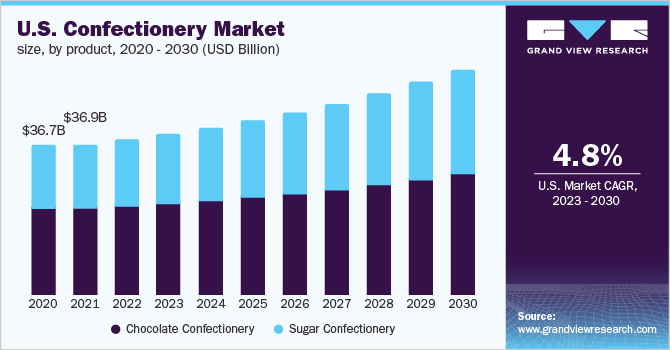

The U.S. confectionery market size was valued at USD 38.17 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. In recent years, confectioneries, particularly chocolate & candies, gummies, and jellies have gained immense popularity among consumers across the U.S. Consumers are now seeking high-quality and tasty confectioneries in different variants. This factor is anticipated to drive the growth of the confectionery industry in the U.S. over the forecast period.

The U.S. confectionery industry has been resilient throughout the pandemic. Even during the COVID-19 pandemic and the global economic crisis that ensued, the U.S. confectionery industry sales exceeded USD 36.70 billion in 2020. This growth can largely be attributed to the U.S.-based consumers re-engaging with the confectionery seasons after a tumultuous 2020 due to lockdowns. According to the NCA’s third annual State of Treating report published in 2022, chocolate and candy sales were up by 11% in 2021 from 2020, as consumers focused on seasonal celebrations, sharing, and gifting, and emotional well-being.

In the U.S., consumption of sugar confectioneries such as candies is on the rise as they are considered simple, affordable treats with uncanny ability to boost the mood. According to the NCA, 4 in 10 consumers are connected to a store or confectionery brand on social media. Around 9 in 10 consumers are interested in learning about a confectionery brand’s environmental commitments and social responsibility practices on the package label and the brand’s website or social media. Around 91% of consumers report taking road trips, and 83% of these consumers, sometimes or always carry chocolates and candies.

In addition, around 66% of Americans have researched candy gifting, baking with candy, or other inspirational ideas on social media, and around 47% of consumers occasionally purchase confectionery items they deem to have a “better-for-you” profile, though how that determination is made varies widely between demographic groups. Further, nearly three-quarters of consumers agree that it is important for chocolate and candy brands to offer a variety of portion sizes. These instances are driving market growth across the U.S.

In the confectionery market, milk-free and gelatin-free products are hitting the shelves owing to the growing popularity of plant-based confectionery. Increasing product launches in vegan chocolate confectioneries across the U.S. For instance, in February 2022, Katjes, Germany’s second-largest gummy candy brand, expanded to the U.S. with a 100% plant-based portfolio. Since launching in May 2021, Katjes USA has secured a nationwide listing at Walgreens with further retail listings set for spring 2022. The brands also offer direct-to-consumers services.

Increasing product launches are driving the overall industry growth. For instance, in April 2021, SkinnyDipped, a maker of coated almonds, peanuts, and cashews, is diving into the candy category with the launch of chocolate bars and peanut butter cups.The brand’s new offerings include a dark chocolate almond bar, a dark chocolate salted caramel bar, dark chocolate peanut butter cups, and milk chocolate peanut butter cups. Featuring a blend of maple sugar, cane sugar, and allulose, the confections have up to 79% less sugar than leading brands and are made without stevia or sugar alcohols especially designed for consumers as they are becoming more educated about the use of sugar alcohols and their connection to gut health.

Product Insights

Chocolate confectioneries accounted for a share of 56.7% of the global revenue for 2022. The growth of the segment is characterized by growing interest in chocolate confectioneries. Millennials and younger consumers are the major consumers of these products owing to growing interest in premium flavors and products such as gourmet chocolates and confectioneries.

Further, the growing availability of several variants such as almonds, and hazelnuts in these products is driving the consumption of chocolate confectioneries as it complements any dry fruit. In 2021, Russell Stover Chocolates introduced ‘Joy Bites’, a line of Fairtrade chocolate bars made with non-GMO and organic ingredients and no added sugar. These product launches are fueling the segment’s growth.

Sugar confectioneries is anticipated to grow at a CAGR of 5.8% over the forecast period. The growth of the segment is characterized by an increase in demand and consumption of toffees, jellies, nougat, and caramel. These products are in high demand during the holiday season. These candies are in high demand and are primarily consumed by children. Many candies contain fruits, nuts, and almonds, among other things, which help to enhance the flavor owing to which the consumption has been on the rise.

Sugar confectioneries appeal to people of all ages, genders, and income levels in the U.S. This adaptability opens up a wide range of opportunities for sugar or candy manufacturers to engage a larger number of consumers. Premium flavor profiles, such as mock tail-based flavors, are becoming more popular in the market to provide more options for the millennial population.

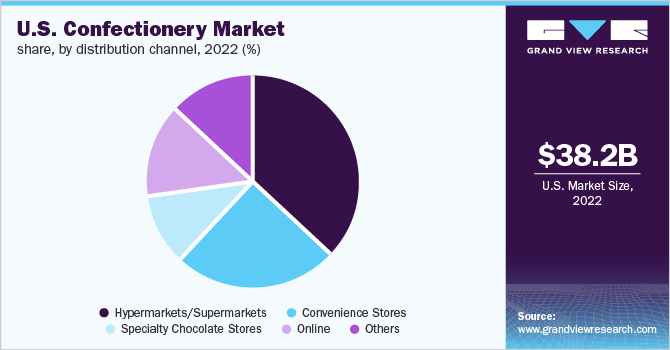

Distribution Channel Insights

Hypermarkets/supermarkets accounted for a larger share of 36.5% in 2022. An increasing number of prominent offline retailers such as Walmart, Kroger, Target Brands, Inc., Tesco, and Walgreens offer these products in different flavors and variants such as dark chocolate, and hazelnut among other formats in the U.S., which propels the growth of the segment.

Increasing product launches through Walmart has contributed to the segment’s growth. For instance, in March 2021, Kinder Bueno Mini launched a popular full-size candy bar, these bite-sized pieces feature smooth milk chocolate, a thin crispy wafer filled a creamy hazelnut filling, and dark chocolate drizzle at Walmart and Target Brands Inc.

Online channel is anticipated to grow with a higher CAGR of 6.4% over the forecast period. In recent years, the segment has witnessed immense product adoption as consumers like to experience different flavors of confectioneries from prominent international brands that are available online. The segment growth was positively impacted due to the temporary closures induced during the COVID-19 pandemic. Several offline retailers faced temporary closure issues owing to which the sales from online channels witnessed growth. Such instances are likely to bode well for market growth in the U.S.

Regional Insights

Northeast U.S. made the largest contribution to the market in 2022. The confectionery industry experienced rapid development, structural adjustment, and industrial upgrading in major economies in the Northeast U.S. including Massachusetts, New Jersey, New York, and Pennsylvania in recent years. Growing consumer interest in sweet dishes and gourmet confectioneries has led to increased demand for these products.

Further, the increasing penetration of major players such as Mondelez International, The Hershey Company, and Ferrero along with the increasing accessibility to such products is driving the growth. Younger consumers and millennials in the region are keen to try new and international sweet dishes such as confectionery among others, which opens new avenues for the U.S. confectionery market growth.

Southeast U.S. is expected to be the fastest-growing region during the forecast period. The availability of a wide variety of products in authentic flavors in confectioneries and consumers’ willingness to try new flavors in the region will bolster the market growth in the coming years. During and after the COVID-19 pandemic, the interest in baked goods that uses the product prevailed across Florida, Mississippi, Georgia, Kentucky, and North Carolina. Players including The Hershey Company, Monin, and Nestle are extending their presence in gourmet chocolate-flavored confectioneries across the region which bodes well for the Southeast U.S. market growth.

Key Companies & Market Share Insights

The industry is characterized by the presence of some large multinational companies with a strong presence across the U.S. Some of the key players are Mars, Incorporated and its Affiliates; Mondelez International; The Hershey Company; Ferrero; General Mills Inc.; Lindt & Sprungli; Kellogg Co.; Clif Bar & Co.; Simply Good Foods Co.; and Nestlé. have been implementing various expansion strategies such as mergers & acquisitions, capacity expansions, strengthening of online presence, and new product launches to gain a competitive advantage.

These manufacturers are adopting various strategies, including new product launches, expansion of product portfolios, and mergers & acquisitions. For instance:

-

In June 2022, Mars, Incorporated and its Affiliates announced a partnership with Perfect Day, Inc. and the launch of its first-ever line of animal-free and earth-friendly chocolate, under its new brand CO2COA. Perfect Day is a manufacturer of animal-free milk protein.

-

In November 2022, Ferrerorevealed its holiday product lineup and launched products ranging from cookies to confectionery to mints. The company expanded its offerings with the addition of seasonal offerings from its cookie brands Keebler and Royal Dansk.

-

In November 2021, Nestlé announced the launch of the Christmas 2021 range stuffed with festive favorites and some new launches from its iconic brands including KitKat, Aero, and Milkybar. Aero is one of Nestlé’s most popular confectionery brands. Aero launched ‘Dreamy White Snowbubbles’ and features the same bubbly taste sensation, with a white center enrobed in smooth milk chocolate.

Some prominent players in the U.S. confectionery market include:

-

Mars, Incorporated and its Affiliates

-

Mondelēz International, Inc.

-

The Hershey Company

-

Ferrero

-

General Mills Inc.

-

Lindt & Sprungli

-

Kellogg Co.

-

Clif Bar & Co.

-

Simply Good Foods Co.

-

Nestlé

U.S. Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 39.57 billion

Revenue forecast in 2030

USD 55.35 billion

Growth Rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

Northeast; Southeast; Midwest; West; Southwest

Key companies profiled

Mars; Incorporated and its Affiliates; Mondelēz International, Inc.; The Hershey Company; Ferrero; General Mills Inc.; Lindt & Sprungli; Kellogg Co.; Clif Bar & Co.; Simply Good Foods Co.; Nestlé

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Confectionery Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the U.S. confectionery market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Chocolate Confectionery

-

Countlines

-

Chocolate Pouches And Bags

-

Tablets

-

Seasonal Chocolates

-

Boxed Assortments

-

Others

-

-

Sugar Confectionery

-

Pastilles, Gums, Jellies, And Chews

-

Mints

-

Medicated Confectionery

-

Toffees, Caramels And Nougat

-

Other Sugar Confectionery

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets/Supermarkets

-

Convenience Stores

-

Specialty Chocolate Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

Northeast

-

Southeast

-

Midwest

-

West

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. confectionery market size was estimated at USD 38.17 billion in 2022 and is expected to reach USD 39.57 billion in 2023.

b. The U.S. confectionery market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 55.35 billion by 2030.

b. Northeast U.S. dominated the U.S. confectionery market with a share of 35.4% in 2022. This is attributable to growing consumer interest in sweet dishes and gourmet confectioneries which has led to increased demand for confectioneries

b. Some key players operating in the U.S. confectionery market include Mars, Incorporated and its Affiliates; Mondelez International; The Hershey Company; Ferrero; General Mills; Lindt & Sprungli; Kellogg Co.; Clif Bar & Co.; Simply Good Foods Co.; Nestlé

b. Key factors that are driving the market growth include increasing demand for confectioneries particularly chocolate and candies, gummies, jellies. Consumers are now seeking for high quality and tasteful confectioneries in different variants, which is driving the U.S. confectionery market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.