- Home

- »

- Healthcare IT

- »

-

U.S. Dental Clearing Houses Market Size, Share Report 2030GVR Report cover

![U.S. Dental Clearing Houses Market Size, Share & Trends Report]()

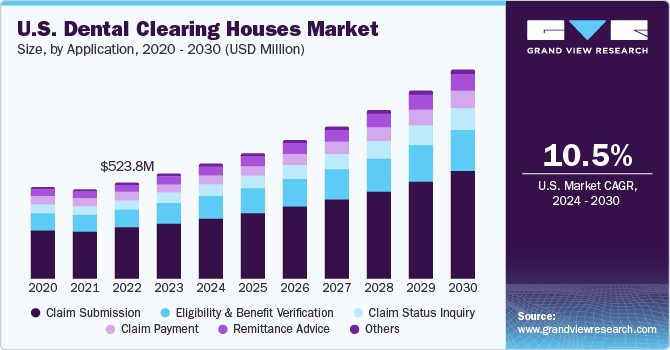

U.S. Dental Clearing Houses Market Size, Share & Trends Analysis Report By Application (Claim Submission, Eligibility & Benefit Verification, Claim Status Inquiry, Claim Payment, Remittance Advice, Others), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-185-2

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. dental clearing houses market size was estimated at USD 523.67 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.49% from 2024 to 2030. This can be attributed to the increasing claim denial rates and high demand for improved administration efficiency in the U.S. The clearinghouse bridges the gap between healthcare providers and insurance payers through Electronic Data Interchange (EDI), enhancing communication and making it simpler & quicker.

A dental claim clearing house is an intermediary between insurance companies and dental healthcare providers. These providers use medical billing software to electronically upload their claims. The clearing houses then review the claims for billing and coding errors before submitting them to the respective payers for processing. Insurance companies either accept or reject the claims. If a claim is rejected, the clearinghouse is notified of the errors. These providers receive reimbursement for their services only if there are no errors in the claim.

The increasing number of dental claim denials and the rise in patient Accounts Receivable (A/R) are the primary factors expected to contribute to the market growth over the forecast period. Dental healthcare is viewed as distinct from primary healthcare, which affects the billing & reimbursement process. Furthermore, the trend of high patient responsibility in the case of insured patients & self-pay complicates the process and increases the claim denial rate. According to the Kaiser Family Foundation statistics, in 2021, around 17% of the in-network claims across HealthCare.gov Issuers were denied. Such factors are expected to contribute to market growth.

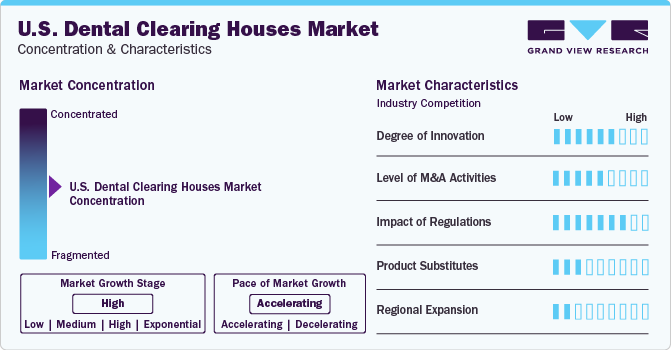

Market Concentration & Characteristics

The dental claims processing workflow became much more efficient and streamlined with the integration of electronic claims processing and HIPAA mandates. Dental clearing houses have made the process more manageable by minimizing touchpoints and enabling the tracking of claims throughout the entire process. This has replaced the complex and manual process that was previously used.

Various companies in the industry, including DentalXChange (doing business as EDI Health Group), Dentrix (a division of Henry Schein One), Change Healthcare, Vyne Dental (owned by Napa EA/MEDX LLC), and Electronic Dental Services, are engaged in mergers and acquisitions to increase their reach and enhance their range of offerings. For instance, in June 2022, DentalxChange acquired its long-time partner, ExtraDent. This acquisition expanded the solution portfolio of the company with the addition of ExtraDent’s Virtual Assistants solution.

In the U.S., the clearing houses must be HIPAA-compliant, guaranteeing personal information and data protection. Moreover, the providers look for the HITRUST-certified status for information security, which suggests that the clearinghouse has passed the security evaluation process and managed risk while maintaining high data protection and anti-theft standards. Each claim file is subsequently converted into a file that is ANSI-X12-837 format compatible.

The major players in the market are adopting several strategies to expand their regional reach, including the adoption of technologically advanced solutions, increasing payer lists, and partnerships & collaborations.

Application Insights

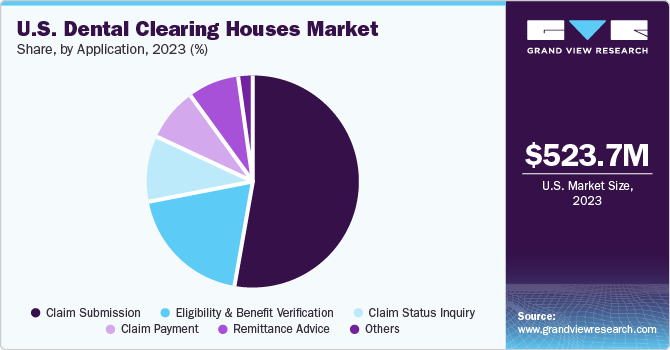

The claim submission segment dominated the market with a revenue share of 52.6% in 2023. This can be attributed to an increase in electronic submission volumes and increasing spending on claim submissions due to higher patient encounters. According to the 2022 CAQH Index, around 662 million dental claims were submitted electronically.

The eligibility and benefit verification segment is expected to witness the fastest growth over the forecast period. This can be attributed to the growing claim denial rates on account of the eligibility of the patients. According to the Optum 2022 Revenue Cycle Denials Index, registration and eligibility were the biggest cause of medical claims denial in the U.S. in 2022, accounting for around 22% of the total denied claims. The dental clearing houses offer electronic eligibility and benefit verification to avoid claim rejection and improve cash flows while streamlining the operations, contributing to the high share of the segment.

Key Companies & Market Share Insights

The market is still in its initial stages, with many companies entering the market. Moreover, the companies operating in the market are involved in various strategic decisions, including mergers & acquisitions, partnership & collaborations, and new product launch, which better suit the changing market landscape.

-

DentalXChange (EDI Health Group, dba), and Change Healthcare are some of the dominant players operating in the market.

-

DentalXChange (EDI Health Group, dba) operates an electronic data interchange platform designed to empower dental practices through various online services, improving the business aspects of their operations. Its services encompass claims & practice management tools, credentials, website development & hosting, a job board, a dental directory, an online community, and timely news & articles

-

Change Healthcare serves as a healthcare insurance claim clearinghouse for payers and providing administrative and consulting support to help providers enhance reimbursement through improved coding, billing, and collections processes

-

Vyne Dental (Napa EA/MEDX LLC), Apex EDI (Therapy Brands), Electronic Dental Services, and Cadence Education are some of the emerging market players functioning in the market.

-

Vyne Dental (Napa EA/MEDX LLC) is a technology & solution provider for dental practices, healthcare providers, and insurance plans. Their offerings encompass diverse solutions, including electronic claims & attachments, batch & real-time eligibility checks, electronic patient forms, mobile payments, patient text & email reminders, dental treatment chat, and other services

-

Electronic Dental Services provides dental, medical, & vision claim processing tools proposed to deliver the cost-effective and most operative solutions. The company serves thousands of dentists, physicians, & other medical providers nationwide its web-based electronic claims reimbursement system that upsurges profitability & productivity while facilitating fast, providing additional reporting & analysis, and payment of insurance claims

Key U.S. Dental Clearing Houses Companies:

- DentalXChange (EDI Health Group, dba)

- Dentrix (Henry Schein One)

- Change Healthcare

- Vyne Dental (Napa EA/MEDX LLC)

- Electronic Dental Services

Recent Developments

-

In April 2023, Vyne Dental acquired Simplifeye, Inc., a software solutions provider. This acquisition simplified the process of the company's claims management and attachment management

-

In June 2021, Vyne Dental acquired Operability, LLC, and its OperaDDS patient engagement & communications platform

-

In December 2021, Vyne Dental acquired Onederful, Inc., a dental plan eligibility software connecting dental payer companies for claims and Electronic Remittance Advice (ERAs) and eligibility & benefits verification

U.S. Dental Clearing Houses Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.04 billion

Growth Rate

CAGR of 10.49% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S.

DentalXChange (EDI Health Group, dba); Dentrix (Henry Schein One); Change Healthcare; Vyne Dental (Napa EA/MEDX LLC); Electronic Dental Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Clearing Houses Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental clearing houses market report based on application.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Claim Submission

-

Eligibility and Benefit Verification

-

Claim Status Inquiry

-

Claim Payment

-

Remittance Advice

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. dental clearing houses market size was estimated at USD 523.67 million in 2023 and is expected to reach USD 517.3 million in 2024.

b. The U.S. dental clearing houses market is expected to grow at a compound annual growth rate of 10.49% from 2024 to 2030 to reach USD 1.39 billion by 2030.

b. Claim submission segment dominated the U.S. dental clearing houses market with a share of 52.6% in 2023 owing to increased efficiency and streamlined workflows, which enables ease of claim submissions.

b. Some key players operating in the U.S. dental clearing houses market DentalXChange (EDI Health Group, dba), Dentrix (Henry Schein One), Change Healthcare, Vyne Dental (Napa EA/MEDX LLC), and Electronic Dental Services

b. Key factors that are driving the U.S. dental clearing houses market growth include increasing dental claim denial rates, rising patient account receivable (a/r), and high demand for improved administration efficiency.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."