- Home

- »

- Medical Devices

- »

-

U.S. Dental Membrane And Bone Graft Substitutes Market, Report, 2030GVR Report cover

![U.S. Dental Membrane And Bone Graft Substitutes Market Size, Share & Trends Report]()

U.S. Dental Membrane And Bone Graft Substitutes Market Size, Share & Trends Analysis Report By Material Type (Allograft, Autograft), By Application (Sinus Lift, Socket Preservation), By End-Use (Hospitals, Dental Clinics), Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-206-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 20214 - 2030

- Industry: Healthcare

Market Size & Trends

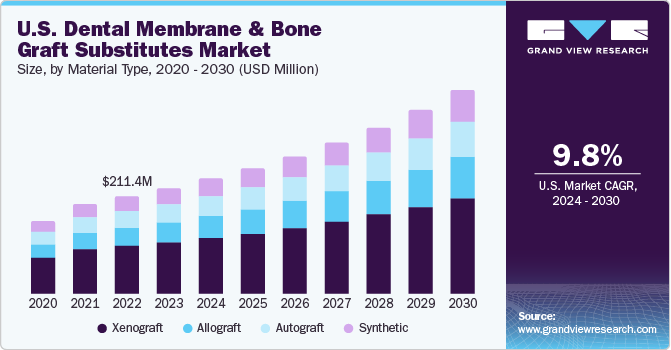

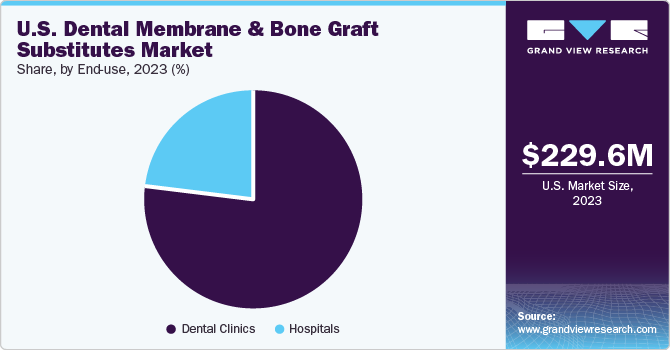

The U.S. dental membrane and bone graft substitutes market size was valued at USD 229.6 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. The U.S. market is expected to witness lucrative growth due to the increasing geriatric population and the presence of sophisticated infrastructure for advanced treatment options such as guided tissue regeneration with CAD/CAM software solutions & digital radiography. Factors such as preventive approaches toward oral care & hygiene, growing R&D activities in dentistry, and increasing disposable income are expected to boost the growth of the market.

As per the CDC, 1 in 4 adults have untreated dental problems, and 46.0% of adults aged over 30 years are showing signs of gum disease. According to the American Dental Association, 58.0% of people in the U.S. visit a dentist once a year, with 15.0% of people making an appointment after experiencing mouth pain. According to the Adults Oral Health & Well Being Survey, 42.0% of U.S. citizens do not visit a dentist as often as they would prefer, and only 15.0% of the surveyed population claimed excellent oral health. Moreover, the geriatric population and its demand for preventive & restorative dental services are likely to witness a surge over the coming years

The growing oral disease burden is expected to propel the dental equipment market. Furthermore, the country has witnessed a surge in the use of dental implants, which has become a standard procedure to treat missing teeth. To carry out this procedure, bone grafting treatment is a requisite as it can accelerate tooth volume and impart stability required for implantation. The demand for bone grafting procedures has increased in proportion to the growing demand for dental implants. Technological advancements in the development of novel synthetic grafting materials, such as calcium sulfate, calcium phosphate cements, bioactive glasses, and polymer-based bone substitutes-which are proven to be safe & effective as bone grafting materials-are expected to propel the market over the forecast period.

The increase in public awareness of dental disease treatment further fuels market growth. For instance, the Alliance of the American Dental Association (AADA) provides oral healthcare programs in the U.S., which benefit people from birth through retirement. Factors such as preventive approaches toward oral care & hygiene, growing R&D activities in dentistry, and increasing disposable income are expected to boost the market growth.

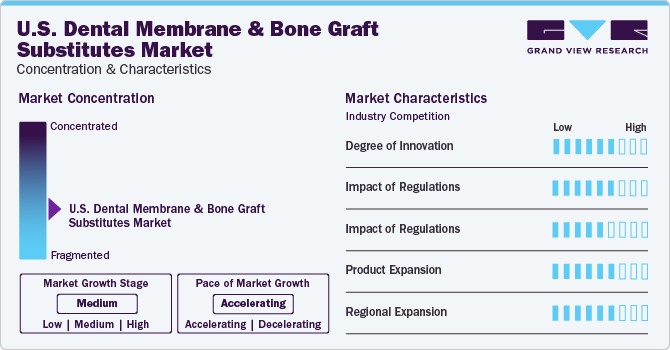

Market Concentration & Characteristics

The demand for dental restoration membranes is increasing significantly due to oral health issues. Players in the dental bone grafts and substitutes market undertake this strategy to strengthen their product portfolios and offer diverse technologically advanced & innovative products to their customers. This strategy is most prominently adopted by companies to attract more customers in the market.

Several market players are acquiring other players to strengthen their market positions. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. For instance, in October 2022, Geistlich announced the acquisition of Lynch Biologics. The acquisition adds another cutting-edge technology to the company’s product portfolio in dentistry.

Even though the dental practices are reopening, the number of patients allowed in offices is limited. Proper adherence to safety guidelines and the reopening of manufacturing sites globally is expected to boost the demand for dental bone grafts & substitute products. Furthermore, the reopening of dental centers with stricter guidelines has invariably increased the cost of dental services, further straining market demand.

With high unemployment levels projected in the coming months, there is a major risk that demand for dental care can decrease due to economic factors. Medical insurance premiums are estimated to increase, meaning that employers may be forced to withdraw dental care, further limiting dental coverage for employees, which would also constrain demand. This has led to a decline in the recent purchases, which is also impacting the product expansions as customers are not actively taking part in the market.

Dental services were among the last to be relaunched after the relaxation of pandemic restrictions, as dental procedures have a high risk of transmission. Movement restrictions between countries interrupted transportation between regional warehouses. Raw material procurement became difficult; hence, products and other components became unavailable, negatively impacting the medical device supply chain. However, with the reopening of the dental clinics, companies have started focusing on expanding their businesses further in the U.S.

End-use Insights

The dental clinics segment dominated the market with a revenue share of 77% in 2023. The number of solo dental practices is increasing across the world. Independent dental clinics are expected to grow in the coming years owing to the rising competition between care providers and the demand for cost-efficient treatments. Most private orthodontists have a single practicing location; however, over 40% are likely to have more than one location. Thus, all these factors have boosted the dental bone graft & substitutes market in dental clinics.

The hospital segment is the fastest-growing segment. Bone grafting procedures are becoming highly specialized due to advancements in technology, and therefore, people are beginning to prefer hospital settings when opting for such procedures. In certain bone grafting procedures, the bone tissue is removed for use from the patient’s body itself; this requires additional surgical treatment and extensive dental imaging, which can be carried out swiftly in hospital settings.

Material Type Insights

The xenograft segment dominated the market with a revenue share of 49.0% in 2023. This is due to its osteoconductive properties that help preserve the original bone mineral structure. The deproteinized bovine bone mineral, commercially named Bio-Oss, is the most used xenograft in periodontal bone regeneration procedures. It is one of the most available bovine bone materials and is processed to provide natural bone minerals without organic elements. Xenogeneic materials are biocompatible and support the formation & ingrowth of new bone at the implantation site.

The allograft segment is the fastest-growing segment. The chronic untreated loss of periodontal tissues, such as gingiva, can be treated through dental bone grafting procedures such as allografts. Cancellous and cortical allografts are mostly used for bone regeneration procedures; they vary in particle size and possess minimal risk of disease transmission due to screening & virucidal tissue processing methods. Approximately 1.75 million allografts are transplanted each year in the U.S. The major driving factor for such bone grafting procedures is the increasing demand for dental implants for improved aesthetics.

Application Insights

The socket preservation segment dominated this market with a revenue share of 33.0% in 2023. This is because it is helpful in the case of dental implants, dental bridges, dentures, and others. Socket preservation procedures involve bone grafting techniques to prevent bone loss immediately after extraction. Advancements in bone grafting materials, such as the advent of synthetic bone materials, have led to an increase in the adoption of socket preservation procedures, as they can accelerate healing and offer a low failure rate.

The sinus lift segment is the fastest-growing segment. Sinus lift procedures can help increase the amount of bone available in the posterior maxilla. According to Perio Implant Advisory, sinus lift procedures have shown more than a 90% success rate. The primary aim of such procedures is to obtain more bone to support dental implants. According to research published in the NCBI, there was a 97.2% implant stability in patients who underwent sinus lift and immediate implant placement.

Key U.S. Dental Membrane And Bone Graft Substitutes Company Insights

Some of the key companies in the U.S. dental membrane and bone graft substitutes market include Geistlich Pharma AG, Nobel Biocare Services AG, Institut Straumann AG, and Zimmer Biomet Holdings, Inc., among others. The market is competitive by nature and is likely to witness several strategic collaborations and partnerships through mergers & acquisitions. The market players are further focused on diversifying the market along with its expansion and acquiring a customer base.

Key U.S. Dental Membrane And Bone Graft Substitutes Companies:

- Geistlich Pharma AG

- Nobel Biocare Services AG

- Institut Straumann AG

- Zimmer Biomet Holdings, Inc.

- Dentsply Sirona, Inc.

- NovaBone Products, LLC

- Collagen Matrix, Inc.

- Medtronic

- Osteogenics Biomedical

- BioHorizons, Inc.

Recent Developments

-

In October 2022, Geistlich Pharma acquired Lynch Biologics, LLC which was aimed at helping Geistlich Pharma strengthen its portfolio by adding Lynch Biologics, LLC's leading product GEM 21S, worldwide. The companies aim to bring advancements in new regenerative technologies in dentistry with this acquisition

-

In April 2023, ZimVie Inc. introduced two new dental biomaterials, RegenerOss CC Allograft Particulate and RegenerOss Bone Graft Plug, to complement their existing portfolio. These products are designed to address extraction sockets and periodontal defects. This launch aims to broaden ZimVie's offerings and cater to a more diverse range of dental applications

U.S. Dental Membrane And Bone Graft Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 250.0 million

Revenue forecast in 2030

USD 442.3 million

Growth Rate

CAGR of 9.8% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, application, end-use

Country scope

U.S.

Key companies profiled

Geistlich Pharma AG; Nobel Biocare Services AG; Institut Straumann AG; Zimmer Biomet Holdings, Inc.; Dentsply Sirona, Inc.; NovaBone Products, LLC; Collagen Matrix, Inc.; Medtronic; Osteogenics Biomedical; BioHorizons, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Membrane And Bone Graft Substitutes Market Report Segmentation

This report forecasts revenue growth in the Italy market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental membrane and bone graft substitutes market based on:

-

Material Type (Revenue in USD Million, 2018 - 2030)

-

Allograft

-

Demineralized Bone Matrix

-

Others

-

-

Autograft

-

Xenograft

-

Synthetic

-

-

Application (Revenue in USD Million, 2018 - 2030)

-

Ridge Augmentation

-

Sinus Lift

-

Periodontal Defect Regeneration

-

Implant Bone Regeneration

-

Socket Preservation

-

-

End-use (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

Frequently Asked Questions About This Report

b. The U.S. dental membrane and bone graft substitutes market size was estimated at USD 229.6 million in 2023 and is expected to reach USD 250.0 million in 2024.

b. The U.S. dental membrane and bone graft substitutes market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 442.3 million by 2030.

b. The xenograft segment dominated the market with a revenue share of 49.0% in 2023. This is due to its osteoconductive properties that help preserve the original bone mineral structure

b. Some of the key companies in the U.S. dental membrane and bone graft substitutes market include Geistlich Pharma AG, Nobel Biocare Services AG, Institut Straumann AG, and Zimmer Biomet Holdings, Inc., among others

b. The U.S. market is expected to witness lucrative growth due to the increasing geriatric population and the presence of sophisticated infrastructure for advanced treatment options such as guided tissue regeneration with CAD/CAM software solutions & digital radiography.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."