- Home

- »

- Medical Devices

- »

-

U.S. Dental Splint Market Size & Share Analysis Report, 2030GVR Report cover

![U.S. Dental Splint Market Size, Share & Trends Report]()

U.S. Dental Splint Market (2022 - 2030) Size, Share & Trends Analysis Report By Mobility Degree (Flexible, Semi-rigid, Rigid), By Distribution Channel (Online, Offline (Through Dental Professionals)), And Segment Forecasts

- Report ID: GVR-4-68039-995-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

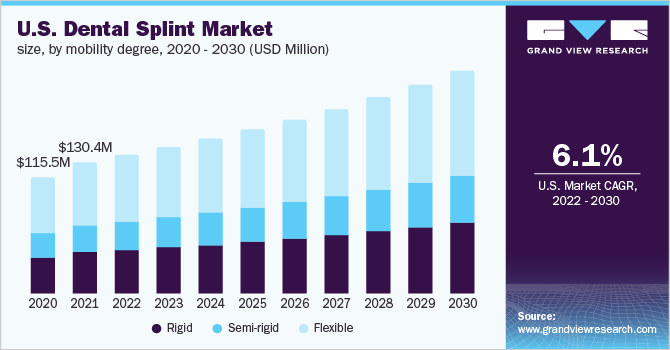

The U.S. dental splint market was valued at USD 130.4 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030. The increasing cases of clenching and grinding of teeth among people and the rising awareness about oral health are anticipated to drive the industry’s growth. Dental hygiene is a crucial part of personal hygiene. In the last few years, people have realized the significance of oral hygiene. They are becoming aware of various disorders and treatment options, such as Temporomandibular Joint function. This has given way to the growth of the market.

In 2021, the American Dental Association reported that more than 70% of surveyed clinicians and dentists observed a rise in teeth clenching and grinding among patients; more than 60% of dental professionals said they observed an increase in TMJ disorder symptoms in their patients.

Millions of individuals suffer from TMJ disorders, characterized by joint dysfunction and pain. TMJ Internal Derangement (ID) is the most prevalent disorder in this field, accounting for 41.1% of patients with TMJ disorder. The condition affects an estimated 10 million U.S. individuals, roughly between the ages of 20 years and 40 years, with these numbers growing further.

The COVID-19 pandemic considerably affected the entire healthcare system, including dental care practices. Dentists were unable to practice during the initial phase of the lockdown, which resulted in the biggest decline in revenue. In March 2020, CDC issued guidelines for dental settings in response to the rising number of COVID-19 cases.

The dental splints market was impacted negatively in 2020 due to decreased number of procedures and disruption in the supply chain. However, in 2021, the market recovered and grew at a significant rate due to COVID-19-related stress disorder.

Mobility Degree Insights

Based on product, the rigid segment had the highest revenue share at 47.6% in 2021. This is attributed to the fact that a rigid splint is the most commonly used splint in the market as it reduces pain by ensuring no movement of the teeth. Rigid dental splints are easy availability in dental clinics that involve low material cost, and ease of modification.

The semi-rigid segment is anticipated to witness a sizable CAGR is anticipated during the forecast period. A semi-rigid splint is used to protect, support, and immobilize teeth that have been suffering from a dental issue. In a semi-rigid splint, the functional mobility of the traumatized tooth is comparable to a rigid splint. However, a semi-rigid splint is more favorable for the recovery of the periodontal ligament, which reduces the risk of ankyloses.

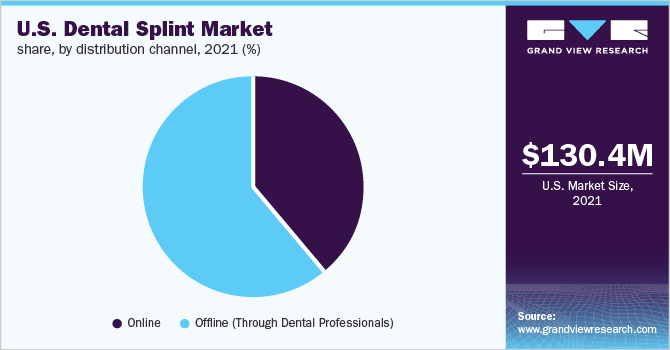

Distribution Channel Insights

Based on distribution channel, the offline segment accounted for the largest revenue share of 55.9% in 2021Most of the customers prefer to buy a product only after physically examining a product, which may reduce the number of product returns for various businesses. In the dental industry, dentists are involved in buying and selling dental products.

The online segment is expected to witness the highest CAGR during the forecast period. The manufacturers of dental splints are distributing their products online and via other retail outlets, such as pharmacies and supermarkets. Some dentists are selling these products online through their websites directly to patients. People tend to look to online stores for buying dental products due to numerous advantages, such as ease of buying, price comparison, and free home delivery. Hence, these factors are responsible for the growth of the segment over the forecast period.

Key Companies & Market Share Insights

The presence of numerous domestic and international players reflects the market's intense competition. With the different strategic actions by key competitors, including partnerships, mergers, acquisitions, and collaboration by these players, the industry is expanding. The COVID-19 pandemic has caused significant losses to the market players. Some manufacturers still launched new products to compete in the market. For instance, it was observed that COVID-related stress led to increased cases of jaw clenching and grinding. Hence, a market player like Glidewell launched the Comfort3D Bite Splint to help in preventing teeth damage caused by clenching and bruxism.

The industry players are launching new products and technology to capture a huge share of the market. For instance, Sporting Smiles introduced 3D stored teeth impressions by which customers can keep their dental impressions on record for life, using digital technology and 3D scanning. Some prominent players in the U.S. dental splint market include:

-

Aqualizer

-

Glidewell

-

Procter & Gamble

-

Dentek

-

Brux Night Guard

-

Sporting Smiles

-

Smile Brilliant

-

Chomper Labs

-

Sentinel Mouth Guards

U.S. Dental Splint Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 137.4 million

Revenue forecast in 2030

USD 220.6 million

Growth Rate

CAGR of 6.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mobility degree, distribution channel

Key companies profiled

Aqualizer; Glidewell; Procter & Gamble; Dentek; Brux Night Guard; Sporting Smiles; Smile Brilliant; Chomper Labs; Sentinel Mouth Guards

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dental Splint Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dental splint market report based on mobility degree and distribution channel:

-

Mobility Degree Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible

-

Semi-rigid

-

Rigid

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline (Through dental professionals)

-

Frequently Asked Questions About This Report

b. The U.S. dental splint market size was estimated at USD 130.4 million in 2021 and is expected to reach USD 137.4 million in 2022.

b. The U.S. dental splint market is expected to grow at a compound annual growth rate of 6.1% from 2022 to 2030 to reach USD 220.6 million by 2030.

b. The rigid segment dominated the U.S. dental splint market with a share of 47.9% in 2022. This is attributable to the fact that a rigid splint is the most commonly used splint in the market as it reduces pain by ensuring no movement of the teeth.

b. Some key players operating in the U.S. dental splint market include Aqualizer, Glidewell, Procter & Gamble, Dentek, Brux Night Guard, Sporting Smiles, Smile Brilliant, Chomper Labs, and Sentinel Mouth Guards.

b. Key factors that are driving the market growth include increasing cases of clenching & grinding of teeth among people and the rising awareness of oral health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.