- Home

- »

- Healthcare IT

- »

-

U.S. Digital Therapeutics Market Size & Share Report, 2030GVR Report cover

![U.S. Digital Therapeutics Market Size, Share & Trends Report]()

U.S. Digital Therapeutics Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Diabetes, Obesity, CNS Diseases, Others), By End Use (Patients, Providers, Payers, Employers, Others), And Segment Forecasts

- Report ID: GVR-4-68038-870-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

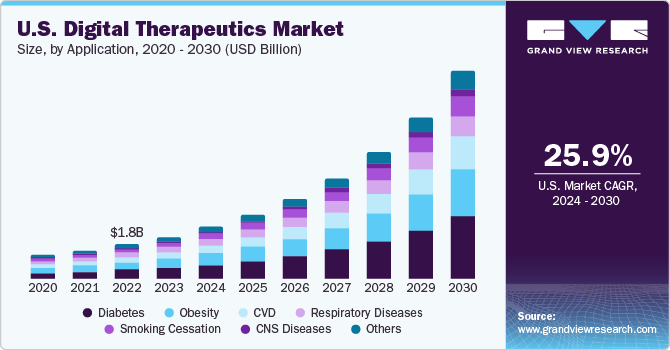

The U.S. digital therapeutics market size was valued at USD 1.8 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 25.4% from 2023 to 2030. The continuously changing digital landscape, rising consumerism in healthcare, the COVID-19 pandemic, and initiatives by key companies are some of the key factors fueling the market growth. In October 2021, Click Therapeutics, Inc. received USD 52 million in Series B funding from multiple investors. This enabled the development and commercialization of the company’s prescription digital therapeutic pipeline, while also helping the company advance its platform capabilities.

Technological advancements aiming to provide transformational healthcare solutions are further anticipated to assist the market growth in the near future. In June 2020, ATAI Life Sciences, in an attempt to enter the digital therapeutics space, launched the IntroSpect Digital Therapeutics platform. The company will provide DTx and precision psychiatry solutions in a probe to combat burgeoning mental health disorders.

The increasing number of smartphone users in the U.S. is another key factor driving the market growth. Awareness of smart health tracking is also expected to increase in the country due to the rapid proliferation of smart healthcare devices. Digital therapeutics can offer on-demand care to patients, with the ability to diagnose and treat patients earlier. Moreover, biopharmaceutical companies are collaborating with digital therapeutic providers to give patients a better quality of care, thereby propelling growth.

Despite the advantages of DTx services and a large smartphone user base in the U.S., it never experienced mass consumer adoption before the COVID-19 outbreak. The pandemic created a major growth opportunity for this technology. CMS and FDA have already mentioned the vital nature of virtual care services in the overall COVID-19 response strategy.

Social distancing and self-isolation have resulted in increased anxiety & stress. According to Mental Health America, there was nearly a 19% increase in clinical anxiety in the first week of February 2020, and around a 12% increase in the first two weeks of March. DTx therapies can help manage these conditions and provide evidence-based solutions. Companies such as BigHealth, Happify, Palo Alto Health Science, and Pear Therapeutics are constantly trying to increase their consumer base and reach out to more patients during this pandemic.

Application Insights

Diabetes dominated the application segment in 2022 with more than 27.7% of the revenue share. Diabetes prevalence is growing rapidly and is linked to blindness, heart attack, kidney failure, stroke, and gangrene in severe cases. Digital therapeutics are being used for the management & prevention of diseases by helping patients change their behavior through constant monitoring, thus improving their health in the long run.

Based on application, the U.S. digital therapeutics market is segmented into diabetes, obesity, CVD, respiratory diseases, smoking cessation, CNS diseases, and others. The CNS diseases segment is expected to show significant growth during the forecast period, owing to the increasing incidence of neurological diseases in the U.S. Alzheimer’s disease, expressive aphasia, degenerative diseases, Huntington’s disease, multiple sclerosis, and Parkinson’s disease are some of the most common neurological diseases that affect a growing proportion of the U.S. population.

Several digital therapeutics companies have been catering to the specific needs of Central Nervous System (CNS) disease patients to reduce anxiety and keep track of their daily activities. The demand has increased after the nationwide lockdown brought on by the COVID-19 pandemic.

According to a KFF tracking poll, around 47% of Americans staying at home have reported negative mental health effects as of March 2020. Out of them, over 21% have reported a major negative impact on their mental health. The FDA has released new guidelines for the computerized behavioral therapy and other DTx solutions during this public health emergency, which is expected to fuel the growth.

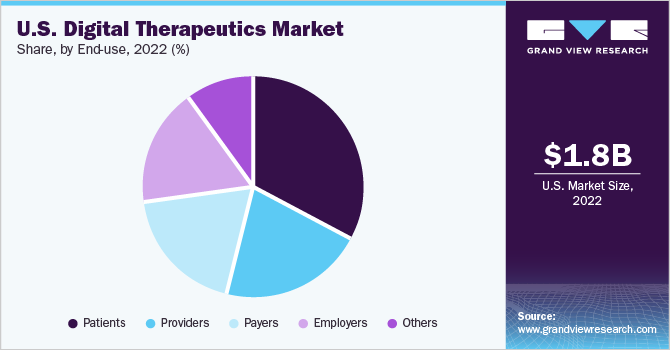

End-use Insights

The patient end-user segment dominated the overall market with more than 32.7% of the revenue share in 2022. The increased adoption of these tools can be attributed to their added benefits, one of which is effective health management at an affordable cost. In addition, the presence of advanced healthcare IT solutions and supportive government programs in the country are factors expected to further boost the adoption of digital therapeutics by patients.

Based on end-use, the market is segmented into patients, providers, payers, employers, & other end-users. The employer segment is expected to show notable growth during the forecast period. Employers are focusing on the management of employee healthcare costs, which is expected to drive segment growth. Moreover, growing awareness through employee healthcare programs is expected to propel the adoption of digital therapeutics for maintaining employee wellbeing.

The availability of various mHealth apps, such as Vida Health, used by payers, providers, and employers to monitor chronic conditions such as prediabetes, obesity, hypertension, & mental health issues, is another factor expected to propel market growth.

Key Companies & Market Share Insights

The digital therapeutics market in the U.S. is competitive. Market players are taking strategic initiatives such as product launches, mergers & acquisitions, and regulatory approvals to gain more market share. For instance, in March 2020, the U.S. FDA approved Somryst by Pear Therapeutics for chronic insomnia, which includes algorithm-driven sleep restriction, recommendations, & consolidation.

In November 2019, Blue Cross Blue Shield of Minnesota announced to provide reimbursement for Omada’s diabetes prevention program to its self-insured payers. Moreover, in April 2022, Pear Therapeutics received FDA’s Safer Technologies Program (STeP) Designation as a product candidate for the treatment of acute and chronic pain. Some of the key players in the U.S. digital therapeutics market include:

-

Omada Health Inc.

-

Teladoc Health, Inc.

-

2Morrow Inc.

-

Propeller Health (ResMed)

-

Fitbit Health Solutions

-

Canary Health

-

WellDoc, Inc.

-

Noom, Inc.

-

Pear Therapeutics, Inc.

-

Click Therapeutics, Inc.

-

Akili Interactive Labs, Inc.

-

Better Therapeutics, Inc.

U.S. Digital Therapeutics Market Report Scope

Report Attribute

Details

The revenue forecast in 2030

USD 10.5 billion

Growth Rate

CAGR of 25.4% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use

Country Scope

The U.S.

Key companies profiled

Omada Health Inc.; Teladoc Health, Inc.; 2Morrow Inc.; Propeller Health (ResMed); Fitbit Health Solutions; Canary Health; WellDoc, Inc.; Noom, Inc.; Pear Therapeutics, Inc.; Click Therapeutics, Inc.; Akili Interactive Labs, Inc.; Better Therapeutics, Inc

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. digital therapeutics market report based on application and end-use.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes

-

Obesity

-

CVD

-

Respiratory Diseases

-

Smoking Cessation

-

CNS Disease

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Employers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. digital therapeutics market size was estimated at USD 1.8 billion in 2022 and is expected to reach USD 2.2 billion in 2023.

b. The U.S. digital therapeutics market is expected to grow at a compound annual growth rate of 25.4% from 2023 to 2030 to reach USD 10.5 billion by 2030.

b. Diabetes dominated the U.S. digital therapeutics market in 2022. This is attributable to the increasing prevalence of the disease and advancements in healthcare IT.

b. Some key players operating in the U.S. digital therapeutics market include Omada Health Inc.; Teladoc Health, Inc.; 2Morrow Inc.; Propeller Health (ResMed); Fitbit Health Solutions; Canary Health; WellDoc, Inc.; Noom, Inc.; Pear Therapeutics, Inc.; Click Therapeutics, Inc.; Akili Interactive Labs, Inc.; and Better Therapeutics, Inc.

b. Key factors driving the U.S. digital therapeutics market growth include increased use of the internet and smartphones, rising consumerism in healthcare, the COVID 19 pandemic, and initiatives by key companies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.