- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Disposable Face Mask Market Size, Growth Report, 2030GVR Report cover

![U.S. Disposable Face Mask Market Size, Share & Trends Report]()

U.S. Disposable Face Mask Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Protective, Dust, Non-Woven), By Application (Industrial, Personal), By Distribution Channel, By State, And Segment Forecasts

- Report ID: GVR-4-68038-547-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

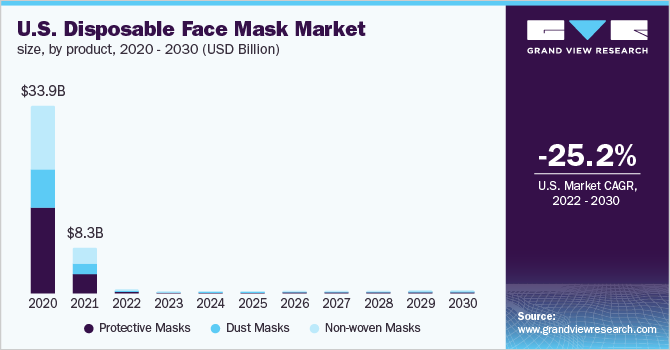

The U.S. disposable face mask market size was valued at USD 8,316.5 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of -25.2% from 2022 to 2030. Rising pollution levels, increased usage among consumers, and more knowledge about health and well-being are the primary factors driving the market. In addition, the rising number of operations conducted daily, along with the unprecedented spread of the coronavirus, is encouraging the use of disposable face masks. Furthermore, the rising frequency of airborne illnesses, rising mask consumption for personnel usage, and rising incidence of hospital-acquired infections might make disposable face masks a profitable business.

The COVID-19 (coronavirus) outbreak that began in China during the first half of 2020 is likely to benefit the global market. The very function of disposable face masks necessitates their consumption worldwide during an outbreak of such pandemic diseases. The disposable face masks industry has been historically relying heavily on the growth of the Chinese market as China has been traditionally supplying most of the disposable face masks worldwide. However, the COVID-19 outbreak has encouraged the entry of new players across countries owing to the unprecedented demand for the product in domestic markets. In the near term, countries are expected to be more independent when it comes to the production of disposable face masks.

Small and medium-sized market players are expected to show considerable improvements in the foreseeable future, given the moderate level of capital expenditure needed to set up a business. Larger companies, however, are likely to aim for global expansion, in a bid to gain a more considerable brand reputation. Capacity expansion is expected to remain the preferred competitive strategy for prominent market participants. For instance, in March 2020, Honeywell expanded its production capabilities in Phoenix, Arizona to produce N95 face masks in support of the U.S. government’s response to the novel coronavirus pandemic.

The COVID-19 outbreak worldwide has been significantly contributing to the increasing demand for raw materials and accessories to make disposable face masks. In this respect, prominent raw material suppliers from around the world have stepped up their efforts to increase their scale of operation. For instance, in March 2020, Asheboro Elastics Corp., a U.S.-based manufacturer of knitted, elastic, woven, and rigid narrow fabrics, announced that it will be manufacturing and supplying 3 million yards of fabric to a Texas-based disposable face masks company to make medical-grade face masks. Such instances of raw material oversupply are expected to surface globally over the forecast period, given the ongoing impact of the novel coronavirus.

The use of a surgical mask to protect one from the viruses and other pathogens that can cause infections is projected to upscale the demand for disposable face masks soon. The main purpose of these masks is to avoid one from getting in contact with airborne germs, dust, and other infection-carrying pathogens. The rise in cases of Hospital Acquired Infections (HAIs), the growing elderly population, and the development of healthcare facilities in emerging economies is fueling the market growth. Though these masks are designed to offer protection, it is recommended to select one that won’t cause any allergies.

Major players in the market have been ramping up their production capacity, along with improvising their distribution channels, to cater to the unexpected spike in the demand. For instance, on March 30, 2020, Honeywell announced to expand its manufacturing capabilities in Phoenix to produce N95 face masks in support of the U.S. government’s response to the novel coronavirus. The companies would produce more than 20 million N95 disposable masks monthly to combat the deteriorating COVID-19 condition in the U.S. This announcement came immediately after the expansion of its manufacturing operations in Smithfield, Rhode Island, announced on March 22, 2020.

Product Insights

The protective masks segment dominated the market and accounted for a revenue share of more than 40.0% in 2021. Protective face masks are preferred by users with respiratory issues such as asthma or lung disease as well as those suffering from various cardiovascular ailments. Protective masks such as the N95 are known to offer higher protection to healthcare workers who are exposed to patients’ respiratory secretions on a regular basis. N95 masks have been the gold standard for face masks during the pandemic as they filter out 95% of airborne particles and are approved by the National Institute for Occupational Safety and Health (NIOSH). They are particularly useful for high-risk situations like during flights or when in an enclosed and crowded environment for a long time.

The dust masks segment is projected to register a CAGR of -22.8% from 2022 to 2030. Dust masks come in various shapes and sizes. Some of them have round elastic bands, while others come with flat elastic bands. Dust masks can have plastic wire, metal wire, or nose foam on the border of the face mask to provide better comfort. Certain dust masks also provide additional benefits such as exhalation valves designed to release hot humid breath quickly, which helps prevent extra heat buildup inside the mask. The basic function of a dust mask is to cover the mouth and nose in order to provide short-term, light-duty breathing protection. Dust masks filter out dust particles and are commonly worn at construction and agricultural worksites.

Application Insights

The personal segment dominated the market and accounted for a revenue share of more than 80.0% in 2021. With the increasing incidence of air-borne diseases and the rising level of pollution, consumers are looking for products to prevent infection and other cardiovascular and respiratory diseases. Disposable face masks are precautionary equipment worn to cover the mouth and nose and prevent users from inhaling toxic poisonous airborne substances or other impure substances in the environment. These masks also serve as a shield against infections, which may spread through the respiratory droplets that are sprayed in the air when an infected person coughs or sneezes. Disposable face masks are used to prevent the spread of infections as well as used for precautionary measures.

The industrial segment is projected to expand at a CAGR of -21.5% from 2022 to 2030. Filtering facepiece particle (FFP) masks are used in a variety of sectors to protect workers from harmful compounds in the air. Masks are used in the metal sector to keep various types of metal smoke, sparks, and dust out of the respiratory tract, which is caused by welding or cutting. Because FFP masks also guard against solid and liquid particles in the form of smoke, droplets, dust, and sparks, these masks are employed in the construction industry, trash disposal, and agriculture.

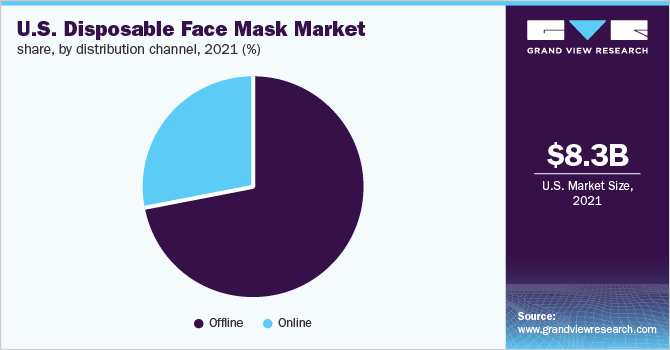

Distribution Channel Insights

The offline segment accounted for the largest revenue share of over 70.0% in 2021. Despite the growing popularity of the online channel, the offline distribution channel still holds a considerable share in the U.S. market. Consumer outlets that sell selective items of a single brand are considered specialty retail stores. Specialty retailers primarily focus on high customer satisfaction. Most pharmacies, drugstores, and hospitals sell disposable face masks at a cheap price. Moreover, purchasing products offline gives a better understanding of the quality and design of the product. Physical verification of the products is only possible through offline channels, and this acts as a crucial deciding factor for consumers.

The online segment is projected to expand at a CAGR of -23.3% from 2022 to 2030. Over the past few years, e-commerce has gained immense popularity as it offers convenience at the click of a button. Buyers across the U.S. are turning to online shopping for a wide range of products, including disposable face masks. Online retail platforms such as Amazon, Walmart, Target, and Etsy sell a wide variety and quantity of disposable face masks for different applications. Online retail platforms also take bulk orders and sell face masks in packs of 30, 50, 100, or more. Additionally, American e-commerce website Esty recently stated that it has been witnessing an unusually high demand for face masks since the outbreak of the novel coronavirus all over the world. To cater to the soaring demand for masks, more than 20,000 retailers are currently using Esty’s online platform to sell thousands of face masks every day.

State Insights

The rest of the U.S. held the largest revenue share of over 35.0% in 2021. California held the second-largest revenue share in 2021. Demand for the product is increasing in this region due to the rise in pollution levels, which is attributed to the release of harmful gases into the air. The high spending power of the working-class population and the government providing masks at a very minimal rate to protect people are other significant factors driving the market in California. Moreover, rising public awareness associated with personal health and hygiene is the factor contributing to the state’s growth.

New York is expected to register a CAGR of -24.6% from 2022 to 2030. Increasing demand for masks from the automotive, health, beauty, and personal care industries in the region have been driving the market in the state. The ongoing COVID-19 pandemic has introduced several new manufacturers into the market. These players have been working round the clock to churn out disposable masks in large quantities to address the critical shortage of protective masks for medical and healthcare workers. Furthermore, diverse product offerings by numerous regional and international manufacturers through the online channel are contributing to the growth of this segment.

Key Companies & Market Share Insights

The U.S. market is highly fragmented with the presence of a large number of regional players. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

-

In April 2020, 3M received a contract from the Donald Trump Government to import more than 165 million N95 face masks from its manufacturing unit in China for healthcare workers in the U.S over the course of three months.

-

In March 2020, Prestige Ameritech announced its plans to ramp up its production capacity. The company typically manufactured more than 250,000 face masks per day. However, due to the COVID19 outbreak, the company increased its production capacity to 1 million marks per day.

-

In April 2020, 3M, Honeywell International, and a unit of Owens & Minor Inc. received contracts from the U.S. Department of Defense to make 39 million N95 face masks for medical workers. Under the terms of this contract, 3M would receive USD 76 million.

Some prominent players in the U.S. disposable face mask market include:

-

3M

-

Honeywell International Inc.

-

Moldex-Metric, Inc.

-

KCWW

-

uvex group

-

Kowa Company Ltd.

-

SAS Safety Corp.

-

DACH Schutzbekleidung GmbH & Co. KG

-

The Gerson Companies

-

JIANGSU TEYIN IMP. & EXP. CO., LTD.

U.S. Disposable Face Mask Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 740.2 million

Revenue forecast in 2030

USD 607.8 million

Growth Rate

CAGR of -25.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, state

State scope

California; Texas; New York; Florida; Illinois; Pennsylvania; Rest of the U.S.

Key companies profiled

3M; Honeywell International Inc.; Moldex-Metric, Inc.; KCWW; uvex group; Kowa Company Ltd.; SAS Safety Corp.; DACH Schutzbekleidung GmbH & Co. KG; The Gerson Companies; JIANGSU TEYIN IMP. & EXP. CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country and state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. disposable face mask market report based on product, application, distribution channel, and state:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Protective Masks

-

Dust Masks

- Non-woven Masks

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial

- Personal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

State Outlook (Revenue, USD Million, 2017 - 2030)

-

California

-

Texas

-

New York

-

Florida

-

Illinois

-

Pennsylvania

- Rest of U.S.

-

Frequently Asked Questions About This Report

b. The U.S. disposable face mask market size was estimated at USD 8,316.5 million in 2021 and is expected to reach USD 740.2 million in 2022.

b. The U.S. disposable face mask market is expected to grow at a compound annual growth rate of -25.2% from 2022 to 2030 to reach USD 607.8 million by 2030.

b. Protective masks dominated the U.S. disposable face mask market with a share of 43.2% in 2021. This is attributable to rising demand among healthcare workers and other industrial application sectors.

b. Some key players operating in the U.S. disposable face mask market include Honeywell International Inc., The 3M Company, Kimberly Clark Worldwide, SAS Safety Corp, Gerson, KOWA, Uvex, and Moldex.

b. Key factors that are driving the U.S. disposable face mask market growth include a growing number of medical workers and hospitals in the country, coupled with the Covid19 pandemic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.