- Home

- »

- Medical Devices

- »

-

U.S. ECG Equipment Market Size And Share Report, 2030GVR Report cover

![U.S. ECG Equipment Market Size, Share & Trends Report]()

U.S. ECG Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Resting ECG, Holter Monitors, Stress ECG Monitors, Event Monitoring System), By End-use (Hospitals, Ambulatory Care, Others), And Segment Forecasts

- Report ID: GVR-2-68038-822-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. ECG Equipment Market Size & Trends

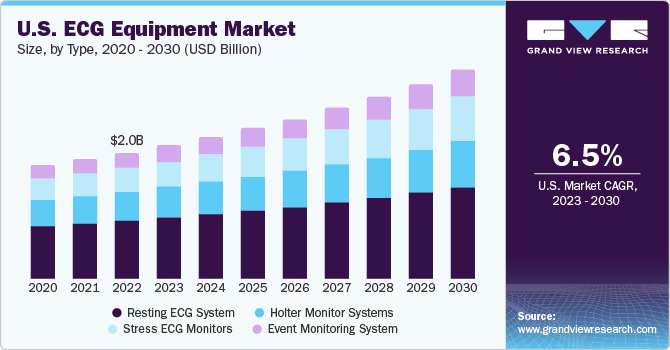

The U.S. ECG equipment market size was valued at USD 2.01 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The rise in the incidence of cardiovascular diseases, large geriatric population base, technological advancements, and new product launches for clear, quick, safe, and reliable results are likely to drive the country’s market growth. Furthermore, favorable regulatory policies, increasing investments by market players for early detection of cardiovascular diseases, and mergers and acquisitions can also add to the development of this market. For instance, in February 2023, GE HealthCare announced the imminent acquisition of Caption Health, Inc. that specializes in AI-based healthcare systems. The acquisition is likely to help GE HealthCare expand its ultrasound business with the addition of AI supported image guidance to its ultrasound device portfolios.

Cardiovascular diseases result in immense health and economic burdens in the U.S. and in almost every other nation. As per the American Heart Association, cardiovascular disease is a leading cause of death, accounting for 17.3 million lives per year globally, and is estimated to lead to more than 23.6 million deaths by 2030. As per a fact sheet released by the World Health Organization in June 2021, cardiovascular diseases led to 17.9 million deaths worldwide. The increasing risks related to cardiovascular diseases are expected to drive the growth of ECG equipment market over the forecast period.

ECG devices, in a painless and non-invasive manner, help reduce patient anxiety and increase adherence to treatment plans. This leads to better patient outcomes and reduced healthcare costs associated with medication and non-adherence. Furthermore, ECG devices can help in the early diagnosis and treatment of cardiovascular diseases and prevent any serious complications. For instance, in February 2022, AliveCor announced the launch of KardiaMobile Card, which is the first of its kind, credit-card sized ECG device that delivers ECG in 30 seconds. The launch of such innovative products can increase their accessibility and further drive the demand in this market.

Moreover, an increasing proportion of geriatric population that is more susceptible to cardiovascular diseases is further expected to drive market growth. According to a study published in PubMed Central in June 2019, data by the American Heart Association suggests that the incidence of CVD is 40% in the 40-59 age group, which increases to 75% and 86% in 60-79 and above 80 age groups respectively.

Moreover, ‘The Demographic Outlook: 2023 to 2053’, published by the Congressional Budget Office in January 2023, suggests that the proportion of population aged 65 years or older, relative to that between 25 and 64 years of age, is expected to reach 34% in 2023 and rise to 46% in 2053. This is likely to increase the demand for various healthcare facilities in the country, including ECG equipment.

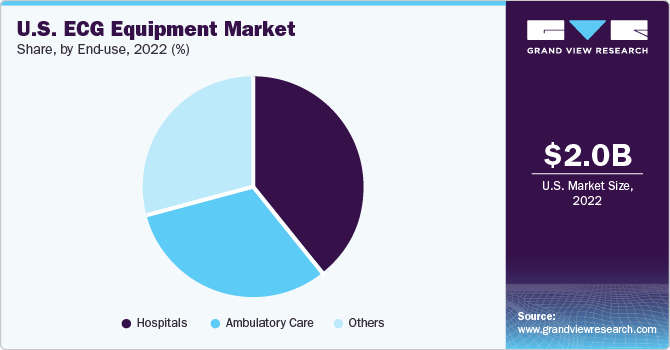

End-use Insights

Hospitals held the highest market share of around 39% in 2022, as the majority of patients rely on hospitals rather than other healthcare facilities due to the availability of well-equipped devices and the latest monitoring software. Moreover, hospitals provide optimal care for patients suffering from cardiovascular diseases (CVDs) and enable early detection and diagnosis, thus boosting market growth among hospitals.

According to a study published in PubMed Central, around 290,000 in-hospital cardiac arrests occur in the U.S. every year. The main causes of cardiac arrest include cardiac and respiratory insufficiency. However, the availability of ventilation, chest compressions, and immediate attention in hospitals can prevent such incidents.

Electrocardiograph equipment is frequently used in hospitals, ambulatory care centers, and other settings. The other end-uses segment is expected to register significant CAGR over the forecast period from 2023 to 2030. The increasing prevalence of various cardiovascular diseases, increasing healthcare expenditure, advancements in technology, and extensive accessibility to treatment in the U.S. are factors expected to drive the growth of this segment during the forecast period.

Type Insights

The resting electrocardiograph segment accounted for the largest revenue share of 46.3% in 2022, owing to a better exchange of information through Cardiovascular Information Systems (CVIS) and electronic health records, which simplifies ECG workflow and reduces the complexity associated with integration. Technological advancements and increasing innovation in ECG monitoring devices with wireless technologies, algorithms, and enhanced connectivity capabilities have increased the demand for this segment.

For instance, in June 2021, Cardiac Insight, Inc., which specializes in wearable cardiac sensors, launched the ‘Cardea SOLO’ ECG System. The system can help in the early detection of cardiac arrhythmias with its in build analysis technology. On the basis of equipment type, the U.S. ECG equipment market is segmented into resting ECG systems, Holter monitoring systems, stress ECG monitors, and event monitoring system.

The Holter monitoring system segment is expected to expand at the fastest CAGR of 7.6% from 2023 to 2030. This can be attributed to the commercialization of various products in recent years and increased demand by physicians and patients due to their portable nature. For instance, in April 2022, Biotricity, a medical diagnostic company, started the commercial sales of Biotres, its wireless wearable cardiac monitoring device, after receiving approval from the FDA in January 2022. Such steps are expected to promote these devices and increase their demand over the forecast period.

Key Companies & Market Share Insights

Several players in the ECG equipment market in the U.S. are focusing on product approvals, regional expansions, and formation of partnerships to add new and innovative products to their portfolio and increase their market share. For instance, in April 2023, the U.S. FDA gave 510(k) clearance to CardioSTAT recorder from Icentia, Inc., which is a flexible and showerproof device designed for cardiac monitoring. It helps in improving patient care while reducing healthcare costs.

Moreover, technological advancements and the changing trend towards preventative care are factors likely to provide further boost to the ECG equipment market in the country.

Key U.S. ECG Equipment Companies:

- BioTelemetry, Inc.

- CompuMed, Inc.

- GE HealthCare

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Hill-Rom Services, Inc.

- NIHON KOHDEN CORPORATION

- Koninklijke Philips N.V.

- Schiller AG

- CardioComm Solutions, Inc.

- McKesson Corporation

U.S. ECG Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.31 billion

Growth Rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use

Country scope

U.S.

Key companies profiled

BioTelemetry, Inc.; CompuMed, Inc.; GE HealthCare; Hill-Rom Services, Inc.; Koninklijke Philips N.V.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Schiller AG; NIHON KOHDEN CORPORATION; CardioComm Solutions, Inc.; McKesson Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. ECG Equipment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. ECG equipment market report on the basis of type and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Resting ECG system

-

Holter monitor systems

-

Stress ECG monitors

-

Event monitoring system

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory care

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. ECG equipment market size was estimated at USD 2.01 billion in 2022 and is expected to reach USD 2,127.6 million in 2023.

b. The U.S. ECG equipment market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 3.31 billion by 2030

b. The resting electrocardiograph system dominated the U.S. ECG equipment market with a share of 46.3% in 2022. This is attributable to a better exchange of information through cardiovascular information systems (CVIS) and electronic health records, which simplifies ECG workflow and reduces the complexity associated with custom integration.

b. Some key players operating in the U.S. ECG equipment Compumed Inc.; BioTelemetry, Inc.; GE Healthcare; Mindray Medical; Hill Rom; Philips Healthcare; Schiller AG; Spacelabs Healthcare; NIHON KOHDEN CORPORATION; and Welch Allyn.

b. Key factors that are driving the market growth include the rise in the incidence of cardiovascular diseases, large geriatric population base, technological advancements, and new product launches for clear, quick, safe, and reliable results.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.