- Home

- »

- Healthcare IT

- »

-

U.S. Electronic Health Records Market, Industry Report 2030GVR Report cover

![U.S. Electronic Health Records Market Size, Share & Trends Report]()

U.S. Electronic Health Records Market Size, Share & Trends Analysis Report By Product (Web-based EHR, Client Server-Based EHR), By Type (Acute, Ambulatory, Post-acute), By Business Model, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-222-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. EHR Market Size & Trends

The U.S. electronic health records market size was estimated at USD 11.38 billion in 2023 and is expected to grow at a CAGR of 2.24% from 2024 to 2030. This growth can be attributed to government initiatives to encourage healthcare IT usage, technologically advanced healthcare services, and rising demand for centralization and streamlining of healthcare data to improve overall patient outcomes and reduce the healthcare costs.

The U.S. accounted for over 38% of the global electronic health records market in 2023, due to high penetration of electronic health records (EHR) systems across different healthcare facilities in the country. The growth of the U.S. EHR market is driven by the greater adaptability of EHR solutions by healthcare companies, the integration of artificial intelligence in healthcare, and significant management of patients and their tasks. The office-based physicians prefer EHRs to a greater extent in the U.S. As per data released by the National Center for Health Statistics, about 88.2 % of office-based physicians are using the EMR/EHR system in their practice.

In addition, the advanced clinical trial designs using the modernized approach of Real-world Data(RWD) and Real-World Evidence (RWE) are reducing documentation and improving regulatory aspects. Such initiatives are anticipated to enhance the demand for electronic health record software market across the U.S. thereby supporting the market growth.

Market Concentration & Characteristics

The market landscape is concentrated, with the presence of large companies such as Epic Systems, Oracle (Cerner), MEDITECH, and a few others. Due to high penetration of EHR systems in the U.S the growth of the market is moderate, however, market will continue to witness positive growth through the forecast period.

Key companies in the U.S. electronic health records industry are launching new products to expand their reach and increase availability in different regions. For instance, in September 2023, Oracle Health announced the integration of AI into EHR system, presenting a new Oracle Clinical Digital Assistant. This unique innovation makes use of AI to improve electronic health records available on the Oracle platform.

Mergers and acquisitions in the electronic health records (EHR) market are increasing, with several companies acquiring smaller players to strengthen their market position, expand product portfolios, and improve competencies. For instance, in September 2023, Thoma Bravo acquired NextGen Healthcare, Inc., a leading EHR systems manufacturer, to expand its capabilities in the market.

Several market companies are involved in geographical expansion to enhance capabilities and have a direct presence in countries having high demand. For instance, in July 2023, Universal Health Services (UHS), a prominent provider of hospital and healthcare services from the U.S., is extending the implementation of the Oracle Health electronic health record (EHR) system across its extensive network of behavioral health facilities. Through this expansion, the company now benefits from a unified EHR system in both acute and behavioral health facilities across the United States. This integration aims to enhance care decisions and elevate patient safety practices.

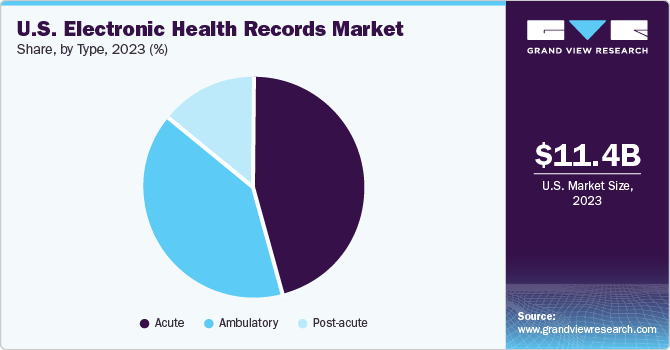

Type Insights

Based on type, the acute segment dominated the market with a share of 46.2 % in 2023. The growth can be attributed to the government initiatives for the adoption of EHRs in small-scale facilities. For instance, acute care hospitals in the U.S. which are covered under the inpatient prospective payment system (IPPS) are eligible for the Medicare incentive payment system.

Post-acute EHRs segment is anticipated to grow at the fastest CAGR from 2024 to 2030. The growth is driven by the diverse applications of EHR, including facilitating rehabilitation services for patients following discharge from acute care hospitals. Post-acute care facilities, comprising inpatient rehabilitation centers, home health agencies, and long-term care hospitals, are expected to witness increased spending, thereby fueling market expansion.

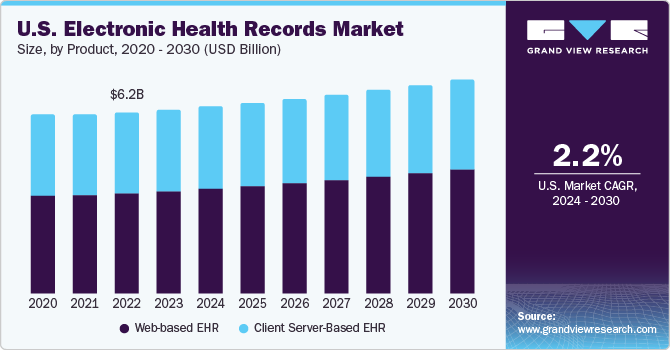

Product Insights

Based on the product, the web based EHR systems dominated the market with a revenue share of 55.7 % in 2023. This growth can be attributed to the rising preference of physicians and healthcare providers, which operate on a smaller scale. The growth is further fuel for easy installation of web-based EHRs without the requirement of in-house servers and can also offer extensive customizations & improvements, as needed.

The client server based (in-house) EHR segment is anticipated to show the fastest CAGR from 2024 to 2030. Client-server-based EHRs provide a safer alternative for users as they offer in-house data storage, hence preventing data theft. These can also be customized as per customer requirements and are a favorable option in the case of multi-physician facilities. Furthermore, they do not require a stable internet connection as compared to web based EHRs, which further drives market growth.

Business Model Insights

Based on the business model insights, professional services segment held the largest market share in 2023. Professional services assist healthcare systems in implementing information systems within their organizations. These services typically include project management, technical and application expertise, optimization of clinical processes, regulatory consulting, and end-user training for the design and implementation of EHR systems.

The subscription segment is expected to witness growth at the fastest CAGR from 2024 to 2030. EHR services can be availed through a time-based subscription model, featuring periodic usage charges. This model represents a primary method for packaging and delivering medical knowledge. The data within EHRs is regularly updated based on research findings and can be independently updated from the software it is integrated with. Moreover, this segment encompasses electronic data interchange transactions, facilitating data transfer between payers and healthcare providers.

End-use Insights

Based on the end-use, the hospital held the largest share of 60.5% % in 2023. The growth can be attributed to the increasing usage of EHRs in hospitals to record large amounts of data. For instance, as per the 2023, study performed by the oxford academic highlights the adoption rates of EHRs in the U.S. has increased significantly from 6.6% to 81.2%, Furthermore, 65% of hospitals intend to invest in improving the functionality of their EHR systems, which also boosts the market growth.

The ambulatory use EHR segment is projected to expand with the fastest CAGR from 2024 to 2030 driven by the growing adoption of EHR technology among healthcare facilities. For instance, as per the 2021, Ambulatory Surgery Center Association survey, 54.6% of respondents indicated the use of an EHR in ASCs. Furthermore, many physician-owned ASCs (62.2%) have implemented an EHR, likely to enhance the growth of the market over the forecast years. Top of Form

Key U.S. Electronic Health Records Company Insights

The U.S. EHR market landscape is consolidated, with the presence of a small number of companies holding majority stake. Key U.S. EHR Companies are athenahealth, Inc., AdvancedMD, Inc., NXGN Management, LLC, Greenway Health, LLC, GE Healthcare, Epic Systems Corporation, Oracle, eClinicalWorks, CureMD Healthcare, CPSI, and Archetype Innovations, LLC.

New expansion activities, product approvals, product launches, partnerships, and acquisitions have positively impacted the EHR market in recent years. Furthermore, there has been a significant increase in the demand for electronic health records due to the growing digitalization which in turn is fueling the market growth.

Key U.S. Electronic Health Records Companies:

- AdvancedMD, Inc.

- HMS Networks

- Oracle (Cerner)

- CPSI Corporation

- Allscripts Healthcare, LLC

- NextGen Healthcare, Inc.

- eClinicalWorks

- CureMD Healthcare

- Greenway Health, LLC

- DXC Technology Company

- Epic Systems Corporation

- McKesson Corporation

Recent Developments

-

In January 2024, American Healthtech, the subsidiary of Computer Programs and Systems, Inc. (CPSI), which provides an EHR platform for the post-acute care market, was sold to post-acute health IT vendor PointClickCare Technologies.

-

In July 2023, Innovaccer Inc. announced a strategic agreement with Post Acute Analytics (PAA) to help health systems succeed with patient-centered value-based care. This will enable providers to utilize an interoperable, cloud-native, AI-driven platform, facilitating the transition from fragmented data solutions and manual processes by consolidating patient data across various EHRs and HIT systems.

U.S. Electronic Health Records Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.52 billion

Revenue Forecast in 2030

USD 13.23 billion

Growth rate

CAGR of 2.24% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, business model, end-use

Country scope

U.S.

Key companies profiled

Oracle (Cerner); AdvancedMD, Inc.;HMS Networks;

CPSI Corporation; Allscripts Healthcare, LLC; NextGen Healthcare, Inc.; eClinicalWorks; CureMD Healthcare; Greenway Health, LLC; DXC Technology Company; Epic Systems Corporation; McKesson Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Electronic Health Records Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. electronic health records market based on product, type, business model, and end-use:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web-based EHR

-

Client Server-Based EHR

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Acute

-

Ambulatory

-

Post-acute

-

-

Business Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Subscriptions

-

Licensed Software

-

Technology Resale

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital use

-

Ambulatory use

-

Frequently Asked Questions About This Report

b. The U.S. electronic health records market size was estimated at USD 11.38 billion in 2023 and is expected to reach USD 11.52 billion in 2024.

b. The U.S. electronic health records market is expected to grow at a compound annual growth rate of 2.2% from 2024 to 2030 to reach USD 13.23 billion by 2030.

b. The web-based electronic health records segment led the U.S. EHR market in 2023.

b. Key players in the U.S. EHR market are Epic Systems, NextGen Healthcare, eClinicalWorks, Cerner Corporation, and Allscripts.

b. Several factors, including growing demand for improved healthcare technology, regulatory requirements, and the rising need for interoperability between different EHR systems drive the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."