- Home

- »

- Medical Devices

- »

-

U.S. Emergency Medical Services Products Market Report, 2030GVR Report cover

![U.S. Emergency Medical Services Products Market Size, Share & Trends Report]()

U.S. Emergency Medical Services Products Market Size, Share & Trends Analysis Report By Product (Life Support & Emergency Resuscitation), By End-use (Hospitals & Trauma Centers), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-914-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

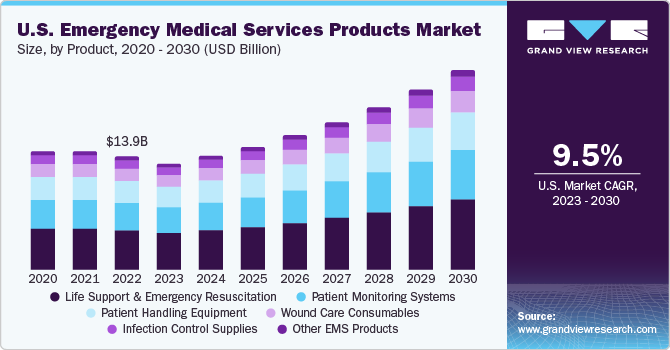

The U.S. emergency medical services products market size was valued at USD 13.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030. Spiraling demand for emergency care, rising incidence of trauma cases, and increasing healthcare spending are among the key trends stoking market growth in the country. Emergency medical services involve the acute care of patients. The EMS department manages patients with medical, obstetric, and surgical emergencies. The department is also equipped to treat injuries, infections, heart attacks, strokes, asthma, and acute pregnancy complications. The Centers for Medicare and Medicaid Services (CMS) has divided emergency departments into Type A and Type B.

Trauma injuries are severe physical injuries, and the sudden occurrence of these injuries requires quick medical attention. According to the American Association for the Surgery of Trauma, this injury is the leading cause of death among individuals between the ages of 1 to 45 and the fourth leading cause of death for all ages. The association also reported that in the U.S., over 3.0 million non-fatal injuries occur every year and lead to over 150,000 deaths.

Additionally, according to the Centers for Disease Control and Prevention (CDC), traumatic brain injury is the major cause of disability and death in the U.S., accounting for 30.0% of all injury-related deaths. Thus, the consistently high number of cases of disability and deaths due to trauma is anticipated to bolster market growth.

Increasing healthcare spending is another factor influencing market dynamics positively. For instance, the expenditure on healthcare in the U.S. rose by 2.7% to USD 4.3 trillion, or USD 12,914 per person in 2021. This growth rate is considerably less than the 2020 growth forecast of 10.3%. The significant slowdown in expenditure can be linked to a drop in government spending on pandemic-related expenses, countering an increase in medical supplies and services that recovered from 2020 owing to delayed care and pent-up demand.

Additionally, the rising incidence rate of burn cases in several U.S. states is further propelling industry growth. For instance, as per data by the U.S. Fire Administration and NFIRS, the national average of residential fire casualties was 6.2 deaths & 25.6 injuries per 1,000 fire incidents. Similarly, a growth in the number of fire departments in the U.S. is expected to propel market expansion further.

U.S. State

Number of Fire Departments

California

842

Texas

1514

Florida

462

New York

1661

Pennsylvania

1794

Illinois

1098

Ohio

1134

Georgia

456

North Carolina

1089

Michigan

971

Furthermore, the COVID-19 pandemic positively impacted the emergency medical service (EMS) products market in the U.S. As per a study by NCBI, COVID-19 had an indirect impact on the rise in emergency medical service calls for opioid use or various cardiac events across the U.S. According to another analysis by a similar source, total EMS call volumes increased by over 20% in 2023. Leading players and service providers adopted various strategies to address the rising demand. For instance, the Copenhagen EMS in Denmark operated two emergency telephone lines in 2022 to cope with the increasing demand for emergency services during the pandemic.

According to Cardinal Health, the demand for personal protection kits increased by 2-12 times the available volume. Leading companies adopted various strategic initiatives to deal with the increasing demand for emergency medical services products, such as product developments, partnerships, geographic expansions, and collaborations.

For instance, as COVID-19 led to the disruption of supply chains, companies such as Cardinal Health re-evaluated their entire supply chain and sourcing practices to meet the growing demand. The company also increased its self-manufacturing capabilities to increase the production capacity of surgical procedural masks, isolation gowns, and face shields. Due to the factors mentioned above, the pandemic positively affected the U.S. emergency medical services products market.

Product Insights

The life support & emergency resuscitation segment dominated the market with the largest revenue share of 34.2% in 2022 and is also expected to expand at the fastest CAGR of 9.85% over the forecast period, owing to the high demand for emergency care due to rising incidence of road accidents. For instance, according to the U.S. Department of Transportation, in 2022, around 38,000 motor vehicle road fatalities were recorded in the U.S., which was around 2,500 more than in 2021. Equipment such as defibrillators, resuscitators, and ventilators are used extensively during road accidents.

Moreover, an increase in the number of people suffering from cardiac arrest is predicted to drive the demand for emergency services in the U.S. For instance, according to the latest stats by the Sudden Cardiac Arrest Foundation, in 2022, more than 356,000 people suffer from out-of-hospital cardiac arrest (OHCA) annually in the U.S., of which nearly 90% of cases are fatal. Emergency products such as ventilators are used during such situations. Thus, the segment is projected to have a significant growth rate due to the abovementioned factors during the forecast duration.

The patient monitoring systems segment is projected to witness significant growth during the forecast period. The rising incidence of cardiac arrest, traumatic accidents, and the COVID-19 pandemic have impacted the demand for patient monitoring systems. For instance, as per the American Heart Association, each year, 350,000 Americans die due to cardiac arrest. Moreover, OSHA states that around 10,000 workplace cardiac arrests happen annually in the U.S. The number of traumatic accidents has also increased, with the CDC stating that around 64,000 TBI-related deaths were recorded in the U.S. in 2021.

As per a similar source, unintentional injuries lead to over 200,900 deaths in the U.S., whereas the death rate due to accidents was calculated to be 12.4 per 100,000 population. As patient monitoring systems are used to monitor vital signs and warning systems to detect & record changes, their demand is expected to rise during the forecast period, thus propelling segment growth. In April 2021, Vyaire Medical announced the launch of its new corporate brand identity as part of its transformational efforts to rapidly innovate leading-edge products and services that enable, enhance, and extend every breath.

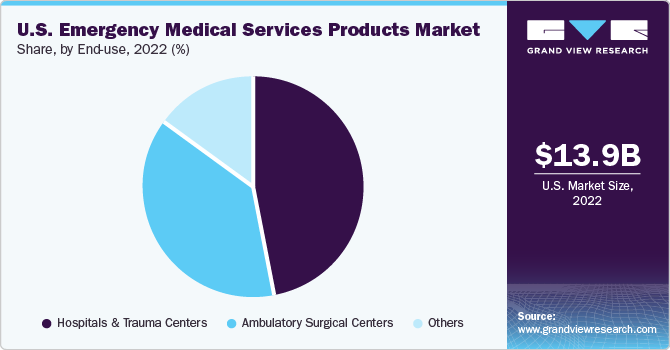

End-use Insights

The hospitals and trauma centers segment dominated the market with the largest revenue share of 46.8% in 2022, owing to an increase in the number of hospitals in the U.S. in recent years. According to the Centers for Disease Control and Prevention, the total number of emergency department visits in the U.S. is 130 million annually, with 35 million injury-related visits. Owing to the abovementioned factors, the segment is anticipated to expand during the forecast period.

As per the American Health Association, the number of hospitals in the U.S. are as follows:

Total Number of Hospitals in the U.S.

6,093

Number of U.S. Community Hospitals

5,139

Number of Non-government Not-for-Profit Community Hospitals

2,960

Number of Investor-Owned (For-Profit) Community Hospitals

1,228

Number of States and Local Government Community Hospitals

951

Number of Federal Government Hospitals

207

Number of Non-federal Psychiatric Hospitals

635

Other Hospitals

112

The ambulatory surgical centers segment is expected to grow at the fastest rate of 10.2% over the forecast period, owing to the increasing number of ASCs in the region. For instance, according to the Ambulatory Surgical Center Association, the number of ASCs in Texas was 461 in 2022, while the number in California tallied up to 845 as of March 2022. ASCs provide same-day surgery and care, which includes diagnosis and preventive procedures. This trend is expected to surge the demand for emergency products, boosting segment growth during the assessment period.

Key Companies & Market Share Insights

The emergency medical services (EMS) products market in the U.S. comprises several small and large manufacturers. The degree of competition and competitive rivalry in the market is anticipated to intensify during the forecast period. Major companies focus on mergers and acquisitions, product launches, and geographic expansions for a competitive edge. Thus, with various strategies utilized by market players, the country’s EMS products market is expected to expand during the forecast period.

For instance, in February 2023, Technimount, a supplier of medical device mounting systems, announced the launch of the Bracket Pro Serie 35 - LP. This solution offers a reliable means of safeguarding the LIFEPAK 15 monitor/defibrillator during Emergency Medical Services (EMS) and Critical Care Transport operations. In another development, Master Medical Equipment partnered with VYAIRE and has become an authorized VYAIRE EMS Distributor and Service Center.

Additionally, in June 2021, VYAIRE announced a partnership with GenWorks Health Pvt. Ltd. The collaboration helps VYAIRE extend its comprehensive range of diagnostic and treatment products to medical professionals, clinics, hospitals, universities, and diagnostic centers in India. This development came at a crucial juncture when the nation was facing an increased respiratory disease burden due to the COVID-19 pandemic. The collaboration aims to enhance the accessibility to top-notch pulmonary screening, testing, and treatment for India’s 1.4 billion population. U.S. Emergency Medical Services Products Companies:

Key U.S. Emergency Medical Services Products Companies:

- Bound Tree Medical

- Henry Schein, Inc.

- Medline Industries, Inc.

- Emergency Medical Products

- Stryker

- Cardinal Health

- Life-Assist

- McKesson Medical-Surgical Inc.

- Smiths Group plc

- Penn Care Inc.

U.S. Emergency Medical Services Products Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 24.49 billion

Growth Rate

CAGR of 9.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

Bound Tree Medical; McKesson Medical-Surgical Inc.; Henry Schein, Inc.; Medline Industries, Inc.; Emergency Medical Products; Stryker; Smiths Group plc; Cardinal Health; Life-Assist; Penn Care Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Emergency Medical Services Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. emergency medical services productsmarket report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Support & Emergency Resuscitation

-

Defibrillators

-

Endotracheal Tubes

-

Ventilators

-

Resuscitators

-

Laryngoscopes

-

-

Patient Monitoring Systems

-

Wound Care Consumables

-

Dressings & Bandages

-

Sutures & Staples

-

Others

-

-

Patient Handling Equipment

-

Medical Beds

-

Wheelchairs & Scooters

-

Other Equipment

-

-

Infection Control Supplies

-

Disinfectant & Cleaning Agents

-

Personal Protection Equipment

-

Others

-

-

Other EMS Products

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Trauma Centers

-

Ambulatory Surgical Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. emergency medical services products market size was estimated at USD 13.9 billion in 2022 and is expected to reach USD 13.0 billion in 2023.

b. The U.S. emergency medical services products market is expected to grow at a compound annual growth rate of 9.47% from 2023 to 2030 to reach USD 24.49 billion by 2030.

b. Hospitals & trauma centers dominated the overall market with a revenue share of around 46% in 2022 owing to the increasing number of hospitals

b. Some key players operating in the U.S. EMS products market include Bound Tree Medical, McKesson Medical-Surgical, Inc., Henry Schein, Inc., Medline Industries, Inc., Emergency Medical Products, Inc., Stryker Corporation, and Smiths Medical.

b. Key factors that are driving the U.S. EMS products market growth include high demand for emergency care, rising incidents of trauma, and increased healthcare spending.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."