- Home

- »

- Medical Devices

- »

-

U.S. EMS Billing Services Market Size & Share Report, 2030GVR Report cover

![U.S. EMS Billing Services Market Size, Share & Trends Report]()

U.S. EMS Billing Services Market Size, Share & Trends Analysis Report by Component (Outsourced, In-House), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-140-5

- Number of Report Pages: 59

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

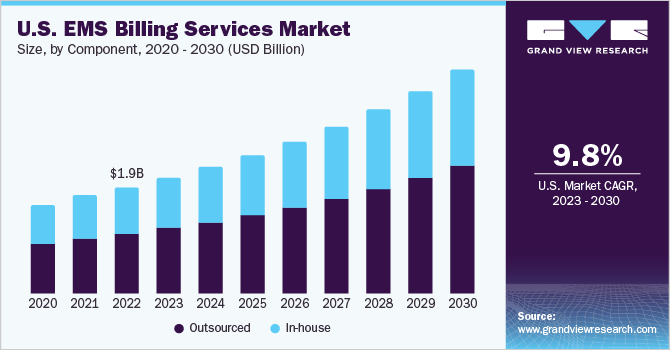

The U.S. EMS billing services market size was estimated at USD 1.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.85% from 2023 to 2030. The market is expected to witness growth during the forecast period, due to the cost-saving benefits of outsourcing billing operations. Emergency medical services (EMS) agencies are turning to specialized billing companies to focus on patient care and reduce overhead costs. Outsourcing allows agencies to utilize expert claims management and reimbursement knowledge, ensuring accurate processing.

The rising number of Emergency Department (ED) visits and the emergence of independent freestanding ED facilities are expected to drive the EMS billing services market in the U.S. According to the National Hospital Ambulatory Medical Care Survey 2020, there were 131.3 million ED visits in the U.S. Of these visits, 38.0 million were injury-related, indicating a substantial demand for emergency medical services.

Furthermore, technological advancements for improved billing services are expected to significantly impact the overall market over the forecast period. As billing procedures become increasingly complex, there is a growing demand for software solutions that can enhance the process and increase client revenue. Billing service providers are either developing their in-house software applications or purchasing them from technology firms to meet this demand.

One such technological advancement is the recent approval received by AIM EMS Software and Services in March 2023. This allows them to aid ambulance services operating in states where implementing NEMSIS v3.5 compliant software for patient care reporting is mandatory. By staying up to date with the latest regulations and standards, billing service providers can ensure smooth operations and compliance with industry requirements.

The COVID-19 pandemic has had a substantial impact on the market, especially on the utilization of emergency department (ED) services. As a result of the pandemic, there has been a significant decrease in ED visits, leading to a negative effect on market growth. According to data from the Centers for Disease Control and Prevention (CDC), the number of ED visits in the United States was estimated to be around 151 million in 2019. However, this figure experienced a decline of 13.2% in 2020.

Component Insights

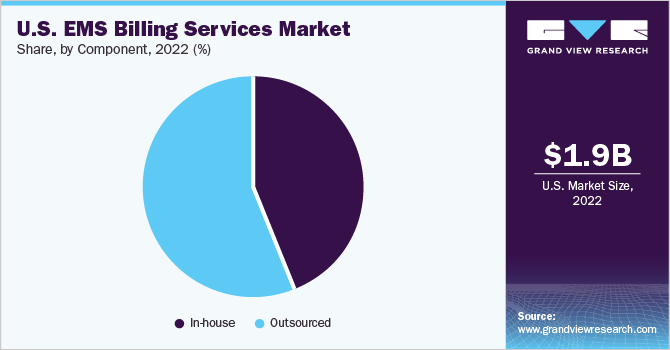

Based on component, the U.S. EMS billing services market is segmented into outsourced and in-house. The outsourced segment held the majority of the market share of 56.3% in 2022. The segment is expected to witness the fastest growth rate during the forecast period. Increasing administrative costs are leading to high demand for outsourced EMS billing services.

In addition, growing demand for third-party billing services to enhance revenue, improve claim filing efficiency and minimize claim denial rates is anticipated to fuel market growth. The availability of certified medical coders and skilled billing staff helps avoid unnecessary delays, thus helping patients save costs and avail quality service.

The in-house segment is expected to witness growth during the forecast period as this component enables healthcare providers to control and oversee their financial operations. The growth of the in-house segment in the U.S. EMS billing services market is driven by the need for increased authority, effectiveness, and financial optimization in the healthcare industry.

Key Companies & Market Share Insights

The market is highly fragmented, with the presence of many players. Partnerships, mergers, acquisitions, and the launches of new services are the major strategies adopted by market players. For instance, in August 2022, EMS Management & Consultants, Inc. acquired VAIRKKO, a prominent workforce and operations management software provider. This acquisition enabled the company to integrate VAIRKKO's innovative solutions into its portfolio. VAIRKKO offers a range of tools designed specifically for EMS agencies, including scheduling, certification, training, and performance management functionalities. Some prominent players in the U.S. EMS billing services market include:

-

EMS Management & Consultants, Inc.

-

Cvikota EMS

-

Omni Medical Billing Service, Inc.

-

Quick Med Claims, LLC.

-

911 Billing Services & Consultant, Inc.

-

Change Healthcare

-

PCC Ambulance Billing Service

-

EMS Billing Management, LLC

-

Pintler Billing Services

-

AIM EMS Software & Services

U.S. EMS Billing Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.0 billion

Growth rate

CAGR of 9.85% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component

EMS Management & Consultants, Inc.; Cvikota EMS; Omni Medical Billing Service, Inc.; Quick Med Claims, LLC.; 911 Billing Services & Consultant, Inc.; Change Healthcare; PCC Ambulance Billing Service; EMS Billing Management, LLC; Pintler Billing Services; AIM EMS Software & Services

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options.

U.S. EMS Billing Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. EMS billing services market report based on component:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

Frequently Asked Questions About This Report

b. The U.S. EMS billing services market size was estimated at USD 1.9 billion in 2022 and is expected to reach USD 2.1 billion in 2023.

b. The U.S. EMS billing services market is expected to grow at a compound annual growth rate of 9.85% from 2023 to 2030 to reach USD 4.0 billion by 2030.

b. The outsourced segment dominated the U.S. EMS billing services market with a share of 56.3% in 2022. Significant cost-savings and high preferences for outsourced billing services is driving the segment growth.

b. Some key players operating in the U.S. EMS billing services market include Cvikota EMS, Change Healthcare, EMS Billing Management, LLC, AIM EMS Software & Services, Pintler Billing Services, Quick Med Claims, LLC, EMS Management & Consultants, Inc., PCC Ambulance Billing Services, and others

b. Cost-saving benefits of outsourcing billing operations is key factor driving the market growth. EMS agencies are turning to specialized billing companies to focus on patient care and reduce overhead costs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."