- Home

- »

- Homecare & Decor

- »

-

U.S. & Europe Bed Linen And Curtains Market Report, 2030GVR Report cover

![U.S. & Europe Bed Linen And Curtains Market Size, Share & Trends Report]()

U.S. & Europe Bed Linen And Curtains Market Size, Share & Trends Analysis Report By Product (Bed Linen, Curtains), By Material (Polyester, Cotton), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-163-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

The U.S. & Europe bed linen and curtains market size was estimated at USD 26.14 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030.The increasing number of home renovations is fueling the demand for bed linen and curtains in this region. Moreover, the rising consumer expenditure on home furnishings is a major factor driving the market growth. Organic fiber-based materials have been witnessing an increased demand over the years. Several consumers have been showing preference for organic cotton as well as for certifications such as Oeko-Tex, which ensure that no toxic chemicals were used while manufacturing the product.

Market players are expected to increase their focus on product innovation with increasing expenditure on research and development. The development of products as per the application area, price competition, and competent distribution channels are among the key strategies for competitive advantage. In October 2021, Himatsingka Seide announced the expansion of sheet production by 80% and towel production by 60%. The sheet capacity grew from 61 million meters per year to 108 million meters. Towel capacity grew from 25,000 tons per year to 40,000 tons. In January 2021, Mitchell Gold + Bob Williams launched its first exclusive bedding line, and the collection comprises an array of textures and subtle colors. Every piece in the line is Oeko-Tex certified. Hence, organic and natural products which are eco-friendly as well as toxin-free have been gaining traction.

Growing digitization, smartphone adoption, and internet connectivity cause organizations to progressively move away from traditional brick-and-mortar retail and toward online sales. To increase product visibility, particularly in emerging markets, producers are showcasing their products on company websites as well as e-commerce portals. According to a blog by Home Textiles in July 2022, with around 20% sales of home textile, Amazon overtook Bath & Beyond in the top position as No. 3 in 2021.

The need for home textile in the U.S. and Europe is being driven by people's changing relationship with their houses and their desire to improve and customize their living spaces. The U.S. witnessed a return to more regular home spending patterns in 2022, with a rise in projects and spending over 2019 and a decline from the exceptionally high demand observed in 2021, according to home services provider Angi's 2022 State of Home Spending report.The same source states that the primary motivation for almost 61% of American homeowners to make improvements to their homes is lifestyle-related, with 34% of them looking to “make their home better suited for lifestyle needs”.

The U.K. and many other European countries are undergoing drastic economic changes with the booming luxury goods market. A Guardian article from November 2022 stated that Kering, the parent company of luxury brands such as Gucci and Balenciaga, saw a 14% increase in sales in October 2022 compared to the past six months. The expanding luxury goods market in the U.K. and Europe is fueling demand and innovation within the U.S. & Europe bed linen and curtains industry as consumers increasingly seek top-quality, tailor-made materials for applications in bedding and other bed linen articles.

Product Insights

Based on product, the bed linen segment dominated the market with a revenue share of about 81% in 2023. This segment is estimated to grow steadily over the forecast period, owing to the rise in innovative materials and products. Welspun for instance, expanded its portfolio in March 2023 by launching the Allerwel brand, which includes allergy-prevention products.The Allerwell brand uses an innovative anti-dust allergy technology that deflects dust mites off the bedding's surface. Healthy biomes are used by natural pro-biotic technology to eliminate allergy-causing biomes from bedding surfaces.

Demand for curtains is set to rise at the highest CAGR of about 7.5% in the forecast period. Curtains are effective coverings as they protect against draughts, and harsh light, prevent cold air from entering, and retain warmth inside. In March 2023, Inter IKEA Systems B.V. launched various floral fabrics in the form of bedding and curtains. The TRÅGSPINNARE curtains, for example, are designed as room-darkening curtains featuring British heritage prints. These curtains come with a heading tape that enables direct attachment to a rod, and the tape is color-coordinated with the curtains, ensuring a tidy and cohesive appearance.

Material Insights

Based on material, the cotton segment dominated the market with a revenue share of over 31% in 2023. Cotton bedding is preferred by consumers for its breathability, softness, durability, and low maintenance. Sustainability is a growing concern among consumers, influencing their purchasing decisions. This has led to several bedding companies adopting eco-friendly practices in their operations. In April 2023, Naturalmat, a U.K.-based bedding and mattress company with five showrooms across the country, achieved B Corp certification, becoming the first in the U.K. to earn this distinction. Committed to sustainability, Naturalmat sources raw materials such as cotton for its bed linen articles, directly from farmers and strives to eliminate waste throughout its manufacturing process.

Demand for linen segment is set to rise at the highest CAGR of about 8% over the forecast period. The home textile sector's premiumization is significantly boosted by direct-to-consumer e-commerce bedding brands, exemplified by Quince in the U.S. This affordable luxury business utilizes a manufacturer-to-consumer (M2C) retail model, eliminating waste and environmental impact while offering premium linen bedding at low prices. Quince's recent USD 77 million Series B funding aims to advance its disruptive M2C approach, signaling positive prospects for the home textile sector, particularly in linen, in the U.S. and Europe.

Distribution Channel Insights

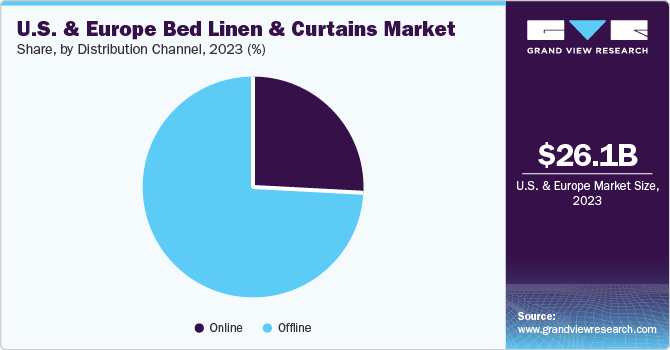

Based on distribution channel, the offline channel segment dominated the market with a revenue share of about 73% in 2023. An increasing number of supermarkets & hypermarkets have begun to offer various bedding products owing to rising consumer adoption. Customers benefit from shopping at such outlets due to lower product prices and the availability of a wide variety of household products under one roof. A 2023 Home Textiles Survey conducted by U.S.-based Cotton Incorporated found that about 70% of blankets were purchased from a physical store, while 2% were curbside or in-store pickup.

The online sales segment is projected to grow at a CAGR of 7.3% during the forecast period. An increasing number of organizations have begun offering bed linen through online channels. In February 2021, U.S.-based Magnolia began offering sheet sets on its website. Similarly, in February 2021, American Blossom Linens launched sheet sets in twin, full, queen, king, California king, and split king sizes on its website. American Blossom Linens is a consumer brand of Thomaston Mills. Thus, the increasing adoption of online channels is promoting the sales of bed linens and curtains through this channel.

Regional Insights

Demand for bed linen and curtains is set to grow at a CAGR of about 7.5% in Europe over the forecast period. According to the Centre for the Promotion of Imports from developing countries (CBI), a division of the Ministry of Foreign Affairs Netherlands, European imports for home decoration and home textiles (HDHT) increased strongly in 2021, with consumers' renewed interest in home improvement and renovation. The mid to high-end market in Europe is relatively more lucrative as it avoids stiff competition from lower-end mass-producing markets such as China. Germany, France, and the U.K. are among the leading European importers of home decoration and home textiles.

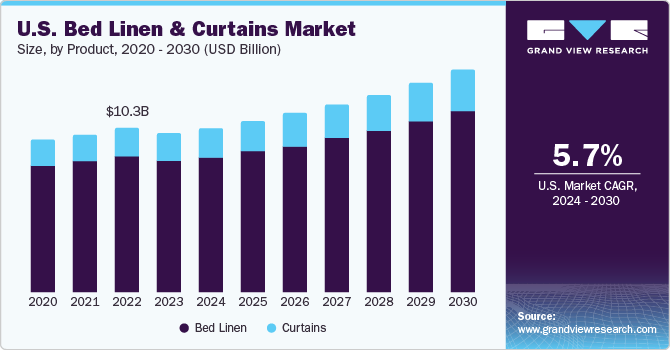

The U.S. bed linen and curtains market is expected to witness a CAGR of about 5.7% over the forecast period. Corporate partnership is one of the most vital strategies leveraged by companies in the U.S. home textile market. For instance, U.S.-based Faribault Mill and WinCraft, a Winona, Minnesota-based brand in licensed sports hard goods and non-apparel items and a division of Fanatics Commerce, collaborated to introduce an exclusive line of Major League Baseball wool throw blankets in August 2023. The 30 MLB (Major League Baseball) teams have granted the Made in the U.S. wool throws official authorization, and each team's branding is artfully woven into the material.

Key Companies & Market Share Insights

The market is characterized by the presence of prominent companies and emerging players. The major players in the market emphasize product innovation & differentiation and unique designs aligned with the changing consumer trends. These players have extensive distribution networks worldwide, which enable them to reach a wide customer base and expand into emerging markets. The emerging companies, on the other hand, are focused on niche markets, specialized product portfolios, and fresh designs to improve their visibility in the market.

Keeco, Inc. is a manufacturer and supplier of home textile products. From bedding products like bed and basic/utility bedding to bath, kitchen textiles, table linens and patio mats, and soft windows, the company offers affordable and trendy products. Its subsidiary, Hollander, has nine manufacturing facilities throughout the U.S. and Canada.

Key U.S. & Europe Bed Linen And Curtains Companies:

- Keeco, Inc.

- Town & Country Living

- Welspun Group

- Indo Count Industries Ltd.

- Trident Limited

- Himatsingka Seide

- 1888 Mills, LLC

- YTML (Yunus Mills)

- Natco Home

- Surya, Inc.

Recent Developments

-

In April 2022, GHCL completed the divestment of its home textile business to Indo Count Industries, a leading manufacturer and exporter of home textiles, for a total consideration of USD 799.17 thousand. With this acquisition, Indo Count became the largest global home textile bedding manufacturer.

-

In October 2021, Himatsingka Seide expanded its sheet towel production by 60% and production by 80%. The sheet capacity grew from 61 million meters per year to 108 million meters. Towel capacity grew from 25,000 tons per year to 40,000 tons.

-

In September 2021, Surya, Inc. expanded its value-focused offering of on-trend area rugs during the New York Home Fashions Market. The offering was available in affordable styles, which included a broad mix of trendy design themes in two constructions - machine-woven from Turkey and hand-woven and hand-tufted varieties from India. The rugs were made from ultra-soft polyester, new versions of space-dyed polypropylene.

U.S. & Europe Bed Linen And Curtains Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.62 billion

Revenue forecast in 2030

USD 43.72 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, region

Regional scope

Europe

Country scope

U.S.

Key companies profiled

Keeco, Inc.; Town & Country Living; Welspun Group; Indo Count Industries Ltd.; Trident Limited; Himatsingka Seide; 1888 Mills, LLC; YTML (Yunus Mills); Natco Home; Surya, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. & Europe Bed Linen And Curtains Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. & Europe bed linen and curtains market report based on product, material, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bed Linen

-

Sheet Set

-

Flat Sheets

-

Fitted Sheets

-

Bed Protectors

-

Quilts & Coverlets

-

Blankets

-

Comforters

-

Pillowcases & Covers

-

-

Curtains

-

Shower Curtains

-

Door Curtains

-

Window Curtains

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Cotton

-

Linen

-

Silk

-

Wool

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Supermarket/ Hypermarket

-

Specialty Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Europe

-

Frequently Asked Questions About This Report

b. The U.S. & Europe bed linen and curtains market was estimated at USD 26.14 billion in 2023 and is expected to reach USD 27.62 billion in 2024.

b. The U.S. & Europe bed linen and curtains market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 43.72 billion by 2030.

b. Europe dominated the U.S. & Europe bed linen and curtains market with a 58% share in 2023. This is attributed to the high emphasis of European households on aesthetics and the desire for sustainable and premium-quality furnishings.

b. Some of the key players operating in the U.S. & Europe bed linen and curtains market include Keeco, Inc.; Town & Country Living; Welspun Group; Indo Count Industries Ltd.; Trident Limited; Himatsingka Seide; 1888 Mills, LLC; YTML (Yunus Mills); Natco Home; Surya, Inc.

b. Key factors that are driving the U.S. & Europe bed linen and curtains market growth include the increasing focus on home aesthetics, a surge in e-commerce bedding brands, heightened awareness of sustainability, growing consumer demand for premium textiles, and innovative retail models like manufacturer-to-consumer (M2C).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."