- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Fishing Goods Market Size, Industry Report, 2030GVR Report cover

![U.S. Fishing Goods Market Size, Share & Trends Report]()

U.S. Fishing Goods Market Size, Share & Trends Analysis Report By Product (Apparel, Footwear, Equipment), Price Range (Mass, Premium), Distribution Channel (Online, Sporting Goods Retailers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-316-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Fishing Goods Market Size & Trends

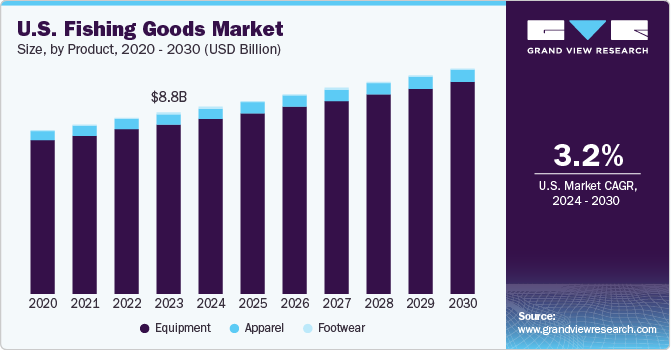

The U.S. fishing goods market size was estimated at USD 8.78 billion in 2023 and is expected to grow at a CAGR of 3.2% from 2024 to 2030.As more Americans seek outdoor activities that offer relaxation and a connection to nature, fishing has emerged as a preferred choice. This trend has been further bolstered by the growing awareness of mental health benefits associated with recreational activities, such as stress relief and improved well-being, which fishing provides. Consequently, the market for fishing equipment, including rods, reels, and tackle, is expanding, driven by a rising number of amateur and experienced anglers.

Technological advancements are another significant factor propelling the growth of the U.S. fishing market. Innovations in fishing gear, such as lightweight and durable materials, advanced fishing lines, and sophisticated fish-finding electronics, have made the sport more accessible and enjoyable. These advancements not only enhance the fishing experience but also attract a broader demographic, including younger generations who are tech-savvy and keen on modern gadgets. Moreover, the integration of mobile apps and online platforms that provide real-time data on weather conditions, fishing spots, and fish behavior has further revolutionized the way people engage with fishing.

Environmental and sustainability initiatives are also playing a crucial role in the market's growth. There is a growing emphasis on sustainable fishing practices and conservation efforts aimed at preserving fish populations and aquatic ecosystems. Organizations and government agencies are promoting catch-and-release programs and responsible fishing practices, which resonate with environmentally conscious consumers. These initiatives help maintain fish stocks and ensure the long-term viability of fishing, attracting individuals who are committed to sustainable outdoor activities.

Market Concentration & Characteristics

The U.S. fishing goods market is characterized by a high degree of innovation, driven by the continuous development of new products and technologies. Companies are consistently introducing advanced fishing gear and equipment that enhance the fishing experience. Innovations include the use of high-tech materials that improve the durability and performance of fishing rods and reels, as well as the incorporation of smart technologies like GPS-enabled fish finders and sonar devices that provide anglers with real-time data and greater precision. Additionally, there are advancements in eco-friendly fishing lines and biodegradable lures, reflecting a growing trend towards sustainable and environmentally responsible products.

The level of mergers and acquisitions (M&A) activity in the U.S. fishing goods industry is also significant, as companies seek to consolidate their market positions and expand their product offerings. Major players in the industry often acquire smaller, innovative companies to integrate new technologies and diversify their portfolios. These acquisitions not only facilitate growth but also enhance competitive advantages by enabling companies to leverage innovations and expand their customer base. The M&A activities are also aimed at achieving economies of scale, optimizing supply chains, and expanding into new geographic markets.

Regulations have a profound impact on the U.S. fishing goods market, shaping both production and consumption patterns. Regulatory bodies like the National Oceanic and Atmospheric Administration (NOAA) and state agencies enforce rules on fishing practices to ensure the sustainability and conservation of fish populations. These regulations affect the market by promoting the development and use of sustainable fishing gear, such as circle hooks and biodegradable nets. Compliance with environmental regulations drives innovation in eco-friendly products and influences consumer preferences towards sustainable goods. Additionally, import tariffs and trade policies can impact the availability and pricing of fishing equipment, affecting market dynamics.

Product substitutes in the fishing goods market include a variety of outdoor recreational equipment and activities that compete for consumer attention and spending. These substitutes range from camping gear and hiking equipment to water sports like kayaking and paddleboarding. The choice between fishing and these alternatives often depends on personal preferences, accessibility, and perceived benefits. However, the unique experience and relaxation that fishing offers, combined with advancements in fishing gear, help maintain its distinct appeal despite the availability of substitutes.

The U.S. market for fishing goods sees frequent product launches, reflecting ongoing innovation and the introduction of new technologies. Companies regularly unveil new models of fishing rods, reels, lures, and accessories that incorporate the latest materials and designs. These product launches are often accompanied by marketing campaigns and promotions aimed at generating excitement and interest among consumers. Seasonal launches, aligned with peak fishing times, and participation in trade shows and expos, such as the International Convention of Allied Sportfishing Trades (ICAST), are common strategies used to showcase new products and attract buyers. These launches not only drive sales but also set industry trends and elevate brand recognition.

Product Insights

The fishing equipment market segment accounted for a share of 93.6% in terms of revenue in 2023. This significant market share is attributed to several factors that highlight the importance and popularity of fishing equipment among consumers. The market share reflects the ongoing demand for a diverse range of fishing gear, including rods, reels, lines, and tackle.

Anglers, both recreational and professional, require specialized equipment to enhance their fishing experience, driving continuous sales in this segment. The need for high-quality, durable, and efficient fishing gear is paramount, as it directly impacts the success and enjoyment of fishing activities.

The U.S. fishing apparel market segment is expected to grow at a CAGR of 2.7% from 2024 to 2030. Technological innovations in fabric and design are pivotal in driving the growth of the fishing apparel market. Modern fishing clothing incorporates advanced materials that offer superior protection against the elements, such as UV-resistant fabrics, moisture-wicking technology, and breathable materials that keep anglers comfortable in various weather conditions.

Additionally, features like quick-drying properties, built-in insect repellent, and enhanced durability make these garments highly functional, and appealing to a wide range of consumers. These technological advancements not only improve performance but also attract a more diverse demographic, including younger, tech-savvy individuals.

Price Range Insights

The mass fishing goods market segment accounted for a share of 65.5% in terms of revenue in 2023. The mass fishing goods market caters to a broad audience, from casual hobbyists to serious anglers. The popularity of fishing as a recreational activity across diverse demographic groups ensures a steady and substantial demand for fishing products. Mass-market brands and products are typically designed to appeal to a wide range of consumers, offering a variety of options in terms of price, functionality, and style. This broad appeal ensures that mass fishing goods remain the preferred choice for most consumers.

The U.S. premium fishing goods market segment is expected to grow at a CAGR of 3.8% from 2024 to 2030. The growing popularity of recreational fishing, particularly among younger demographics and affluent individuals, is driving demand for premium fishing goods. This segment of consumers often seeks out the best gear to enhance their fishing experience, whether they are seasoned anglers or new to the sport. The appeal of fishing as a relaxing and rewarding outdoor activity continues to attract a diverse and expanding audience, further boosting market growth.

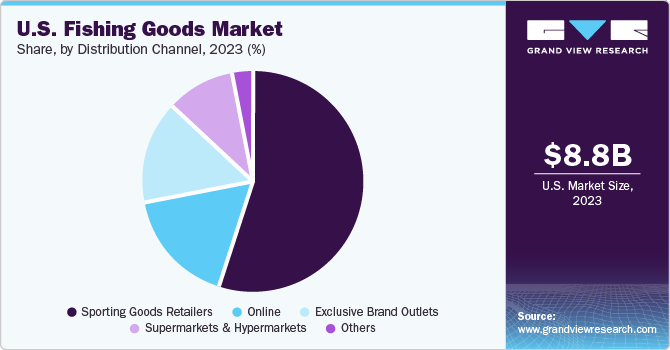

Distribution Channel Insights

Sales of fishing goods through sporting goods retailers accounted for a share of 55.4% in 2023. A major factor contributing to the high sales through sporting goods retailers is the consumer preference for in-store shopping experiences. Many anglers, particularly those investing in premium or specialized equipment, prefer to see and handle products before making a purchase. This hands-on approach allows them to assess the quality, feel, and functionality of fishing gear, which is crucial for ensuring that the products meet their specific needs. The ability to physically inspect and try out products instills confidence in their purchases, driving sales through brick-and-mortar stores.

Sales of fishing goods through online stores are expected to grow at a CAGR of 4.6% from 2024 to 2030. The continued expansion of e-commerce is a significant driver of the growth in online sales of fishing goods. More consumers are becoming comfortable with online shopping, influenced by the convenience and often better pricing found online. E-commerce platforms provide a wide range of products, often more extensive than what is available in physical stores, attracting consumers who prefer to shop from the comfort of their homes. This trend is particularly appealing to younger, tech-savvy anglers who are accustomed to making purchases online.

Key U.S. Fishing Goods Company Insights

The U.S. fishing goods market is fragmented in nature, attributed to the presence of many small, regional companies that are introducing smart multi-functional appliances with attractive product designs and specifications to cater to diverse consumer preferences. Key manufacturers are working toward increasing the availability of fishing goods in retail and online stores. Moreover, these manufacturers are constantly striving to develop new and improved products that offer enhanced functionality and ease of use.

Key U.S. Fishing Goods Companies:

- Pure Fishing, Inc.

- Shimano North America Fishing, Inc.

- Daiwa Corporation

- Rapala USA

- Johnson Outdoors Inc.

- Eagle Claw Fishing Tackle Co.

- St. Croix Rods

- Lew's Fishing

- Zebco (Zero Hour Bomb Company)

- Plano Synergy Holdings, Inc.

Recent Developments

-

In April 2024, Shimano North America Fishing, a prominent innovator in the global fishing industry, proudly announced the launch of the enhanced Clarus F family of rods. Engineered to cater to the modern multi-species angler, these rods redefined versatility with actions meticulously crafted for a variety of freshwater and inshore saltwater applications.

-

In March 2024, the 200-size Custom Lite SS Spinning Reel was a welcomed addition to Lew’s Custom Lite family, seamlessly blending with its lightweight design and smooth drag. It excelled particularly in situations where anglers typically used backing tied to a braided main line. Since the inception of the Custom Lite family, the standard 200 and 300-size spinning reels have been favored by many pros for their high-quality performance and reliable consistency.

U.S. Fishing Goods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.05 billion

Revenue forecast in 2030

USD 10.95 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, distribution channel

Country scope

U.S.

Key companies profiled

Pure Fishing, Inc.; Shimano North America Fishing, Inc.; Daiwa Corporation; Rapala USA; Johnson Outdoors Inc.; Eagle Claw Fishing Tackle Co.; St. Croix Rods; Lew's Fishing; Zebco (Zero Hour Bomb Company); Plano Synergy Holdings, Inc.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Fishing Goods Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. fishing goods market report based on product, price range, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Footwear

-

Equipment

-

Rods, Reels, and Components

-

Lines and Leaders

-

Lures, Flies, and Artificial Baits

-

Creels, Strings, and Landing Nets

-

Others (Skis, Snowboards, and Others)

-

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. fishing goods market size was estimated at USD 8.78 billion in 2023 and is expected to reach USD 9.05 billion in 2024.

b. The U.S. fishing goods market is expected to grow at a compounded growth rate of 3.2% from 2024 to 2030 to reach USD 10.95 billion by 2030.

b. The fishing equipment market accounted for a share of 93.6% in 2023. his significant market share is attributed to several factors that highlight the importance and popularity of fishing equipment among consumers. The market share reflects the ongoing demand for a diverse range of fishing gear, including rods, reels, lines, and tackle.

b. Some key players operating in the market include Pure Fishing, Inc., Shimano North America Fishing, Inc., Daiwa Corporation, Rapala USA, Johnson Outdoors Inc., Eagle Claw Fishing Tackle Co., St. Croix Rods, Lew's Fishing, Zebco (Zero Hour Bomb Company), and Plano Synergy Holdings, Inc.

b. As more Americans seek outdoor activities that offer relaxation and a connection to nature, fishing has emerged as a preferred choice. This trend has been further bolstered by the growing awareness of mental health benefits associated with recreational activities, such as stress relief and improved well-being, which fishing provides.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."