- Home

- »

- Next Generation Technologies

- »

-

U.S. Freelance Platforms Market Size, Industry Report, 2030GVR Report cover

![U.S. Freelance Platforms Market Size, Share & Trends Report]()

U.S. Freelance Platforms Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Platform, Services), By End-user, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-239-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Freelance Platforms Market Trends

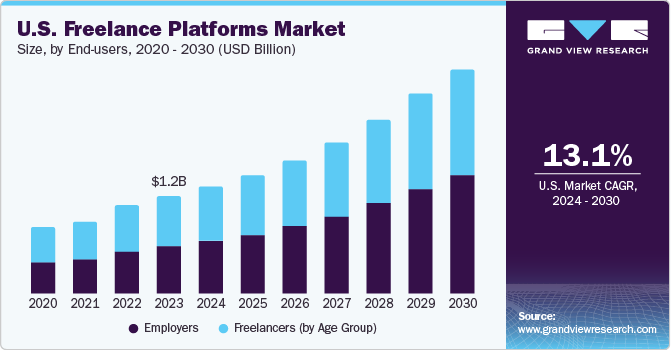

The U.S. freelance platforms market size was estimated at USD 1.17 billion in 2023 and is projected to grow at a CAGR of 13.1% from 2024 to 2030. The U.S. has a flourishing gig economy, robust entrepreneurial culture, and a vibrant startup ecosystem. Freelance platforms serve as a crucial resource for startups and small businesses in the U.S., enabling them to efficiently scale operations by accessing specialized skills on a project basis without the need for a full-time workforce. In this evolving landscape, freelance platforms provide a structured marketplace that seamlessly connects skilled freelancers with businesses seeking their expertise, thereby propelling market growth.

In 2023, the U.S. accounted for approximately 23.86% share of the global freelance platforms market. One of the key drivers of the gig economy is the evolving mindset of the workforce. Individuals increasingly seek autonomy and flexibility in their professional lives, favoring non-traditional work arrangements over traditional 9-to-5 roles. As the gig workforce expands, so does the demand for platforms that streamline the process of finding, hiring, and managing freelancers. These platforms serve as virtual meeting grounds, facilitating the matchmaking between talent and employers on a global scale. Instead of maintaining a fixed workforce, companies can leverage freelance talent on a project-by-project basis, aligning their resources with specific needs and thereby increasing the cost-effectiveness of the projects. As the gig workforce continues to expand, freelance platforms are likely to play an increasingly integral role in shaping the future of work, providing efficient, scalable, and flexible solutions for businesses and professionals alike.

Globalization has redefined the operational landscape for businesses, dismantling geographical barriers and fostering a more interconnected global community. In this context, freelance platforms serve as catalysts by establishing centralized marketplaces where businesses can access a worldwide pool of talent. Cost efficiency is another key benefit associated with the growing trends of globalization and remote work. Freelance platforms empower businesses to tap into talent without incurring the overhead costs associated with traditional employment, such as office space, equipment, and benefits. Furthermore, the growing popularity of remote work and globalization has spurred innovation in collaboration tools and communication technologies. Freelance platforms bridge geographical divides, grant access to a diverse talent pool, and furnish cost-effective solutions, positioning them as indispensable entities in the dynamic landscape of modern work. As businesses continue to embrace global collaboration and remote work, the freelance platforms market is likely to witness sustained expansion.

The overreliance of freelance platforms on platform algorithms is one of the key restraints to the growth of the freelance platforms market. While these algorithms play a critical role in connecting freelancers with appropriate projects and clients, exclusive dependence on them introduces challenges that affect the overall efficacy and satisfaction of both freelancers and businesses. A primary concern associated with relying solely on algorithms is the potential for mismatches between the skills and expertise of freelancers and the specific requirements of clients. Algorithms often rely on historical data, and if this data contains biases or limitations, the algorithm may perpetuate these biases in the selection process.

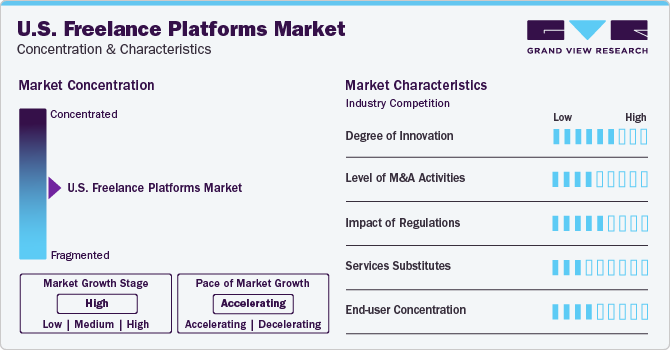

Market Concentration & Characteristics

The stage of market growth is high and the pace is accelerating. The market is highly competitive with the presence of both small and large companies. The competitive rivalry within the freelance platforms market is intense. Numerous platforms vie for market share, leading to continuous innovation, feature enhancements, and aggressive marketing strategies. Differentiation is crucial for platforms to attract and retain users, and the industry landscape is characterized by a constant race to offer unique features, improve user experience, and expand the range of services.

The protection of intellectual property is crucial. Freelance platforms need to ensure their terms of service and policies address issues of content ownership and copyright. The government may introduce or amend regulations affecting the gig economy, freelancers rights, and data privacy on freelance platforms. Compliance with these regulations is crucial for platform operators. Evolving employment laws, particularly those defining the status of freelancers, impact the legal framework for freelance platforms. Classification as independent contractors or employees has significant implications for freelancers.

The threat of substitutes is relatively low in the freelance platforms market. Despite the existence of traditional employment models, the unique value proposition of freelance platforms in providing on-demand, specialized skills for specific projects creates a niche that is not easily replaced. The efficiency, flexibility, and global reach offered by these platforms make them a preferred choice for both businesses and freelancers.

Freelance platforms are increasingly incorporating AI tools for tasks such as talent matching, automated project management, and skill assessment. AI enhances efficiency in identifying suitable freelancers for specific projects, improving the overall user experience. With the increasing use of smartphones, freelance platforms are optimizing their interfaces for mobile devices. Mobile apps and responsive designs enhance accessibility and user engagement, enabling freelancers and clients to access these platforms conveniently.

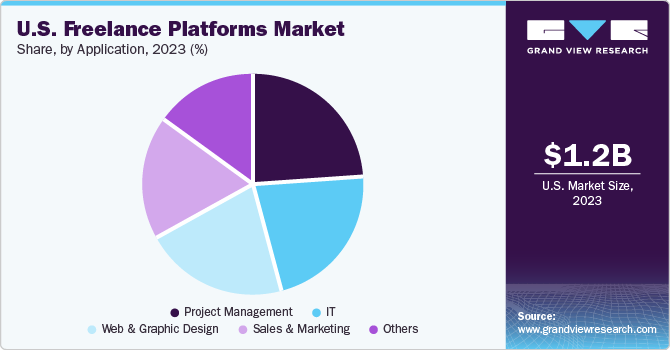

Application Insights

The project management segment led the market in 2023 with a revenue share of more than 23%. In terms of application, the market is bifurcated into project management, sales & marketing, IT, web & graphic designs, and others segments. The use of project management applications available on freelance platforms is gaining substantial traction as businesses are increasingly recognizing the value of flexible project management solutions. Freelance project managers offer expertise in planning, execution, and monitoring of projects, allowing companies to adapt quickly to changing demands. Project management has become crucial for dynamic project scopes, such as software development and marketing. Freelance platforms provide access to a wide range of experienced project managers with diverse industry knowledge, allowing businesses to find the right expertise for their projects.

The web & graphics segment is anticipated to grow at the fastest CAGR of 15.4% throughout the forecast period. The rapid growth of e-commerce has created a need for web and graphics professionals to design and develop user-friendly and visually appealing online stores. From creating product images and banners to designing intuitive interfaces, freelancers in the web and graphics field play a crucial role in helping businesses thrive in the competitive e-commerce landscape. Moreover, businesses of all sizes recognize the importance of a strong online presence to reach their target audience. This has led to a surge in demand for web and graphics professionals who can create visually appealing websites, engaging user interfaces, and eye-catching graphics to enhance brand identity and attract customers.

Component Insights

The platform segment led the market in 2023 with a revenue share of more than 51%. In terms of component, the market is bifurcated into platform and services segments. The platform segment is further categorized as project-based, solution-based, talent-based, and hybrid. The growth of this segment can be attributed to globalization, the flexibility and scalability it offers, cost-effectiveness, and the accessibility of specialized talent. The acceptance of the gig economy and continuous technological advancements further contribute to the expansion of the segment. The platform segment is expected to witness continuous evolution as it offers a seamless and efficient environment for collaboration between diverse clients and freelancers.The ability of freelance platforms to connect clients with freelancers globally, along with providing flexibility, cost savings, and access to specialized skills, has made them a preferred mode of work arrangement.

The services segment is anticipated to witness the fastest CAGR of 14.5% over the forecast period. The services segment plays a key role in facilitating seamless collaborations between clients and freelancers. These services encompass advanced matching and sourcing algorithms, enabling clients to find the right freelancers for their projects efficiently. Various communication and collaboration tools, such as integrated messaging systems and video conferencing tools, streamline interactions in real-time. Secure payment systems and automated invoicing features ensure transparent and timely financial transactions, with escrow services providing an additional layer of security. Project management and tracking tools enhance productivity by assisting freelancers in organizing tasks and updating clients on the progress of projects. The services offered are advantageous for both the freelancers and clients and hence will aid in the market growth in the coming years.

End-user Insights

The freelancer segment led the market in 2023 with a revenue share of more than 52.0%. Based on end-user, the market is bifurcated into employers and freelancer segments. The freelancer segment is further categorized into age groups: 18 - 34, 35 - 54, and above 55. Freelancers aged 18 to 34 often utilize these platforms to kickstart their careers, gain experience, and build portfolios. The higher adoption of remote work among this age group can be attributed to flexible work time, remote workplace, access to the global market, and convenience in choosing work opportunities. In addition, the readiness of the age group to upskill and scale despite challenges in the market is propelling the growth of the market in the forecast period. Furthermore, the younger age group often has a strong entrepreneurial spirit and a desire to create their opportunities.

The employers’ segment is anticipated to grow at a considerable CAGR of 14.7% throughout the forecast period. The employers’ segment is further bifurcated into SMEs and large enterprises. The employers segment comprises a diverse range of businesses seeking external talent for specific projects or ongoing tasks. These employers, ranging from small and medium enterprises (SMEs) to large enterprises, leverage the capabilities of freelance platforms to address their staffing and project requirements efficiently. For SMEs, freelance platforms represent a gateway to a global talent pool, offering a cost-effective means to access specialized skills without committing to permanent hires. These platforms enable SMEs to remain agile, scaling their workforce with project demand fluctuations.

Key U.S. Freelance Platforms Company Insights

The U.S. freelance platforms industry is highly competitive. Some key players in the market include Upwork Global Inc., Toptal, and Fiverr International Ltd among others.

-

Upwork Global Inc. is one of the leading online marketplaces connecting businesses with skilled freelancers worldwide. It offers Upwork Basic, a platform for businesses to hire freelancers, and Upwork Plus, which provides additional features and a secure environment. For large organizations, Upwork Business and Upwork Enterprise suite offer advanced solutions, allowing employers to easily find and hire freelancers based on their specific requirements.

-

Toptal, LLC is a developer of a networking platform that aims to connect companies with freelance talent. The platform boasts a vast network of highly skilled freelance software developers, designers, and finance experts. The company’s screening process is rigorous, ensuring that the freelancers possess excellent communication skills and pass technical exams specific to their areas of expertise. This meticulous selection process enables businesses to find and hire the desired freelance talent to accelerate, adapt, and scale their projects effectively.

Contently and WorkGenius are some of the emerging companies in the U.S. Freelance Platforms industry.

-

WorkGenius is a pioneering company that specializes in developing an artificial intelligence digital workforce solution. Its innovative technology is designed to efficiently staff projects worldwide with skilled freelancers. Its platform significantly reduces overhead costs by streamlining the selection and verification process, as well as handling IP transfers, invoicing, and delivery. The company empowers businesses to achieve their goals by leveraging the power of artificial intelligence and freelance talent.

-

Contently is a provider of a content-marketing platform that caters to the needs of global enterprises seeking to create compelling and measurable content. The company’s platform offers a comprehensive suite of tools and features that assist brands in content creation, distribution, and optimization. By centralizing all corporate content in one convenient location, businesses can efficiently manage their content and streamline approval processes. Furthermore, the platform also enables businesses to optimize every aspect of their content marketing strategy, ensuring maximum engagement and impact.

Key U.S. Freelance Platforms Companies:

- Upwork Global Inc.

- Toptal, LLC

- Guru.com

- 99designs

- Crowdspring

- WorkGenius

- Paro, Inc.

- Contently

- Gigster LLC

- Fiverr International Ltd.

Recent Developments

-

In August 2023, Fiverr launched Fiverr Pro. Fiverr Pro is a powerhouse end-to-end solution. It addresses the unique needs of larger organizations in today's dynamic business landscape by fusing an intelligently curated catalog of exceptional professional talent with advanced business tools. Fiverr Pro, formerly Fiverr Business, has evolved to become even more intuitive, collaborative, and powerful.

-

In July 2023, Upwork and OpenAI, a leading AI research and deployment company, announced OpenAI Experts on Upwork, giving OpenAI customers and other businesses direct access to trusted expert independent professionals deeply experienced in working with OpenAI technologies. Upwork and OpenAI co-designed the program to feature talent adept at working with the OpenAI API platform and to draw from the 250 unique AI skills available on Upwork, including GPT-4, Whisper, and AI model integration.

U.S. Freelance Platforms Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.29 billion

Revenue forecast in 2030

USD 2.70 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Base year for estimation

2023

Historic year

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-user, application

Country scope

U.S.

Key companies profiled

Upwork Global Inc.; Toptal, LLC; Guru.com; 99designs; Crowdspring; WorkGenius; Paro, Inc.; Contently; Gigster LLC; Fiverr International Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Freelance Platforms Market Report Segmentation

This report forecasts revenue growth at a country level and offers a qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. freelance platforms market report based on component, end-user, and application.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platform

-

Project-based

-

Solution-based

-

Talent-based

-

Hybrid

-

-

Services

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Employers

-

SMEs

-

Large Enterprises

-

-

Freelancers (by Age Group)

-

18 - 34

-

35 - 54

-

Above 55

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Project Management

-

Sales & Marketing

-

IT

-

Web and Graphic Design

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. freelance platforms market size was estimated at USD 1.17 billion in 2023 and is expected to reach USD 1.29 billion in 2024.

b. The U.S. freelance platforms market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 2.70 billion by 2030.

b. The platform segment dominated the U.S. freelance platforms market with a share of over 51.7% in 2023.

b. Some key players operating in the U.S. freelance platforms market include Upwork Global Inc., Toptal, LLC, Guru.com, 99designs, Crowdspring, WorkGenius, Paro, Inc., Contently, Gigster LLC, and Fiverr International Ltd., among others.

b. Key factors driving the market growth include flourishing gig economy, robust entrepreneurial culture, and a vibrant startup ecosystem in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.