- Home

- »

- Homecare & Decor

- »

-

U.S. Garden Planters Market Size, Industry Report, 2033GVR Report cover

![U.S. Garden Planters Market Size, Share & Trends Report]()

U.S. Garden Planters Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Clay/Terracotta, Plastic/Resin/Polypropylene, Ceramic), By End Use (Residential, Commercial), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores), And Segment Forecasts

- Report ID: GVR-4-68040-180-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Garden Planters Market Summary

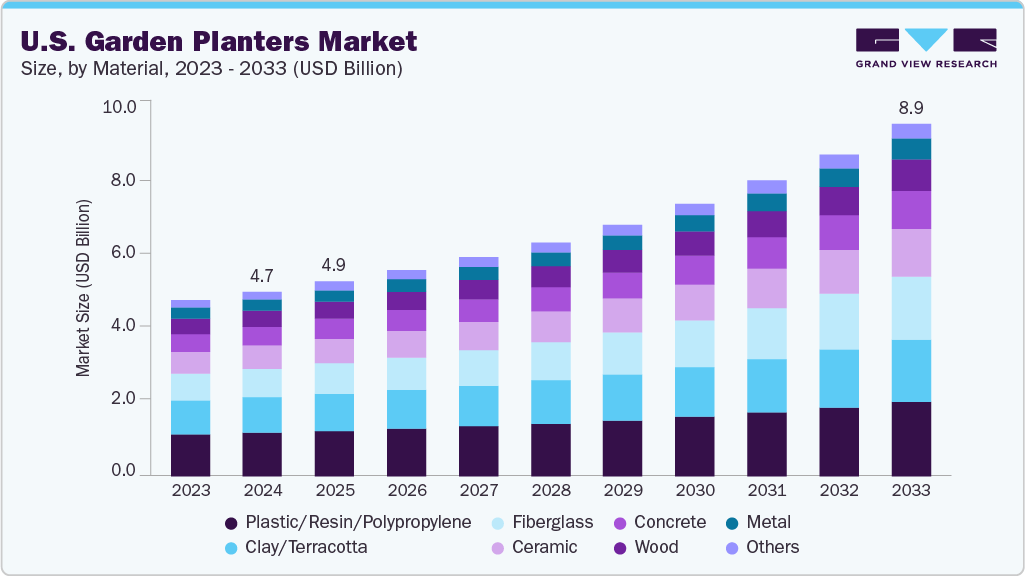

The U.S. garden planters market size was valued at USD 4.66 billion in 2024 and is expected to reach USD 8.90 billion by 2033, growing at a CAGR of 7.7% from 2025 to 2033. The market is increasingly shaped by consumer interest in aesthetic and lifestyle gardening rather than just functional cultivation. Many homeowners are looking for planters that function as decor elements.

Sleek lines, interesting textures, and designer finishes have become important. Indoor planter use is also growing, spurred by the “bring the outdoors in” motif: plants in living rooms, kitchens, and workspaces are now part of interior styling. In addition, younger consumers, Millennials and Gen Z, are driving a revival in small-scale gardening (e.g., herbs, succulents), often using compact planters or modular systems in limited-space homes.

Sustainability is a major driver for product choice in planters. Consumers show willingness to pay premiums for eco-friendly attributes such as recycled materials, biodegradable composites, or water-conserving designs. In a recent choice experiment, sustainability attributes (e.g., low embodied carbon, recyclability) had an observable influence on preferences. Manufacturers are responding with recycled plastics, bio‐resins, and composite materials. There is also growing adoption of smart and self-watering planters that can monitor moisture or integrate wicking systems, smoothing maintenance for casual gardeners.

In addition, beyond residential use, commercial and institutional landscaping is also contributing to demand. Offices, restaurants, hotels, and retail spaces increasingly integrate planters into outdoor patios, entryways, and interiors to enhance ambiance, provide biophilic décor, or partition spaces. Municipal greening initiatives and “green city” strategies encourage the use of container planting in public spaces where soil beds are impractical. Meanwhile, online and specialty retail channels are enabling consumers to access niche, designer, or custom planters easily, further supporting product variety and adoption.

Consumer Behavioral Analysis

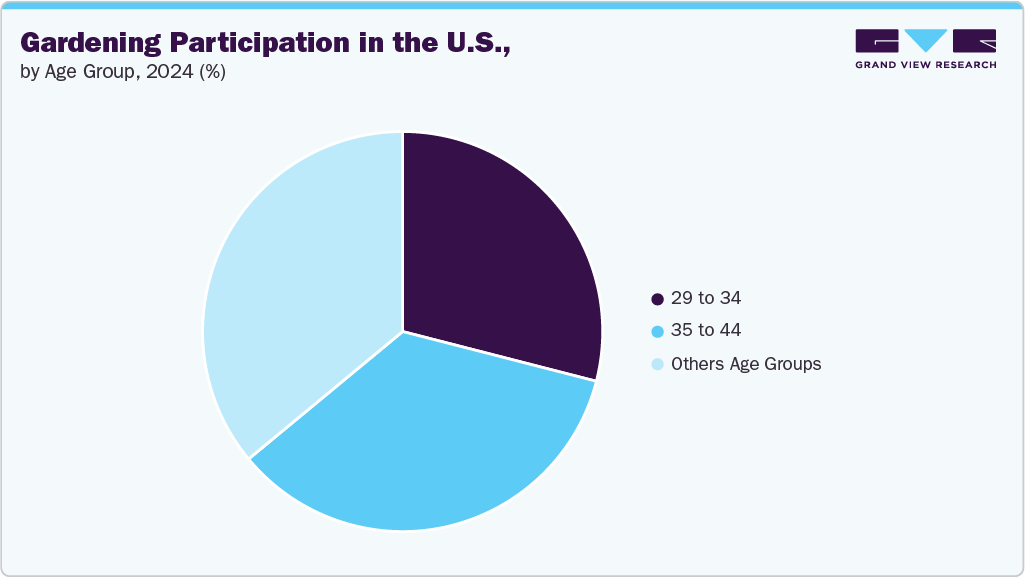

The U.S. garden planter market is undergoing a significant transformation in its consumer demographic landscape, driven by evolving age group dynamics and an increasing involvement of millennials in gardening. According to the 2024 National Gardening Survey conducted by Garden Research, a division of the National Gardening Association, individuals aged 35-44 continue to lead gardening participation, accounting for 35% of the market. However, millennials, particularly those aged 29-34, are closely trailing behind, representing 29% of the market. This emerging trend underscores the distinct opportunities and behavioral nuances between these two influential age groups, which are reshaping the trajectory and future demand within the garden planter industry.

There is an increasing consumer demand for garden planters made from sustainable materials that minimize environmental impact. Biodegradable options, such as those made from plant-based composites and recycled materials, are gaining popularity as eco-conscious consumers seek products that align with their values. Manufacturers are responding by innovating materials that not only meet functional requirements but also adhere to sustainability standards. This trend reflects a broader movement toward environmentally responsible gardening practices, with consumers prioritizing products that contribute to a circular economy and reduce plastic waste.

As consumers become more aware of deforestation and its environmental consequences, there is a marked shift towards wood alternatives in garden planters. Products made from composite wood materials, which incorporate recycled plastics with wood fibers, are increasingly favored for their durability and resistance to decay. These alternatives provide the aesthetic warmth of natural wood while eliminating concerns related to water damage, pest infestations, and environmental sustainability. The appeal of composite wood planters aligns with consumer desires for visually appealing yet environmentally friendly gardening solutions.

Material Insights

The plastic/resin/polypropylene planters segment accounted for a revenue share of 23.45% of the U.S. garden planters market in 2024 due to their lightweight nature, affordability, and durability, making them suitable for both indoor and outdoor applications. These materials are resistant to harsh weather conditions, cracking, and fading, offering long-lasting performance with minimal maintenance. Additionally, advancements in molding technologies have enabled the production of planters in various designs, colors, and textures that mimic ceramic or stone finishes, further driving consumer preference for stylish yet cost-effective options.

The fiberglass planters segment is expected to grow at a CAGR of 9.4% from 2025 to 2033 due to the rising consumer preference for premium, durable, and lightweight materials that combine aesthetics with functionality. Fiberglass planters offer superior resistance to weather, UV exposure, and corrosion, making them ideal for both residential and commercial landscaping. Their sleek, modern appearance aligns well with contemporary outdoor and indoor décor trends. Moreover, the increasing use of fiberglass in large-scale installations for hotels, offices, and public spaces, owing to its low maintenance and long lifespan, is further boosting its market demand.

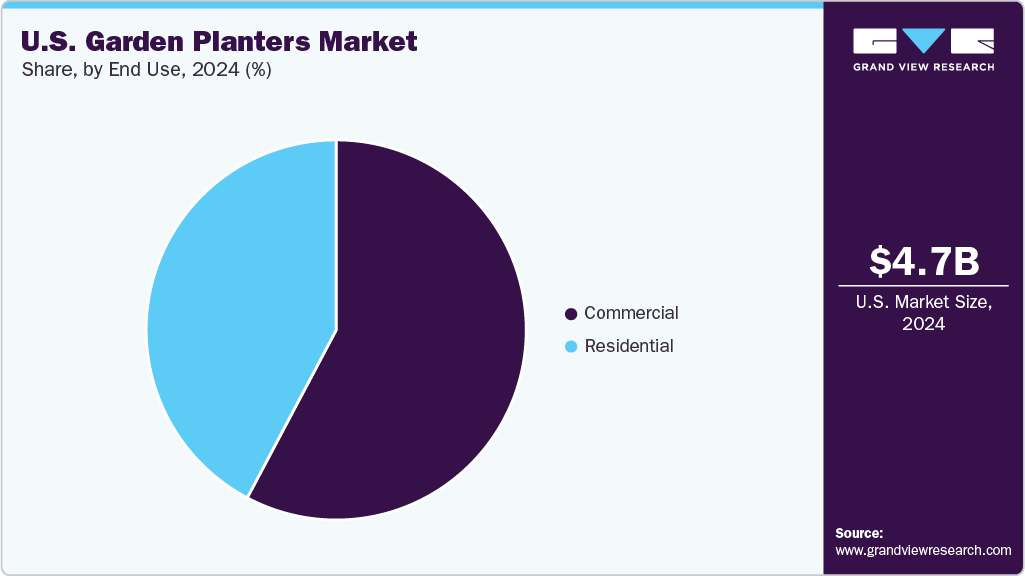

End Use Insights

Garden planters used for commercial applications accounted for a revenue share of 57.76% of the U.S. garden planters market in 2024 due to the rising incorporation of greenery in commercial spaces such as offices, hotels, restaurants, shopping centers, and public areas. Businesses are increasingly adopting planters to enhance aesthetics, promote employee well-being, and create inviting environments aligned with biophilic design trends. Additionally, urban redevelopment projects and municipal green initiatives are driving the installation of planters in streetscapes and public plazas. The demand for durable, low-maintenance, and weather-resistant planters also supports their widespread use in commercial settings.

Garden planters used for residential applications are expected to grow at a CAGR of 8.4% from 2025 to 2033 due to the rising popularity of home gardening and interior décor trends that emphasize greenery and wellness. Consumers are increasingly incorporating plants into balconies, patios, and indoor spaces to enhance aesthetics and air quality. The growth of urban housing and smaller living spaces has fueled demand for compact, lightweight, and modular planters. Additionally, the growing interest in sustainable living, DIY gardening, and online availability of decorative planters is further boosting adoption across U.S. households.

Distribution Channel Insights

Garden planters sold through home improvement stores accounted for a revenue share of 33.87% of the U.S. garden planters industry in 2024, due to the wide product availability, competitive pricing, and consumer trust associated with established retail chains such as Home Depot, Lowe’s, and Ace Hardware. These stores offer an extensive range of materials, sizes, and designs, catering to both residential and commercial buyers. Additionally, the in-store experience allows customers to evaluate quality and aesthetics directly, while seasonal promotions and expert advice on gardening and landscaping further drive planter purchases through this channel.

Garden planters sold through online/e-commerce are expected to grow at a CAGR of 9.0% from 2025 to 2033, largely driven by the increasing consumer preference for convenience, product variety, and doorstep delivery. E-commerce platforms offer access to a wide selection of planter styles, materials, and price ranges that may not be available in local stores. The rise of digital home décor trends, influencer marketing, and virtual gardening communities has also boosted online sales. Moreover, easy product comparison, customer reviews, and frequent discounts make online platforms a preferred choice for both new and experienced gardeners.

Key U.S. Garden Planters Company Insights

The U.S. garden planters industry combines well-established brands and emerging manufacturers. Leading companies actively respond to evolving gardening trends by innovating planters and broadening their product portfolios to enhance comfort, durability, and sustainability. This strategic adaptation helps them maintain a competitive edge and strengthen their position in a dynamic gardening industry.

-

THE HC COMPANIES, INC. is a prominent manufacturer of horticultural containers, offering a comprehensive range of products for diverse growers in the greenhouse, nursery, retail, and commercial markets. It represents the integration of several storied brands in the horticultural container industry, including ITML, Dillen, Amerikan, Kord, and Listo, which have contributed to its innovative product portfolio and industry leadership. It operates multiple production facilities across North America. HC's product line includes a variety of containers and solutions catering to different growing needs, using advanced manufacturing techniques such as blow molding, thermoforming, injection molding, co-extrusion, and vacuum forming.

-

Bloem is a manufacturer of high-quality gardening products, specializing in planters, hanging baskets, window boxes, and other containers designed to meet the needs of today's gardeners and retailers. The company offers a diverse range of products in various styles, sizes, and colors to cater to both indoor and outdoor living spaces. Its focus on creating innovative designs, combined with a commitment to sustainability, defines its approach to product development and business operations. Bloem produces its planters domestically and places a strong emphasis on offering on-trend products in fashionable colors. The company is dedicated to supporting retailers by providing solutions that resonate with consumers, including in-store displays and merchandising tools that are designed to enhance product visibility and maximize sales potential.

Key U.S. Garden Planters Companies:

- THE HC COMPANIES, INC.

- Bloem

- Crescent Garden Company

- Mayne Inc.

- Tusco Products

- Planters Unlimited

- Urban Pot

- Jay Scotts

- Novelty Manufacturing Co

- Veradek

Recent Developments

-

In June 2024, the Crescent Garden Company, along with Suntory Flowers, a gardening company that develops flowers, hosted the Spring Design Challenge. It invited nine designers to create floral arrangements using Senetti flowers and Crescent Garden Company’s TruDrop Flex Self-Watering Planters. After showcasing their designs on social media, a winner was chosen using the poll feature on Instagram.

-

In July 2023, Platinum Equity announced its acquisition of The HC Companies, a major North American horticultural container manufacturer. The deal, which was finalized following the completion of certain conditions, involved HC's six manufacturing and distribution facilities in the U.S. and Canada. Under the new ownership, HC's President and CEO continue to lead the company, with plans for growth and innovation supported by Platinum Equity's resources and expertise. The acquisition also positioned HC for further expansion and potential acquisitions in related markets.

U.S. Garden Planters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.90 billion

Revenue forecast in 2033

USD 8.90 billion

Growth rate

CAGR of 7.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in thousand Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end use, distribution channel

Country scope

U.S.

Key companies profiled

THE HC COMPANIES, INC.; Bloem; Crescent Garden Company; Mayne Inc.; Tusco Products; Planters Unlimited; Urban Pot; Jay Scotts; Novelty Manufacturing Co.; Veradek.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Garden Planters Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. garden planters market report based on material, end use, and distribution channel.

-

Material Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

Clay/Terracotta

-

Plastic/Resin/Polypropylene

-

Wood

-

Concrete

-

Metal

-

Ceramic

-

Fiberglass

-

Others (Bamboo, Fabric, Paper)

-

-

End Use Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

Supermarkets and Hypermarkets

-

Home Improvement Stores

-

Specialty Stores

-

Co-Op/Independent

-

Online/E-commerce

-

Frequently Asked Questions About This Report

b. The U.S. garden planter market was estimated at USD 4.66 billion in 2024 and is expected to reach USD 4.90 billion in 2025

b. The U.S. garden planter market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 8.90 billion by 2033.

b. Plastic garden planters in the U.S. garden planter market with a share of around 23.45% in 2024. The lightweight nature of plastic garden planters, coupled with their availability in a diverse range of sizes and designs, enhances their versatility and drives their adoption among consumers.

b. Some key players operating in the U.S. garden planter market include TTHE HC COMPANIES, INC.; Bloem; Crescent Garden Company; Mayne Inc.; Tusco Products; Planters Unlimited; Urban Pot; Jay Scotts; Novelty Manufacturing Co.; Veradek.

b. Key factors that are driving the U.S. garden planter market include the growing consumer interest in gardening and government initiatives toward green cities in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.