- Home

- »

- Medical Devices

- »

-

U.S. Healthcare Finance Solutions Market Size Report, 2030GVR Report cover

![U.S. Healthcare Finance Solutions Market Size, Share & Trends Report]()

U.S. Healthcare Finance Solutions Market Size, Share & Trends Analysis Report By Equipment Type, By Healthcare Facility Type, By Services, By Lenders (Government & Other Federal Agencies, Private Players), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-947-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

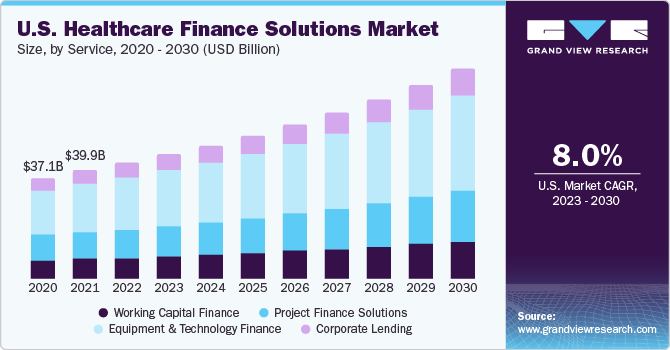

The U.S. healthcare finance solutions market size was valued at USD 46.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.7% from 2022 to 2030. The COVID-19 pandemic had an unprecedented impact on the healthcare business in 2020. The rising need for medical equipment and tools and hi-tech infrastructure to provide better quality services to patients were the primary market growth drivers. The rising number of admissions to healthcare facilities due to chronic diseases, aging population, and disability is driving the growth of healthcare expenditure in the country.

The coronavirus pandemic negatively impacted the finance solutions market initially as the companies had to work remotely to operate the business. However, the U.S. healthcare finance solutions market responded well to the outbreak and seized the opportunity, as the demand for funds increased by the healthcare providers to provide medical services. The COVID-19 pandemic has increased the number of admissions in the healthcare facilities which resulted in better healthcare facilities, high-quality treatment, and the requirement of medical equipment to fulfill the demands of the patients.

Healthcare in the U.S. is more expensive than in any other country. The health care spending per person in the U.S. was USD 10,966 in 2019. This can be attributed to advancements in treatment, healthcare tools, or equipment and the development of advanced healthcare infrastructure. Healthcare providers continue to participate in various value-based care models that drive clinical integration and financial risk based on performance.

Digitalization has helped healthcare providers deal with the challenges of the pandemic and improve patient outcomes. Digital technology is likely to grow the healthcare business. For instance, Siemens Financial Services is helping in removing barriers to investment and helping the healthcare sector and providers secure the equipment, technology, and facilities needed to provide better services to the patients.

The healthcare industry is evolving with the rising adoption of technologically advanced products for enhancing functions and processes. Advancements can be observed in healthcare equipment, software, infrastructure, and therapy, among others. Safe and effective therapy or treatment is a primary concern of every healthcare provider, and technological advancements make it easy to achieve this goal.

The U.S. is one of the leading countries to manufacture and develop technologically advanced products for the healthcare industry, which is increasing the total cost of healthcare for patients. This is directly increasing the financial burden on patients. New medical technology is responsible for a 40% to 50% increase in annual healthcare costs.

Health insurance and finance solutions companies provide payment for innovations, such as advanced therapy, and medical services from advanced healthcare providers, as medical treatments can be very expensive and their cost would be beyond the reach of many people unless they are covered by healthcare insurance schemes.

Equipment Type Insights

The decontamination equipment segment dominated the U.S. healthcare finance solutions market with a 36.0% revenue share in 2021 as there is a high requirement for the equipment and they are costly and need huge capital investment. The COVID-19 pandemic has boosted the diagnostic area for the detection and testing of the virus which increased the demand for diagnostic kits and other diagnostic equipment.

Based on equipment, the market is segmented into diagnostic/imaging equipment, specialty beds, surgical instruments, decontamination equipment, and IT equipment. The specialty beds segment is anticipated to grow at the fastest CAGR of 9.2% over the forecast period. This is due to the increase in demand for advanced beds in the healthcare facilities and the development of healthcare infrastructure is expected to fuel this industry’s growth over the forecast period.

Healthcare Facility Type Insights

The hospital & health systems were the largest segment in 2021 accounting for 25.0% of the market share owing to the increasing number of hospitals & health systems along with their increasing demand for medical care. Among frequently changing laws, expansion of healthcare access, and increasing patient admission, hospitals need financial support. Simultaneously, healthcare facilities are expected to offer the most appropriate care and the most desired outcomes to the patients. Hence, the segment is anticipated to witness significant growth over the forecast period.

The outpatient surgery center is another highly driven healthcare facility. Outpatient imaging centers are medical facilities providing imaging services. These imaging centers use advanced techniques and high-tech equipment to generate accurate images of organs, soft tissues, and blood vessels, among others. Outpatient imaging centers are expected to grow at the fastest rate of 9.1% over the forecast period due to increasing investments in R&D for developing innovative technology and the growing incidence of chronic diseases in the country.

Lenders Insights

The private player's segment contributed to the largest market share accounting for 51.1% of the share in 2021 This can be attributed to the fast approval and cash disbursement process by the private players. Based on lenders, the U.S. market is segmented into government and other federal agencies, private players, and others (such as patients).

The traditional methods of financing solutions involve endless paperwork and manual document collection are time-consuming processes that caused delays in the loan disbursement. In today’s world, with the help of AI-based platforms, the process is fast, paperless, and provides flexibility to design financial solutions and orchestration of responsibilities and communications.

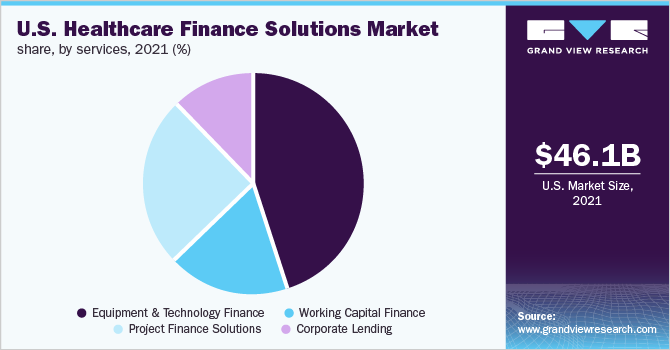

Services Insights

Based on services, the equipment and technology finance segment accounted for the largest market share of 45.0% in 2021. This is due to the huge capital required for the setup along with the costly healthcare equipment which requires financial support. Financial solutions companies work closely with the business sector to fulfill the long-term financial requirements of the sector. Finance companies provide various benefits to their clients such as tax benefits, flexible payment terms, and no depreciation.

The finance companies provide various benefits to their clients such as tax benefits, flexible payment terms, no deprecation, etc. These companies use financial expertise and digitalization to provide financial solutions to serve the equipment & technology need of the healthcare sector which is likely to result in smooth functioning of the business operations.

The report also provides a crisscross analysis of lenders and service side segments for analyzing the share of lenders in each service type. In equipment and technology finance, the private players segment dominated the market with a share of 50.0% in 2021 and is likely to grow at a CAGR of 7.4% during the forecast period. The majority of the private finance companies offer equipment and technology finance to healthcare providers, which is a major factor driving the market growth.

Key Companies & Market Share Insights

This market is fragmented due to the presence of many financial service providers. Several market participants are privately held. The players are focusing on adopting various growth strategies, such as partnership and expansion of product portfolios to retain their market position.

The finance solutions companies are introducing digitalization and innovative technologies to improve their capabilities in terms of services, fast disbursement of funds, and remote transactions. The players are focusing on adopting various growth strategies, such as partnership and expansion of product portfolios to retain their market position.

Recent developments:

-

In September 2021, Siena Healthcare Finance recently provided a USD 12.0 million working capital facility for a private equity-backed multi-state provider of specialty pharmaceutical, infusion, and nutritional therapy services for patients with chronic disease and health issues

-

In April 2021, CIT Group collaborated with iCleanse to provide low-interest financing on all iCleanse disinfection products to keep customers and staff safe from infectious pathogens

-

In April 2021, Commerce Bankshare, Inc. has joined Guidewire PartnerConnect as a solution partner. The partnership is likely to enable insurers to provide single- and multi-party electronic claims payments

Some prominent players in the U.S. healthcare finance solutions market include:

-

Siemens Financial Services, Inc.

-

General Electric Company

-

Commerce Bankshares, Inc.

-

Thermo Fisher Scientific, Inc.

-

Siena Healthcare Finance

-

CIT Group, Inc.

-

Stryker

-

Gemino Healthcare Finance

-

Oxford Finance LLC

-

TCF Capital Solutions

U.S. Healthcare Finance Solutions Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 49.4 billion

Revenue forecast in 2030

USD 89.8 billion

Growth rate

CAGR from 7.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Equipment type, healthcare facility type, services, lenders

Country scope

U.S.

Key Companies Profiled

Siemens Financial Services, Inc.; General Electric Company; Commerce Bankshares, Inc.; Thermo Fisher Scientific, Inc.; Siena Healthcare Finance; CIT Group, Inc.; Stryker; Gemino Healthcare Finance; Oxford Finance LLC; TCF Capital Solutions

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. healthcare finance solutions market report based on equipment type, healthcare facility type, services, and lenders:

-

Equipment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic/Imaging Equipment

-

Specialist Beds

-

Surgical Instruments

-

Decontamination Equipment

-

IT Equipment

-

-

Healthcare Facility Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Health Systems

-

Outpatient Imaging Centers

-

Outpatient Surgery Centers

-

Physician Practices & Outpatient Clinics

-

Diagnostic Laboratories

-

Urgent Care Clinics

-

Skilled Nursing Facilities

-

Pharmacies

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Technology Finance

-

Government & Other Federal Agencies

-

Private Players

-

Others

-

-

Working Capital Finance

-

Government & Other Federal Agencies

-

Private Players

-

Others

-

-

Project Finance Solutions

-

Government & Other Federal Agencies

-

Private Players

-

Others

-

-

Corporate Lending

-

Government & Other Federal Agencies

-

Private Players

-

Others

-

-

-

Lenders Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Other Federal Agencies

-

Private Players

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. healthcare finance solutions market size was estimated at USD 46.1 billion in 2021 and is expected to reach USD 49.4 billion in 2022.

b. The U.S. healthcare finance solutions market is expected to grow at a compound annual growth rate of 7.7% from 2022 to 2030 to reach USD 89.8 billion by 2030.

b. Decontamination equipment segment dominated the U.S. healthcare finance solutions market with a share of 36.0% in 2021. This is attributable to high requirement of the equipment and need huge capital investment.

b. Some key players operating in the U.S. healthcare finance solutions market include • Siemens Financial Services, Inc. General Electric Company, Commerce Bankshares, Inc., Thermo Fisher Scientific, Inc., Siena Healthcare Finance, CIT Group, Inc., Stryker, Gemino Healthcare Finance, Oxford Finance LLC, TCF Capital Solutions.

b. Key factors that are driving the market growth include rising need of medical equipment and tools and increasing required of hi-tech technology and infrastructure to provide better quality services to the patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."