- Home

- »

- Medical Devices

- »

-

U.S. Healthcare Staffing Market Size & Share Report, 2030GVR Report cover

![U.S. Healthcare Staffing Market Size, Share & Trends Report]()

U.S. Healthcare Staffing Market Size, Share & Trends Analysis Report By Type (Travel Nurse Staffing, Per Diem Nurse Staffing, Locum Tenens Staffing, Allied Healthcare Staffing), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-500-7

- Number of Report Pages: 86

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

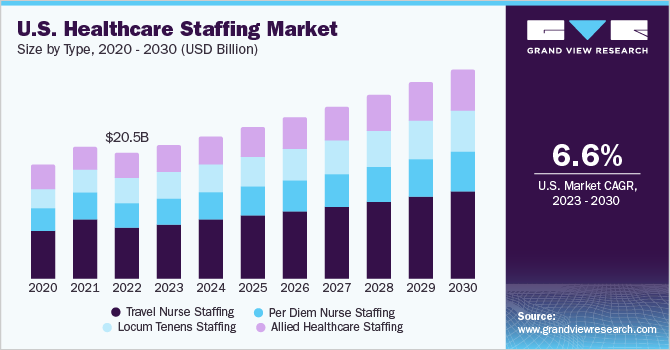

The U.S. healthcare staffing market size was valued at USD 20.5 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.69% from 2023 to 2030. Some of the factors responsible for the market growth are the increasing demand for temporary staffing for medical professionals due to the rising geriatric population and the lack of skilled nursing staff across the country.

An increase in life expectancy has led to a rise in the geriatric population. According to the U.S. Census Bureau, the number of adults aged 65 or older is on track to grow an estimated 80% between 2020 and 2030. People over 65 are three times more likely to have a hospital stay and twice as likely to visit a physician's office, compared with the rest of the population. An aging population is expected to have a significant impact on healthcare delivery because they are highly susceptible to lifestyle diseases and chronic conditions.

The current healthcare system is under pressure owing to the large geriatric population. According to the Association of American Medical Colleges, the physician shortage is expected to range from 46,900 to 121,900 physicians by 2032. Moreover, as per estimates by the American Nurses Association, there will be a need for 3.44 million nurses by 2022. Many hospitals and other medical facilities are partnering with recruiting agencies to fulfill vacant positions on a temporary or permanent basis. This is expected to fuel market growth.

Travel or per diem nurses are compensated at a much higher rate when compared to regular full-time nurses. For instance, the annual average salary of full-time nurses ranges from USD 50,000 to USD 60,000; however, per diem nurses can get as high as USD 90,000 to USD 100,000. High compensation, flexible working hours, opportunity to travel, and greater exposure to various medical systems are factors due to which the preference for allied healthcare, per diem, travel nurse, or locum tenens as a career option is increasing.

COVID-19 U.S. healthcare staffing market impact: 25.5% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

As a result of the pandemic, there has been a massive shift in the market landscape. The requirement for travel nurses is at a record level while non-critical procedures have witnessed a spike in cancellations. Within allied health recruitment, the pandemic has driven an abrupt move from OT/PT/SLT to respiratory treatment.

Care providers are depending on recruiting agencies for assistance in scaling up to care for COVID-19 patients. Moreover, they are offering services to efficiently respond to changes in the patient count and optimize workforce spending.

Staffing organizations experienced double-digit revenue gains owing to the drastic increase in demand for temporary nurses. For instance, AMN Healthcare's revenue from the nurse and allied staffing solutions increased by 9.3% in 2020, compared to the previous year.

Due to the stress and burnout created by the COVID-19 pandemic, many nurses and physicians are planning to take early retirement. This will increase the existing shortage of medical staff further, resulting in high demand for temporary and locum nurses.

A significant increase in the number of government & non-government hospitals, acute care centers, long-term care centers, and other types of medical facilities is anticipated to significantly fuel the market growth. Improving medical infrastructure and increasing investment in public health is leading to an increase in the number of hospitals. According to the American Hospital Association, the total number of hospitals in the U.S. in 2020 was 6,090. Setting up a new hospital requires the employment of well-trained medical staff. This is likely to propel market growth.Type Insights

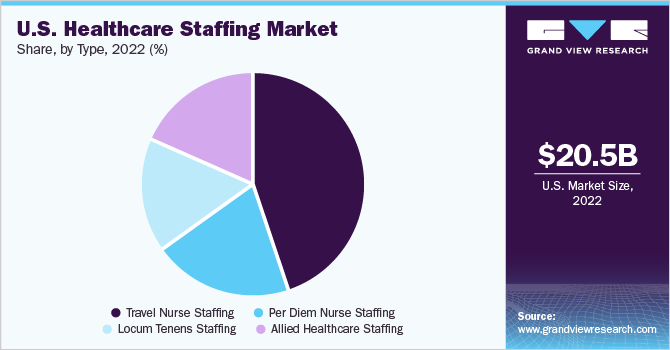

Travel nurse staffing dominated the market with a share of 39.55% in 2022 and is expected to emerge as the fastest-growing segment with a CAGR of 6.37% during the forecast period. This can be attributed to the high pay, travel opportunity, and short-term assignments. Furthermore, in response to increasing medical expenses, hospitals are forced to reduce their staff. Hence, they opt for these services to ensure that nurses are available when the workload increases.

On the other hand, the locum tenens staffing segment is anticipated to witness maximum growth during the forecast period. The rising shortage of primary care physicians and specialists and hospitals hiring locum tenens in peak seasons to reduce cost are primary reasons for the growth of the segment. According to Staff Care’s 2020 Survey of Temporary Physician Staffing Trends report, nearly 52,000 physicians were working as locum tenens in 2019. An increasing number of physicians preferring to work as locum tenens is likely to favor the segment growth.

Allied healthcare professionals include physical therapists, medical technologists, pharmacists, dental hygienists, phlebotomists, radiographers, pathologists, and others. Improving access to public healthcare, growing retired baby boomers, and rising prevalence of chronic diseases are likely to drive the segment growth.

Key Companies & Market Share Insights

The market is moderately fragmented. AMN Healthcare, Envision Healthcare Corporation, CHG Management, Inc. accounted for the leading position in the market. This can be attributed to the company’s wide network of partners and client base, excellent hiring and recruitment services, and investment in technology.

Partnerships and collaborations, mergers and acquisitions, adoption of the latest technology, and geographical expansion are some of the strategic initiatives undertaken by the major players to strengthen their market position. In June 2021, Cross Country Healthcare, Inc. completed the acquisition of Workforce Solutions Group, Inc., a provider of talent management solutions to its clients. Some of the companies present in the U.S. healthcare staffing market include:

-

Envision Healthcare Corporation

-

AMN Healthcare

-

CHG Management, Inc.

-

Maxim Healthcare Group

-

Cross Country Healthcare, Inc.

-

Aya Healthcare

-

Trustaff

-

TeamHealth

-

Adecco Group

-

LocumTenens.com

U.S. Healthcare Staffing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.6 billion

Revenue forecast in 2030

USD 34.7 billion

Growth Rate

CAGR of 6.69% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Envision Healthcare Corporation; AMN Healthcare; CHG Management, Inc.; Maxim Healthcare Services, Inc.; Cross Country Healthcare; Aya Healthcare; Trustaff; TeamHealth; Adecco Group; LocumTenens.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. healthcare staffing market report based on type:

-

U.S. Healthcare Staffing Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Travel Nurse Staffing

-

Per Diem Nurse Staffing

-

Locum Tenens Staffing

-

Allied Healthcare Staffing

-

Frequently Asked Questions About This Report

b. The U.S. healthcare staffing market size was estimated at USD 20.5 billion in 2022 and is expected to reach USD 23.6 billion in 2023.

b. The U.S. healthcare staffing market is expected to grow at a compound annual growth rate of 6.69% from 2023 to 2030 to reach USD 34.7 billion by 2030.

b. Travel nurse staffing dominated the U.S. healthcare staffing market with a share of 39.6% in 2022. This is attributable to the anticipated physician shortage in the coming years and the rising demand for healthcare services.

b. Some key players operating in the U.S. healthcare staffing market are Envision Healthcare Corporation; AMN Healthcare; CHG Management, Inc.; Maxim Healthcare Services, Inc.; Cross Country Healthcare; Aya Healthcare, Trustaff, TeamHealth; Adecco Group; and LocumTenens.com

b. Key factors that are driving the U.S. healthcare staffing market growth include increasing demand for temporary staffing for healthcare professionals due to the rising geriatric population and lack of skilled nursing staff across the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."