- Home

- »

- Consumer F&B

- »

-

U.S. Healthy Snacks Market Size, Industry Report, 2033GVR Report cover

![U.S. Healthy Snacks Market Size, Share & Trends Report]()

U.S. Healthy Snacks Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Frozen & Refrigerated, Bakery, Savory, Bars & Confectionery, Dairy), By Claim, By Packaging, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-203-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Healthy Snacks Market Summary

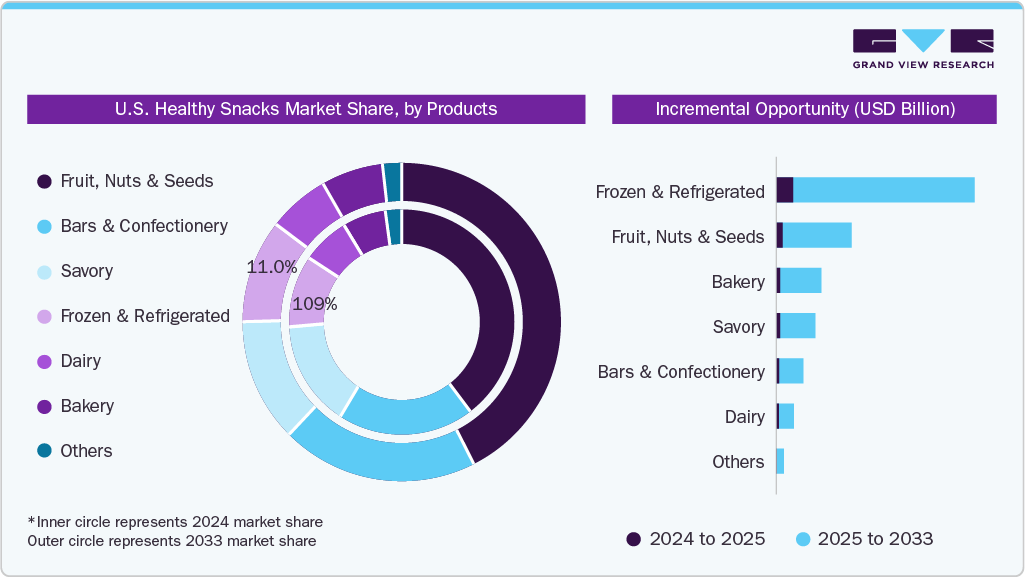

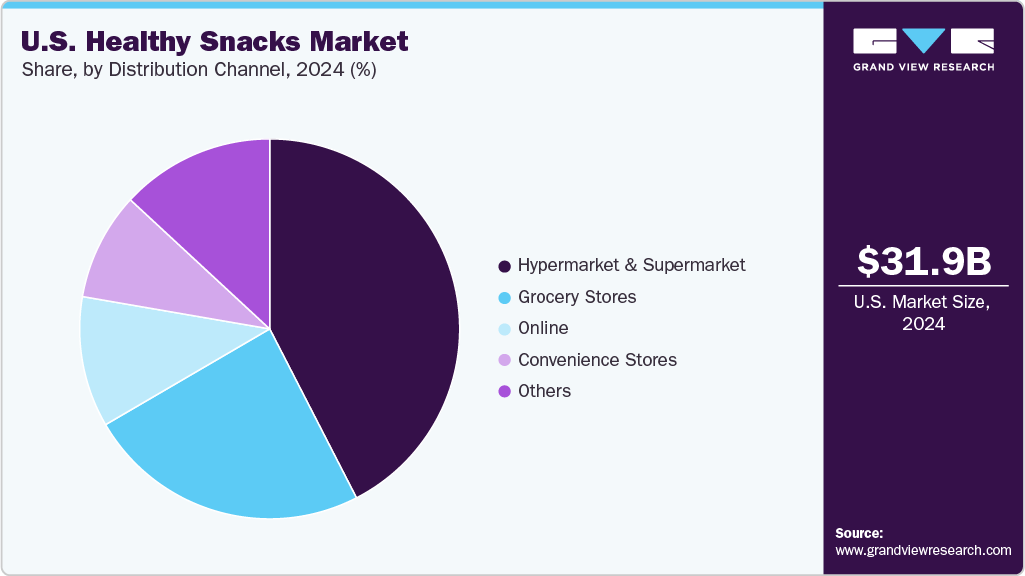

The U.S. healthy snacks market size was estimated at USD 31.90 billion in 2024 and is projected to reach USD 54.61 billion in 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market has grown significantly in recent years, fueled by rising consumer awareness of nutrition, wellness, and lifestyle-related health conditions.

Key Market Trends & Insights

- The U.S. healthy snacks market is expected to grow at a 6.2% CAGR from 2025 to 2033.

- By product, the fruit, nuts, and seeds segment accounted for a share of 39.3% in 2024.

- By claim, the organic segment accounted for a share of 37.07% in 2024.

- By packaging, the bag & pouches segment accounted for a share of 42.2% in 2024.

- By distribution channel, the online segment is growing at a significant CAGR of 8.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 31.90 Billion

- 2033 Projected Market Size: USD 54.61 Billion

- CAGR (2025-2033): 6.2%

As more Americans adopt healthier eating habits, the demand for snacks that combine convenience with nutritional value continues to expand. Consumers are increasingly seeking snack options that align with specific dietary preferences, such as low-sugar, high-protein, gluten-free, and plant-based. This shift is driven by growing concerns around obesity, diabetes, and heart health, as well as the popularity of diets such as keto, paleo, and vegan. As a result, products made with clean-label ingredients, free from artificial preservatives, colors, and flavors, are in high demand. Thus, increasing consumption of healthy snacks would propel the growth of the U.S. healthy snacks industry.

Innovation and investment play a critical role in meeting demand. Healthy snacks manufacturers are expanding production capacities and developing new product lines to cater to changing tastes and dietary needs. For instance, companies are investing in premium snack varieties and lactose-free products to capture niche markets, which in turn would propel the growth of the U.S. Healthy Snacks Market.

Popular segments within the healthy snacks category include fruits, nuts, seeds, and products made from whole grains, which together make up a significant portion of the market. Consumers increasingly prefer snacks that are free from artificial additives, preservatives, and allergens, such as gluten and dairy. Labels highlighting organic, non-GMO, low sugar, and high protein content are also highly sought after.

Consumer Insights for U.S. Healthy Snacks

The U.S. healthy snack market is strongly shaped by evolving consumer preferences that prioritize wellness, convenience, and transparency. Today’s consumers are more informed about nutrition and increasingly seek snacks that support their health goals without sacrificing taste or convenience.

A large portion of U.S. consumers now actively look for snacks that offer functional benefits such as high protein, fiber, low sugar, or added vitamins and minerals. Chronic health concerns such as obesity and diabetes have pushed consumers to reduce intake of artificial ingredients, excessive sugar, and unhealthy fats. Many shoppers prefer snacks made from natural, organic, or plant-based ingredients.

Busy lifestyles and changing work patterns have increased demand for portable, ready-to-eat snacks. Consumers want options that are easy to carry and consume between meals or during work breaks. This trend has expanded the appeal of single-serve packaging and snack bars. Millennials and Gen Z are leading the healthy snack trend, motivated by sustainability and social responsibility. Older consumers often focus on functional benefits related to aging and wellness. Diverse cultural backgrounds have also introduced interest in globally inspired flavors and ingredients.

Product Insights

The sale of fruit, nuts, and seeds, healthy snacks in the U.S. healthy snacks market, accounted for a revenue share of 39.3% in 2024. The increasing prevalence of dietary trends such as plant-based diets, veganism, and paleo diets also influences the market. Fruits, nuts, and seeds align well with these dietary preferences, contributing to the sustained growth of this market segment. In addition, the perception of these snacks as wholesome, natural, and sustainable further enhances their appeal among environmentally conscious consumers.

Sustainability and sourcing are gaining attention, with demand for organic, non-GMO, and ethically sourced products increasing. Packaging innovations that preserve freshness while reducing environmental impact are becoming standard.

The demand for bakery products in the U.S. is expected to grow at a CAGR of 6.4% from 2025 to 2033. One key factor driving demand is the increasing focus on health and wellness. Consumers are seeking healthier bakery options that include whole grains, reduced sugar, and gluten-free varieties. There is a noticeable rise in interest for products made with natural ingredients and clean labels, as buyers become more aware of nutrition and ingredient quality. Functional bakery items that offer additional benefits, such as added fiber or protein, are also gaining popularity.

Claim Insights

The demand for organic claims in the U.S. healthy snacks industry accounted for a share of 37.07% in 2024. Health-conscious individuals often associate organic products with better nutritional value, improved taste, and fewer allergens, which contributes to a higher preference for organic snacks. Parents in particular gravitate toward organic options for their children, viewing them as safer and more wholesome. This is especially prevalent in urban centers and developed markets where discretionary income allows for premium spending. Recognizing the rising demand, companies are introducing new product lines to meet evolving needs. For instance, in April 2025, Pitaya Foods introduced a new product line of regenerative and organic frozen fruits, available in 3 varieties: Regenerative & organic strawberries, blueberries, and mangoes. The newly introduced product line is USDA-organic certified and is free of synthetic additives and pesticides.

The high protein claim is expected to grow at a CAGR of 8.3% from 2025 to 2033. Beyond performance and diet trends, high-protein products are increasingly marketed for weight management, as they promote fullness and reduce cravings. This drives adoption among a broader audience interested in healthy snacking as part of a balanced lifestyle. For instance, in March 2024, KP Snacks introduced lentil crisps in delicious variants: sweet chili & red pepper and sour cream and onion, available in a 24-gram single format.

Packaging Insights

The bag and pouch packaging segment accounted for a revenue share of 42.2% in 2024. Custom packaging solutions, including various sizes, shapes, and types such as straight bags, pillow-shaped bags, and roll stock packaging, are available to meet the specific needs of snack producers. This ensures that their products stand out on shelves and cater to consumer preferences for healthy, convenient snack options. For instance, KP Snacks, a prominent UK-based snack manufacturer, implemented a significant packaging overhaul by introducing new flow wrap equipment. This advancement led to a 35% reduction in plastic packaging for six packages of popular brands such as Discos, Roysters, and Frisps, amounting to an annual saving of over 100 tonnes of plastic/

The demand for canned packaging in the global healthy snacks market is expected to grow at a CAGR of 6.4% from 2025 to 2033. Cans offer excellent durability and protection, significantly reducing spoilage and damage during transportation, which helps maintain product quality until it reaches the consumer.

Their tamper-evident design also assures that the food remains safe and untouched, an increasingly important factor for today’s health-conscious buyers. Additionally, cans' strong recyclability supports sustainability goals, aligning with the environmental values shared by both consumers and brands. Thus, the growing adoption of canned packaging is expected to fuel the market's growth during the forecast period.

Distribution Channel Insights

In 2024, sales of healthy snacks through the hypermarket and supermarket channels accounted for a revenue share of 42.44%. The convenience and accessibility of these retail channels, typically located in urban and suburban areas, make it easy for individuals to purchase healthy snacks during routine shopping trips. Collaborations with popular brands for in-store promotions and advertising campaigns increase brand visibility and generate consumer interest. Competitive pricing and discounts on healthy snacks further incentivize consumers to select these options over less nutritious alternatives, which is fueling the growth of the U.S. healthy snacks industry during the forecast period.

The sale of healthy snacks through online channels is expected to grow at a CAGR of 8.5% from 2025 to 2033. E-commerce has become an increasingly important channel for healthy snack brands. As of 2023‑24, healthy snack sales online are growing faster than many traditional food categories. This growth is driven by shifting consumer behavior; people are more willing to discover new brands online, shop from home, and value convenience combined with health.

Online platforms offer a wide product range, and brands can offer many variants (vegan, gluten‑free, keto, etc.) without needing shelf space in brick‑and‑mortar stores. Subscription boxes and direct‑to‑consumer (DTC) models allow consumers to try multiple healthy snacks in smaller amounts.

E-commerce giants such as Amazon Fresh, Walmart, and Instacart, along with specialized grocery platforms such as FreshDirect and Thrive Market, have expanded their dairy offerings. These platforms now provide not only traditional dairy but also organic, lactose-free, and plant-based alternatives, catering to a wide range of dietary needs.

Key U.S. Healthy Snacks Company Insights

The U.S. healthy snacks market is characterized by the existence of global brands as well as local dairy manufacturers, which has resulted in a high intensity of competitive rivalry. The U.S. is also experiencing an upsurge in healthy snacks, which is coupled with the launch of new products in the markets, such as organic cheese and milk, in order to cater to the demand from teenagers and the young population. Thus, it is assisting these key market participants in generating greater demand for their vast product portfolios.

Key U.S. Healthy Snacks Companies:

- Kellanova (The Kellogg Company)

- Nestlé S.A.

- Danone North America

- Unilever Plc.

- PepsiCo

- Mondelēz International

- Hormel Foods Corporation

- Del Monte Foods, Inc.

- Select Harvests Limited

- B&G Foods

- Monsoon Harvest (Wingreens Harvest)

- Conagra Brands, Inc.

- General Mills Inc.

- Mars Inc.

Recent Developments

-

In April 2024, Hormel Foods introduced Planters Nut Duos Cocoa Cashews & Espresso Hazelnuts, offering a heart-healthy snack option with zero cholesterol per serving. This product combines cocoa-flavored cashews and espresso-flavored hazelnuts, providing 4 grams of plant-based protein and 1 gram of dietary fiber per 30g serving. It is available through major U.S. retailers such as Target and ShopRite.

-

In August 2023, Unilever announced its acquisition deal with Yasso Holdings, Inc., a brand known for its premium frozen Greek yogurt in the U.S. This strategic move falls in line with Unilever's premiumization strategy within its Ice Cream Business Group, adding Yasso to a prestigious portfolio alongside brands such as, Ben & Jerry's, Magnum, and Talenti. Yasso's product line perfectly caters to the increasing demand for convenient, healthier, and indulgent frozen snacks in North America.

U.S. Healthy Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.63 billion

Revenue Forecast in 2033

USD 54.61 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product, claim, packaging, distribution channel

Key companies profiled

Kellanova (The Kellogg Company); Nestlé S.A.; Danone North America; Unilever Plc.; PepsiCo; Mondelēz International; Hormel Foods Corporation; Del Monte Foods, Inc.; Select Harvests Limited; B&G Foods; Monsoon Harvest (Wingreens Harvest); Conagra Brands, Inc.; General Mills Inc.; Mars Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthy Snacks Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. healthy snacks market report based on product, claim, packaging, and distribution channel:

-

Product Outlook (Revenue, USD Million; 2021 - 2033)

-

Frozen & Refrigerated

-

Fruit, Nuts and Seeds

-

Bakery

-

Savory

-

Bars and Confectionery

-

Dairy

-

Others

-

-

Claim Outlook (Revenue, USD Million; 2021 - 2033)

-

Gluten-Free

-

Low/NSugar

-

Low/NFat

-

Organic

-

Eco-friendly Packaging

-

Plant-based

-

Vegan

-

Halal

-

High Protein

-

High Fiber

-

Non-GMO

-

Others

-

-

Packaging Outlook (Revenue, USD Million; 2021 - 2033)

-

Bag & Pouches

-

Boxes

-

Cans

-

Jars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2021 - 2033)

-

Hypermarket & Supermarket

-

Convenience Stores

-

Online

-

Grocery Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. healthy snacks market size was estimated at USD 21.47 billion in 2023 and is expected to reach USD 22.85 billion in 2024.

b. The U.S. healthy snacks market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030 to reach USD 35.34 million by 2030.

b. Healthy savory snacks dominated the U.S. healthy snacks market with a share of more than 32.97% in 2023. Those who work long hours, tend to prefer savory snacks instead of cooked food as their choice for dinner primarily drives the demand for this segment.

b. Some key players operating in the U.S. healthy snacks market include Nestlé; The Kellogg Company; Unilever; Donone North America; PepsiCo; Mondelēz International; Hormel Foods Corporation; Del Monte Foods, Inc.; Select Harvests; Good Culture; Core Foods

b. Key factors that are driving the U.S. healthy snacks market growth include Increasing awareness about human health and the significant contributions of food in determining the quality of health has resulted in a growing number of consumers shifting towards healthier snack choices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.