Market Size & Trends

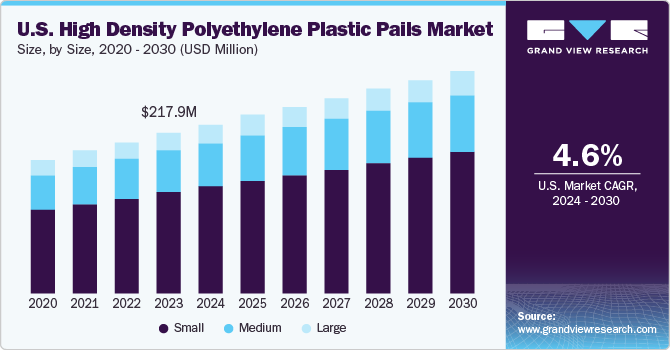

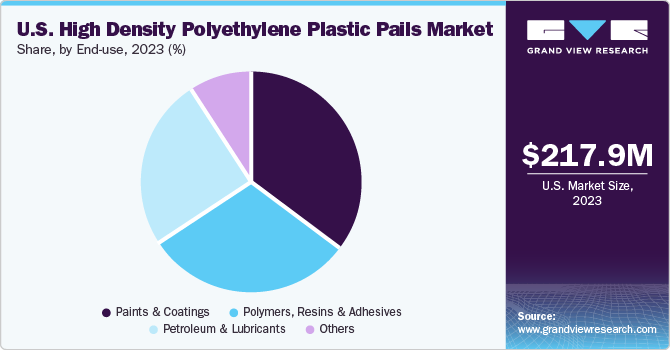

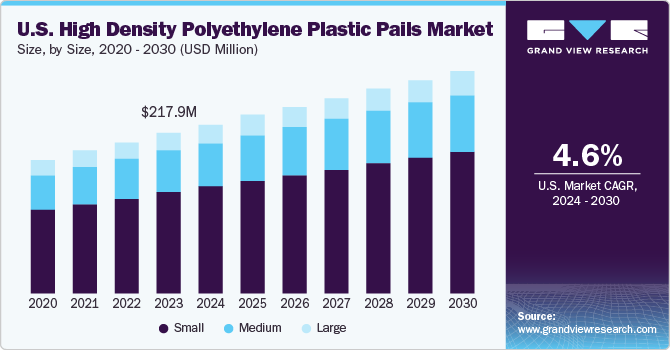

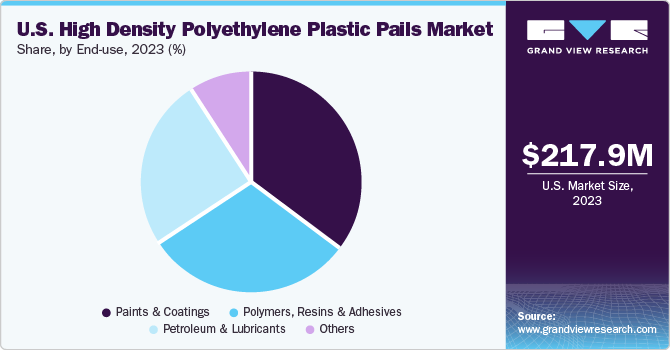

The U.S. high density polyethylene plastic pails market size was valued at USD 217.9 million in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. Unceasing increase in constructions and redevelopments worldwide and growing demand for high density polyethylene plastic pails from paints and coatings industry is expected to generate higher growth for this market. These plastic pails are increasingly used for packaging purposes in multiple industries such as paints and coatings, chemicals, agricultural fertilizers, petroleum & lubricants, polymers, resins, adhesives and others.

The increasing demand for packaging solutions across various industries is a significant growth driver for this market. Particularly, the rising growth of the construction sector and increasing demand for paints and coatings have increased the need for HDPE plastic pails. In February 2024, construction spending in the U.S. for December 2023 increased by 0.9% compared to November, and an increase of 13.9% was recorded compared to December 2022 estimates. The growing urbanization, increasing demand for commercial spaces in the country, and rising inflow of businesses and people from different regions are expected to drive the growth of the construction industry, in turn generating increasing demand for HDPE plastic pails used in paints, adhesives, chemicals, and coatings of different sorts.

Features such as enhanced durability and versatility, lighter weight, sustainability, convenience, ease of use, and safety are also contributing to the growth of this industry. In addition, customized products developed by some market participants according to specific requirements of businesses and organizations have created increasing demand for HDPE plastic pails.

Furthermore, stringent regulations and guidelines regarding the use of materials and other features in packaging for industries such as chemicals, adhesives, resins, and others have encouraged companies and businesses to use reliable packaging solutions such as HDPE plastic pails. In addition, HDPD plastic pails are extensively used in shipping and logistics during global trade of multiple products and goods.

The growing technological advancements in HDPE plastic pails have also played a crucial role in driving market growth. Production processes and pail design innovations have led to more efficient and cost-effective manufacturing. Companies invest in technology and production to produce high-quality HDPE pails with improved features, such as better sealing and stacking capabilities.

Size Insights

Based on the size, the small-sized pails segment dominated the global industry and accounted for a revenue share of 63.0% in 2023. The segment growth is driven by rising demand for smaller packaging sizes in multiple industries, such as packaged food, chemicals, adhesives, pharmaceuticals, and more. The increasing popularity of sample-sized and trial-sized products also contributes to the growth in demand for small-sized pails as companies seek packaging solutions to offer fewer products for trials.

The medium-sized pails segment is expected to experience a significant CAGR over the forecast period. The segment growth is driven by the increasing demand from the industrial and infrastructural sector owing to its versatility and wide range of applications, where medium-sized pails are used for packaging and storing lubricants, chemicals, and other materials. These pails are typically available in 5 liters to 25 liters capacity; among these, the 20-liter capacity bucket is the most popular size in the market. Furthermore, these pails are widely used in the food and beverage industries for packaging and storing ingredients, sauces, and other products.

End-use Insights

The paints & coatings segment dominated the U.S. high-density polyethylene (HDPE) plastic pails market in 2023. The growth of this segment is driven by the increasing demand for paints and coatings in the construction and automotive industries. The HDPE plastic pails are particularly valued in this sector for their strength, resistance to chemical interactions, and ability to preserve the integrity of the products. Increasing advancements and innovations in painting and coatings products, such as low-VOC and eco-friendly formulations, have also been driving the growth of this segment.

The polymers, resins & adhesives segment is anticipated to experience the fastest CAGR of 5.0% during the forecast period. The increasing demand for these products is particularly strong in the automotive, aerospace, and construction sectors, which often require these materials for daily activities from manufacturing to construction. Manufacturers in this industry continuously seek effective packaging solutions to deliver products and transport during the trade. In addition, the rise of advanced polymer technologies and the expansion of industries requiring high-performance adhesives further contribute to the segment's growth.

Key U.S. High Density Polyethylene Plastic Pails Company Insights

Some key companies operating in the U.S. high density polyethylene plastic pails market include. M&M Industries, Inc., Polyethylene Containers, Inc., Labelmaster, and others. To address the growing competition, the major industry participants have adopted strategies such as enhanced research, implementation of quality assurance practices, sustainability, collaborations, effective distribution and expansion of product portfolios.

-

M&M Industries, Inc., a multinational manufacturer of plastic containers and packaging solutions, offers a diverse portfolio of products that cater to different packaging needs, including plastic pails and containers. The company caters to a wide array of sectors, including the chemical industry, food and beverage, pharmaceuticals, and construction. M&M Industries markets its plastic pails products under its “M&M Pails” brand.

-

Polyethylene Containers, Inc. specializes in packaging container technology and materials handling. The company manufactures plastic pails, containers, feeders, and other packaging solutions. It caters to a wide range of sectors, including agriculture, automotive, chemicals, and others. The company’s expertise is in providing durable and versatile containers suitable for various applications.

Key U.S. High Density Polyethylene Plastic Pails Companies:

- Polyethylene Containers, Inc.

- M&M Industries, Inc.

- Siena Plastics

- C.L. Smith

- New AGE, Inc.

- Vestil Manufacturing Corp.

- Dura-Plas, Inc.

- TranPak Inc.

- Labelmaster

Recent Developments

-

In February 2024, Polyethylene Containers, Inc. launched an innovative initiative to address environmental concerns by transforming ocean-bound plastic into a new line of sustainable containers. With this innovative ocean-bound plastic, PCI aims to reduce the amount of plastic waste that might otherwise end up in the oceans.

-

In January 2024, Labelmaster announced a new partnership with CurTec. This partnership enables CurTec to expand its market presence through Labelmaster’s extensive distribution network. It aims to empower both companies to offer enhanced packaging solutions to industries that require stringent safety and quality standards.

U.S. High Density Polyethylene Plastic Pails Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 229.9 million

|

|

Revenue Forecast in 2030

|

USD 301.7 million

|

|

Growth rate

|

CAGR of 4.6% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million, volume kilotons and CAGR from 2024 to 2030

|

|

Report Coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments Covered

|

Size, end-use

|

|

Key companies profiled

|

Polyethylene Containers, Inc.; M&M Industries, Inc.; Siena Plastics; C.L. Smith; New AGE, Inc.; Vestil Manufacturing Corp.; Dura-Plas, Inc.; TranPak Inc.; Labelmaster

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. High Density Polyethylene Plastic Pails Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. high density polyethylene plastic pails market report based on size, and end-use:

-

Size Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)