- Home

- »

- Medical Devices

- »

-

U.S. Hospital Gowns Market Size Report, 2021-2028GVR Report cover

![U.S. Hospital Gowns Market Size, Share & Trends Report]()

U.S. Hospital Gowns Market Size, Share & Trends Analysis Report By Type (Surgical Gowns, Non-surgical Gowns, Patient Gowns), By Usability (Disposable Gowns, Reusable Gowns), By Risk Type, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-781-0

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

Report Overview

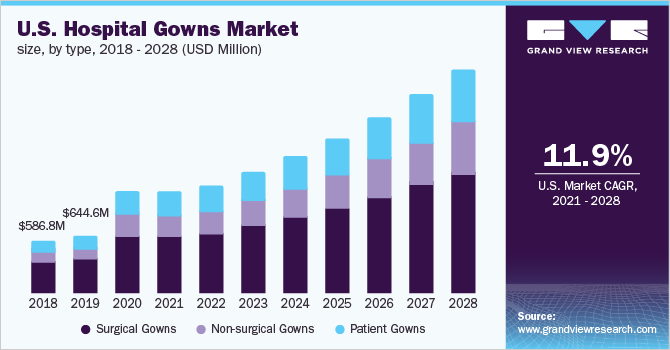

The U.S. hospital gowns market size was valued at USD 1.1 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.9% from 2021 to 2028. The market is expected to witness significant growth owing to the increasing prevalence of chronic diseases, such as diabetic foot ulcers and venous leg ulcers. Moreover, the rising prevalence of epidemics and pandemics, such as COVID-19 and SARS, in the U.S. is expected to boost market growth. Increasing awareness regarding surgical site infection and a rise in disposable income are also other major factors expected to foster market growth. Increasing incidence of hospital-acquired infections and rising number of surgeries are among the key factors anticipated to propel the demand for hospital gowns in the U.S.

According to the Healthcare Information and Management Systems Society, every day, one out of 25 patients in the U.S. develops a hospital-acquired infection. Hospital gowns can help prevent the spread of infection as they provide a protective barrier against the transmission of microbes and infected fluids. Thus, increasing cases of hospital-acquired infections are expected to boost the demand for hospital gowns. In addition, an increase in the number of surgeries being performed in the U.S. is expected to fuel the market growth.

According to a report published by the WHO in April 2020, there were more than 723,605 existing cases and more than 28,252 new confirmed cases of COVID-19 in the U.S. Furthermore, in order to meet the large demand for hospital gowns in the U.S., Ford has started manufacturing hospital gowns out of airbag materials. Therefore, the U.S. market for hospital gowns is anticipated to grow at a considerable rate over the forecast period. Moreover, the U.S. government is taking certain health measures in response to COVID-19, which includes administration set up for children and families to impart program information for families, children, and communities.

A growing number of surgeries is a key factor expected to drive the market over the forecast period. For instance, according to the report published by the Health Research Educational Trust (HRET) in 2018, around 15.0 million surgeries are performed in the U.S. every year. As such, hospital gowns, being an essential requirement for surgical procedures, are expected to witness high demand over the forecast period.

The major end-users of hospital gowns are hospitals, clinics, ambulatory surgery centers, research institutes, academic institutes, home healthcare, and pharmacies. These consumers require gowns as protective equipment for ensuring the safety of their employees and patients from nosocomial infections. Maintaining proper hygiene and sanitation is necessary to maintain a healthy environment in these places. The increasing incidence of hospital-acquired infections is one of the major reasons behind the surge in the demand for hospital gowns.

Type Insights

Surgical gowns held the largest share of over 55.0% in 2020 and are anticipated to maintain their lead over the forecast period owing to the increasing number of surgeries in the U.S. Healthcare professionals are increasingly using surgical isolation gowns as protective gear for treating COVID-19 patients. Surgical gowns can be used for any kind of risk level (Level 1 to level 4) and are preferred when treating COVID-19 patients due to the highly infectious nature of the disease. Based on type, the market has been segmented into surgical, nonsurgical, and patient gowns.

The patient gowns segment is expected to expand at a CAGR of 12.2% during the forecast period. Patient gowns held a significant share and the market position of this segment can be attributed to the growing number of patients due to the increasing prevalence of cardiovascular diseases. In addition, the large and exponentially increasing number of critically ill COVID-19 patients is anticipated to boost the market growth.

Risk Type Insights

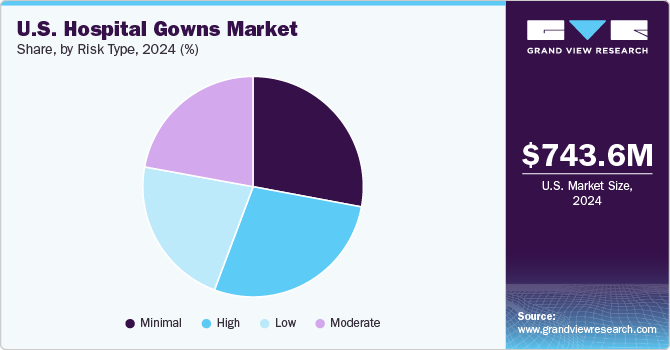

High-risk hospital gowns held the largest share of over 25.0% in 2020. These gowns can help protect against pathogens and infectious diseases during surgical and fluid-intensive procedures. These gowns provide high tensile strength, tear resistance, and high breathability. Increasing hospital admissions and research activities are anticipated to boost the segment growth over the forecast period.

Minimal risk hospital gowns held the second-largest share in 2020 and are anticipated to witness the fastest growth over the forecast period owing to the presence of a large number of patients suffering from various non-communicable diseases. On the basis of risk type, the market has been segmented into minimal, low, moderate, and high-risk hospital gowns.

Usability Insights

Disposable gowns held the largest share of more than 85.0% in 2020 and are expected to witness considerable growth over the forecast period, as their use can significantly reduce the risk of spreading diseases between patients. Therefore, the outbreak of the coronavirus pandemic has increased the demand for disposable gowns in the U.S. Based on usability, the market has been categorized into disposable and reusable hospital gowns.

Disposable hospital gowns are segmented into low, average, and premium prices. Low-price disposable gowns provide resistance against bacterial contamination and are not used for surgical purposes. They are skin-friendly and stain-resistant. Average-priced disposable gowns can protect against bacterial and microbial contaminations and are generally used for research purposes.

The recent COVID-19 related lockdown in many countries caused washing, bleaching, and conditioning of reusable gowns to act as a barrier for the growth of the reusable gowns segment. High demand for hospital gowns during the pandemic can be catered by technologically advanced reusable gowns. Technological advancements in the healthcare sector are anticipated to contribute to the high growth of the reusable hospital gowns segment.

Key Companies & Market Share Insights

The market players are adopting various strategies, such as mergers & acquisitions, partnerships, and product launches, to strengthen their foothold in the market. Some of the companies in the market, such as Cardinal Health; 3M; and Medline Industries, Inc., have in-house production facilities for raw materials. These companies also supply raw materials to other hospital gown manufacturers through a diverse distribution channel in different regions across the globe. Some of the independent fiber distributors operating in the market are LynkTrac Technologies LLC; bagbarn.com; Griff Network; PPE Market; SafetyPure PPE; and Certified Safety Mfg., Inc. Some prominent players in the U.S. hospital gowns market include:

-

Medline Industries, Inc.

-

Standard Textile Co., Inc.

-

Angelica

-

AmeriPride Services Inc.

-

3M

-

Cardinal Health

U.S. Hospital Gowns Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.13 billion

Revenue forecast in 2028

USD 2.47 billion

Growth Rate

CAGR of 11.90% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, usability, risk type

Countryscope

U.S.

Key companies profiled

Medline Industries, Inc.; Standard Textile Co., Inc.; Angelica; AmeriPride Services Inc.; 3M; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country& segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. hospital gowns market report on the basis of type, usability, and risk type:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Surgical Gowns

-

Non-surgical Gowns

-

Patient Gowns

-

-

Usability Outlook (Revenue, USD Million, 2016 - 2028)

-

Disposable Gowns

-

Low

-

Average

-

Premium

-

-

Reusable Gowns

-

Low

-

Average

-

Premium

-

-

-

Risk Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Minimal

-

Low

-

Moderate

-

High

-

Frequently Asked Questions About This Report

b. The U.S. hospital gowns market size was estimated at USD 1.13 Billion in 2020 and is expected to reach USD 1.12 Billion in 2021.

b. The U.S. hospital gowns market is expected to grow at a compound annual growth rate of 11.90% from 2021 to 2028 to reach USD 2,472.39 million by 2028.

b. Surgical hospital gowns dominated the U.S. hospital gowns market with a share of 56.50% in 2020. This is attributable to rising rising number of surgeries and increasing prevalence of epidemics & pandemics, such as Ebola, SARS, and COVID-19.

b. Some key players operating in the U.S. hospital gowns market include Medline Industries, Inc., Standard Textile Co., Inc., Angelica, AmeriPride Services Inc., 3M, and Cardinal Health.

b. Key factors that are driving the market growth include increasing number of surgical procedures, rising incidence of Hospital Acquired Infections (HAIs), and impact of COVID-19 outbreak.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."