- Home

- »

- Next Generation Technologies

- »

-

U.S. Hydroponics Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Hydroponics Market Size, Share & Trends Report]()

U.S. Hydroponics Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Aggregate Systems, Liquid Systems), By Crop Type (Tomatoes, Lettuce, Peppers), And Segment Forecasts

- Report ID: GVR-4-68040-213-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hydroponics Market Size & Trends

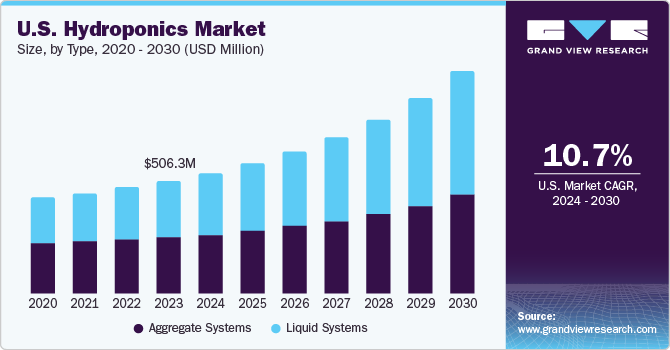

The U.S. hydroponics market size was estimated at USD 506.25 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2030. The rapid growth in the U.S. hydroponics industry is owing to the increased adoption of hydroponic systems in the indoor cultivation of vegetables. Consumers are getting more and more aware of the adverse effects of pesticides and artificial ripening agents on health. As hydroponics cultivation eliminates the necessity for such products, the market growth is projected to witness an upward curve. Hydroponics farming produces nutritionally superior vegetables. Moreover, low installation costs and simple operability of the hydroponics systems are anticipated to propel the market growth further.

In 2023, the U.S. accounted for approximately 10.1% share of the global hydroponics market. The increasing population in the U.S. leads to food security challenges that prompts manufacturers to adopt advanced or urban cultivation methods such as indoor farming. Nowadays, numerous farmers in the U.S. leverage hydroponics systems, an advanced technique of indoor farming due to its ease of availability and setup & maintenance. The U.S. market is poised for growth due to several key factors, including a consistently increasing population, limited availability of cultivable land, government incentives, and a rising demand for fresh, high-quality food. The scarcity of land in urban settings has prompted innovative solutions like hydroponics.

Hydroponic systems enable growing plants in nutrients and water without using soil as a base. Hydroponic systems can be used for indoor as well as outdoor gardening or cultivation. These systems are a great alternative for growing various plants in small spaces, such as indoors. In indoor hydroponic gardening, all the required elements that impact plant growth, including humidity, light, temperature, nutrients, pH levels, and water, can be easily controlled and maintained. Thus, indoor hydroponic gardening is more manageable and less time-consuming compared to gardening with soil. Hydroponic systems are also available in the form of stackable systems, which allow growers to extend growing capacity by adding one column above another stack in the existing system. The rising availability of these systems could propel market growth.

The high initial investment is one of the key factors restraining industry growth. Hydroponics requires warehouses for cultivation, which may cost higher in an urban area compared to farmlands, further limiting the adoption of hydroponics. In addition, the high cost of installing LEDs, active heat systems, creating a controlled environment, and high maintenance costs further hinder the adoption of hydroponics, which is expected to restrain market growth over the forecast period.

Market Concentration & Characteristics

The market growth stage is high, and the rate of growth is accelerating. The hydroponics market in the U.S. witnesses a high level of mergers and acquisitions activities by the key companies. Factors attributed to the high activity of M&A are the leading companies’ desire to increase their market share as well as gain access to the latest technologies involving hydroponics to maintain a competitive edge against the competitors.

Hydroponics industry is also witnessing a significant number of innovations. For instance, hydroponic robots use smart technology, such as computer vision and machine learning, and perform tasks previously done only by cultivators. Internet of Things (IoT) enables real-time monitoring and control of key environmental variables, such as temperature and nutrient levels, facilitating data-driven decision-making. In addition, introducing specialized LED grow lights has optimized plant growth through targeted light spectrums and reduced energy consumption. Artificial Intelligence and machine learning algorithms are now used to analyze data and predict plant growth patterns and potential diseases, enabling preventive and more effective interventions.

There is no direct substitute for hydroponics farming. However, conventional soil-based farming remains a popular method, relying on natural soil for plant growth. Aquaponics, however, combines aquaculture (fish farming) with hydroponics, creating a symbiotic system where fish waste provides nutrients for plants. The choice between hydroponics and its alternatives often depends on factors such as space, resource availability, and the specific needs of the crops being cultivated.

Crop Area concentration is an important aspect of hydroponics. Hydroponics are being adopted by various end-users, including commercial agriculture, research and development, and home gardening. In large-scale commercial agriculture, hydroponic systems are deployed to enhance crop yield and quality, providing a concentrated application in this sector. In addition, research and development institutions leverage hydroponics for controlled experiments and studies on plant growth, creating another concentrated end-use segment.

Type Insights

Based on type, the market is segmented into aggregate systems and liquid systems. The aggregate systems segment held the largest revenue share of 50.12% in 2023. This share is attributed to the user-friendly nature of aggregate systems where inert and solid media like peat, rock wool, vermiculite, sand, sawdust, perlite, or coconut coir support plant growth. The utilization of key technologies such as drip systems, ebb and flow systems, and wick systems further underscores the segment's prominence.

The liquid systems segment is anticipated to witness the fastest CAGR of 12.35% over the forecast period. This is attributed to the growing preference for closed-system cultivation among cultivators. Nutrient Film Technique (NFT) and deepwater culture systems are being increasingly adopted for cultivating leafy vegetables such as lettuce. Liquid systems, without any solid medium, submerge plant roots directly in the nutrient solution, simplifying the cultivation process. Thus, nutrients are supplied directly to the plant roots, resulting in accelerated growth and maximized yields. However, even if the risk of soil-borne diseases is reduced, the nutrient solutions that are recirculated in closed systems increase the potential dispersal of pathogens.

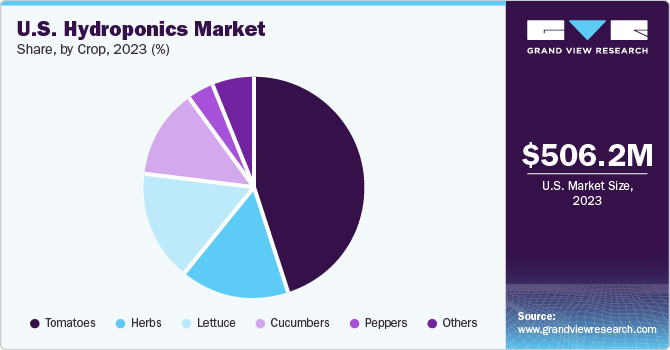

Crop Type Insights

Based on crop type, the market is segmented into tomatoes, lettuce, peppers, cucumbers, herbs, and others. The tomatoes segment held the largest revenue share of 44.65% in 2023. This is attributed to the fact that tomatoes are the most extensively cultivated hydroponic crop worldwide, primarily due to their rapid cultivation rate and significantly lower water requirements compared to conventionally farmed tomatoes. Growing materials such as rock wool, perlite, or coconut coir are used for hydroponic tomato cultivation.

The lettuce segment is expected to register the fastest CAGR of 13.5% from 2024 to 2030. Green and red leaf lettuce is the largest hydroponically grown vegetable among indoor farmers owing to its raw consumption in relatively large quantities. The hydroponic cultivation of lettuce is rising in the U.S. due to its rising demand from households and fast-food chains across the region.

Key U.S. Hydroponics Company Insights

The market is fragmented with the presence of several key companies. Some key companies in the U.S. hydroponics market include AmHydro, Lumigrow, and BrightFarms, among others.

-

American Hydroponics (AmHydro.com Inc.) is a U.S.-based organization that manufactures commercial food-grade growing systems for large and small commercial systems. The company offers various hydroponic systems such as Nutrient Film Technique (NFT) Systems, Vine Crop Systems, Medical Crop Systems, and others.

-

LumiGrow offers horticultural lighting solutions. The company provides a variety of grow light solutions for Controlled Environment Agriculture (CEA), greenhouses, and research chambers. LumiGrow offers grow lights for leafy green plants & herbs, cannabis, vine crops, floriculture, specialty crops, propagation, and crop breeding. The company also provides an energy-efficient series of LED lights along with a wireless control system to manage these lights.

Freight Farms and Bowery Farming are some of the emerging market companies in the target market.

-

GrowGeneration is among the largest hydroponics suppliers in the country with 50+ retail and distribution centers. GrowGeneration sells thousands of products, such as organic nutrients and soils, advanced lighting technology, and state-of-the-art hydroponics equipment used by commercial and home growers.

-

Freight Farms provides digital and physical solutions for creating a local produce ecosystem. It manufactures a flagship product called The Leafy Green Machine, a total hydroponic growing system that produces a variety of herbs and vegetables.

Key U.S. Hydroponics Companies:

- AeroFarms

- AmHydro

- Freight Farms

- Green Sense Farms Holdings, Inc

- LumiGrow

- Unrivaled Brands Inc

- BrightFarms

- The Scotts Company LLC

- Hydrodynamics International

- Signify Holding

Recent Developments

-

In September 2023, leading indoor spinach grower BrightFarms entered an exclusive licensing deal with partner Element Farms. BrightFarms is collaborating with Element Farms to establish a new standard for indoor-grown produce in the Northeast. This mutually beneficial partnership allows BrightFarms to distribute Element Farms’ indoor-grown spinach throughout the Northeast under the BrightFarms brand, further satisfying the strong consumer demand for high-quality, locally-grown spinach.

-

In February 2024, American Hydroponics (AmHydro),provider of best-in-class hydroponic growing systems and CEA grower support, and Ryzee, an Agtech startup that develops hardware and data-driven software systems for CEA markets announced the strategic partnership and collaboration to develop a groundbreaking all-in-one farm optimization platform, designed from the ground up to address pain points that growers deal with on a daily basis.

U.S. Hydroponics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 541.25 million

Revenue forecast in 2030

USD 995.61 million

Growth rate

CAGR of 10.7% from 2024 to 2030

Historic data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, crop type

Country scope

U.S.

Key companies profiled

AeroFarms; AmHydro; Freight Farms; Green Sense Farms Holdings, Inc.; LumiGrow; Unrivaled Brands Inc; BrightFarms; The Scotts Company LLC; Hydrodynamics International; Signify Holding

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hydroponics Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. hydroponics market based on type and crop type.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Aggregate Systems

-

EBB & Flow Systems

-

Drip Systems

-

Wick Systems

-

-

Liquid Systems

-

Deep Water Culture

-

Nutrient Film Technique (NFT)

-

Aeroponics

-

-

-

Crop Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Tomatoes

-

Lettuce

-

Peppers

-

Cucumbers

-

Herbs

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hydroponics market size was estimated at USD 506.25 million in 2023 and is expected to reach USD 541.25 million in 2024.

b. The U.S. hydroponics market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 995.61 million by 2030.

b. The tomatoes segment held the largest revenue share of 44.6% in 2023. This is attributed to the fact that tomatoes are the most extensively cultivated hydroponic crop worldwide, primarily due to their rapid cultivation rate and significantly lower water requirements compared to conventionally farmed tomatoes.

b. Some of the prominent companies in the U.S. hydroponics Market include AeroFarms, AmHydro, Freight Farms, Green Sense Farms Holdings, Inc., LumiGrow, Unrivaled Brands Inc, BrightFarms, The Scotts Company LLC, Hydrodynamics International, and Signify Holding.

b. The rapid growth in the U.S. hydroponics industry is owing to the increased adoption of hydroponic systems in the indoor cultivation of vegetables.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.