- Home

- »

- Medical Devices

- »

-

U.S. Individual Health Insurance Market Size Report, 2030GVR Report cover

![U.S. Individual Health Insurance Market Size, Share & Trends Report]()

U.S. Individual Health Insurance Market Size, Share & Trends Analysis Report By Type (Public, Private), By Demographics (Minors, Adults, Seniors), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-048-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

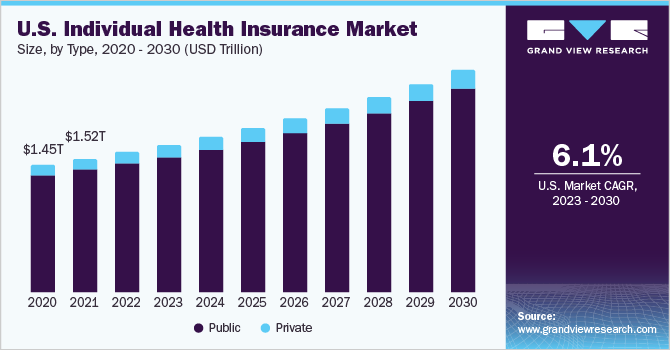

The U.S. individual health insurance market size was valued at USD 1.60 trillion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.08% from 2023 to 2030. An increase in insurer participation and new product offerings are among the major factors leading to the rising demand for individual health insurance in the U.S. For instance, according to a report published by KFF, several insurers entered the market in 2021 and are growing their service coverage, about 30 insurers entered the individual market across 20 states.

Furthermore, the growing prevalence of chronic disorders in the country such as diabetes, cancer, cardiovascular diseases, and neurodegenerative diseases is expected to increase the adoption of individual health insurance. For instance, according to the International Diabetes Federation, in 2021 there were about 32.2 diabetes cases in the U.S. These cases are projected to reach 34.7 million by 2030. The cost of treating chronic conditions like cancer and heart disease is very high in the U.S. Many people opt for health insurance as a result to prevent the sudden weight of having to pay a sizable sum of money for hospitals and other medical bills.

The U.S. healthcare system is characterized by a number of distinctive characteristics, including a high relative cost to individuals and a lack of universal coverage. The government runs initiatives that often pay for healthcare costs for the most economically challenged people such as the aged, the disabled, and the underprivileged. Since there is no one national health insurance system, the people in the U.S. mainly depend on employers who voluntarily offer health insurance coverage to their employees and dependents. However, there was a significant increase in unemployment during the COVID-19 pandemic, which had a detrimental influence on employee-sponsored health insurance and, to some extent, provided chances for private insurers.

Type Insights

Based on type, the market was dominated by the public segment in 2022, due to the widespread use of government-sponsored health insurance (Medicare) in the country. Medicare is a federal government scheme that offers health insurance for people aged 65 years or older and to certain individuals under 65 who have specific disabilities or diseases. Almost 55 million beneficiaries are covered under this scheme in the U.S.

The private segment is anticipated to grow at a considerable CAGR of 6.60% over the forecast period. Due to the escalating cost of healthcare, several individuals are making investments to better protect themselves from the financial hardships caused by healthcare. When compared to public plans like Medicare, private insurance typically offers more options. This may enable individuals to select the alternatives that are mostly required and omit those that are not. Shorter wait times, more specialized care, and more advanced facilities are further benefits of private health insurance. Public facilities may often be overloaded and may frequently offer substandard care.

Demographic Insights

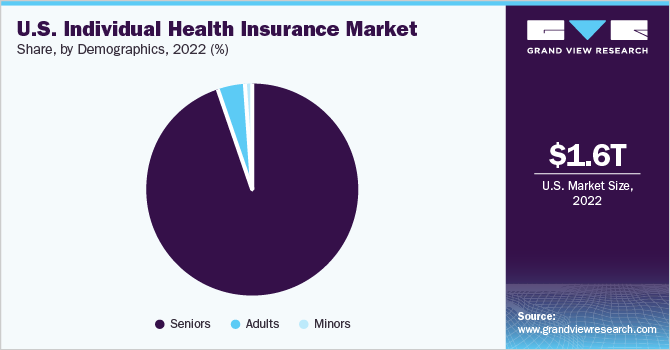

The seniors segment dominated the U.S. individual health insurance industry in 2022 by capturing a share of over 90.0%, as in the U.S. all citizens 65 years and above are covered under the government-sponsored Medicare health insurance plan. Moreover, a few percent of this class do have other supplementary private health insurance plans. Moreover, Seniors are also more likely to buy insurance to offset the rising cost of healthcare due to their higher chance of contracting various chronic conditions.

The adult segment is estimated to showcase the fastest growth over the forecast period. This is because of the growing prevalence of lifestyle diseases in adults (e.g., diabetes, heart disease, obesity). Even though the majority of working individuals are protected by employer-sponsored health insurance plans, the protection offered by employers' insurance plans might occasionally be insufficient, which lowers the value of protection. Moreover, not all adults are covered under government-sponsored schemes, thus creating opportunities for the private insurance sector.

Regional Insights

Based on region the U.S. individual health insurance industry is segmented into Northeast, Midwest, South, and West and further subdivided into 50 states. The South region dominated the market by capturing over 37.0% of the overall market share, as a substantial population is covered by individual health insurance in the region. In 2022 Florida state held the largest market share of 22.1% in the south region, followed by Texas capturing about 22.0% as a large section of the population in these states are insured by individual health insurance.

The West region held the second-largest share of the individual health insurance market and is further expected to experience the fastest CAGR of 10.5% over the forecast period, owing to the increased adoption of individual health insurance in the states such as California, Washington, and Arizona.

Key Companies & Market Share Insights

Key market participants are focusing on implementing a number of strategies, including partnerships and collaborations, the launch of new products, and investments in regional insurance companies, to increase their presence and availability of services. For instance, in March 2021, Highmark In and HealthNow New York Inc. entered into an affiliation agreement. This deal aimed to create the fourth largest BCBS insurer by bringing in the Blue Cross and Blue Shield (BCBS) licensees that serve in the Pennsylvania, West Virginia, Delaware, and New York regions. Some prominent players in the U.S. individual health insurance market include:

-

United Health Group Incorporated

-

Elevance Health (formerly Anthem, Inc.)

-

Health Care Service Corporation

-

Cigna

-

Kaiser Foundation Health Plan, Inc

-

Independence Holding Company (IHC Group)

-

Providence Health Plan

-

Point32Health

-

Highmark

U.S. Individual Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,684.8 billion

Revenue forecast in 2030

USD 2.54 trillion

Growth rate

CAGR of 6.08% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

Northeast, Midwest, South, West

Segments covered

Type, demographics, region

Key companies profiled

United Health Group Incorporated; Elevance Health (formerly Anthem, Inc.); Health Care Service Corporation; Cigna; Kaiser Foundation Health Plan, Inc; Independence Holding Company (IHC Group); Providence Health Plan; Point32Health; Highmark

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Individual Health Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. individual health insurance market report based on type, demographics, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

-

Demographics Outlook (Revenue, USD Billion, 2018 - 2030)

-

Minors

-

Adults

-

Seniors

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Northeast

-

Connecticut

-

Massachusetts

-

Pennsylvania

-

New Jersey

-

New York

-

Others

-

Maine

-

New Hampshire

-

Rhode Island

-

Vermont

-

-

-

Midwest

-

Illinois

-

Indiana

-

Michigan

-

Ohio

-

Wisconsin

-

Iowa

-

Minnesota

-

Missouri

-

Others

-

Kansas

-

Nebraska

-

North Dakota

-

South Dakota

-

-

-

South

-

Michigan

-

Florida

-

Georgia

-

Maryland

-

North Carolina

-

South Carolina

-

Virginia

-

Alabama

-

Kentucky

-

Tennessee

-

Louisiana

-

Texas

-

Others

-

Delaware

-

West Virginia

-

Mississippi

-

Arkansas

-

Oklahoma

-

-

-

West

-

Arizona

-

Colorado

-

Nevada

-

California

-

Oregon

-

Washington

-

Others

-

Idaho

-

Montana

-

New Mexico

-

Utah

-

Wyoming

-

Alaska

-

Hawaii

-

-

-

Frequently Asked Questions About This Report

b. The U.S. individual health insurance market size was estimated at USD 1.60 trillion in 2022 and is expected to reach USD billion 1,684.8 in 2023.

b. The U.S. individual health insurance market is expected to grow at a compound annual growth rate of 6.08% from 2023 to 2030 to reach USD 2.54 trillion by 2030.

b. Seniors segment dominated the U.S. individual health insurance market with a share of 94.4% in 2022. As in the U.S. all citizens 65 years and above are covered under the government sponsored Medicare health insurance plan, moreover a few percentages of this class do have other supplementary private health insurance plans.

b. Some key players operating in the U.S. individual health insurance market include United Health Group Incorporated; Elevance Health (formerly Anthem, Inc.); Health Care Service Corporation; Cigna; Kaiser Foundation Health Plan, Inc; Independence Holding Company (IHC Group); Providence Health Plan; Point32Health; Highmark

b. Key factors that are driving the market growth include increase in insurer participation and new product offerings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."