- Home

- »

- Healthcare IT

- »

-

U.S. Integrated Delivery Network Market Size, Report, 2030GVR Report cover

![U.S. Integrated Delivery Network Market Size, Share & Trends Report]()

U.S. Integrated Delivery Network Market (2024 - 2030) Size, Share & Trends Analysis Report By Integration Model (Vertical, Horizontal), By Service (Acute Care/Hospitals, Primary Care, Long-term Health, Specialty Clinics), By Facility, And Segment Forecasts

- Report ID: GVR-4-68038-606-6

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

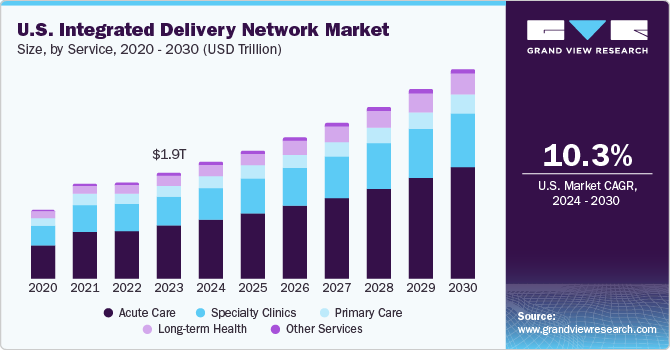

The U.S. integrated delivery network market size was estimated at USD 1.92 trillion in 2023 and is expected to expand at a CAGR of 10.25% from 2024 to 2030. The demand for affordable and well-organized healthcare systems is expected to rise alongside the growth of the elderly population, which is particularly vulnerable to chronic diseases. Moreover, the surge is poised to accelerate the expansion of the U.S. Integrated Delivery Network market.

The goal of Integrated Delivery Network (IDN), also referred to as the Integrated Delivery System (IDS), is to offer higher quality, cost-effective, patient centric, and efficient care services. IDNs are formed by combining hospitals, medical clinics, and physician groups. Both healthcare providers and patients utilizing these services stand to benefit significantly from the integrated approach of IDNs.

The COVID-19 pandemic has posed unprecedented challenges to the healthcare system. IDNs had to adapt to the changing needs and demands of patients, communities, and health workers, while also facing financial and operational pressures. Some of the strategies that IDNs have adopted to cope with the pandemic include leveraging digital technologies for remote consultation, monitoring, and triage of patients, collaborating with other providers, and implementing policy measures to support integration.

IDNs present a compelling value proposition for healthcare providers, including doctors, hospitals, and physicians. The benefits of joining an IDN include the ability to adapt to the changing healthcare landscape, expanded geographic reach, enhanced quality of services, contractual advantages, stronger financial capabilities, and economies of scale. Moreover, IDNs help providers increase their market visibility and provide physicians with a secure income. Patients can benefit from a well-coordinated, multi-service healthcare system that offers primary, acute care, and financial services, among others, through a single entity at lower costs.

With the introduction of the Affordable Care Act in 2010, healthcare facilities have shifted their focus to outpatient settings due to increased incentives by the federal government. This has resulted in outpatient care gaining more traction in recent years. Moreover, the growing demand for accountable care and clinical integration has led hospitals to adapt to becoming Accountable Care Organizations (ACOs), which helps reduce healthcare costs and improve the quality of treatment provided. This is expected to promote the adoption of integrated healthcare services provided by IDNs, resulting in market growth.

Furthermore, the high prevalence of chronic diseases and disorders such as diabetes, cancer, respiratory disorders, neurological disorders, and heart-related conditions and the sudden outbreak of the pandemic are fueling the demand for healthcare services in U.S. As per the National Health Council, the count of individuals aged 50 years and older grappling with chronic diseases is projected to rise from 137.25 million in 2020 to 221.13 million by 2050. Integrated delivery networks offer a comprehensive framework for orchestrating the care of chronic diseases by providing fair and integrated health services. Consequently, this facilitates convenient and cost-effective treatment options for patients dealing with chronic illnesses.

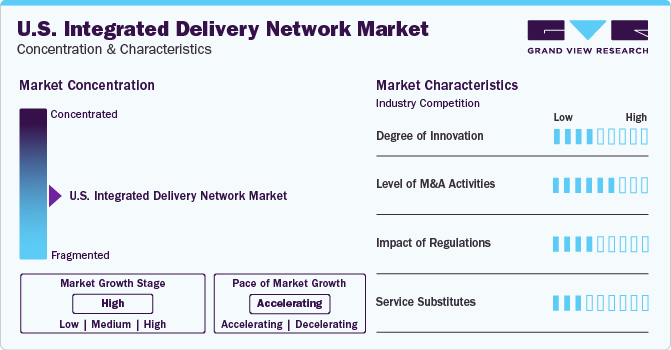

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, the impact of regulations, product substitutes, and regional expansion.

Technological advancements are expected to increase due to the evolution of health systems into highly integrated delivery networks (IDNs), with their level of influence growing substantially as networks integrate acute hospitals, outpatient providers, and payer groups. For instance, in November 2023, UnitedHealth Group expanded its network of behavioral health providers and improved integrated care delivery, showcasing a commitment to improving mental health and overall well-being. The company's efforts to broaden the network and prioritize integrated care highlight its dedication to addressing mental health issues and offering comprehensive support for individuals requiring assistance.

Several market players such as CommonSpirit Health, UNITEDHEALTH GROUP, and HCA Healthcare are engaged in merger and acquisition activities. With M&A activity, these market players expand their geographic reach and enter new territories. For instance, in December 2023, HCA Healthcare acquired 11 emergency departments from SignatureCare Emergency Centers in Texas. The aim of this acquisition is to expand its high-acuity service and emergency lines.

Regulations have a significant impact as they influence the growth and operation of these networks. Regulations often focus on care coordination and integration systems within IDNs, ensuring that patients have access to high-quality, integrated care while reducing the impact of fragmented healthcare systems.

Substitutes for the U.S. integration delivery networks are difficult to find. Integrated Delivery Networks and payviders aim to succeed at value-based care, focusing on improving healthcare quality, safety, and patient outcomes while reducing costs. Companies in this industry are vertically integrated, performing all activities from R&D to after-sales services.

Service Insights

The acute care segment dominated the market in 2023 with a revenue share of 50.0%. This is attributable to the presence of a large number of hospitals offering a wide range of disease treatment services, high adoption of acute care/hospital facilities; and an increase in the number of surgeries performed in hospital infrastructure. Acute care/hospital settings offer patients with well-equipped, advanced treatment facilities, along with trained professionals under one roof. This is further supported by satisfactory reimbursement guidelines for patients who regularly visit hospitals as compared to those looking for treatment at primary care centers.

In addition, various initiatives undertaken by IDNs to improve their service capability are propelling the growth of the segment. For instance, in May 2023, HCA Healthcare Inc. announced more than USD 300 billion in investments in educating and training nurses clinically. This investment aims to improve the quality of care given to their patients while improving the delivery of treatment.

The long-term health segment is projected to witness the highest growth rate over the forecast period. The growth in the healthcare segment is driven by the growing geriatric population leading to a longer course of treatment and care needed. In June 2023, the University of Pittsburgh Medical Center initiated a novel study centered on patients, actively involving them in addressing challenges encountered during dialysis, including issues like fatigue, depression, and pain. This process allows patients to establish goals and tailor their treatment to address any concerns they face.

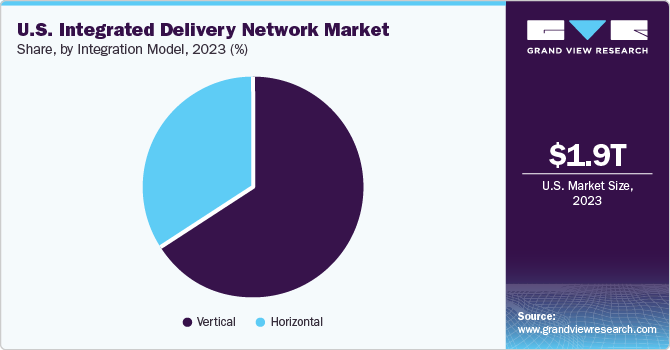

Integration Model Insights

The vertical integration model led the market and accounted for 66.0% of the revenue in 2023 and is expected to register the fastest CAGR during the forecast period. Vertical integration in IDNs offers comprehensive care throughout all stages of life, including end-of-life and hospice support. These networks typically include a wide range of medical specialties, such as pediatricians, orthopedic surgeons, obstetricians and gynecologists, and other healthcare professionals.

Additionally, they often include assisted living facilities to cater to patient needs. A standard example of a vertically integrated delivery system by Kaiser Foundation Health Plan, Inc., which offers diverse services encompassing pharmacy, surgery, laboratory diagnostics, and health education institutes. Such setup supports patients and increases opportunities for physicians at the primary stage to connect and speak with specialists, hospital staff, and others.

The primary objective of a vertically integrated IDN is to provide a unified network that addresses patients' healthcare requirements throughout their lifespan. This contrasts with horizontal IDNs, which consist of multiple dispersed facilities. In a horizontal integration model, multiple hospitals, either regional or national, are integrated together. These networks include organizations that provide a similar type of treatment and may include additional facilities integrated into them. HCA Healthcare is one of the largest for-profit hospital operators in the U.S. with around 182 hospitals that follows the horizontal integration model.

Facility Insights

The acute facilities segment led the market and accounted for 64.65% of the revenue in 2023. These facilities are healthcare settings designed to provide short-term medical treatment for patients experiencing severe or sudden onset of symptoms due to injury or illness. With increasing vertical integration in the U.S. healthcare system, acute care facilities under IDNs are able to provide comprehensive treatments at reduced costs. Acute care hospitals rely on IDNs to manage tasks such as supply chain, IT infrastructure, staffing resources, and increase access to specialty drugs. Thus, care centers functioning under IDNs aid in improving the healthcare ecosystem.

The outpatient facilities segment is expected to grow at the fastest CAGR over the forecast period. Outpatient facilities provide medical services to patients who do not require overnight hospitalization and can be treated on an outpatient basis. Increased technological advancements in outpatient facilities across the U.S. have been transformative, driven by the pursuit of greater convenience, efficiency, and patient-centric care.

According to the Holon Solutions article published in January 2024, introducing minimally invasive surgical techniques and robotic surgery has revolutionized outpatient treatment. These innovations allow complex procedures to be performed more precisely, resulting in shorter recovery times. This makes outpatient settings more suitable for these procedures, enhancing patient comfort and reducing costs.

Key U.S. Integrated Delivery Network Company Insights

The U.S. market is highly fragmented with the presence of around 1,000 provider networks. Moreover, providers are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

Key U.S. Integrated Delivery Network Companies:

- HCA Healthcare

- Ascension

- Kaiser Foundation Health Plan, Inc.

- UNITEDHEALTH GROUP

- Providence

- UPMC

- Trinity Health

- TH Medical

- CHSPSC, LLC

- CommonSpirit Health

Recent Developments

-

In July 2023, Kaiser Foundation Health Plan, Inc. launched a new home-based hospice service in Oahu for their members. This hospice service aims to support individuals with serious illnesses, enhancing their quality of life and enhancing their and their family's compassionate and comfortable care.

-

In May 2023, in May 2023, CommonSpirit Health, a non-profit hospital chain, operating through its wholly-owned subsidiary Catholic Health Initiatives Colorado announced the acquisition of a collection of five hospitals based in Utah, U.S. Additionally, this acquisition encompasses more than 35 medical group clinics and established a robust and complete clinically integrated network of care providers. CommonSpirit Health has 145 hospitals and around 2,200 care sites in 23 states in the U.S.

-

In January 2023, the United Health Foundation in collaboration with Children's Minnesota, announced a three-year grant partnership valued at USD 3 million. This initiative aims to tackle pediatric issues such as asthma, vaccinations, and mental health among underserved children and families residing in the Twin Cities region. As part of this effort, the partnership will facilitate culturally responsive health interventions in combination with established community partners, as well as local public-school districts.

-

In July 2022, HCA Healthcare partnered with The University of Texas at El Paso to open multiple opportunities for students interested in healthcare careers. This four-year partnership aims to support over 30 nursing and around 50 healthcare administration opportunities and donated USD 750,000.

U.S. Integrated Delivery Network Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.79 trillion

Growth rate

CAGR of 10.25% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Integration model, service, facility

Country scope

U.S.

Key companies profiled

HCA Healthcare; Ascension; Kaiser Foundation Health Plan, Inc.; UNITEDHEALTH GROUP; Providence; UPMC; Trinity Health; TH Medical; CHSPSC, LLC; CommonSpirit Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Integrated Delivery Network Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. integrated delivery network market report based on integration model, service, and facility.

-

Integration Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vertical

-

Horizontal

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Acute Care

-

Primary Care

-

Long-term Health

-

Specialty Clinics

-

Other Services

-

-

Facility Outlook (Revenue, USD Billion, 2018 - 2030)

-

Acute Facilities

-

Outpatient Facilities

-

Frequently Asked Questions About This Report

b. The U.S. integrated delivery network market size was estimated at USD 1.92 trillion in 2023 and is expected to reach USD 2.11 trillion in 2024.

b. The U.S. integrated delivery network market is expected to grow at a compound annual growth rate of 10.25% from 2024 to 2030 to reach USD 3.79 trillion by 2030.

b. Vertical segment dominated the U.S. integrated delivery network market with a share of 66.0% in 2023. This is attributable to various collaborative initiatives taken by key IDNs to improve their existing service portfolio along with the investments in research & development of new treatment options.

b. Some key players operating in the U.S. integrated delivery network market include HCA Healthcare, Inc.; United Health group; CommonSpirit Health; Ascension Health; Providence St Joseph Health.

b. Key factors that are driving the market growth include growing demand for value-based healthcare services, an increasing number of geriatric populations and constantly surging population with chronic illness are expected to boost the need for low cost and organized healthcare system among the patient population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.