- Home

- »

- Pharmaceuticals

- »

-

U.S. Intravenous Immunoglobulin Market Size Report, 2030GVR Report cover

![U.S. Intravenous Immunoglobulin Market Size, Share & Trends Report]()

U.S. Intravenous Immunoglobulin Market Size, Share & Trends Analysis Report By Application (Primary Immunodeficiency Diseases, Multifocal Motor Neuropathy), By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-428-4

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

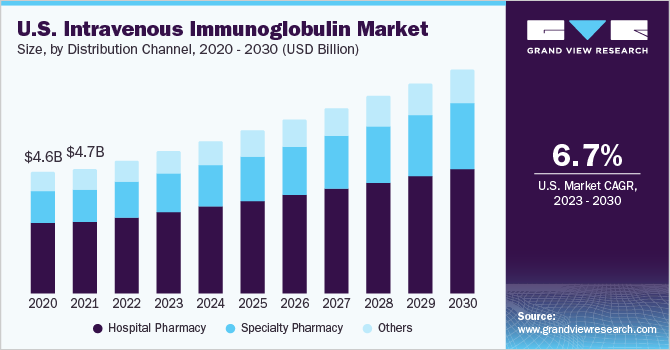

The U.S. intravenous immunoglobulin market size was valued at USD 5.74 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. Some of the major factors propelling the U.S. IVIG market are the increase in demand for immunoglobulin replacement therapies for the treatment of Primary Immunodeficiency Diseases (PIDD) and the approval of new products, which is improving the availability of treatment options for patients.Home infusion therapy adoption accelerated at an exponential rate, which can be attributed to the safer administration of treatments at home along with the weak immunity of immunocompromised patients. The trend is anticipated to continue post-pandemic.

The COVID-19 pandemic has led to key shifts in the market dynamics of the industry. The U.S. IVIG market witnessed a shortage of immunoglobulin products, which can be attributed to the heightened demand for plasma products during the early stages of the pandemic for the treatment of SARS-CoV-2 patients. This created significant stress on the plasma supply chain, which was worsened by the reduction in plasma donations during the pandemic. Plasma fractionations require time, and supply disruptions became apparent in early 2021.Companies are exploring the use of IGIV therapies as a potential treatment. Approval in the upcoming years can lead to higher treatment adoption.

The cost of treatment with immunoglobulin is expensive and impedes the overall adoption of IVIG in the U.S. For instance, as per NCBI in 2021, the average cost per session in the U.S. was around USD 9,720, which translates to a monthly cost of USD 41,796 for 4.3 sessions. The average cost of treating a CIDP patient every year exceeds USD 136,000, thereby making access to treatment for patients without insurance or Medicare difficult.

Changing needs of patients has led to an increased focus by key players on obtaining approval and launching novel products in the market to cater to the rising number of patients requiring IVIG. In July 2021, Octagam 10% was approved by the FDA for the treatment of dermatomyositis in adults. The launch of Octagam 10% is anticipated to have a significant impact on patients with dermatomyositis, improving the armamentarium of available treatments.

IVIG replacement therapy is used for the treatment of several autoimmune, neurological, and hematological diseases, as well as immunodeficiency. The U.S. FDA has approved the use of IVIG in various disorders; however, it is also used in many off-prescription disorders, such as Guillain-Barre syndrome, myasthenia gravis, and multifocal motor neuropathy. Due to the efficacy and safety offered by IVIG, the preference for IVIG is increasing. For instance, the quantity of IVIG units used for the treatment of CIDP has significantly increased.

Application Insights

The primary immunodeficiency diseases segment held the largest market share of 21.32% of the U.S. IVIG market in 2022, attributable to the high cost of treatment and the rising number of patients requiring treatment. According to the American Academy of Allergy, Asthma, & Immunology, over 300 different types of PIDDs have been observed. PIDD has an incidence rate of 1 in 1,200 in the U.S., i.e., nearly 270,000 cases. The presence of organizations such as the Immune Deficiency Foundation, which aim at enhancing the diagnosis and treatment of PIDDs through research, education, and advocacy, is anticipated to improve the adoption of IVIG therapy among patients.

CIDP is anticipated to grow at the fastest rate as IVIG treatment is effective in 85% of CIPD patients, which is anticipated to increase its adoption. Key players are focusing on developing novel formulations for the maintenance and treatment of CIPD. For instance, in July 2022, Takeda announced positive results for HYQVIA, indicated for the treatment and maintenance of CIPD from the Phase 3 clinical trial. The company submitted regulatory applications in Europe and the U.S. in 2022.

Distribution Channel Insights

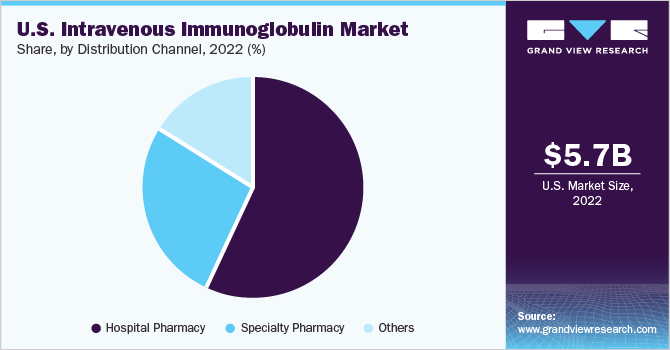

The hospital pharmacies segment accounted for the largest revenue share of 57.46% of the U.S. IVIG market in 2022, owing to the large number of hospitals and easy availability of products in the hospitals. The easy availability of products in hospitals has propelled the growth of this segment. Moreover, hospital-owned outpatient pharmacies have an advantage over traditional retail pharmacies, as they have access to a patient's electronic health record. As a result, patients can obtain the required medications without a doctor’s prescription. These factors can be attributed to the growth of this segment.

On the other hand, the specialty pharmacy segment is estimated to witness significant growth over the foreseeable future. Specialty pharmacies facilitate easy treatment at home, thus this segment is anticipated to gain significant market share during the forecast period. Specialty drugs represent a significant and emerging part of the future pharmacy business. As per May 2021 data from CVS, specialty drugs accounted for 52% of the overall expenditure of pharmacies in 2020. Moreover, there has been a 98% increase in new therapies for associated conditions.

Key Companies & Market Share Insights

The leading players in the U.S. IVIG market are focusing on growth strategies, such as innovations in the existing IVIG products, product launches, R&D, and mergers & acquisitions. For instance, in April 2023, Takeda Pharmaceutical Company Limited received FDA approval to expand the use of their Immune Globulin Infusion 10% with Recombinant Human Hyaluronidase, Hyqvia. Hyqvia is used for the treatment of primary immunodeficiency in patients aged 2 years and older. Some prominent players in the U.S. intravenous immunoglobulin market include:

-

Biotest AG

-

China Biologics Products Holdings, Inc.

-

Octapharma AG

-

LFB Biotechnologies S.A.S

-

Takeda Pharmaceutical Company Limited

-

Bio Products Laboratory Ltd.

-

Pfizer, Inc.

-

CSL

-

ADMA Biologics, Inc.

-

Grifols, S.A.

-

Kedrion S.P.A.

U.S. Intravenous Immunoglobulin Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.42 billion

Growth Rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2020

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel

Key companies profiled

Biotest AG; Octapharma AG; LFB Biotechnologies S.A.S; China Biologics Products Holdings, Inc.; Grifols; S.A.; Kedrion S.P.A.; CSL ; Takeda Pharmaceutical Company Limited; Bio Products Laboratory Ltd.; Pfizer, Inc.; ADMA Biologics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Intravenous Immunoglobulin Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. intravenous immunoglobulin market report on the basis of application and distribution channel:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Immunodeficiency

-

Chronic Inflammatory Demyelinating Polyradiculoneuropathy (CIDP)

-

Primary Immunodeficiency Diseases (PIDD)

-

Congenital AIDS

-

Chronic Lymphocytic Leukemia

-

Myasthenia Gravis

-

Multifocal Motor Neuropathy

-

Immune Thrombocytopenia (ITP)

-

Kawasaki Disease

-

Guillain-Barre Syndrome

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Specialty Pharmacy

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. intravenous immunoglobulin market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 10.42 billion by 2030.

b. The market opportunity for the U.S. intravenous immunoglobulin market includes the introduction of more efficient and cost-effective IVIG therapies.

b. Key factors that are driving the market growth include increasing incidence of immunodeficiency disorders, robust pipeline, government initiatives, and approval of novel IVIG therapies.

b. The U.S. intravenous immunoglobulin market size was estimated at USD 5.74 billion in 2022 and is expected to reach USD 6.17 billion in 2023.

b. Some key players operating in the U.S. intravenous immunoglobulin market includeBiotest AG, Octapharma AG, LFB Biotechnologies, Grifols, S.A., Kedrion Biopharma, Inc., CSL Behring, BDI Pharma, Inc., Takeda Pharmaceutical Company Limited (Shire plc), ADMA Biologics, Inc., Baxter International Inc., and, Bio Products Laboratory Ltd.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."