- Home

- »

- Pharmaceuticals

- »

-

U.S. And Japan Platelet Rich Plasma Market Report, 2030GVR Report cover

![U.S. And Japan Platelet Rich Plasma Market Size, Share & Trends Report]()

U.S. And Japan Platelet Rich Plasma Market Size, Share & Trends Analysis Report By Type, (Pure Platelet Rich Plasma, Leukocyte Rich Platelet Rich Plasma), By Application, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-179-8

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Market Size & Trends

The U.S. and Japan platelet rich plasma market size was estimated at USD 175.62 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.15% from 2024 to 2030.The prevalence of chronic degenerative diseases related to aging was found to be increasing exponentially, which proves that chronic wounds are a significant biomedical burden. Thousands of patients in the U.S. suffer from acute and chronic wounds caused due to infections, surgeries, burns, diabetic & venous ulcers, and pressure ulcers. For instance, in the U.S., over 6 million people are affected by chronic wounds, with an annual cost of USD 25 billion.

The platelet rich plasma (PRP) is an emerging technology in biomedical research that focuses on restoring, replacing, and regenerating damaged cells & tissues.Platelets play an essential role in the wound-healing process because of their hemostatic function and presence of growth factors & cytokines. Thus, demand for PRP treatments in Japan and the U.S. is continually increasing owing to its potential to stimulate and accelerate tissue healing.

Platelet rich plasma therapy has emerged as an advanced wound therapy that can be used in non-healing/hard-to-heal chronic & acute wounds. Several research studies have demonstrated the ability of PRP to accelerate the healing process. The growing number of evidence-based studies for evaluating potential of platelet rich plasma in wound healing is anticipated to positively impact demand for PRP therapies in the U.S. and Japan. According to a research study published in 2023, platelet rich plasma can be used as an adjuvant therapy in burns and skin grafts.

Similarly, according to another research study published in 2022, PRP therapies can improve angiogenesis & granulation tissue, reduce inflammation around wounds, and promote wound healing. Thus, an increasing number of evidence-based studies is expected to increase adoption of platelet rich plasma treatments for wound healing.

Market Concentration & Characteristics

Market growth stage is medium, and pace of market growth is accelerating. U.S. and Japan platelet rich plasma industry is characterized by a medium degree of innovation owing to the development and approval of novel platelet rich plasma products. For instance, in March 2022, Terumo Corporation received U.S. FDA clearance for its Rika Plasma Donation System. The system is designed to optimize plasma collection to aid patients affected by numerous life-threatening illnesses.

U.S. and Japan platelet rich plasma market players leverage these strategies to increase their product capabilities and promote reach of their offerings in U.S. and Japan. For instance, in April 2021, Terumo Corporation, collaborated with CSL Plasma to deliver a novel plasma collection platform at CSL Plasma U.S. collection centers. This initiative was expected to boost its offerings in the U.S. Similarly, in February 2020, EmCyte Corporation,acquired all assets of U.S.-based Cellmedix Holdings LLC, along with its Centrepid Platelet Concentrator system. This acquisition was expected to expand EmCyte’s product development expertise and intellectual property profile. The addition of intellectual property propelled its commitment to develop innovative products.

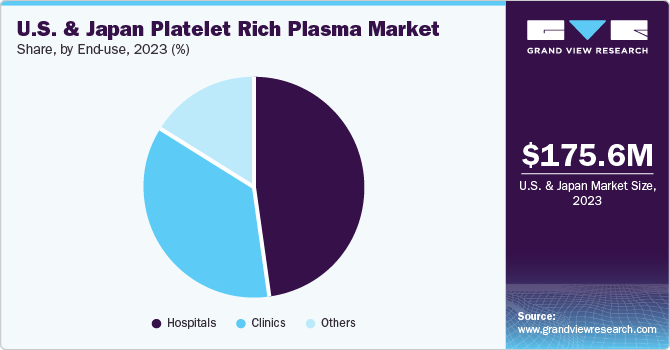

End-user concentration is a significant factor in the market. Since there are a number of hospitals that are driving demand for platelet rich plasma products. In addition, growing R&D activities in academic and research institutes is also a key factor likely to create opportunities for platelet rich plasma market in the U.S. and Japan during the forecast period.

End-use Insights

Hospitals segment accounted largest revenue share of the market in 2023. Owing to presence of a substantial number of hospitals providing platelet rich plasma-based therapies across the U.S. and Japan. Numerous studies have evaluated applications of PRP in hospital settings for anterior cruciate ligament reconstruction, joint osteotomy, plantar fasciitis, arthroplasty, rotator cuff repair, degenerative spine disease, elbow tendinitis, Achilles tendinopathy, and knee osteoarthritis. Furthermore, PRP injections are common treatment option adopted by hospitals for treatment of osteoarthritis & knee osteoarthritis. These factors are likely to contribute to the segment’s dominance.

Clinics sector is projected to witness the highest growth rate over the forecast period. Growth is attributed to rising awareness and acceptance of regenerative therapies, including platelet rich plasma, which is boosting demand for clinics specializing in these treatments. In the U.S., advanced healthcare infrastructure and a strong demand for regenerative therapies have led to establishment of numerous PRP clinics. These clinics offer state-of-the-art facilities and experienced medical professionals, ensuring optimal patient outcomes. In addition, the number of PRP clinics is growing in Japan due to growing demand for regenerative medicine and a rising focus on innovative healthcare solutions. Thus, aforementioned factors are expected to propel the segment over the forecast period.

Product Insights

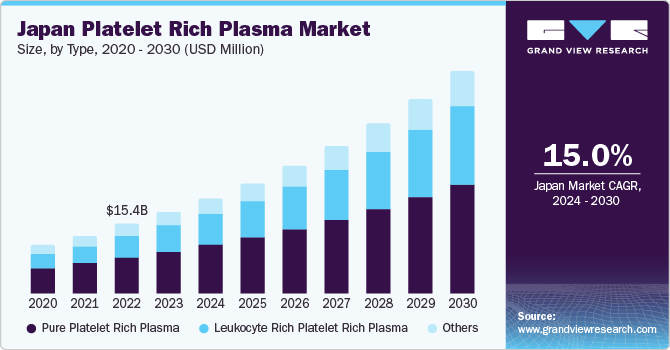

Pure platelet rich plasma segment led the market and accounted for a revenue share of 51.24% in 2023. Effective elimination of risks & adverse effects, such as an allergic or immune reaction in a pure PRP therapeutic approach, has gained attention of players operating in the market. Increasing initiatives related to PRP treatment by emerging players in the market contribute to expansion of PRP therapy applications, thereby strengthening segment growth. For instance, in February 2023, Royal Biologics announced the launch of its ultrapure next-generation PRP system BIOINCYTE PRFM. In addition, in November 2022, Rohto Pharmaceutical, a Japan-based Company, launched Autotro, a wound treatment system utilizing autologous platelet-rich plasma therapy, approved by the Ministry of Health. Distribution operations are outsourced to Medipal Holdings to promote wound healing.

Leukocyte-rich platelet rich plasma is anticipated to witness the fastest growth over the projected timeframe. Increasing applications of leucocyte-rich PRP across various therapeutic areas, such as bone regeneration & Knee Osteoarthritis (KOA), are expected to propel segment growth in the near future. Furthermore, substantial efficacy of leukocyte-rich plasma in several health conditions is estimated to positively impact segment growth. For instance, according to a study conducted by a group of researchers at Baylor College of Medicine in August 2021, a single dose of leukocyte-rich platelet rich plasma has shown significant improvement in knee joint pain & mobility.

Application Insights

Orthopedics segment accounted for a significant revenue share in 2023. Increase in a number of research studies targeted toward the evaluation of PRP efficacy in orthopedic applications has propelled demand for platelet rich plasma in recent years. In addition, increasing number of reimbursement facilities and government support is expected to have a positive impact on adoption of PRP for orthopedic applications during the forecast period. For instance, in June 2022, TRICARE insurance announced coverage for platelet rich plasma injections that will be used for treatment of chronic osteoarthritis of knee or lateral epicondylitis. In addition, the National Spinal Cord Injury Statistical Center reports an annual incidence of approximately 18,000 new spinal cord injuries in the U.S., as of 2023. The growing interest in PRP and its potential to accelerate recovery from these injuries has gained considerable attention.

Others segment is expected to register the fastest CAGR during the forecast period. Growing adoption of PRP is in various applications including oral surgeries, maxillofacial surgeries, cancer, dermatology, neurosurgery, and treatment of leg ulcers is projected to boost segment growth. Many neurosurgeons in various hospitals and clinics are using PRP therapy to treat various nerve injuries in peripheral nervous system (PNS), such as carpal tunnel syndrome, sciatica, and similar injuries. Furthermore, the growing number of facilities that offer platelet rich plasma treatments for skin is projected to accelerate segment growth during the forecast period. For instance, in September 2023, South Central Regional Medical Center introduced hair loss treatment with the help of PRP. According to the institute, PRP treatment will stimulate new hair growth along with improving texture of existing hair.

Regional Insights

U.S. dominated platelet rich plasma market and accounted for 89.67% share in 2023. The local presence of many leading manufacturers that focus on developing novel PRP preparation systems is expected to contribute to market growth. High adoption of PRP treatments across key end-use settings, such as hospitals & clinics, and growing adoption by offices or physician clinics are expected to expand market in the U.S. Several research efforts suggest that PRP therapy may offer an effective treatment option for hair loss, which affects many individuals in the U.S. and impacts their quality of life. For instance, according to an NCBI 2023 article, researchers at the New Jersey Medical School evaluated PRP treatment for Androgenetic Alopecia (AGA). The study showed that PRP therapy demonstrated higher efficiency than minoxidil for treating AGA. This positive research trend and the potential benefits of PRP therapies are anticipated to boost their demand as hair loss treatments in the coming years.

Japan is anticipated to witness significant growth in the market. Rising number of cosmetic surgeries to improve facial features in Japan is anticipated to boost the PRP market. In addition, the growing medical tourism industry is expected to boost adoption of PRP treatments. In some cases, PRP therapy can prevent the need for surgery, which is anticipated to fuel market growth. This includes treating damaged tissues in orthopedics, joint replacement, and spinal fusion to prevent damage progression. The presence of a strong research base for PRP therapies is expected to boost their adoption in the region.

Key Companies & Market Share Insights

Some of the key players operating in the market include Johnson & Johnson Services, Arthrex, Inc., EmCyte Corporation, Terumo Corporation, and Zimmer Biomet.

-

Johnson & Johnson Services, Inc. is a global healthcare company engaged in R&D, manufacture, and commercialization of a wide range of healthcare products.The company has three business units: Pharmaceuticals, Consumer, and Medical Devices. It enhances access & affordability, establishes healthy communities, and provides healthcare products within reach of everyone.

-

Arthrex, Inc. is a privately held global medical company engaged in product development and provides medical education in orthopedics. The company has pioneered arthroscopy and develops over 1,000 novel products & procedures every year.It has regional head offices in Singapore and Munich, Germany.

-

Factor Medical, Inc., Royal Biologics, APEX Biologix, and Dr. PRP USA LLC are some of the emerging market participants in the market.

-

Factor Medical, Inc. is a medical device company primarily focusing on regenerative medicine and biologic products. It is an exclusive manufacturer of the SELPHYL Autologous PRP system. PRP can facilitate faster recovery for chronic conditions such as joint injury & musculoskeletal pain.

-

Royal Biologics is a company operating in the field of orthobiologics and life sciences, with a strong emphasis on R&D. It offers innovative solutions to facilitate healing across diverse clinical scenarios. The main focus is on utilizing autologous and live cellular therapies to cater to various needs related to musculoskeletal health & regenerative medicine.

Key U.S. And Japan Platelet Rich Plasma Companies:

- Johnson & Johnson Services, Inc.

- Arthrex, Inc.

- EmCyte Corporation

- Dr. PRP USA LLC

- Juventix Regenerative Medical, LLC

- Terumo Corporation

- Zimmer Biomet

- Stryker

- Apex Biologix

- Celling Biosciences, Inc.

- Factor Medical, Inc.

- CAREstream America

- Royal Biologics.

Recent Developments

-

In June 2023, Dr. PRP USA LLC, received 510k clearance from the U.S. FDA for its PRP kits. This initiative was expected to boost its offerings.

-

In March 2023, APEX Biologix, entered into a license agreement with the Mayo Clinic to develop novel regenerative products for treating acute and chronic diseases.

-

In February 2023, Royal Biologics announced the commercial launch of BIOINCYTE PRFM in the U.S. This initiative was expected to boost its offerings.

U.S. And Japan Platelet Rich Plasma Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 195.13 million

Revenue forecast in 2030

USD 348.45 million

Growth rate

CAGR of 10.15% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, country

Country scope

U.S.; Japan

Key companies profiled

Johnson & Johnson Services, Inc.; Arthrex, Inc.; EmCyte Corporation; Dr. PRP USA LLC; Juventix Regenerative Medical, LLC; Terumo Corporation; Zimmer Biomet; Stryker; Apex Biologix; Celling Biosciences, Inc.; Factor Medical, Inc.; CAREstream America; Royal Biologics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase optiaons

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Japan Platelet Rich Plasma Market Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. and Japan platelet rich plasma market report based on type, application, end-use, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pure Platelet Rich Plasma

-

Orthopedics

-

Sports Medicine

-

Spine

-

Trauma

-

Foot and Ankle

-

Diabetes Mellitus

-

Joint Reconstruction

-

-

Others

-

-

Leukocyte Rich Platelet Rich Plasma

-

Orthopedics

-

Sports Medicine

-

Spine

-

Trauma

-

Foot and Ankle

-

Diabetes Mellitus

-

Joint Reconstruction

-

-

Others

-

-

Others

-

Orthopedics

-

Sports Medicine

-

Spine

-

Trauma

-

Foot and Ankle

-

Diabetes Mellitus

-

Joint Reconstruction

-

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Sports Medicine

-

Spine

-

Trauma

-

Foot and Ankle

-

Diabetes Mellitus

-

Joint Reconstruction

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Japan

-

Frequently Asked Questions About This Report

b. The U.S. and Japan platelet rich plasma market size was valued at USD 175.62 million in 2023 and is expected to reach USD 195.13 million in 2024.

b. The U.S. and Japan platelet rich plasma market is projected to grow at a compound annual growth rate (CAGR) of 10.15% from 2024 to 2030 to reach USD 348.45 million by 2030.

b. Pure platelet rich plasma led the U.S. and Japan platelet rich plasma market and accounted for 51.24% of revenue in 2023. Effective elimination of risks & adverse effects, such as an allergic or immune reaction in a pure PRP therapeutic approach, has gained attention of players operating in U.S. and Japan platelet rich plasma market.

b. Some key players operating in the U.S. and Japan platelet rich plasma market include Johnson & Johnson Services, Inc., Arthrex, Inc., EmCyte Corporation, Dr. PRP USA LLC, Juventix Regenerative Medical, LLC, Terumo Corporation, Zimmer Biomet, Stryker, Apex Biologix, Celling Biosciences, Inc., Factor Medical, Inc., CAREstream America, and Royal Biologics.

b. Key factors that are driving the market growth include high prevalence of chronic degenerative diseases related to aging and increasing number of patients that suffer from acute and chronic wounds caused due to infections, surgeries, burns, diabetic & venous ulcers, and pressure ulcers

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."