- Home

- »

- Homecare & Decor

- »

-

U.S. Laundry Facilities And Dry-Cleaning Services Market Report, 2030GVR Report cover

![U.S. Laundry Facilities And Dry-Cleaning Services Market Size, Share & Trends Report]()

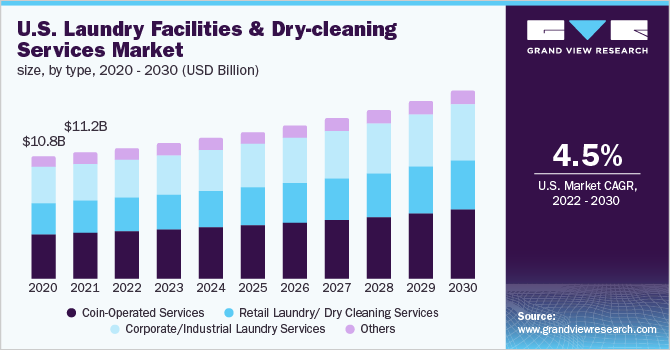

U.S. Laundry Facilities And Dry-Cleaning Services Market Size, Share & Trends Analysis Report By Type (Coin-operated Services, Retail Laundry/Dry Cleaning Services, Corporate/Industrial Laundry Services), Region (Northeast, Southwest), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-127-6

- Number of Pages: 83

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The U.S. laundry facilities and dry-cleaning services market size was estimated at USD 10.82 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030. The increasing number of people joining the workforce in the U.S. is contributing to the rising preference for professional laundry facilities and dry-cleaning services to save both time and energy. The major customer segment of these facilities and services are working professionals who find it difficult to find time for their daily chores due to their hectic schedules or late-night jobs.

Even though the COVID-19 pandemic seems to be on a decline in terms of its impact, its economic impact continues to grow. From laundry businesses having to close down temporarily to closing up shop completely, the ripple effects that the outbreak has had and will continue to have on a national and global level are unprecedented. According to a survey by Planet Laundry, between 2019 and 2020, laundry owners' average gross revenue fell by 7% due to the coronavirus.

Consumers in the U.S. often followed the routine of running a quick wash at the local laundromat after coming home from work. However, since working from home, the need to go out and use these services has declined considerably. Even with stay-at-home orders lifted across the country, the new normal has arguably settled in, compelling more and more consumers to rethink their daily routines. This is a significant obstacle for laundromat businesses throughout the U.S.

According to Procter & Gamble Co., the average American family washes 300-390 laundry loads per year. Moreover, the average American household spends around USD 170 on laundry annually as per the Bureau of Labor Statistics’ Annual Consumer Expenditure Survey for 2020. The annual expenditure on laundry supplies varies across income levels as well. The below table represents the expense made annually by different income groups in 2020.

With technological advancements, the growing prevalence of the internet and social media, and changing customer demographics, consumers are increasingly opting for laundry facilities and dry-cleaning services. These changes can be daunting for long-time owners of these facilities who are striving to keep up with the changing times, whereas new investors are looking for an opportunity to open new-age laundry facilities and dry-cleaning services.

Increasing adoption of online services by the overall consumer group has been a major trend in the industry and helping businesses grow. Additionally, the convenience and effortlessness provided by such services is another aspect that is leading toward their high adoption. High disposable incomes and rising expenditure on personal hygiene are acting as major catalysts for laundry facilities and dry-cleaning services, influencing their acceptance in the U.S.

Type Insights

In terms of revenue, the coin-operated type dominated the market with a share of 36.3% in 2021. The working-class population has significantly increased over the last few years, thereby contributing to the rising demand for coin-operated laundries due to their convenient use. The demand for these services is primarily due to the growing population of health-conscious consumers in the country has significantly increased the use of laundry services. The increasing preference for fragrant laundered clothes, particularly in developed economies, the U.S. being one, has increased the demand for fragrant cleaning products.

The retail laundry or dry clean service segment is projected to register a CAGR of 5.1% from 2022 to 2030. Retail laundry services are emerging as reliable and convenient services at a reasonable price as, nowadays, consumers with busy schedules are willing to pay for their laundry. The growing working population coupled with the rising spending on clothes and cleaning services, is expected to further fuel the demand for these services over the forecast period.

Regional Insights

West region dominated this market with a share of 25% in 2021. This is attributable to the laundry facilities and dry-cleaning services that are emerging as reliable and convenient services at a reasonable price as nowadays busy consumers are willing to pay for their laundry. Moreover, the introduction of technologically advanced products, such as coin- or card-operated machines, is anticipated to fuel the market growth over the forecast period.

The Northeast region is expected to witness a CAGR of 4.9% from 2022 to 2030. Growing awareness regarding the importance of overall appearance, personal care, and hygiene, coupled with the influence of social media and emerging trends in fashion, drives the market growth. The market is starting to incorporate computerized lockers inside offices or apartment buildings that allow customers to pick up and drop off their laundry 24/7.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of U.S. laundry facilities & dry-cleaning services. Players in the market are diversifying the service offering to maintain market share.

-

For instance, in June 2021, the Alliance for Strong Families, the largest national umbrella organization of community centers, joined CSC. Additionally, local CSC teams engaged with these community centers on various volunteer opportunities throughout the year, such as providing food and clothing, painting or repairing playgrounds or common areas, and more

-

For instance, in April 2022, Lapels Cleaners announced the opening of Lapels Cleaners in Queen Creek, Arizona. The new location emphasized ‘The Future Garment Care’ by servicing the customer’s garment needs regardless of the cleaning process

Some prominent players in the U.S. laundry facilities and dry-cleaning services market include:

-

CSC ServiceWorks, Inc.

-

Lapels Dry Cleaning

-

Yates Dry Cleaning & Laundry Services

-

ByNext

-

Lavatec Laundry Technology GmbH

-

Angelica Corporation

-

Tide Cleaners

-

FlyCleaners

-

ZIPS Dry Cleaners

-

The Huntington Company

U.S. Laundry Facilities And Dry-Cleaning Services Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 11.17 billion

Revenue forecast in 2030

USD 16.10 billion

Growth rate

CAGR of 4.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

Northeast; Southwest; Midwest; West; Southeast

Country scope

U.S.

Key companies profiled

CSC ServiceWorks, Inc.; Lapels Dry Cleaning; Yates Dry Cleaning & Laundry Services; ByNext; Lavatec Laundry Technology GmbH; Angelica Corporation; Tide Cleaners; FlyCleaners; ZIPS Dry Cleaners; The Huntington Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laundry Facilities And Dry-Cleaning Services Market Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. laundry facilities and dry-cleaning services market report based on type and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Coin-Operated Services

-

Retail Laundry/ Dry Cleaning Services

-

Corporate/Industrial Laundry Services

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 -2030)

-

Northeast

-

Southwest

-

Midwest

-

West

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. laundry facilities & dry-cleaning services market was estimated at USD 10.82 billion in 2021 and is expected to reach USD 11.17 billion in 2022.

b. The U.S. laundry facilities & dry-cleaning services market is expected to grow at a compound annual growth rate of 4.5% from 2022 to 2030 to reach USD 16.10 billion by 2030.

b. West region dominated the U.S. laundry facilities & dry-cleaning services market with a share of around 25.2% in 2021. This is owing to the rising demand for trendy U.S. laundry facilities & dry-cleaning services across the region coupled with rising key players' initiatives to introduce technologically advanced products, such as coin- or card-operated machines.

b. Some of the key players operating in the U.S. laundry facilities & dry-cleaning services market include CSC ServiceWorks, Inc., Lapels Dry Cleaning, Yates Dry Cleaning & Laundry Services, ByNext, Lavatec Laundry Technology GmbH, Angelica Corporation, Tide Cleaners, FlyCleaners, ZIPS Dry Cleaners, The Huntington Company.

b. Key factors that are driving the U.S. laundry facilities & dry-cleaning services market growth include the increasing number of people joining the workforce, With technological advancements consumers are increasingly opting for laundry facilities, dry cleaning services, and rising residential and commercial building construction.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."