- Home

- »

- Medical Devices

- »

-

U.S. Mechanical Ventilators Market, Industry Report, 2030GVR Report cover

![U.S. Mechanical Ventilators Market Size, Share & Trends Report]()

U.S. Mechanical Ventilators Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ventilators, Accessories), By End Use (Hospital, Home Care), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-216-6

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

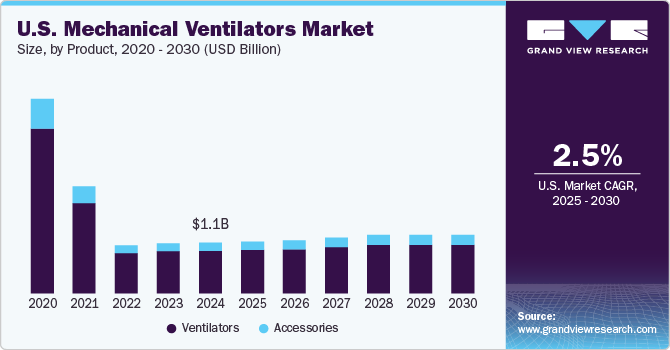

The U.S. mechanical ventilators market size was valued at USD 1.08 billion in 2024 and is expected to grow at a CAGR of 2.5% during the forecast period. The increasing prevalence of chronic respiratory conditions such as obstructive pulmonary disease, asthma, obstructive sleep apnea, and exertional dyspnea, among others coupled with technological advancement in the device is fueling market growth. According to data from the National Council on Aging, as of October 2023, Obstructive Sleep Apnea (OSA)-a condition marked by irregular breathing and reduced oxygen supply to the brain-affects approximately 39 million adults in the U.S. and an estimated 936 million people worldwide.

Increasing advancements in research and development in respiratory interventions and launching innovative devices are expected to drive growth in this market over the forecast period. Key market players invest in cost-effective mechanical ventilators, supported by a favorable regulatory environment that enhances market expansion. For instance, Nihon Kohden OrangeMed, Inc. obtained U.S. FDA clearance for the NKV-330 Ventilator System in July 2022. This non-invasive system offers respiratory support in emergencies.

Moreover, the rising prevalence of chronic respiratory conditions is fueling growth of the U.S. mechanical ventilators industry. According to American Lung Association, approximately every two minutes, an individual is diagnosed with lung cancer, resulting in over 342 fatalities daily among the population in the U.S. This is contributing to the increasing cost related to chronic respiratory disorder.

A study published JAMA Network Open titled “Global Burden of Chronic Obstructive Pulmonary Disease Through 2050” in December 2023, in the U.S., the costs associated with COPD are expected to rise significantly over the next two decades, potentially reaching USD 40 billion annually. This would result in a total expenditure of approximately USD 800 billion over 20 years. In order to mitigate this public and private organizations are engaging in the programs aimed at educating the U.S. population about the awareness of solutions capable of managing COPD.

For instance, in 2023, the American Lung Association established its Research Institute and increased its annual investment in lung disease research to USD 25 million. In addition, the organization enhances support resources for lung cancer patients and their caregivers. Through LUNG FORCE Walks, online resources, and advocacy initiatives, the organization is assisting over 600,000 individuals in the U.S. affected by lung cancer. The aforementioned factors are anticipated to fuel the demand for technologically advanced and cost-effective mechanical ventilators in the country.

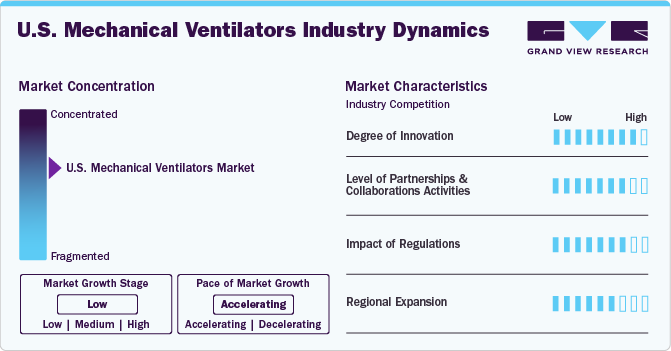

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including the impact of regulations, degree of innovation, industry competition, regional expansion, and level of partnerships & collaboration activities. The U.S. mechanical ventilators market is consolidated, with the presence of limited providers dominating the market.

The market is experiencing high innovation, driven by portability, automation, and advancements in AI integration. Manufacturers focus on creating compact, user-friendly, and versatile devices to cater to ICU and home care settings. Enhanced features like remote monitoring, precise oxygen control, and patient-driven adjustment aim to improve outcomes and efficiency. For instance, in February 2024, Getinge launched its advanced Servo-c mechanical ventilator in the Indian market. It is created to meet the varied respiratory requirements of both adult and pediatric patients, the Servo-c offers cutting-edge lung protective therapeutic features.

The U.S. mechanical ventilators industry is experiencing moderate level of mergers and acquisitions, largely driven by major healthcare companies aiming to enhance technological capabilities and expand market share. These acquisitions often focus on integrating advanced respiratory solutions, including AI-driven ventilators and portable devices, into larger healthcare portfolios.

The impact of regulations on the market is high due to the stringent FDA standards guiding device safety, efficacy, and manufacturing quality. Compliance with these regulations drives innovation and extends product development timelines and costs. Emergency use authorizations (EUAs), issued during COVID-19, streamlined access temporarily but have since tightened, reinforcing high standards.

The level of regional expansion in the industry is moderate. Companies are establishing distribution networks and partnerships with local healthcare facilities to improve reach. Portable and telehealth-compatible ventilators are especially key, addressing regional disparities in healthcare infrastructure. This expansion supports broader, equitable access to ventilators, especially critical in areas prone to respiratory illnesses and seasonal health crises.

Product Insights

Based on product, the ventilators segment held the largest revenue share of over 83.94% in 2024 and is anticipated to grow at a fastest growth rate over the forecast year. Market growth is driven by the growing awareness of mechanical ventilators across various healthcare settings. The development of cost-efficient, user-friendly, and portable devices contributes to their rising adoption. For instance, in May 2022, Max Ventilator launched non-invasive ventilators equipped with humidifiers and oxygen therapy features, highlighting their adaptability for adult and neonatal care.

Accessories segment is expected to witness the fastest growth at a CAGR of 3.6% over the forecast period. The accessories market is further categorized into flow sensors, breathing circuit sets, endotracheal tubes, masks, and other accessories, such as expiratory valves, and humidifiers. The endotracheal tubes segment gained popularity owing to its crucial role in mechanical ventilation. These tubes are useful in maintaining and establishing airway patency and protecting the airway against aspiration.

End Use Insights

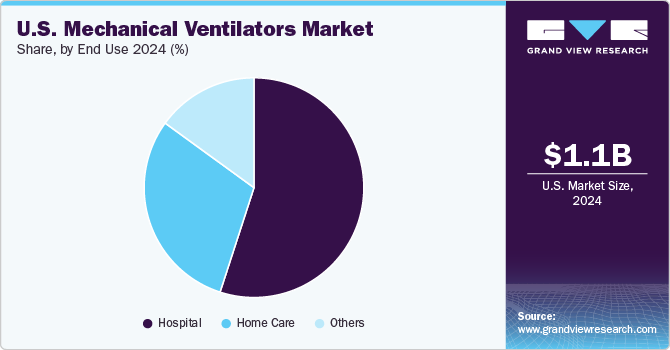

The growth of the U.S. mechanical ventilator market across various end use segments, including hospitals, home care, and others, is driven by several key factors. Hospitals remain the largest end use segment, propelled by the increasing prevalence of respiratory diseases such as COPD, asthma, and COVID-19, which require acute care and ventilation support. Advancements in ventilator technology, such as compact designs and enhanced safety features, further contribute to their adoption in hospital settings.

The home care segment is witnessing significant growth, fueled by the growing number of government initiatives heading for curbing healthcare expenditures by promoting home healthcare to support market growth. Value-based healthcare is another major factor contributing to market growth. In the U.S., Medicare reimbursements are highly favorable in offering value-based healthcare for improved patient outcomes at a low cost. Thus, in-home care has become a modality of choice for treatment and is expected to witness lucrative growth over the forecast period.

Key U.S. Mechanical Ventilators Company Insights

The competitive landscape of the mechanical ventilator industry features key players such as Getinge, VYAIRE, Medtronic, Drägerwerk AG & Co. KGaA, GE Healthcare, Koninklijke Philips N.V., Smiths Group plc, Hamilton Medical, ResMed, and Ventec Life Systems. These industry leaders are actively engaged in strategic initiatives, including mergers and acquisitions, to strengthen their market positions.

A notable example is the partnership formed in in August 2023, Medline, a leading U.S.-based manufacturer of medical supplies and devices, partnered with Flight Medical, an Israeli respiratory device manufacturer. As part of this collaboration, Medline exclusively offers the Flight 60 transportable ventilator. This advanced device seamlessly transitions between invasive and non-invasive ventilation modes, catering to the ventilation needs of high-acuity patients. Its portability and durability make it an ideal solution for a wide range of patients, from pediatric to adult cases.

Key U.S. Mechanical Ventilators Companies:

- Getinge

- VYAIRE

- Medtronic

- Drägerwerk AG & Co. KGaA

- GE Healthcare

- Koninklijke Philips N.V.

- Smiths Group plc

- Hamilton Medical

- ResMed

- Ventec Life Systems

Key U.S. Mechanical Ventilators Company Insights

-

In January 2024, Koninklijke Philips N.V. announced the discontinuation of select respiratory products in the U.S. and its territories, including the ventilators, SimplyGo Mini, SimplyGo, and Everflo oxygen concentrators. This decision is expected to bring notable shifts in the ventilators market. According to a survey poll conducted by HME News in February 2024, approximately 70% of respondents believe that Philips' withdrawal from a significant portion of the U.S. respiratory market will have a considerable influence on the industry.

-

While the discontinuation of respiratory products by Philips Respironics indicates a significant development in the mechanical ventilators industry, it also presents opportunities for other market players to innovate and expand their presence.

Medtronic

-

In October 2022, Medtronic decided to separate its respiratory interventions (PMRI) and patient monitoring businesses from the ventilator market. The decision was made due to the company's significant expansion during the COVID-19 pandemic, which led to ventilator shortages.

-

Later, Medtronic recognized that the spinoff plan no longer benefited the firm.

-

Therefore, in February 2024, Medtronic announced to exit the ventilator business and merge its Patient Monitoring and Respiratory Interventions (PMRI) segments into a new unit called Acute Care and Monitoring (ACM).

Recent Developments

-

In October 2024, Vyaire Medical annocuned the sale of its Ventilation Business segment to ZOLL Medical Corporation. As part of the agreement, ZOLL acquired the bellavista, LTV, fabian, and 3100 HFOV product lines, including associated consumables, accessories, service parts, and service programs. Furthermore, ZOLL also acquired Vyaire’s existing inventory of AVEA, SiPAP, ReVel, and VELA ventilators, along with Vyaire MicroBlenders.

-

In February 2024, Getinge introduced its Servo-c mechanical ventilator to the Indian market, aiming to meet the respiratory needs of both pediatric and adult patients. The device offers lung-protective therapeutic features to address a range of respiratory requirements. This development supports the accessibility and affordability of advanced healthcare solutions for hospitals across India, strengthening the company's market position.

-

In January 2023, Getinge introduced the Servo-c mechanical ventilator, focusing on specific markets. This device is designed to provide lung-protective therapies for both pediatric and adult patients.

U.S. Mechanical Ventilators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.25 billion

Growth rate

CAGR of 2.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Key companies profiled

Getinge; VYAIRE; Medtronic; Drägerwerk AG & Co. KGaA; GE Healthcare; Koninklijke Philips N.V.; Smiths Group plc; Hamilton Medical; ResMed; Ventec Life Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mechanical Ventilators Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mechanical ventilators market report based on product and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ventilators

-

Critical Care

-

Neonatal

-

Transport & Portable

-

Others

-

-

Accessories

-

Breathing circuit sets

-

Flow sensors

-

Endotracheal tubes

-

Masks

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Home Care

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mechanical ventilator market is expected to witness a compound annual growth rate of 2.5% from 2025 to 2030 to reach USD 1.25 billion by 2030.

b. The ventilators segment held the largest revenue share of over 83.94% in 2024, owing to their increased product demand in Intensive Care Units (ICUs). Critical care devices held the largest revenue share compared to other types of ventilators due to their high cost and demand in ICUs.

b. Some of the key players operating in the U.S. mechanical ventilator market include Getinge; VYAIRE; Medtronic; Drägerwerk AG & Co. KGaA; GE Healthcare; Koninklijke Philips N.V.; Smiths Group plc; Hamilton Medical; ResMed; and Ventec Life Systems.

b. Key factors that are driving the U.S. mechanical ventilator market growth include increasing incidences of respiratory diseases, advancements in ventilator technology, rising geriatric population, growing ICU admissions, and heightened demand during emergencies like the COVID-19 pandemic, boosting adoption and innovation.

b. The U.S. mechanical ventilator market size was estimated at USD 1.08 billion in 2024 and is expected to reach USD 1.11 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.