- Home

- »

- Medical Devices

- »

-

U.S. Medicare Supplement Health Insurance Market Report, 2030GVR Report cover

![U.S. Medicare Supplement Health Insurance Market Size, Share & Trends Report]()

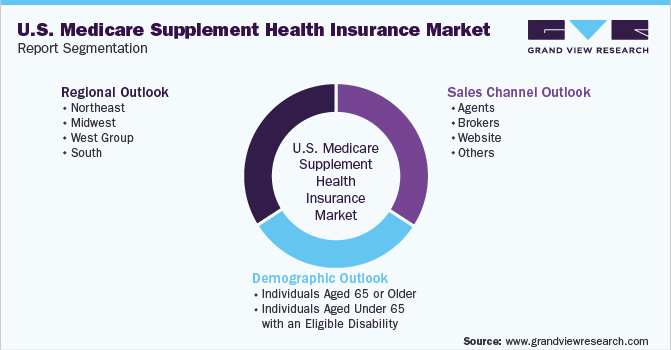

U.S. Medicare Supplement Health Insurance Market Size, Share & Trends Analysis Report By Demographic (Individuals Aged 65 Or Older, Individuals Aged Under 65 With An Eligible Disability), By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

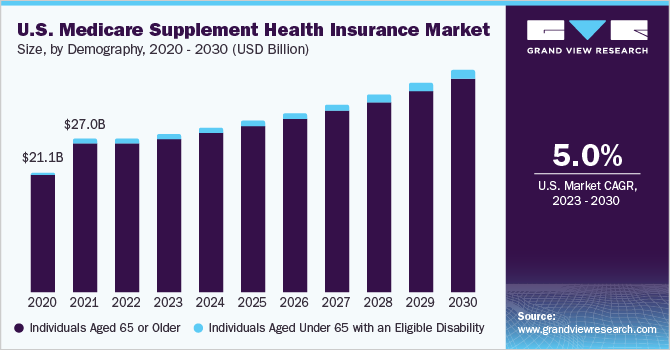

The U.S. medicare supplement health insurance market size was valued at USD 26.97 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. High healthcare costs and benefits offered by this plan are the key factors driving the demand for medicare supplement health insurance. Many individuals in the U.S. purchase medicare supplement health insurance to control this high spending on healthcare.

The upside of the plan is that it makes budgeting and predicting out-of-pocket expenses easier. Because of its role in bridging the initial Medicare coverage gap, the medicare supplement health insurance is also known as medigap. It aids in covering outstanding medical expenses, including co-payments, deductibles, and coinsurance. These benefits are offering lucrative growth opportunities for the medicare supplement health market in the country.

The main factor influencing the nation's medicare supplement health insurance carriers is the high expense of healthcare in the U.S. Healthcare in the country is very expensive due to a number of variables, including high, unregulated prescription drug costs and the highest salaries of healthcare providers when compared to other western nations. Moreover, administrative rules for billing and coding add to an individual's expenses, making the entire process of obtaining healthcare services expensive and medical debt quite widespread in the nation.

For instance, according to a KFF article, 41% of Americans report having debt from medical or dental bills in 2022. This debt includes money owed to credit cards, collections companies, family and friends, banks, and other lenders to cover the cost of their medical care.

The COVID-19 pandemic introduced various challenges across different domains, especially in public health care. However, despite these intense challenges the number of medicare enrollees has kept increasing even during the pandemic. While medicare earned significant revenues during the pandemic as well. The medigap experienced a drop in sales as it is a health insurance plan that is provided by private insurers. Thus, factors like the rise in unemployment due to restricted economical activities and lack of preparedness to deal with the pandemic by major private players.

However, during the second half of the pandemic, many players started focusing on how to improve their online channels which helped in gaining many customers. Moreover, different strategies accepted by healthcare service providers such as increasing usage of telehealth services and increasing awareness regarding insurance also had a positive impact on the sales of the medigap supplement health insurance.

Demographic Insights

Individuals aged 65 or older dominated the U.S. medicare supplement health insurance market in 2022 with a revenue share of more than 97% owing to a higher number of individuals in this category opting for this policy. In addition, only people enrolled under medicare can avail the medicare supplement health insurance plans. As per the government guidelines, only individuals aged 65 or older and individuals aged under 65 with an eligible disability can be enrolled under medicare.

Thus, as the number of individuals that fall under the aged 65 or above category is higher, the segment is anticipated to dominate the market throughout the forecast period as well. According to the U.S. Department of Health and Human Services, out of the total beneficiaries enrolled in 2019, 86.2% of them were individuals aged 65 or older.

However, the rising disability cases among the younger population in the U.S. is leading to a significant growth of individuals aged under 65 with an eligible disability segment. For instance, according to the American Community Survey estimates, in 2019, more than 1.3 million U.S. young people aged 16 to 20 had a disability.

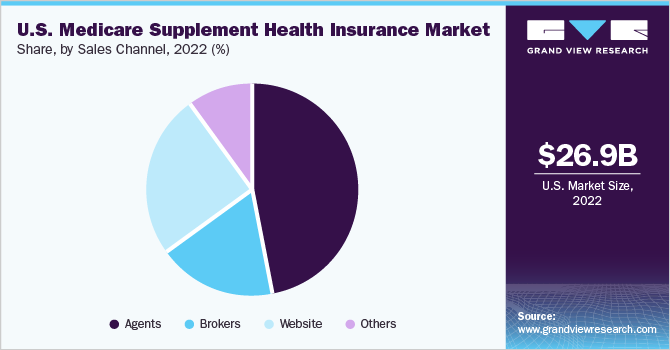

Sales Channel Insights

In 2022, the agents segment dominated the market with 47% of the revenue share. This is owing to the highest sales achieved through this sales channel by the virtue of it being the oldest channel of insurance sales. In addition, the physical presence of the person gives added credibility and ease of communication making it more feasible for customers to purchase insurance policies via this sales channel.

Moreover, medicare supplement health insurance is mainly for senior citizens and studies suggest that a majority of them are not comfortable with exclusively online insurance and health tools. For instance, according to a research article, published by Wilmington plc publication in 2021, only 40% of the senior population is highly comfortable with shopping for health coverage online.

On the other hand, the website segment is observing significant growth with a higher CAGR, due to the increasing number of people buying insurance policies via online channels post-COVID-19 pandemic. Increasing efforts by insurance providers to create well-informed websites which make the entire process of purchasing an insurance policy more convenient and reliable is also driving the growth of online sales channels. Although the sales revenue is not as high as agents, the rise in fraudulent actions through agents is creating growth opportunities for this segment.

Regional Insights

The South region accounted for the highest market share in 2022, owing to the highest number of individuals enrolled under medicare in this region. A similar trend is anticipated to be observed over the forecast period with the region maintaining its dominance. For instance, according to the U.S. Centers for Medicare & Medicaid Services, in 2020, the South region accounted for 23.4 million enrollees from a total of 61.40 million under the medicare scheme.

The West section is expected to witness maximum growth over the forecast period. This is due to the growing number of insurance providers in the region. California dominated the West region due to the growing personal health spending in the state. According to the U.S. Centers for Medicaid and Medicaid Services, in 2020, California spent the most on personal healthcare in 2020 ($410.9 billion), accounting for 12.2% of all personal healthcare spending in the country.

Key Companies & Market Share Insights

The major participants are concentrating on implementing a wide range of strategies, such as joint ventures and partnerships, the introduction of new products, and investments in regional insurance firms to increase their visibility and product availability.

Market participants are focusing on constantly broadening their customer network and reaching out to a larger number of patients through these established networks and offering great deals for their employees as well. For instance, in November 2022, an agreement between Aspirus Network Inc. and Anthem Blue Cross and Blue Shield was signed that guarantees, that all Anthem members will continue to have access to care from Aspirus Network providers and facilities while still being covered under their plan. Some prominent players in the U.S. medicare supplement health insurance market include:

-

Cigna Health & Life Insurance Company

-

Anthem Blue Cross

-

United Healthcare Insurance Company

-

Mutual of Omaha

-

Humana

-

State Farm Mutual Automobile Insurance Company

-

National Health Insurance Company

-

United American Insurance Company

-

Washington National Insurance Company

-

Everence Association, Inc.

U.S. Medicare Supplement Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.90 billion

Revenue forecast in 2030

USD 39.26 billion

Growth rate

CAGR of 5.00% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Demographic, sales channel, region

Regional scope

Northeast; Midwest; South; West

State scope

50 states excluding the District of Columbia & Puerto Rico

Key companies profiled

Cigna Health & Life Insurance Company; Anthem Blue Cross; United Healthcare Insurance Company; Mutual of Omaha; Humana; State Farm Mutual Automobile Insurance Company; National Health Insurance Company; United American Insurance Company; Washington National Insurance Company; Everence Association, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medicare Supplement Health Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medicare supplement health insurance market report based on demographic, sales channel, and state:

-

Demographic Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individuals Aged 65 or Older

-

Individuals Aged Under 65 with an Eligible Disability

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agents

-

Brokers

-

Website

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Northeast

-

Connecticut

-

Massachusetts

-

Pennsylvania

-

New Jersey

-

New York

-

Others

-

New Hampshire

-

Rhode Island

-

Vermont

-

Maine

-

-

-

Midwest

-

Illinois

-

Indiana

-

Michigan

-

Ohio

-

Wisconsin

-

Iowa

-

Kansas

-

Minnesota

-

Missouri

-

Nebraska

-

Others

-

North Dakota

-

South Dakota

-

-

-

West Group

-

Arizona

-

Colorado

-

Nevada

-

Utah

-

California

-

Oregon

-

Washington

-

Others

-

Idaho

-

Montana

-

New Mexico

-

Wyoming

-

Alaska

-

Hawaii

-

-

-

South

-

Florida

-

Georgia

-

Maryland

-

North Carolina

-

South Carolina

-

Virginia

-

Alabama

-

Kentucky

-

Tennessee

-

Louisiana

-

Oklahoma

-

Texas

-

Others

-

Delaware

-

West Virginia

-

Mississippi

-

Arkansas

-

-

-

Frequently Asked Questions About This Report

b. The U.S. medicare supplement health insurance market size was estimated at USD 26.97 billion in 2022 and is expected to reach USD 27.90 billion in 2023.

b. The U.S. medicare supplement health insurance market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 39.26 billion by 2030.

b. South region dominated the U.S. medicare supplement health insurance market with a share of 37.4% in 2022. This is attributable to the presence of noteworthy insurance plans and the substantial number of individuals with health insurance in the region.

b. Some key players operating in the U.S. medicare supplement health insurance market include Cigna Health & Life Insurance Company, Anthem Blue Cross, United Healthcare Insurance Company, Mutual of Omaha, Humana, State Farm Mutual Automobile Insurance Company, National Health Insurance Company, United American Insurance Company, Washington National Insurance Company and Everence Association, Inc.

b. Key factors that are driving the U.S.medicare supplement health insurance includesHigh healthcare costs and benefits offered by the plan.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."