- Home

- »

- Healthcare IT

- »

-

U.S. Memory Care Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Memory Care Market Size, Share & Trends Report]()

U.S. Memory Care Market (2023 - 2030) Size, Share & Trends Analysis Report By Services (Memory Exercise & Activity, Daily Reminder, Personal Assistance Safety), By End-use (Long Term Care Centers, Home Care Settings), And Segment Forecasts

- Report ID: GVR-4-68040-042-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

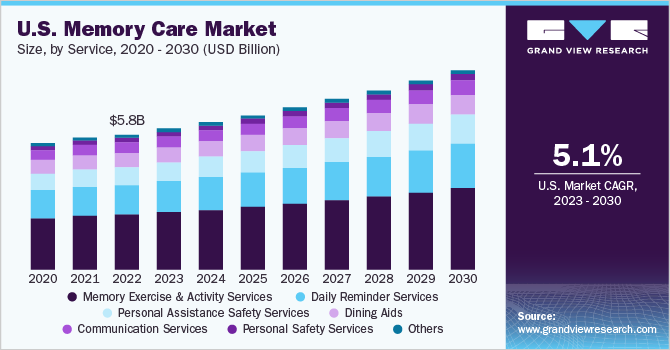

The U.S. memory care market size was valued at USD 5.82 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% over the forecast period from 2023 to 2030. The market growth can be attributed to several factors including rapidly aging population, the increasing prevalence of dementia such as Alzheimer's disease and other forms, and the growing demand for specialized care facilities for elderly patients suffering from memory related ailments. According to the National Institutes of Health, over 40% of individuals above the age of 65 in the U.S. live with memory impairment, which is equal to about 16 million people in the U.S. alone, and 1% of those individuals progress to severe form of dementia.

In addition, according to the Alzheimer’s Association 6 out of 10 people suffering from dementia experience serious symptoms such as wandering away from home. Hence, the demand for memory care centers is anticipated to grow in the coming years. In September 2022, Masonicare opened a new memory care unit which is likely to be beneficial for patients with Alzheimer’s and other forms of dementia. The care unit offers sensory stimulation, recreation, a sunroom, and other specialized programs.

The COVID-19 pandemic had a significant impact on the market growth. Memory care facilities that specialize in caring for individuals with dementia were particularly hard hit by the pandemic due to the vulnerability of their residents to the virus. Many facilities had to implement strict protocols and procedures to prevent the spread of the virus. Some of the initiatives included restricted visitations, increased cleaning and sanitization, and implementing social distancing measures, which in turn affected the occupancy rates and revenue generation. In addition, the centers had to incur additional costs related to the purchase of personal protective equipment (PPE) and increased staffing needs. According to the (CMS), the COVID-19 pandemic also had a significant impact on nursing homes. As of December 2021, there have been more than 199,000 reported COVID-19 deaths among nursing home residents and staff in the U.S.

According to the Alzheimer's Association, the number of Americans older adults suffering from Alzheimer's disease is expected to double by 2050. This is likely to drive the awareness and demand for the industry that provides specialized care for individuals with dementia. According to a report by the Department of Health and Human Services, memory care facilities are increasingly recognized as an important component of the long-term service continuum, with a growing demand for specialized aid that meets the need of the patients suffering from memory loss with advanced age. The U.S. government offers funding for the industry through programs such as Medicaid and the Veterans Administration, which helps to make the treatment options more affordable and accessible fueling the market growth.

Service Insights

Based on the service, the market is segmented into memory exercise & activity services, daily reminder services, personal assistance, dining aids, communication services, personal safety services, and others. In 2022, the memory exercise & activity services segment accounted for the largest market share of 40.4% in terms of revenue share pertaining to the number of patients suffering from neurodegenerative diseases. These services are designed uniquely for dementia patients to keep their minds engaged with sensory stimulation. These services support the patients with different memory games, visually stimulating activities, small tasks, and community-based care activities. They act as a helpful way to keep the patients engaged in reducing common dementia behaviors such as wandering, thereby boosting the mood improving their sense of independence, confidence, and self-esteem, and the overall quality of life.

Personal assistance safety services segment is expected to project the fastest CAGR of 6.0% over the forecast period. There has been a shift towards providing services in the community centers rather than in institutional settings such as hospitals and nursing homes. Personalized service safety allows individuals to receive care in the comfort of their own homes, which is also economical for patients. Personal assistance safety provides additional support to patients helping them maintain their safety, dignity, and independence.

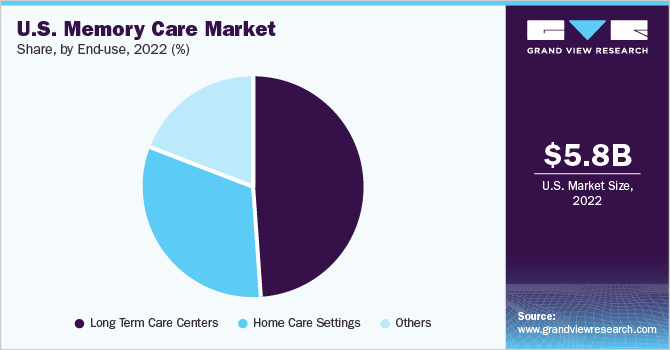

End-use Insights

Based on end-use, the market is segmented into long-term care centers, home care settings, and others. In 2022, the long-term care centers held a majority of the market share of 48.5% in terms of revenue and is also likely to witness the fastest CAGR of 5.5% over the forecast period owing to the rising need for chronic care among the elderly population. The increased Alzheimer's or dementia patient inflow and growing requirement for services which has enhanced the market growth. Moreover, the advanced medical infrastructure in the country provides care offerings with a skilled workforce.

On the other hand, the home care setting is expected to hold the second position in the market as it provides initial diagnosis and exceptional memory care for the patients. The home care settings often focus on everyday activities such as bathing, dressing, eating and other such activities. In addition, home care supports the patients to communicate their needs better. Patients receive the memory care in the comfort of their own surroundings.

Key Companies & Market Share Insights

Key players operating in the market are engaging in various strategic initiatives such as partnerships, acquisitions, expansions, and collaborations. For instance, in June 2022, SYNERGY HomeCare announced the launch of a new memory care program that combines specific training for caregivers, and engagement tools for family and clients' resources & support. In addition, according to the program, 70% dementia patients are expected to live at home, and nearly a third of those receiving in-home care have dementia. Some of the prominent players in the U.S. memory care market are:

-

Brookdale Senior Living

-

Sunrise Senior Living

-

Life Care Services

-

Five Star Senior Living

-

Atria Senior Living

-

Erickson Living

-

Kensington Park Senior Living

-

Masonicare

-

ProMedica Health System, Inc.

-

Azura Memory Care

-

Affinity Living Group

U.S. Memory Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.61 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Service, end-use

Country scope

U.S.

Key companies profiled

Brookdale Senior Living; Sunrise Senior Living; Life Care Services; Five Star Senior Living; Atria Senior Living; Erickson Living; Kensington Park Senior Living; Masonicare; ProMedica Health System, Inc.; Azura Memory Care; Affinity Living Group;

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Memory Care Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. memory care market report based on services and end-use:

-

Service Outlook (USD Million; 2017 - 2030)

-

Memory Exercise & Activity Services

-

Daily Reminder Services

-

Personal Assistance Safety Services

-

Dining Aids

-

Communication Services

-

Personal Safety Services

-

Others

-

-

End-use Outlook (USD Million; 2017 - 2030)

-

Long Term Care Centers

-

Home Care Settings

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. memory care market size accounted for USD 5.82 billion in 2022 and is anticipated to reach USD 6.09 billion in 2023.

b. The U.S. memory care market is expected to grow at a CAGR of 5.1% from 2023 to 2030 to reach USD 8.61 billion by 2030.

b. In 2022, the memory exercise & activity services segment accounted for the largest market share of 40.4% in terms of revenue share pertaining to the number of patients suffering from neurodegenerative diseases. These services offer support for the patients with different memory games, visually stimulating activities, small tasks, and community-based care activities.

b. Some of the key market players positively influencing the U.S. memory care market are Brookdale Senior Living, Sunrise Senior Living, Life Care Services, Five Star Senior Living, Atria Senior Living, Erickson Living ; among others.

b. The U.S. memory care market growth can be attributed to several factors including rapidly aging population, the increasing prevalence of dementia such as Alzheimer's disease and other forms, and the growing demand for specialized care facilities for elderly patients suffering from memory related ailments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.