- Home

- »

- Beauty & Personal Care

- »

-

U.S. Men’s Grooming Products Market, Industry Report, 2030GVR Report cover

![U.S. Men’s Grooming Products Market Size, Share & Trends Report]()

U.S. Men’s Grooming Products Market Size, Share & Trends Analysis Report By Product (Skin Care, Hair Styling, Shave/Beard Care), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-238-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

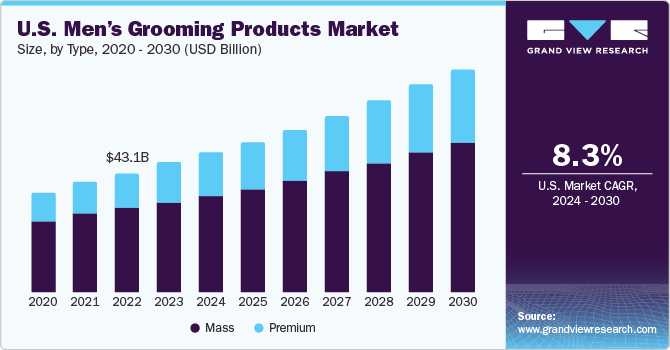

The U.S. men’s grooming products market size was estimated at USD 46.54 billion in 2023 and is expected to grow at a CAGR of 8.3% from 2024 to 2030. Increasing awareness among males regarding personal hygiene and natural grooming products, coupled with the growing numbers of start-ups in the natural, organic, and herbal space, is projected to fuel market growth throughout the forecast period. High spending capacity and growing demand for self-care among male population in the region is anticipated to create market growth opportunity.

U.S. market accounted for the share of 21.30% of the global men’s grooming products market revenue in 2023. The rapidly increasing number of appearance-conscious men and the growing adoption of grooming products among middle- and high-income individuals are factors supporting the sales of men’s grooming products in the region. The presence of established manufacturers such as Procter & Gamble and Unilever, along with the growing infrastructure for retailers, is expected to further support market growth.

American males have steadily increased their spending on personal care and cosmetic products over the past ten years. They are moving beyond traditional grooming options like shaving tools and beard care. Manufacturers in the region are securing investments to expand their product offerings and presence to leverage this emerging trend. For instance, Cleverman, a men's grooming start-up offering custom beard and hair color treatments, has secured USD 1.8 million in venture funding. The money would be used to increase brand awareness, expand e-commerce, and engage in research and product development.

The increasing awareness of health and wellness has prompted American men to pay more attention to skincare and grooming. Men in the U.S. are becoming increasingly open to experimenting with new and upcoming personal care products and globally recognized services. This trend is increasingly apparent in cities like New York, Los Angeles, and Miami, which are some of the largest markets for personal care services in the country. Several men in the country are opting for unique and high-quality grooming brands and do not mind paying a higher price for these products.

Market Concentration & Characteristics

The U.S. men’s grooming product market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Prospective manufacturers are likely to focus on product innovation to enter the men’s grooming products market. A powerful way to gain brand reputation is attractive website content. Social networking platforms play a crucial role in boosting brand awareness. Most new brands post skillfully- and attractively-crafted content regularly on their social media platforms to increase brand awareness among men.

Most manufacturers have been adopting cruelty-free production as a thumb rule. Customers have become increasingly aware of animal rights. Thus, manufacturers avoid sourcing as well as testing their products on animals. This has led to the increased popularity of natural, organic, herbal, and vegan grooming products. These products are also safe for the environment, and, thus, have been gaining more popularity.

End-user concentration is a significant factor in the U.S. men’s grooming products market. Over the past few years, there has been an increase in demand for men’s grooming products, especially skincare and haircare products, and this trend is expected to continue in the years to come.A rising number of male consumers are improving their knowledge of personal care, makeup, and cosmetics by following online influencers and celebrities.

Distribution Channel

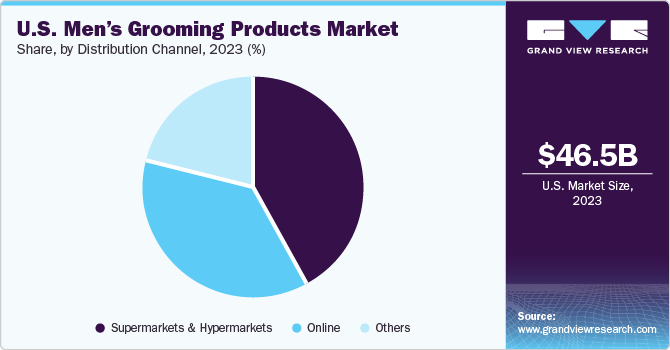

The men’s grooming product sales in the U.S. through supermarkets and hypermarkets accounted for a revenue share of 41.6% in 2023. The rapid growth of hypermarkets and departmental stores in the country has been encouraging beauty and hair care product manufacturers to distribute their products through these channels. Most offline stores selling grooming products have professional sales assistants who aid consumers regarding various attributes of different products, which helps men make informed purchase decisions. These factors are expected to drive the offline segment over the forecast period.

The online sales of men’s grooming product in the U.S. is projected to grow at a CAGR of 12.8% over the forecast period of 2024 to 2030. Diverse product offerings on the e-commerce platform are a key factor contributing to the growth of this segment. Furthermore, according to a 2022 survey titled ‘Men’s Attitudes on Beauty & Personal Care’ published in the Global Cosmetic Industry Magazine, 61% of men surveyed responded that they shop for personal grooming products from Amazon.

Product Insights

The U.S. men’s skin care products market accounted for a revenue share of 32.9% in 2023. Skincare products such as hydrating face and body moisturizers have higher penetration in the country. To cater to this consumer need, many manufacturers have been developing and innovating new products that can help retain the moisture of the skin and maintain skin health. Moreover, according to the American Society of Plastic Surgeons, "brotox", (Botox for men) a cosmetic procedure, has currently experienced a high demand among men, witnessing a 400% increase in treatments since 2000. This surge in popularity highlights the growing interest and acceptance of skin-related cosmetic procedures among males. This also emphasizes the increasing awareness regarding skin care among men. This is likely to drive the demand for skin products among males.

The men’s hair styling products market in the U.S. is projected to grow at a CAGR of 9.0% over the forecast period of 2024 to 2030. Men are now more open to experimenting with different hairstyles and looks, fueling the demand for hair styling products. According to a 2019 study published by contributors including Varun N., et al, nearly 81.9% of men in the U.S. use hair styling products. Among which, some of the most preferred hair styling products include wax, gels, sprays, and mousse. The use of hair styling products is particularly high among men in the age group of 18 to 29 in the U.S. Furthermore, the demand for hair care products has increased among men in the country due to the rising adoption of personal care products and the popularity of sporting a beard. According to a report published by the U.S. Department of Commerce in 2019, there has been a boom in barber shops and specialty stores catering specifically to men and their hair care needs. The use of hair grooming products has become quite popular among men due to the availability of affordable salon services.

Type Insights

The mass men’s grooming products market in the U.S. accounted for a revenue share of 71.0% in 2023. An increasing number of men are opting for personal and skincare products that go beyond shaving-related ones and deodorants. Thus, the acceptance of mass skincare products such as moisturizers, body lotions, face creams, and anti-aging creams for regular skincare routines is playing an important role in building a strong male consumer base.

The U.S. premium men’s grooming products market is projected to grow at a CAGR of 10.3% from 2024 to 2030. Premium and high-end brands have also been launching products catering to men’s skincare concerns. For instance, in June 2019, Giorgio Armani, a luxury and premium-end brand, ventured into the men’s personal care and grooming market by launching a three-piece skincare line for men, which includes face washes, toners, and moisturizers.

Key U.S. Men’s Grooming Products Company Insights

Some of the key players operating in the market Procter & Gamble (P&G), Colgate-Palmolive Company, and Unilever PLC

-

Procter & Gamble (P&G) is an American multinational company founded in 1837 and headquartered in Ohio, U.S. The company, along with its subsidiaries, manufactures and sells consumer products worldwide through 10 major segments: baby care, feminine care, fabric care, hair care, personal health, home care, oral care, family care, grooming, and skin & personal care.

-

Colgate-Palmolive Company Colgate-Palmolive Company was founded in 1806 and is headquartered in New York, U.S. The company manufactures, markets, distributes, and retails products in categories such as health care, household, personal care, and veterinary products.

Estee Lauder Companies, Inc., Coty Inc., andBaxter of California. are some of the other participants in the U.S. men’s grooming products market,

-

Coty Inc. was founded in 1904 and is headquartered in New York, U.S. The company is a manufacturer, designer, distributor, and retailer of fragrances, cosmetics, skincare, nail care, and hair care products. The company sells a wide range of products under 77 brands, which are segmented into Coty Luxury, Coty Consumer Beauty, and Coty Professionals.

-

Estee Lauder Companies, Inc. is a manufacturer, marketer, and distributor of skincare, makeup, fragrance, and hair care products. Its portfolio comprises renowned brands such as Aramis, Origins, M·A·C, Estée Lauder, Smashbox, KILIAN PARIS, Dr.Jart+, La Mer, Bobbi Brown Cosmetics, Jo Malone London, Lab Series, GLAMGLOW, Too Faced, Aveda, Bumble and bumble, TOM FORD, Le Labo, Clinique, Darphin Paris, Editions de Parfums Frédéric Malle, AERIN Beauty, NIOD, and The Ordinary.

Key U.S. Men’s Grooming Products Companies:

- Procter & Gamble (P&G)

- Colgate-Palmolive Company

- Unilever PLC

- Estee Lauder Companies, Inc.

- Coty Inc.

- Baxter of California

- Shiseido Co., Ltd.

- Beiersdorf AG.

- L'Oréal Groupe

- Reckitt Benckiser

Recent Developments

- In June 2023, Procter & Gamble's Old Spice brand launched its captivating "Smelf-Confidence" campaign through two ad spots inspired by musical theater during the Super Bowl LVII celebrations. The ads featured the debut of Swaggy Spice, the brand's very first Old Spice mascot, who made his first appearance during the opening night of Super Bowl LVII.

U.S. Men’s Grooming Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 50.35 billion

Revenue forecast in 2030

USD 81.05 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, type

Country scope

U.S.

Key companies profiled

Procter & Gamble (P&G); Colgate-Palmolive Company; Unilever PLC; Estee Lauder Companies, Inc.; Coty Inc.; Baxter of California; Shiseido Co., Ltd.; Beiersdorf AG.; L'Oréal Groupe; Reckitt Benckiser

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Men’s Grooming Products Market Report Segmentation

This report forecasts growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. men’s grooming products market report based on product, distribution channel, and type:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skin Care

-

Hair Styling

-

Shave/Beard Care

-

Accessories

-

Color Cosmetics

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Online

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass

-

Premium

-

Frequently Asked Questions About This Report

b. Skin care products dominated the U.S. men's grooming products market with a share of around 33% in 2023. The surge in popularity of skin care and the growing awareness, interest, and acceptance of skin-related cosmetic products among males is driving the demand for skin products among males.

b. Some of the key players operating in the U.S. men's grooming products market include Procter & Gamble (P&G); Colgate-Palmolive Company; Unilever PLC; Estee Lauder Companies, Inc.; Coty Inc.; Baxter of California; Shiseido Co., Ltd.; Beiersdorf AG.; L'Oréal Groupe; Reckitt Benckiser

b. Increasing awareness among males regarding personal hygiene and natural grooming products, coupled with the growing numbers of start-ups in the natural, organic, and herbal space, is projected to fuel market growth throughout the forecast period.

b. The U.S. men's grooming products market was estimated at USD 46.54 billion in 2023 and is expected to reach USD 50.35 billion in 2024.

b. The U.S. men's grooming products market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 81.05 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."