- Home

- »

- Medical Devices

- »

-

U.S. Mental Health and Addiction Treatment Centers MarketGVR Report cover

![U.S. Mental Health And Addiction Treatment Centers Market Size, Share & Trends Report]()

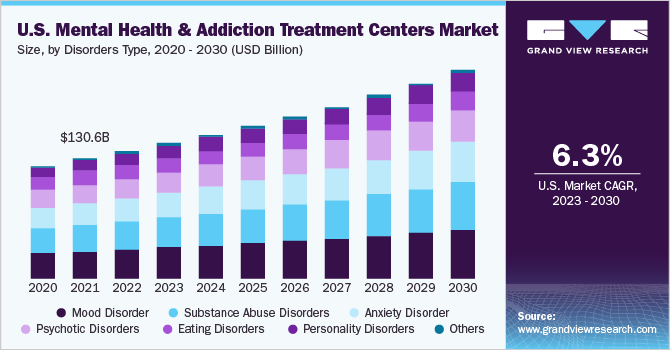

U.S. Mental Health And Addiction Treatment Centers Market Size, Share & Trends Analysis Report By Disorder Type (Mood Disorder, Anxiety Disorder, Psychotic Disorders), By Treatment Centers, By Age Group, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-080-8

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The U.S. mental health and addiction treatment centers market size was valued at USD 138.45 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. One of the primary driving factors for the growth of the U.S. mental health and addiction treatment centers market is the increasing prevalence of mental health and substance use disorders. As per the Substance Abuse and Mental Health Services Administration (SAMHSA), around 25% of Americans suffer from mental or substance use disorders and around 1 in 5 Americans experience mental illness, and 1 out of 12 Americans have a substance use disorder. Moreover, the rising prevalence of addiction and substance use disorders is also contributing to the growth of the market.

The rising prevalence of mental health disorders in the U.S. is a concerning trend that has been attributed to several factors including societal pressures, increasing rates of substance abuse, and the impact of technology and social media on mental health. These factors have contributed to an increase in anxiety, depression, and other mental disorders, leading to a significant rise in demand for mental health services.

The COVID-19 pandemic had a significant impact on mental health globally, leading to increased stress, anxiety, and depression due to lockdowns, economic instability, and overall well-being concerns. Disrupted daily routines, increased social isolation, and heightened financial and job-related stressors contributed to a rise in mental disorders. The WHO's World Mental Health Report revealed a 25% increase in depression and anxiety cases in the first year of the pandemic, bringing the total number of people with mental disorders close to 1 billion.

The pandemic has also highlighted the importance of behavioral health, leading to increased awareness and acceptance of behavioral health concerns. There has been a greater emphasis on providing behavioral health support and resources, such as teletherapy and online behavioral health services. According to a survey by the National Council for Behavioral Health, nearly 90% of mental health and addiction care providers in the U.S. reported using telehealth to deliver assistance during the pandemic.

Market players are investing in expanding their operations, developing new facilities, and enhancing their service offerings to meet the growing demand for mental and addiction treatment services. Acadia Healthcare, Universal Health Services, and Behavioral Health Group are major players that have announced plans to expand their operations and invest in new facilities in 2023. This investment is aimed at increasing access to mental and addiction care offerings and improving patient outcomes. In February 2023, Lehigh Valley Health Network (LVHN) and Universal Health Services (UHS) announced a joint venture to construct a new 144-bed behavioral health hospital in Hanover Township, Pennsylvania. The facility will be located across from the LVH-Muhlenberg campus and is intended to cater to the growing demand for high-quality behavioral healthcare offerings for seniors, adults, and adolescents.

Disorder Insights

By disorder, the mood disorder segment held the largest share of 23.7% in 2022.Mood disorders are a prevalent mental illness that impacts an individual's persistent emotional state and can be classified as affective disorders.According to the National Institute of Mental Health, it is estimated that 21.4% of U.S. adults experience a mood disorder at some point in their lives. Moreover, the segment growth is being driven by increasing awareness and diagnosis of mood disorders, advances in treatment methods such as cognitive-behavioral therapy and medication management, and greater insurance coverage for behavioral disorders treatment through the Affordable Care Act. These driving factors have led to a greater demand for specialized care centers for mood disorders during the forecast period.

Furthermore, the anxiety disorder segment is anticipated to grow at the fastest rate over the forecast period. Anxiety disorders are the most common mental illness in the U.S. According to data from the Anxiety and Depression Association of America, anxiety disorders impact 6.8 million adults and over 31.9% of adolescents aged between 13 and 18 years old in 2021. These statistics emphasize the significant impact of anxiety disorders on both age groups in the U.S. and highlight the need for effective treatment and support for affected individuals. Furthermore, the COVID-19 pandemic has heightened anxiety and stress levels, creating an uptick in demand for anxiety disorder treatment and support, thereby driving the segment's growth.

Treatment Centers Insights

By services, the outpatient treatment centers segment held the largest share of 42.0% in 2022. The segment is also expected to exhibit the highest CAGR during the forecast period. The demand for outpatient treatment centers has been on the rise in recent years due to the increasing prevalence of behavioral disorders and addiction issues in the U.S. According to the National Institute on Drug Misuse, there are over 14,500 drug abuse and addiction treatment facilities in the U.S., with outpatient treatment being a common option. Outpatient programs provide structured care to those struggling with addiction while enabling them to maintain social and professional responsibilities. Studies have shown that outpatient treatment can significantly increase the likelihood of long-term recovery for individuals with behavioral disorders.

The rising demand for outpatient mental health services has created an opportunity for providers, who are now expanding their services and introducing new and innovative approaches to treatment For instance, in April 2023 Hanley Center a behavioral health center launched a Mental Health Intensive Outpatient Program (IOP) to address the pressing need for outpatient services for people with mental disorders.

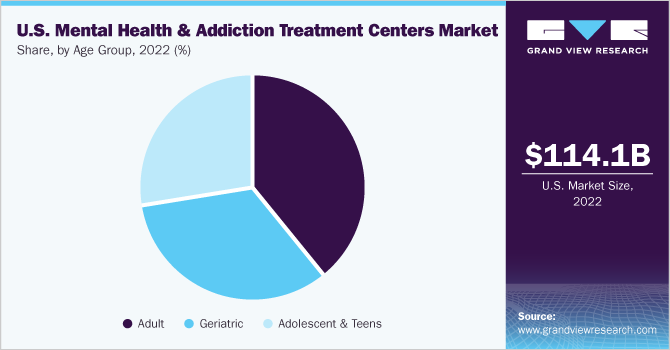

Age Group Insights

In 2022, the adult age group segment held the largest share of 39.6%. As per the National Institute on Drug Abuse, individuals above the age of 18 are more susceptible to mental and addiction disorders compared to younger age groups. This is mainly attributed to the various life stressors that come with aging, such as changes in relationships, financial strain, and physical well-being concerns. As a result, there is a growing need for accessible and effective behavioral and addiction treatment offerings that can address the unique needs of this demographic.

The adolescent & teens segment is anticipated to grow at the fastest rate over the forecast period. As per data from the National Institute of Mental Health (NIMH), around 20% of adolescents between the ages of 13 and 18 in the U.S. experience a severe mental disorder at some point during their lives. Governments are investing in mental and addiction treatment services to meet the growing demand for these services. In March 2023, the Health Resources and Services Administration (HRSA), under the U.S. Department of Health and Human Services (HHS), announced the availability of USD 25 million for the expansion of primary health care, including behavioral healthcare services, in schools. Currently, HRSA-funded health centers are operating over 3,400 school-based service sites across the U.S.

Key Companies & Market Share Insights

Market players are undertaking strategies such as mergers & acquisitions, regional expansion, and novel product development to increase market penetration. For instance, in February 2023, Acadia Healthcare formed a strategic partnership with the UNC Center for the Business of Health to provide support to communities affected by the opioid epidemic in the U.S. The collaboration between Acadia Healthcare and UNC Center for the Business of Health is a strategic move to leverage their collective knowledge and expertise in addressing the opioid epidemic. Some of the key players operating in the U.S. mental health and addiction treatment centers market include:

-

Acadia Healthcare

-

Behavioral Health Network, Inc. (BHN)

-

Promises Behavioral Health

-

Pyramid Healthcare Inc

-

Haven Corporate

-

Universal Health Services, Inc. (UHS)

-

Aware Recovery Care.

-

CareTech Holdings Plc

-

American Addiction Centers

U.S. Mental Health And Addiction Treatment Centers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 146.81 billion

Revenue forecast in 2030

USD 225.23 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million & CAGR from 2023 to 2030

Country scope

U.S.

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Disorder, treatment centers, age group

Key companies profiled

Acadia Healthcare; Behavioral Health Network, Inc. (BHN); Promises Behavioral Health; Pyramid Healthcare Inc; Haven Corporate; Universal Health Services, Inc. (UHS); Aware Recovery Care.; CareTech Holdings Plc; American Addiction Centers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mental Health And Addiction Treatment Centers Market Report Segmentation

This report forecasts revenue growth at regional level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mental health and addiction treatment centers market on the basis of disorder, treatment centers, age group:

-

Disorder Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Mood Disorder

-

Substance Abuse Disorders

-

Anxiety Disorder

-

Psychotic Disorders

-

Eating Disorders

-

Personality Disorders

-

Others

-

-

Treatment Centers Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Outpatient Treatment Centers

-

Inpatient Treatment Centers

-

Residential Treatment Centers

-

Other Treatment Options

-

-

Age Group Outlook (Revenue, USD Million; 2017 - 2030)

-

Adult

-

Geriatric

-

Adolescent & Teens

-

Frequently Asked Questions About This Report

b. The U.S. mental health and addiction treatment centers market was estimated at USD 138.45 billion in 2022 and is expected to reach USD 146.81 billion in 2023.

b. The mood disorder segment accounted for 23.7% of revenue share in 2022. The segment growth is driven by increasing awareness and diagnosis of mood disorders, advances in treatment methods such as cognitive-behavioral therapy and medication management, and greater insurance coverage for behavioral disorders treatment through the Affordable Care Act.

b. • The outpatient treatment centers segment held the largest share in 2022 and is expected to exhibit the highest CAGR during the forecast period. The rise in demand for outpatient treatment centers can be attributed to the increasing prevalence of behavioral disorders. The U.S. Outpatient programs offer structured care while allowing patients to maintain social and professional responsibilities. Research has indicated that outpatient treatment significantly improves the chances of long-term recovery for individuals with behavioral disorders.

b. The rising prevalence of addiction and substance use disorders is contributing to the growth of the market.

b. Some of the key market players operating in the market are Acadia Healthcare; Behavioral Health Network, Inc. (BHN); Promises Behavioral Health; Pyramid Healthcare Inc; Haven Corporate; Universal Health Services, Inc. (UHS); Aware Recovery Care.; and CareTech Holdings Plc American Addiction Centers; among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."