- Home

- »

- Animal Health

- »

-

U.S. Military Animals Market Size, Industry Report, 2030GVR Report cover

![U.S. Military Animals Market Size, Share & Trends Report]()

U.S. Military Animals Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Service Type (Casualty, Sentry, Narcotic Detection), By Sector (Army, Navy, Marine, Air Force), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-096-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Military Animals Market Size & Trends

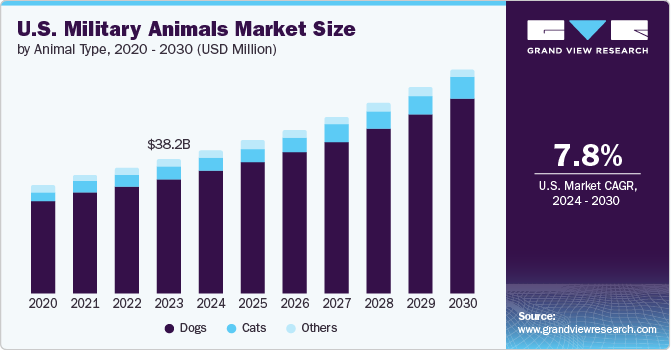

The U.S. military animals market size was estimated at USD 38.18 million in 2023 and is estimated to grow at a CAGR of 7.8% from 2024 to 2030. Key factors driving the market growth include the rising internal and external security challenges, as well as the rising demand for military working dogs and increasing expenditure on these animals. The American military utilizes dogs across all branches. Furthermore, dogs have been used in battle since ancient times. Their applications include everything from battle training to serving as sentinels, scouts, compassion dogs, couriers, and trackers, and some of these roles still exist in the current military.

Unlike in the past, when a dog was only used as a weapon, troops now consider Military Working Dogs as fellow warriors who deserve the same amount of care and medical attention as their human counterparts. Moreover, military working dogs are frequently employed to patrol and look for illicit such as explosives, drugs, or other items. They can identify hidden objects more successfully than their human counterparts due to their keen sense of smell.

The impact of the COVID-19 pandemic in 2020 placed tremendous pressure on the world's healthcare systems, governments, and societies. The pandemic crisis exposed various flaws in the current emergency response mechanisms by catching a number of nations off guard on the international stage. Most training and international travel ended, recruiting moved online, and some deployments were postponed due to the pandemic. However, more importantly, the pandemic caused certain permanent modifications to military protocols and operations, and some of the measures the Defence Department implemented to battle COVID-19 will have an ongoing or permanent impact on how the force functions.

In addition, according to the U.S. Army Medical Center of Excellence, on April 19, 2023, the U.S. Army Material Development Agency conducted a test of a veterinary anesthesia device for the U.S. Army Medical Test and Evaluation Activity. The test was carried out at Lackland Air Force Base in Texas' Holland Military Working Dog Hospital. The Texas-based Fort Cavazos 43rd Medical Detachment Veterinary Service Support members attended the test. The operational assessment aimed to evaluate the utility and efficacy of the veterinary anesthesia apparatus system for military working dogs by staging genuine anesthesia-related activities in a training and operational setting.

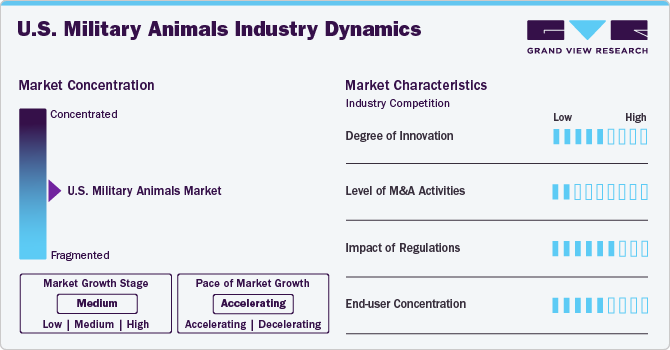

Market Concentration & Characteristics

The market exhibits moderate concentration. The growth stage is medium, and the pace of growth is accelerating. One major factor propelling market growth is technological advancements. Integrating technology with animals, such as wearable sensors for monitoring health and behavior, enhances their utility and appeal in military operations. Moreover, technological innovations such as communication devices and wearable technology improve the capabilities of military animals. For instance, dogs equipped with cameras and microphones can provide real-time intelligence to their handlers.

The market demonstrates a moderate degree of innovation. Innovations in military working dogs (MWDs) have significantly enhanced their effectiveness and safety in various operations. Some notable advancements include advanced training techniques, which consist of positive reinforcement and reward-based training methods to improve learning and performance. Moreover, simulation-based training environments better prepare dogs for real-world scenarios.

Within the market, there exists a low level of mergers and acquisitions activity, indicative of ongoing consolidation, strategic acquisitions, and partnerships among industry players. For instance, in July 2024, Pond & Company, an industry leader in technology, architectural, planning, and construction management services, acquired Trident, a Texas-based rust and integrity company that was formerly a member of Consolidated Asset Management Services.

The market experiences a moderate to high impact of regulations. In many countries, military animals are granted legal protections that make it a criminal offense to harm or mistreat them. These laws recognize the valuable service military animals provide and aim to ensure their protection. Military animals, including dogs, horses, and other species, undergo rigorous training to perform specific tasks. They are trained in areas such as detection, tracking, patrolling, and search and rescue. Certification programs ensure that these animals meet the required standards for their roles.

The end users of military animals are typically various branches of the military and related defense organizations. These animals are trained and deployed for a variety of roles, including detection dogs, patrol and attack dogs, search and rescue dogs, service and therapy animals, and homing pigeons. Each military branch may have specific units and programs dedicated to training, caring for, and deploying these animals, leveraging their unique abilities to enhance operational effectiveness.

Animal Type Insights

The dogs segment dominated the market in 2023 and is expected to witness a lucrative CAGR during the forecast period. Dogs have served in the military for hundreds of years. They have recently been trained in communications, such as carrying messages in battle or pulling telephone wires from one site to another. Military dogs are also used to find and follow fugitives and enemy soldiers. Scout dogs are taught to quietly discover explosive devices and hidden enemies like snipers using their excellent senses of smell and hearing. Dogs are excellent at searching military bases or camps for trespassers.

In terms of dog breeds, German Shepherds dominated the dog segment market. Some dog breeds are not appropriate for these kinds of roles. For instance, a Chihuahua is simply too small to perform some jobs. Due to their loyalty, obedience, loving nature, and potent bite, the German Shepherd, Belgian Malinois, and Retriever breeds are currently the most frequently utilized in the military. In addition, they must be physically fit with no physical constraints.

Service Type Insights

Based on service type, the scout/patrol search segment dominated the market in 2023. Similar to sentry dogs, dogs are trained for patrol searches, with the exception that silence is essential for this job. These dogs have been taught to find snipers and ambushes stealthily. Not many dogs are suitable for this extremely important job; these dogs must be intelligent and have a calm demeanor. They are normally well in front of the lines, off-leash, and away from their handlers. They signal their handlers by tightening their stance or by flicking an ear.

Sentry is expected to witness a lucrative CAGR during the forecast period. These dogs have been taught to growl or bark to alert troops to any impending danger. This is useful at night when visibility is constrained. In addition, they keep watch over supply depots, airports, and any other crucial locations or storage facilities. They are also reportedly used by the Coast Guard to identify enemy submarines.

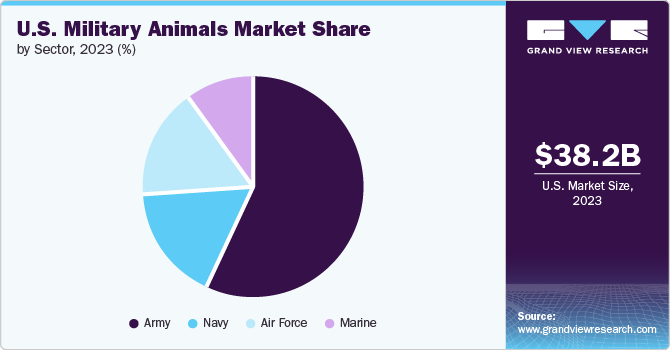

Sector Insights

By sector, the army dominated the market in 2023 and is expected to witness a lucrative CAGR during the forecast period. The Army is responsible for defending the United States' land mass, territories, commonwealths, and possessions. It accomplishes this by supplying the necessary forces and tools for long-lasting stability and military operations on land. The Army also assists other branches with logistics and assistance. The Army is the biggest and most established branch of the military.

The U.S. Armed Forces are regarded as having the strongest military in the world. Due to their enormous budget, the U.S. Armed Forces have significant defense and power projection capabilities, which has led to the development of powerful technology that enables the force to be widely deployed throughout the world, including at about 800 military bases outside of the United States.

Key U.S. Military Animals Company Insights

Due to the existence of organizations offering training and support to military working dogs, the market is competitive. Working dogs with the proper training may find drugs, bombs, people buried beneath debris, smuggled food, pipeline leaks, and game animals. A worldwide increase in demand is being caused by their adaptability, particularly for security reasons. Organizations are thus growing in competition with foreign governments and one another when it comes to hiring their services. For instance, the woman-owned small business (WOSB) ExcelsiorK9 provides working dogs and obedience training.

Key U.S. Military Animals Companies:

- Pond & Company

- Shultz K9 Enforcement Inc

- K9 Partners for Patriots

- ExcelsiorK9

- TWG Group

- Us K9 Unlimited

- Worldwide Canine

- Cobra Canine

- K2 Solutions, Inc

U.S. Military Animals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.67 million

Revenue forecast in 2030

USD 63.80 million

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, sector, service type

Key companies profiled

Pond & Company; Shultz K9 Enforcement Inc; K9 Partners for Patriots; ExcelsiorK9; TWG Group; Us K9 Unlimited; Worldwide Canine; Cobra Canine; K2 Solutions, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Military Animals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. military animals market based on animal type, service type, and sector:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

German Shepherds

-

Belgian Malinois

-

Retrievers

-

Others

-

-

Cats

-

Others

-

-

By Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Scout/Patrol Search

-

Sentry

-

Casualty

-

Explosive Detection

-

Narcotic Detection

-

Others

-

-

By Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Army

-

Air Force

-

Marine

-

Navy

-

Frequently Asked Questions About This Report

b. The U.S. military animals market size was estimated at USD 38.18 million in 2023 and is expected to reach USD 40.67 million in 2024.

b. The U.S. military animals market is expected to grow at a compound annual growth rate of 7.79% from 2024 to 2030 to reach USD 63.80 million by 2030.

b. Dogs dominated the U.S. military animals market with a share of 85.71% in 2023. This is attributable to dogs who have served in the military for hundreds of years. They have recently been trained in communications, such as carrying messages in battle or pulling telephone wires from one site to another.

b. Some key players operating in the U.S. military animals market include Pond & Company; Shultz K9 Enforcement Inc; K9 Partners for Patriots; ExcelsiorK9; TWG Group; Us K9 Unlimited; Worldwide Canine; Cobra Canine; K2 Solutions, Inc.

b. Key factors that are driving the U.S. military animals market growth include the rising internal and external security challenges, the rising demand for military working dogs, and increasing expenditure on these animals

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."