- Home

- »

- Medical Imaging

- »

-

U.S. Mobile MRI Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Mobile MRI Services Market Size, Share & Trends Report]()

U.S. Mobile MRI Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Neurological, Cardiovascular), By End Use (Hospitals, Imaging Centers), And Segment Forecasts

- Report ID: GVR-4-68040-026-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mobile MRI Services Market Trends

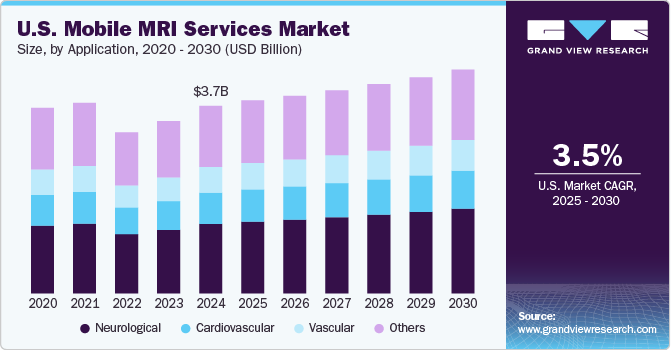

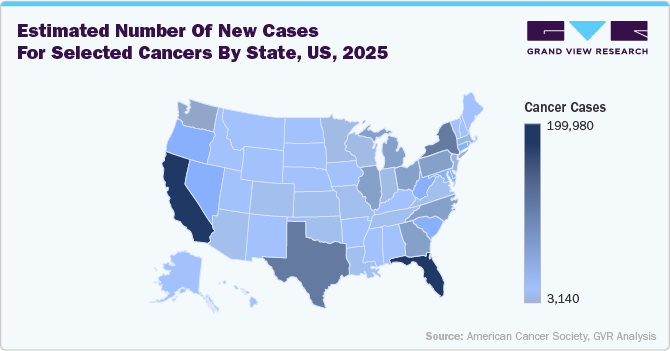

The U.S. mobile MRI services market size was estimated at USD 3.67 billion in 2024 and is projected to grow at a CAGR of 3.52% from 2025 to 2030. The major factors attributed to the growth include the better convenience and cost-effectiveness offered by mobile MRI services compared to other traditional imaging equipment. Moreover, the increasing prevalence of chronic diseases such as cancer, neurological disorders, and cardiovascular diseases further drives the market growth in the country. For instance, according to the American Cancer Society, approximately 2,041,910 new cancer cases are projected in the U.S. in 2025, with an estimated 618,120 cancer-related deaths.

In addition, the U.S. is witnessing rapid aging of its population, which is driving the growth of mobile MRI services. Older adults face a higher risk of chronic illnesses and health issues associated with aging, necessitating frequent diagnostic imaging for early identification and continuous monitoring. The Population Reference Bureau (PRB) projects that the number of people aged 65 and over in the U.S. will rise from 58 million in 2022 to 82 million by 2050, a 47% increase. Over the same timeframe, this age group’s proportion of the total population is anticipated to grow from 17% to 23%. This senior demographic is particularly susceptible to various diseases, thereby increasing the demand for MRI services across the nation, which is propelling market growth.

The expansion of MRI service providers in the U.S. is playing a crucial role in addressing the diagnostic imaging needs of underserved communities, particularly in rural and low-income urban areas where access to advanced imaging has historically been limited. As hospitals and clinics in these regions often lack financial resources or patient volume to justify the purchase of fixed MRI systems, mobile MRI providers are addressing this demand by offering flexible, rotating services that bring high-quality imaging directly to patients’ doorsteps. For instance, in May 2025, Seven Corners Healthcare launched mobile MRI services to significantly enhance medical access for patients residing in rural and underserved communities. This initiative aims to bring essential diagnostic imaging capabilities directly to areas where traditional healthcare facilities and specialized equipment are limited, addressing disparities in healthcare availability and improving patient outcomes by reducing travel burdens. Such initiatives by healthcare providers improve access to essential services and also help reduce wait times, travel burdens, and health disparities, making them a critical component of the evolving U.S. healthcare landscape.

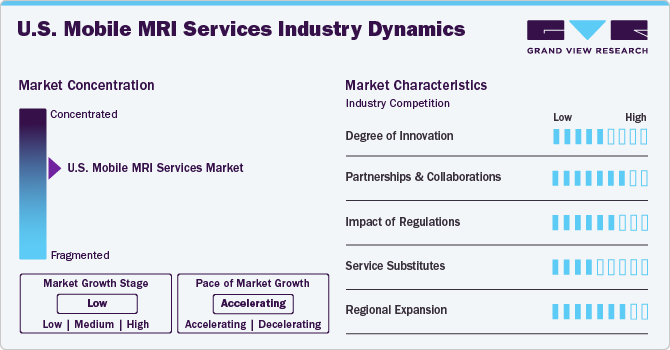

Market Concentration & Characteristics

The industry growth stage is low to moderate, and the pace of growth is accelerating. The U.S. mobile MRI services industry is characterized by a low-to-moderate degree of growth. Key driving factors include the increasing prevalence of chronic diseases, demand for cost-effective and convenient imaging solutions, technological advancements in MRI equipment, the growing aging population requiring frequent diagnostics, and the rising preference for home healthcare services that enhance patient accessibility and satisfaction.

The degree of innovation in the U.S. mobile MRI services industry constantly evolves as new technologies are developed and adopted. The industry has seen significant growth in recent years due to the increasing demand for diagnostic imaging services and the implementation of advanced imaging technologies. For instance, in September 2024, Nicklaus Children's Hospital unveiled the first mobile MRI unit specifically designed for pediatric patients at its West Kendall location. This innovative technology aims to enhance access to advanced imaging services for children, particularly those with special needs or anxiety about traditional MRI environments. The mobile unit is equipped with state-of-the-art features to ensure comfort and safety, allowing for quicker and more efficient diagnoses. This initiative reflects the hospital's commitment to improving healthcare delivery for young patients in the community.

The U.S. mobile MRI services industry has seen a significant increase in partnerships and collaborations, driven by the need for cost-effective imaging solutions and improved patient access to diagnostic services. Key players are forming strategic alliances with hospitals, outpatient centers, and diagnostic imaging facilities to expand their service offerings and geographic reach. In addition, collaborations with technology firms are becoming more prevalent as mobile MRI providers seek to integrate advanced imaging technologies and artificial intelligence into their operations. For instance, in November 2024, Shared Medical Services and Nebraska Medicine announced a collaboration to deploy Philips' helium-free MRI imaging technology. This initiative aims to enhance patient care by providing advanced imaging solutions while addressing environmental concerns associated with traditional helium-based systems. The new MRI systems will improve efficiency and reliability, benefiting healthcare providers and patients.

The U.S. mobile MRI services industry is significantly influenced by regulatory frameworks that govern healthcare delivery and medical imaging practices. Regulations such as the Medicare Improvements for Patients and Providers Act (MIPPA) and state-specific licensure requirements impose stringent operational standards, affecting service accessibility and cost structures. Compliance with these regulations often necessitates substantial investments in technology and training, which can limit market entry for smaller providers. In addition, reimbursement policies set by Medicare and private insurers dictate the financial viability of mobile MRI services, influencing pricing strategies and service offerings.

The U.S. mobile MRI services industry faces a moderate threat of substitution, primarily from expanded capacity and technological advancements within fixed-site MRI facilities. As hospitals and imaging centers invest in newer, faster, and higher-field strength permanent units, their ability to handle patient volume increases, potentially reducing the reliance on mobile units for overflow or temporary needs. However, the core value of mobile MRI is to provide flexible, on-demand access, especially in underserved rural areas or during facility renovations, which increases its demand in the country.

The U.S. mobile MRI services industry is witnessing significant regional expansion driven by increasing demand for diagnostic imaging, particularly in underserved areas. Rural populations are seeing a surge in mobile MRI units to enhance access to healthcare services. In addition, partnerships between hospitals and mobile service providers are becoming more prevalent, enabling facilities to offer MRI services without the substantial capital investment required for fixed installations. For instance, in August 2024, Northeast Missouri Health Council (NMHC) announced the addition of mobile MRI services through a partnership with Shared Medical Services. This initiative brings advanced diagnostic imaging directly to rural communities, improving access to care and reducing patient travel. The mobile unit at Northeast Regional Medical Center offers state-of-the-art MRI technology on designated days.

Application Insights

The neurological segment held the largest market share of 37.33% in 2024 and is projected to grow at the fastest CAGR over the forecast period. MRI remains the leading modality for examining the brain and diagnosing neurological conditions such as brain tumors. In addition, the rising incidence of neurological disorders is anticipated to drive the demand for these devices during the forecast period. For example, a ScienceDirect article estimates that over 12 million Americans may suffer from neurodegenerative diseases by 2050 without new treatments. MRI is the preferred tool for neurological imaging, so the segment is expected to witness notable growth in the coming years.

The cardiovascular segment is also expected to experience significant growth during the forecast period, driven by the rising prevalence of cardiac conditions, including heart valve disorders, arrhythmia, stroke, and heart attack. For example, according to the CDC, cardiovascular disease remains a leading cause of death, with one person dying from it approximately every 33 seconds. In the year 2022 alone, heart disease was responsible for 702,880 deaths, representing the equivalent of 1 in every five deaths recorded that year. The growing prevalence fuels the demand for mobile MRI systems to provide improved diagnostic and treatment services directly at patients’ locations.

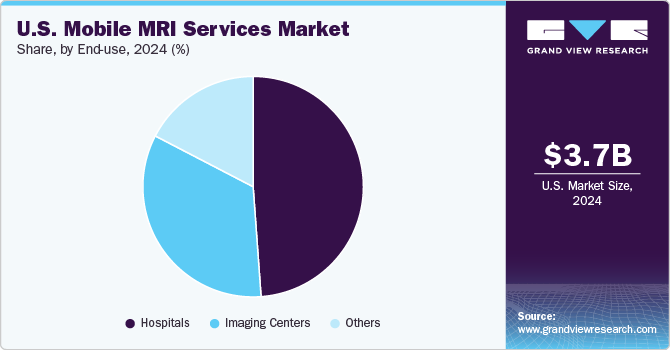

End Use Insights

The hospital segment dominated the market in 2024, accounting for the largest revenue share. This segment is also projected to experience the fastest growth over the forecast period. Hospitals are increasingly adopting mobile imaging services primarily because these services help save valuable space within facilities, reducing the need for significant initial infrastructure investment. Furthermore, mobile MRI units offer a valuable temporary imaging solution for hospitals. This temporary utility is particularly beneficial during periods of new building construction, when existing fixed units are undergoing repair or maintenance, or when a hospital is evaluating the potential long-term utility of installing a fixed unit. These factors are expected to drive market growth within the hospital segment.

The imaging centers’ segment is expected to experience a notable CAGR during the forecast period. These centers offer various imaging services at a single location, utilizing multiple modalities. Hospitals that do not have adequate space for dedicated MRI rooms can greatly benefit from these facilities, which also extend their services to several hospitals. However, managing patient volume at these centers can be quite challenging. Still, the increasing prevalence of mobile MRI units allows more patients in specific geographic areas to access MR diagnostic services.

Key U.S. Mobile MRI Services Company Insights

The U.S. mobile MRI services industry is highly competitive and has several key players. The major market players are focused on expanding geographical presence, forming partnerships to enhance imaging services and patient care, taking advantage of important cooperation activities, and exploring mergers & acquisitions.

Key U.S. Mobile MRI Services Companies:

- RAYUS Radiology

- Shared Medical Services

- DMS Health

- KMG

- Front Range Mobile Imaging, Inc.

- Meridian Group International

- INTERIM DIAGNOSTIC IMAGING, LLC

- Akumin Inc.

- RadNet, Inc.

- Probo Medical

Recent Development

-

In March 2025, Wake Radiology launched its newest mobile MRI unit, enhancing access to advanced imaging services across the Triangle area. This state-of-the-art unit brings cutting-edge technology directly to local communities, improving convenience and patient care. Designed for flexibility and efficiency, the mobile MRI serves multiple locations, expanding Wake Radiology’s ability to meet growing demand.

-

In March 2025, Stillwater Billings Clinic launched local MRI services, reducing the need for patients to travel for imaging. The mobile unit will operate bi-weekly, providing essential scans without radiation. This initiative aims to enhance healthcare accessibility and reduce waiting times for residents in the area.

-

In August 2024, Prenuvo launched its first-ever mobile MRI clinic, offering 60-minute whole-body MRI scans to expand access to preventive health screening across more communities. The mobile unit delivers the same advanced imaging technology as Prenuvo’s clinics, aiming to improve early disease detection and health outcomes by making MRI scans more convenient and accessible to people nationwide.

U.S. Mobile MRI Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.8 billion

Revenue forecast in 2030

USD 4.5 billion

Growth rate

CAGR of 3.52% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use

Key companies profiled

RAYUS Radiology; Shared Medical Services; DMS Health; KMG; Front Range Mobile Imaging, Inc.; Meridian Group International; INTERIM DIAGNOSTIC IMAGING, LLC; Akumin Inc.; RadNet, Inc.; Probo Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mobile MRI Services Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mobile MRI services market report based on application and end use:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Neurological

-

Cardiovascular

-

Vascular

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Imaging centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mobile MRI services market size was estimated at USD 3.67 billion in 2024 and is expected to reach USD 3.78 billion in 2025.

b. The U.S. mobile MRI services market is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2030 to reach USD 4.5 billion by 2030.

b. The neurological segment dominated the U.S. mobile MRI services application market with a share of 37.33% in 2024. This is attributable to the growing prevalence of neurological disorders.

b. Some key players operating in the U.S. mobile MRI services market include RAYUS Radiology; Shared Medical Services; DMS Health; KMG; Front Range Mobile Imaging, Inc.; Meridian Group International, INTERIM DIAGNOSTIC IMAGING, LLC; Akumin Inc.; RadNet, Inc.; and Probo Medical

b. Key factors that are driving the U.S. mobile MRI services market growth include convenience and cost-effectiveness of mobile MRI services compared to traditional imaging equipment, increasing patient awareness, and increasing prevalence of chronic disorders such as cancer, cardiovascular, and neurological conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.