U.S. N95 Masks Market Size & Trends

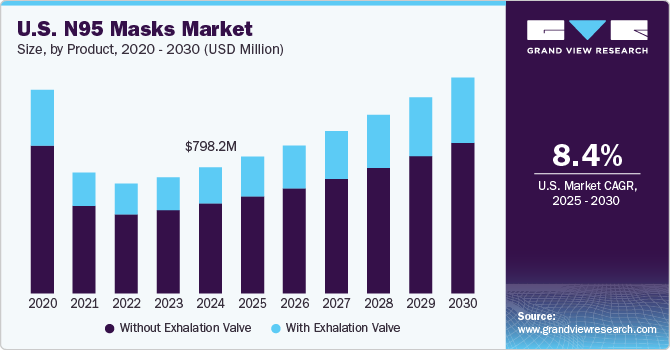

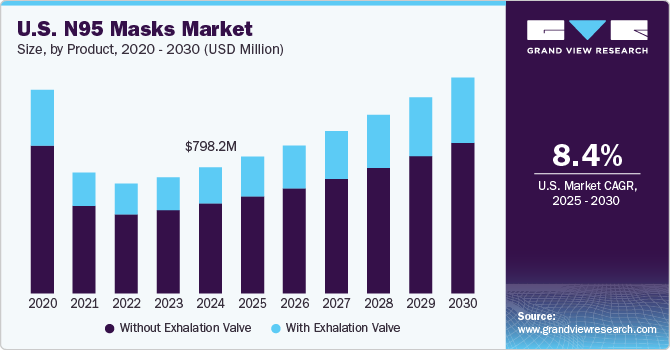

The U.S. N95 masks market size was estimated at USD 798.2 million in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. Increased demand for masks and respirators during the COVID-19 pandemic and stringent respiratory safety norms in the construction and manufacturing sectors boosted the industry’s growth. The outbreak of the COVID-19 pandemic was a major driver, increasing the demand for N95 masks in the country.

The global rise in infectious diseases increased the demand for effective personal protective equipment (PPE) such as N95 masks. This trend was driven not only by the COVID-19 pandemic but also by the prevalence of other respiratory illnesses that require protective measures. Increasing health awareness among the elderly population has led to greater use of masks as a precaution against viral infections. Heightened consumer vigilance regarding airborne contaminants has significantly driven the demand for these masks, particularly for personal use.

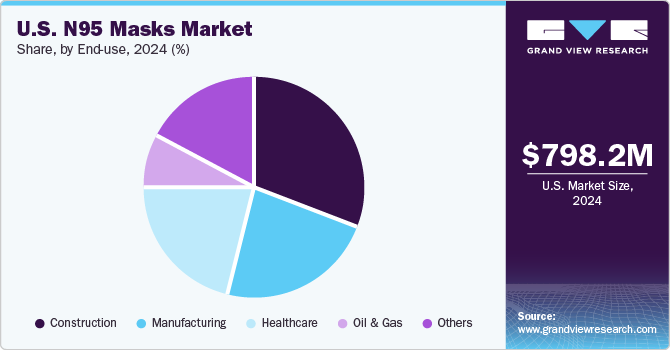

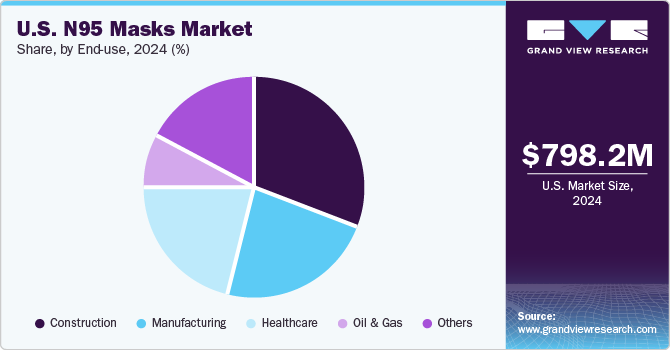

The major end-use sectors for N95 masks include pharmaceuticals, construction, manufacturing, food processing, and wildfire response. N95 respirators are vital in healthcare to protect medical staff from infectious diseases, especially during aerosol-generating procedures. In construction, they safeguard workers from dust and particulates during tasks such as sanding and demolition. Food processing employees wear them to prevent airborne contamination, while during wildfires, they offer crucial protection against smoke and particulate exposure.

Product Insights

The N95 mask without an exhalation valve led the U.S. market and accounted for a revenue share of 71.44% in 2024 due to its closer facial fit. Health ministries across the U.S. promote the use of such masks, as they provide additional inhaling protection and prevent the spread of infection from an individual to the community. These masks filter at least 95% of airborne particles, including droplets and aerosols, making them effective against infections and particulate matter. In healthcare settings, they are worn by professionals to prevent the spread of airborne diseases, particularly during aerosol-generating procedures.

The N95 mask with an exhalation valve is expected to grow at the fastest CAGR of 9.5% over the forecast period, as they help the wearer filter out impurities while inhaling and prevent the uncomfortable accumulation of heat and carbon dioxide in the masks, increasing the wearer's comfort level. N95 masks with an exhalation valve are non-oil masks used in non-oil environments. They can filter about 95 percent of particles with a minimum size of 0.3 microns, including fumes, mist, and dust. These masks contain a connected exhalation valve that reduces exhalation resistance, making breathing easier for personnel wearing the mask.

Distribution Channel Insights

The online sector dominated the U.S. N95 masks market and accounted for a revenue share of 51.39% in 2024. During health crises such as the COVID-19 pandemic, online platforms facilitated bulk buying, reaching a broader audience and meeting urgent demand. Additionally, targeted digital marketing, promotions, and the ability to compare prices have further stimulated consumer interest and sales.Moreover, this opens up avenues for manufacturers to provide customized consumer offerings, such as mask printing.

The offline distribution channel segment is expected to expand significantly at a CAGR of 6.5% over the forecast period. Physical locations provide immediate access for customers seeking protection from airborne pathogens or particulate matter. In addition, consumers who may not be comfortable with online shopping or lack access to reliable internet connections rely more on offline sources. Furthermore, offline sales are boosted by government regulations or initiatives that encourage the distribution of N95 masks through physical retail outlets.

End-use Insights

The construction industry led the U.S. N95 masks market and accounted for a revenue share of 30.86% in 2024. N95 masks are designed to filter at least 95% of airborne particles, including dust and fumes, making them crucial for protecting construction workers from respiratory hazards such as silica dust and asbestos fibers. In painting environments with volatile organic compounds (VOCs), N95 masks reduce exposure to harmful fumes. Many N95 masks feature adjustable straps and breathable fabrics, ensuring comfort for prolonged use during physically strenuous activities.

The demand for N95 masks in the healthcare sector is likely to register the highest CAGR of 12.0% over the forecast period. N95 respirators are essential in healthcare settings to safeguard workers from respiratory viruses and airborne particles transmitted by patients. They are commonly used in nursing homes and other healthcare environments where the risk of transmission between patients and staff is elevated. Healthcare workers, particularly those in high-risk areas such as emergency rooms and intensive care units, and during aerosol-generating procedures, rely on N95 masks for protection.

Key U.S. N95 Mask Company Insights

Key companies in the U.S. N95 masks market are 3M, Honeywell International Inc., AlphaProTech, and Ansell Ltd., among others. To meet demand, companies expand production facilities and secure raw materials such as melt-blown fabric through long-term contracts or vertical supply chains. They also improve distribution by scaling e-commerce and partnering with distributors to supply large buyers, including hospitals and governments.

-

3M, headquartered in Minnesota, U.S., offers a variety of masks with filtration efficiency, comfortable fit, and lightweight design. These masks are ideal for various industries dealing with airborne pathogens.

-

Honeywell International Inc., headquartered in New Carolina, U.S., manufactures several N95 masks, including the DC300 and DF300 series. These masks are designed to filter airborne particles, effectively providing solutions to various industries.

Key U.S. N95 Mask Companies:

- 3M

- Honeywell International Inc.

- AlphaProTech

- Ansell Ltd.

- O&M Halyard

- The Gerson Companies

- Cardinal Health

- Medline Industries, LP

- Moldex-Metric

Recent Developments

-

In January 2025, 3M partnered with Direct Relief to support first responders and communities affected by wildfires in Los Angeles, providing 5 million N95 respirators. Through this collaboration, 3M ensures quick access to essential protective equipment in disaster zones. They continue to support recovery efforts by distributing supplies through local clinics and nonprofits.

U.S. N95 Masks Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 855.6 million

|

|

Revenue forecast in 2030

|

USD 1.28 billion

|

|

Growth rate

|

CAGR of 8.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, distribution channel, end-use

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

3M; Honeywell International Inc.; AlphaProTech; Ansell Ltd.; O&M Halyard; The Gerson Companies; Cardinal Health; Medline Industries, LP; Moldex-Metric; and Prestige Ameritech

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. N95 Mask Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. N95 masks market report based on product, distribution channel, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

With Exhalation Valve

-

Without Exhalation Valve

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Construction

-

Manufacturing

-

Oil & Gas

-

Others