- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Natural Personal Care Market Size & Share Report, 2025GVR Report cover

![U.S. Natural Personal Care Market Size, Share & Trends Report]()

U.S. Natural Personal Care Market Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care, Oral Care), By Demography (Baby, Middle-aged Adults, Young Adults), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-040-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Specialty & Chemicals

Report Overview

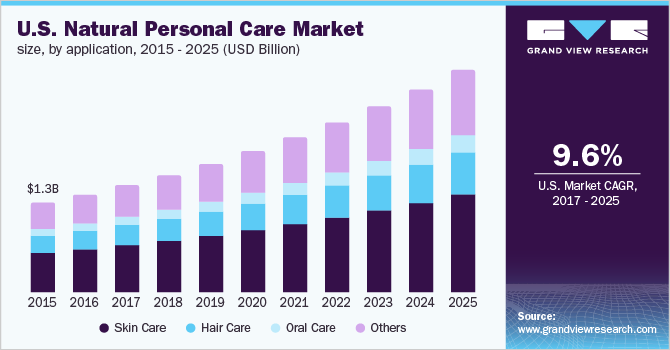

The U.S. natural personal care market size to be valued at USD 3.17 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 9.6% during the forecast period. An upswing in the demand for natural anti-aging products by middle-aged and young adult population in the recent past has provided an upthrust to the market. With increasing awareness regarding the harmful effects of chemical products on the human body, consumers are being encouraged to adopt natural products. Furthermore, favorable regulations supporting the use of natural products in personal care products is poised to propel the market.

The market includes a wide variety of products such as skincare, oral care, hair care, cosmetics and sprays, perfumes, and feminine & masculine hygiene products. Growing concerns pertaining to health are poised to fuel the demand for the product in the country over the forecast period.

The demand for natural personal care products in the baby segment is likely to witness rapid growth over the forecast period. Rising awareness levels of parents regarding the benefits of using natural products for babies has been a vital factor for the development of the market. The Honest Company; Seventh Generation, Inc.; S.C. Johnson & Son, Inc., and The Clorox Company among various other companies are focusing on manufacturing baby-specific products, which, in turn, is expected to boost the growth of the market during the same period

Skincare manufacturers have recognized the opportunities that exist in the natural skincare market and are continuously adopting strategic initiatives such as mergers, acquisitions, and new product development in order to gain market share and a competitive edge.

Lifestyle changes are leading to a rise in the demand for multi-functional products and travel-size or single-use pack sizes of products such as creams, lotions, and sunscreens. Compact beauty products such as creams, lotions, sunscreens, and lipstick crayons are creating opportunities for beauty and packaging companies to develop travel-size or single-serve pack sizes

Players manufacture natural personal care products to cater to the various needs of consumers. Companies market their products as those with improved features and better quality for custom applications. The majority of companies are continuously striving for excellence and enhancing their market position to get ahead in the competition. In addition, cost and efficiency also play key roles in the selection of the product.

U.S. Natural Personal Care Market Trends

The natural personal care market is expected to see a significant rise owing to the heightened demand due to the increased awareness of the benefits of organic products. The constant use of chemical-based cosmetics and personal care products has resulted in skin toxicity that has a significant impact on consumers' preferences for organic products.

Problems such as exposure to harmful UV rays, aging, and increased pollution in cities are creating a demand for products that help mitigate these problems and maintain healthy and natural skin, especially for women. The easy availability of a wide range of natural personal care products and the exponential rise in the number of natural care brands in the market are expected to drive the demand.

The cost of natural care products is relatively higher when compared to chemical-based products. The cost associated with the production and the cost of natural care products tends to restrict the market growth because a large portion of the population cannot afford these products for daily use.A significant increase in demand attributes to the increased adoption of e-commerce channels and a large customer base that uses these channels to order products of daily use. With the availability of natural care products on e-commerce websites and awareness among customers about these products and their advantages thereby acting as a great opportunity for the market growth in the forecast period.

Product Insights

Based on the product, the market has been divided into skin care, hair care, and oral care. The others segment includes cosmetics, fragrances, and hygiene products. While skincare products were at the forefront of the market in 2017, the others product segment held a sizeable share. The increasing population coupled with rising disposable income is anticipated to bolster the demand for fragrances and cosmetics.

Increased disposable income allows customers to spend more on luxury products, of which fragrance, cosmetics, and hygiene products are an important part. Hygiene products are projected to experience growth over the forecast period, owing to increasing health awareness among women and men. Full-fledged advertising and commercialization are some of the key trends positively influencing the growth of the market.

Rising demand for skin & sun care products, changing lifestyles, and improving global economies, along with fluctuating climatic conditions, are poised to support the growth of the others segment.

A shift of preference towards natural beauty products, particularly in the U.S. and other European countries, is likely to foster the growth of the cosmetics industry. Rising demand for natural and herbal beauty products has created growth opportunities for manufacturers to innovate and develop new products in accordance with consumer preferences.

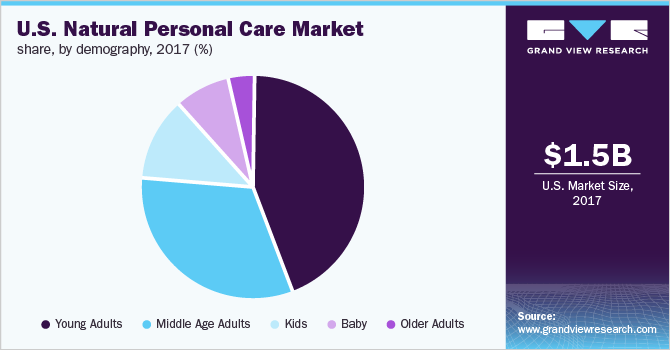

Demography Insights

The market has been segmented, by demography, into baby, kids, young adults, middle-aged adults, and older adults. In 2017, young adults dominated the U.S. natural personal care market and held over 44.0% share of the overall revenue. This segment mainly includes the working-class population.

Individuals in this segment are familiar with the benefits of using natural and organic products as compared to their synthetic counterparts. Rising exposure of skin to harmful sun rays and other air pollutants is stirring up the demand among young adults for products that can help prevent early aging and ensure younger-looking skin

Middle-aged adults held a significant share in the market. This demographic focuses more on products that have anti-aging properties and contain no harmful chemicals. Increased consumption of sunblock, anti-tan, and anti-aging creams among middle-aged men as well as women is estimated to be a key factor contributing to the high demand for personal care products. Companies such as Estée Lauder and The Procter & Gamble Company have developed products that cater particularly to the needs of this demographic segment.

Key Companies & Market Share Insights

The market is characterized by the presence of various well-established players. Players face intense competition from each other as the majority of them are among the top consumer goods companies and have a large consumer base. Players are well-established and have strong and vast distribution networks. Key players cater to the demand from various demographics including children, men, and women of all ages. The impact of major players on the market is quite high as the majority of them have a global presence.

Recent Developments

In June 2022, TheEstée Lauder Companies Inc. (ELC) announced the opening of its new, cutting-edge distribution center in Galgenen, Switzerland. This new 300,000square-foot facility expands on the company's existing distribution footprint in Switzerland, allowing ELC to remain at the forefront of delivering beauty and cosmetics products

Some of the key manufacturers present in the market are Aveda Corporation; Burt’s Bees; The Estée Lauder Companies Inc.; The Hain Celestial Group; Amway Corporation; The Procter & Gamble Company; and The Colgate-Palmolive Company.

U.S. Natural Personal Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 3.17 billion

Growth rate

CAGR of 9.6% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD billion/million and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

demography and product

Regional scope

The U.S.

Key companies profiled

Aveda Corporation; Burt’s Bees; The Estée Lauder Companies Inc.; The Hain Celestial Group; Amway Corporation; The Procter & Gamble Company; and The Colgate-Palmolive Company.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Natural Personal Care Market Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. natural personal care market report on the basis of demography and product:

-

Demography Outlook (Revenue, USD Million, 2014 - 2025)

-

Baby

-

Kids

-

Young Adults

-

Middle Age Adults

-

Older Adults

-

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Skincare

-

Haircare

-

Oral care

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."