- Home

- »

- Clinical Diagnostics

- »

-

U.S. Non Invasive Prenatal Testing Market Size Report, 2030GVR Report cover

![U.S. Non Invasive Prenatal Testing Market Size, Share & Trends Report]()

U.S. Non Invasive Prenatal Testing Market (2023 - 2030) Size, Share & Trends Analysis Report By Gestation Period, By Risk, By Method, By Technology, By Product, By Application (Trisomy, Microdeletion Syndrome), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-107-3

- Number of Report Pages: 117

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

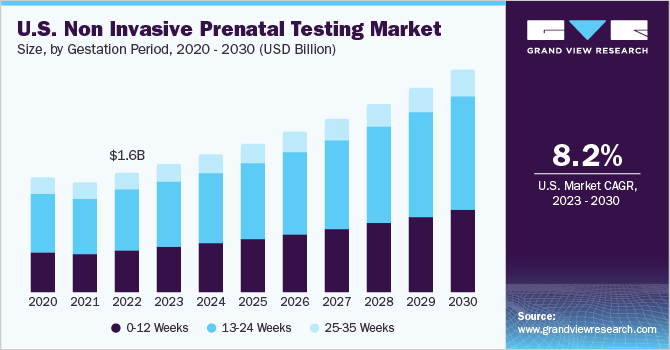

The U.S. non invasive prenatal testing market size was estimated at USD 1.60 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.18% from 2023 to 2030. The market’s growth can be attributed to the increasing average maternal age, rising incidence of chromosomal disorders, and collaborations & licensing agreements among key players. Moreover, high adoption and demand for early non invasive prenatal testing (NIPT) and improvements in reimbursement scenarios are among the factors anticipated to boost market growth over the forecast period.

Due to a number of factors, including an increase in doctors preferring advanced genetic screening for pregnant women with elevated risk, a desire to delay childbearing, and an increase in pregnancy-related issues in the third or second pregnancy stage, NIPT has grown increasingly in demand worldwide. Amniocentesis and sampling of chorionic villus are two invasive prenatal testing methods that could result in complications like miscarriage. As a result, there is a significant need for tests that are more effective, noninvasive, and secure and to reduce falls in the use of these procedures. For the identification of frequently occurring trisomies in the fetus, such as Turner syndrome, Down syndrome, fetal rhesus D status, and sex chromosome disorders, as well as for fetal sex determination, NIPT uses cell-free fetal DNA (cffDNA) that circulates in the mother's blood.

The increasing incidence of chromosomal abnormalities is expected to accelerate market growth. Among all the countries, there is a substantial opportunity in the U.S. for noninvasive prenatal screening, with nearly 3.66 million annual births and an increasing number of high-risk pregnancies. In addition, there is a heavy burden of genetic diseases. As per the report published by Centres of Disease Control and Prevention in June 2023, a survey was conducted in the U.S., which reported that the reported incidence of major chromosomal abnormalities is 1 in 140 newborns in the country, with trisomy 21 (Down syndrome) having a high incidence of 1 in 700 births, resulting in the birth of 6,000 newborns with Down syndrome every year. Families can benefit from accurate and early screening using NIPT to know about their baby's genetic issue. Thus, this high incidence is anticipated to boost the demand for prenatal tests.

Furthermore, noninvasive fetal tests have a lower failure and false-positive rate, which has resulted in a considerable increase in the uptake of noninvasive tests in the last few years. Other advantages of NIPT include precise results in overweight & obese women and the detection of a higher number of genetic disorders such as microdeletions. Furthermore, key manufacturers in the market are undertaking several efforts to provide advanced products in the market. For instance, in June 2019, Illumina announced the launch of an expanded version of its VeriSeq NIPT, which now enables screening of a broader range of chromosomal conditions related to birth defects.

Moreover, key players are also involved in the product portfolio expansion, which drives the market growth. For instance, in January 2023, Juno Diagnostics announced the establishment of a clinical advisory board to support the portfolio of products for its non invasive prenatal screening (NIPS) procedure.The board comprises renowned professionals in reproductive medicine, women's health, and patient-focused prenatal care, which is projected to enhance the company's capacity to assist a larger community before, during, and following their pregnancies.

The COVID-19 pandemic slightly impacted the U.S. non invasive prenatal testing market. Several manufacturing companies maintained regular communication with the U.S. FDA to keep themselves informed of supply chain disruptions. In addition, several research studies were conducted to estimate the commercial impact of COVID-19. According to a SeraCare report, IVD developers and clinical testing facilities collaborated with research organizations to determine the effects of COVID-19 infection on pregnancy and congenital debilities in infants, as well as the requirement for NIPT during the COVID-19 pandemic. However, a lack of established outcomes may adversely impact the demand for NIPT tests during the COVID-19 pandemic. One of the barriers preventing diagnostic centers and hospitals from offering noninvasive prenatal screening services was the intense pressure to treat patients with COVID-19, as non invasive prenatal testing (NIPT) procedures were halted.

Gestation Period Insights

The 13-24 weeks segment dominated the U.S. NIPT market in 2022 with a revenue share of 50.80%. As the maximum number of NIPT procedures are performed in the second trimester. Several companies have focused on the analysis of cfDNA in a sample of maternal blood collected in the first trimester to develop a more accurate and reliable NIPT. The market's expansion is anticipated to be fueled by the complementary use of ultrasonography with alpha-fetoprotein testing and NIPT beyond 12 weeks of pregnancy. Additionally, tests used in quad screening, including Alpha-Fetoprotein (AFP), Unconjugated Estriol (EU), Human Chorionic Gonadotropin (hCG), and Inhibin A, are helping to boost this segment's income.

The 0-12 weeks segmentis expected to showcase lucrative growth during the forecast period due to a wide range of products being offered in the market. A considerable amount of income is generated in this segment as a result of the first-trimester aneuploidy testing and maternal-fetal DNA screening performed during this time. Additionally, the combined information from biochemistry and sonography can be used to detect genetic changes with an accuracy level of 91% to 96%, making first-trimester risk screening preferable to other trimesters.

Risk Insights

The high & average pregnancy risk segment dominated the U.S. non invasive prenatal testing market in 2022 with a revenue share of 76.11%, owing to the wide adoption of NIPT in this risk segment. Moreover, the high-risk nature of pregnancies in women aged over 35 years is anticipated to drive the segment. The available products in the market provide sensitivity within the range of 99.0% to 99.9% for detecting Down syndrome. Additionally, extended health coverage and plans for NIPT drive the market growth.

For instance, in October 2020, Natera, Inc. A prominent health plan announced an extension of its coverage to all singleton pregnancies, adding 17 million new covered lives. According to the most recent round of medical policy revisions in 2020, the number of covered lives for average risk NIPT has more than doubled. According to Natera, 139 million commercial lives-or nearly 77% of covered lives-are currently covered in the United States for average risk NIPT.

The low-risk segment is expected to register the fastest CAGR during the forecast period. Support from the government, such as budget assignment for average-risk pregnancies, is expected to be a favorable factor for growth. For instance, as per the reports of the National Centre for Biotechnology Information published in the year 2019, testing in pregnancies with average risk made it feasible to find an increased percentage of afflicted cases, leading to an increase in funding for this group in Ontario of USD 35 million.

Method Insights

The cell-free DNA in maternal plasma tests segment dominated the U.S. NIPT market in 2022 with a revenue share of 69.43%. Wide acceptance, high cost of tests, and rapid adoption of tests that detect circulating biomarkers, such as cell-free DNA fragments, have contributed to the largest market share held by this segment. Moreover, rapid technological advancements and the launch of new products in the segment are likely to have a positive impact on market growth.

For instance, in September 2019, Laboratory Corporation of America Holdings published findings from the largest cell-free chromosomal DNA screening investigation in a multifetal pregnancy. The research, which was published in PLOS ONE, found that non invasive cell-free DNA testing utilizing the MaterniT21 PLUS test produced precise results that were comparable to those for singleton pregnancies.

Biochemical tests are projected to grow at a lucrative rate. They are conducted at 8 to 24 weeks of pregnancy. However, the adoption rate varies due to the accuracy’s dependency on the mother’s health, especially in conditions such as obesity, which can hinder test results. However, the adoption rate for these tests is still high. For instance, 75% to 90% of fetuses with defects in the neural tube are detected by alpha-fetoprotein testing. The wide adoption rate is anticipated to act as a driver for the segment.

Technology Insights

The others segment which include rolling cycle amplification, karyotyping, Sanger sequencing, ultrasound scanning, and other blood tests held the maximum revenue share of 53.06% in 2022. A companion test to the cell-free DNA-based NIPT is ultrasound detection. Massively parallel shotgun sequencing, digital PCR, and microarray-based techniques are the other methods included in NIPT. Also, the advancements in ultrasound detection techniques and 3D-4D imaging have improved real-time monitoring, safety, and efficiency of the test, which is further expected to propel the segment growth.

The NGS segment is the fastest-growing segment. Currently, most of the commercially approved products are based on whole exome and whole genome sequencing to detect chromosomal anomalies. Furthermore, expanding the technology for detecting monogenic diseases is likely to boost revenue in this segment. It is frequently used to detect chromosomal aneuploidies, microdeletions, and trisomy disorders. As opposed to other methods, NGS-based noninvasive prenatal diagnostics can be carried out as early as 10 weeks of pregnancy. Additionally, NGS-based assays are more accurate than other noninvasive prenatal diagnostics, which have an accuracy rate of above 99%.

Product Insights

The consumables and reagents segment dominated the U.S. NIPT market with a share of over 71.40% in 2022. Illumina Inc.; F. Hoffmann-La Roche Ltd.; Natera, Inc.; and other regional players offer a wide range of consumables & reagents for NIPT. These players offer various kits, consumables, reagents & instruments to perform prenatal tests. For instance, in August 2020, the Society for Maternal-Fetal Medicine and the American College of Obstetricians and Gynecologists released joint guidelines recommending that prenatal screening to detect fetal chromosomal abnormalities be offered to all pregnant women irrespective of their baseline risk & maternal age.

The consumables and reagents segment is also projected to grow at the fastest CAGR during the forecast period. The market for consumables and reagents in NIPT is impacted by a number of variables, including supplier competition, regulatory restrictions, and technical improvements. Companies operating in this market concentrate on creating consumables and reagents that are of the highest caliber, most dependable, and easiest to use to satisfy the needs of NIPT laboratories and healthcare providers.

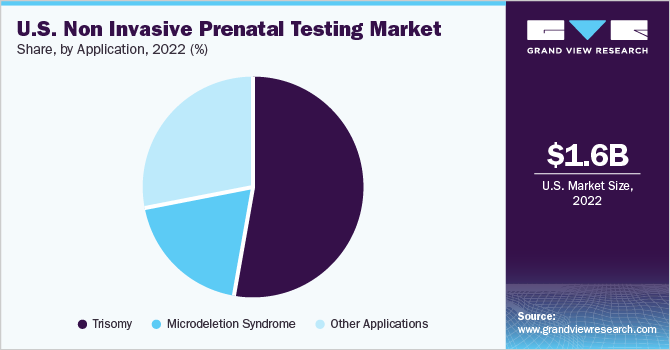

Application Insights

The trisomy segment dominated the U.S. non-invasive prenatal testing market with a share of over 53.56% in 2022. Growing incidence of trisomy, increasing awareness among people, and favorable initiatives undertaken by government bodies are key factors propelling the segment’s growth. High diagnosis rates, widespread acceptance, and public awareness, as well as the launch of novel and cutting-edge tests, are further factors driving market expansion in the United States.

For instance, in May 2021, in addition to the current IONA test, which provides screening for trisomies 21, 18, and 13, as well as fetal sex determination, Yourgene established IONA Care, a non invasive prenatal test service. This test can determine whether a pregnant woman is carrying a fetus with autosomal aneuploidies and sex chromosome aneuploidies. Therefore, during the projection period, such product introductions are anticipated to boost market growth.

However, the microdeletion syndrome segment is anticipated to grow at the fastest rate over the forecast period. To identify specific microdeletions linked to particular syndromes, NIPT for microdeletion syndromes examines the mother's blood for cell-free DNA (cfDNA). The NIPT can be used to screen for a number of microdeletion syndromes, including the DiGeorge syndrome, Cri-du-chat syndrome, Angelman syndrome, Prader-Willi syndrome, and Wolf-Hirschhorn syndrome.

The scope of prenatal genetic screening has been broadened with the inclusion of microdeletion syndromes in NIPT, enabling expecting parents to acquire more thorough information about the genetic health of their child. Even though NIPT can detect certain diseases, confirmation of the diagnosis frequently necessitates further diagnostic procedures, such as fluorescence in situ hybridization (FISH) or chromosomal microarray analysis.

End-use Insights

The diagnostic laboratories segment dominated the U.S. NIPT market with a share of over 61.90% in 2022, attributable to numerous diagnostic facilities offering NIPT all over the world. For the diagnosis of Trisomies 21, 18, and 13, Monosomy X, and other sex chromosomal abnormalities, laboratories like MedGenome Labs Ltd. offer MedGenome Claria NIPT testing. Similar to this, MedGenome's Claria NIPT Plus can identify Angelman syndrome, Edwards' syndrome, Down syndrome, 1p36 deletion syndrome, Klinefelter syndrome, Triple X, triploidy, monosomy X (Turner syndrome), Jacob's syndrome, 22q11.2 deletion syndrome, Prader-Willi syndrome, Patau syndrome, and Cri-du-chat syndrome.

Key developers, such as Illumina, are outsourcing their sample processing to Illumina CLIA labs when in-house facilities are not sufficient. Moreover, laboratories conducting NIPT tests across the U.S. are operated in compliance with quality-assurance regulations to safeguard test quality and reproducibility.

The diagnostic laboratories segment is anticipated to grow at the fastest CAGR over the forecast period. The NIPT market has experienced rapid growth, and diagnostic laboratories are essential to providing and carrying out NIPT services. These labs offer the tools, personnel, and technology required to conduct the screening test and provide accurate findings to medical professionals and pregnant parents.

Key Companies & Market Share Insights

The key players operating in the U.S. non-invasive prenatal testing market are focusing on partnerships, geographical expansions, and strategic collaborations in emerging and economically favorable regions. Moreover, the regulatory approvals for product launch drives the market. For instance, in August 2022, As part of the Q-Sub process, Natera, Inc. proactively submitted a pre-submission to the Food and Drug Administration for its NIPT in Boston at the Canaccord Genuity 42nd Annual Growth Conference. In June 2022, the business submitted its pre-submission for the fetal chromosomal aneuploidies and syndrome of 22q11.2 deletion. ome prominent players in the U.S. non invasive prenatal testing market include:

-

Illumina, Inc.

-

Natera, Inc.

-

Laboratory Corporation of America Holdings

-

Ariosa Diagnostics (Roche)

-

QIAGEN

-

Myriad Women’s Health, Inc.

-

Biora Therapeutics, Inc.

-

Quest Diagnostics Incorporated

-

Eurofins Scientific

-

BioReference Health, LLC (Subsidiary of OPKO Health, Inc.)

-

Invitae Corporation

U.S. Non Invasive Prenatal Testing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.96 billion

Growth rate

CAGR of 8.18 %from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume (number of tests in thousands), revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gestation period, risk, method, technology, product, application, end-use

Key companies profiled

Laboratory Corporation of America Holdings; Illumina, Inc.; Natera, Inc.; QIAGEN; Ariosa Diagnostics (Roche); Myriad Women’s Health, Inc.; Biora Therapeutics, Inc.; Quest Diagnostics Incorporated; Eurofins Scientific; BioReference Health, LLC (Subsidiary of OPKO Health, Inc.); Invitae Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Non Invasive Prenatal Testing Market Report Segmentation

This report forecasts volume & revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. non invasive prenatal testing market report based on gestation period, risk, method, technology, product, application, and end-use:

-

Gestation Period Outlook (Volume, Number of Tests in Thousands; Revenue, USD Million, 2018 - 2030)

-

0-12 weeks

-

13-24 weeks

-

25-35 weeks

-

-

Risk Outlook (Revenue, USD Million, 2018 - 2030)

-

High & Average Risk

-

Low Risk

-

-

Method Outlook (Volume, Number of Tests in Thousands; Revenue, USD Million, 2018 - 2030)

-

Biochemical Screening Tests

-

Cell-free DNA in Maternal Plasma Tests

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

NGS

-

Array Technology

-

PCR

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables & Reagents

-

Instruments

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trisomy

-

Microdeletion Syndrome

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Frequently Asked Questions About This Report

b. The U.S. non invasive prenatal testing market size was estimated at USD 1.60 billion in 2022 and is expected to reach USD 1.70 billion in 2023.

b. The U.S. non invasive prenatal testing market is expected to grow at a compound annual growth rate of 8.18% from 2023 to 2030 to reach USD 2.96 billion by 2030.

b. 0-12 weeks dominated the U.S. non invasive prenatal testing market with a share of 50.79% in 2022. This is attributable to the maximum number of NIPT procedures performed in the second trimester.

b. Some key players operating in the U.S. non invasive prenatal testing market are Laboratory Corporation of America Holdings; Illumina, Inc.; Natera, Inc.; Qiagen; Ariosa Diagnostics (Roche); Myriad Women’s Health, Inc.; Biora Therapeutics, Inc.; and Quest Diagnostics Incorporated.

b. Key factors that are driving the market growth include the increasing average maternal age, rising incidence of chromosomal disorders, and collaborations & licensing agreements among key players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.