- Home

- »

- Medical Devices

- »

-

U.S. Ophthalmic Handheld Surgical Instruments Market Report, 2030GVR Report cover

![U.S. Ophthalmic Handheld Surgical Instruments Market Size, Share & Trends Report]()

U.S. Ophthalmic Handheld Surgical Instruments Market Size, Share & Trends Analysis Report By Product (Forceps Scissors, Chopper), By End-use (Hospitals, Ophthalmic Clinics), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-023-4

- Number of Report Pages: 71

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

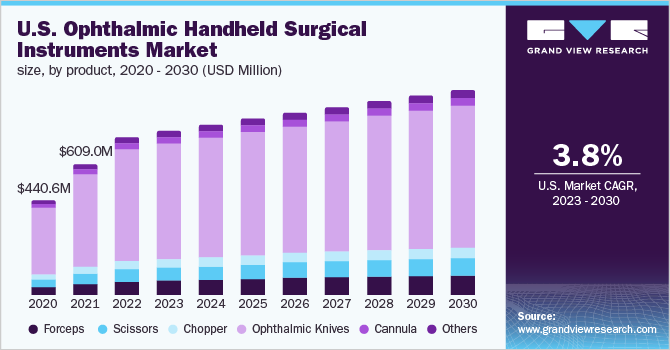

The U.S. ophthalmic handheld surgical instruments market size was valued at USD 735.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030. The increasing prevalence of eye disease, favorable government policies, and improving eye care infrastructure to control the burden of eye diseases are the major factors boosting the growth of the ophthalmic handheld surgical instruments market in the U.S.

The COVID-19 pandemic has greatly obstructed every aspect of healthcare delivery in the U.S. The first two months of the pandemic led to a dramatic decline in elective and preventative care, which impacted modalities ranging from procedures and imaging to laboratory tests and vaccinations. Similarly, the field of ophthalmology was not immune to the impact of the pandemic. Elective cataract surgery postponed during the pandemic consistently led to longer wait and possible anxiety among patients. Admission rates of patients in hospitals also declined due to the fear of infection, further reducing the number of eye surgeries performed during the pandemic.

However, with the economies going back to normalcy and the increasing usage of digital services, and a rise in overall screentime post-pandemic, is expected to lead to an increase in ophthalmic diseases. This, in turn, is anticipated to help the market grow at the pre-covid growth rate over the forecast period.

Conditions such as cataracts, glaucoma, age-related macular degeneration, and diabetic retinopathy are major causes of visual impairment & blindness globally. An increase in the elderly population is creating a proportionate increase in the number of people suffering from visual impairment and blindness. Thus, leading to a rise in demand for ophthalmic handheld surgical instruments.

For instance, in the U.S., nearly 1.3 million people aged 40 years and older are legally blind (defined as best-corrected visual acuity, worse than or equal to 20/200 in the better-seeing eye). More than 2.9 million people aged 40 years and older have low vision (defined as best-corrected visual acuity worse than 20/40; this number excludes those who are legally blind).

The abovementioned statistics represent the overall eye disease burden in the U.S., contributing to the growing demand for ophthalmic handheld surgical instruments. Moreover, ophthalmic disorders, such as childhood blindness, age-related macular degeneration, trachoma, corneal opacities, and onchocerciasis, are expected to witness the highest occurrence over the forecast period.

An increase in government initiatives about creating awareness about visual impairments is expected to drive the market over the forecast period. The global burden of blindness was anticipated to double by 2020, especially in developing economies, provided additional measures were not undertaken.VISION 2020 is a global campaign raising awareness among governments and people about the implications of blindness. International decision-makers and NGOs need to be convinced that human resources and financial resources provided for the elimination of blindness are a sound, returnable investment.

Product Insights

The ophthalmic knives segment dominated the market with the highest revenue share in 2022. This is due to the wide availability of ophthalmic knives in different shapes, sizes, and styles. Currently, there are two types of knives used in eye surgery - disposable and diamond knives. Diamond knives are facing a surge in demand owing to their advantages such as precision incisions, reusability, cost efficiency, and durability.

The scissors segment is expected to undergo maximum growth over the forecast period as it is the most found instrument in the kit while conducting ocular surgeries.A regular surgical kit consists of three to six different types of ophthalmic scissors, especially for trabeculectomy and extracapsular cataract extraction.

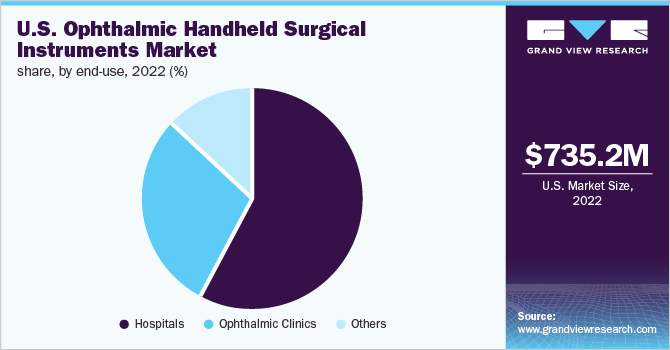

End-use Insights

The hospitals segment held the largest market share of around 57.3% in 2020. Increased availability of surgical instruments to perform complex surgeries, presence of skilled staff, well-equipped emergency care departments, a large number of ophthalmic hospitals in the U.S., and heavy funding to improve infrastructure are certain factors responsible for its large segment share. Improved government schemes and reimbursement criteria have influenced segment growth.

The U.S. government covers the cost of cataract surgery for patients aged 65 and above. Medicare is responsible for bearing 80% of the total cataract surgery cost, including pre-and postoperative examination, cataract removal, intraocular lens implantation, and protective eyewear after the operation. Thus, hospitals continue to witness high admission rates

The ophthalmic clinics segment accounted for a share of 29.1% in 2022 and is expected to witness the fastest growth over the forecast period. Factors such as the introduction of advanced & cost-effective surgical devices; shorter waiting times compared to hospitals, lower surgery costs, and a rise in the number of ophthalmic centers are expected to boost segment growth during the forecast period. For instance, in 2020, cataract surgery cost USD 2,578 for an outpatient hospital facility and only USD 1,600 at a standalone ophthalmic center due to low facility charges.

Key Companies & Market Share Insights

Mergers and acquisitions form one of the key sustainable strategies undertaken by market players. For instance, in April 2021, Katena Products, Inc. announced the purchase of ASICO, LLC—an industry leader with experience of about 35 years, having a diverse product range of more than 1,500 items, including single-use cannulas & blades, stainless steel & titanium instruments, and selection of diamond knives.

In May 2021, Medline announced its plans to acquire Hudson RCI respiratory consumables from Teleflex. With the acquisition, the company plans to bring two manufacturing facilities into its portfolio of more than 20 existing North American plants. Some prominent players in the U.S. ophthalmic handheld surgical instruments market include:

-

BVI

-

Accutome, Inc.

-

Medline Industries, Inc.

-

Haag-Streit Group

-

Appasamy Associates

-

Millennium Surgical Corp

-

Katalyst Surgical

-

ASICO, LLC.

-

INKA Surgical Instruments

-

Surgical Holdings

U.S. Ophthalmic Handheld Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 765.3 million

Revenue forecast in 2030

USD 953.7 million

Growth rate

CAGR of 3.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

U.S.

Key companies profiled

BVI; Accutome, Inc.; Medline Industries, Inc.; Haag-Streit Group; Appasamy Associates; Millennium Surgical Corp; Katalyst Surgical; ASICO, LLC.; INKA Surgical Instruments; Surgical Holdings

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ophthalmic Handheld Surgical Instruments Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ophthalmic handheld surgical instruments market report based on product, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Forceps

-

Scissors

-

Chopper

-

Ophthalmic Knives

-

Cannula

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Frequently Asked Questions About This Report

b. The U.S. ophthalmic handheld surgical instruments market size was estimated at USD 735.2 million in 2022 and is expected to reach USD 765.3 million in 2023

b. The U.S. ophthalmic handheld surgical instruments market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 953.7 million by 2030.

b. Ophthalmic knives segment held the highest market share by product owing to increasing usage of these in ophthalmic surgeries.

b. Some key players operating in the U.S. anti snoring devices and snoring surgery market include BVI, Accutome, Inc. , Medline Industries, Inc., Haag-Streit Group, Appasamy Associates, Millennium Surgical Corp, Katalyst Surgical, ASICO, LLC., INKA Surgical Instruments and Surgical Holdings

b. Key factors that are driving the U.S. ophthalmic handheld surgical instruments market growth include the Increasing prevalence of eye disease, favorable government policies and improving eye care infrastructure to control the burden of eye diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."