- Home

- »

- Healthcare IT

- »

-

U.S. Orthopedic Ambulatory Surgery Center Market Report, 2030GVR Report cover

![U.S. Orthopedic Ambulatory Surgery Center Market Size, Share & Trends Report]()

U.S. Orthopedic Ambulatory Surgery Center Market Size, Share & Trends Analysis Report By Procedure (ACL Reconstruction, Knee Replacement, Hip Replacement, Shoulder Replacement, Arthroscopy, Foot & Ankle), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-032-2

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

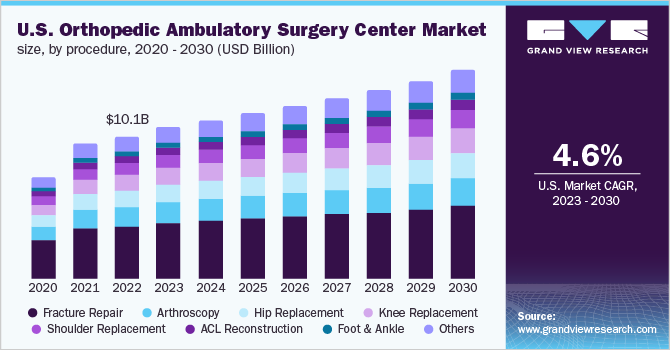

The U.S. orthopedic ambulatory surgery center market size was valued at USD 10.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.61% from 2023 to 2030. The growth can be attributed to the lower cost of orthopedic surgeries in ambulatory surgery centers (ASCs) and rising investment in orthopedic ASCs. As per research conducted by the Rothman Orthopaedic Institute based in Philadelphia, and Hospital for Special Surgery based in New York, treatment in ASCs costs around 40% less compared to hospital-based outpatient departments. The number of outpatient orthopedic surgical procedures undertaken at ambulatory surgery centers (ASCs) has significantly increased in the past few years. The growing demand can be attributed to the lower cost of treatment at these centers for orthopedic surgeries. According to the study published in PubMed in March 2022, among 990,980 outpatient orthopedic surgeries performed from 2013 to 2018, the ASCs utilization rate increased from 31% to 34% for all the orthopedic procedures with a CAGR of 3.3% for lumbar microdiscectomy, 1.4% for anterior cruciate ligament, 1.8% for knee arthroscopy, 1.4% of carpal tunnel release, 1.2% for the repair of the arthroscopic rotator cuff, and 0.5% for the repair of the bunion.

Medical device vendors such as orthopedic & spine companies and DME manufacturers are suppliers of orthopedic ASCs. With the growing preference and patient shift to ASCs, medical device manufacturers are launching various platforms & programs to transition their pricing and offers in line with customers. Hence, many companies are entering into the supplier business to offer services to orthopedic ASCs. For instance, in 2020, Stryker launched an ASC-focused business segment with around 13,990 products and around 22 product categories that specifically meet the demand for outpatient orthopedic surgery centers.

The number of ASCs is rapidly growing with the continuous shift of cases from Hospital-based Outpatient Departments (HOPDs) to ASCs. This growth can be attributed to several factors including the increased movement of cases from HOPDs to ASCs owing to better patient outcomes, higher patient safety, cost-effectiveness, and profitability. The shift is majorly observed in orthopedic surgeries including knee replacements and elective hip surgeries. According to a research article, more than 50% of joint replacement surgeries would be performed in ASCs by 2030. Hence, the number of ASCs offering orthopedic services is increasing in the U.S.

The COVID-19 pandemic led to the halt of nonurgent orthopedic procedures at ASCs. In March 2021, CMS, CDC, the American College of Surgeons, and the Ambulatory Surgery Center Association issued guidelines to postpone elective surgeries to reduce exposure to the virus. Moreover, the pandemic led to staff burnout and attrition, which has created a shortage of staff in the U.S. As per the 2021 OR Manager Salary/Career Survey, around 49% of ASCs reported open positions for registered nurses, which is double in number compared to 2020.

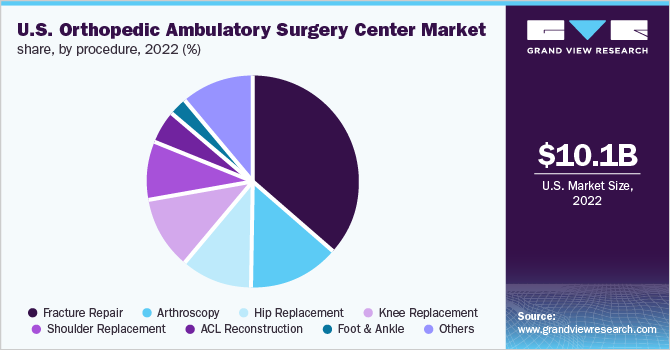

Procedure Insights

Based on procedure, the U.S. orthopedic ASC market has been segmented into ACL reconstruction, knee replacement, hip replacement, shoulder replacement, arthroscopy, foot & ankle, fracture repair, and others. The fracture repair segment accounted for the largest market share of 37.1% in 2022. This can be attributed to the growing cases of fractures in the U.S. and the low cost of treatment for fracture repairs in Ambulatory Surgery Centers (ASCs) compared to Hospital-based Outpatient Departments (HOPDs). Hence, fracture repair is shifting from hospital settings to orthopedic ASCs. As per the article published in ScienceDirect in 2019, around 6.3 million fractures occur in the U.S. and are treated each year.

Moreover, ankle fractures are the most common injuries in the U.S., accounting for around 10% of the total fractures annually in the country. As per the article published in the Sage journal in October 2022, the outpatient ankle fracture repair performed at ASCs cost around USD 12,315 compared to USD 35,944 in HOPDs and around USD 96,697 in hospital inpatient settings.

The knee replacement segment is expected to witness the fastest growth during the forecast period, owing to the migration of knee replacement patients from inpatient hospital settings to cost-effective ASCs & HOPDs. Other factors driving this segment are the changing reimbursement scenario for knee replacement surgeries in the U.S., focusing more on orthopedic ASCs.

The CMS payment updates shifted joint replacements toward ASC and outpatient settings, and studies demonstrated that the procedure can be performed safely in ASCs. There are more than 500 ASCs in the U.S. that perform total joint replacements, and there are 50 ASC facilities in California. With 42 ASC-equipped institutions, Florida is in 2nd place, followed by Maryland and Texas, each of which has 32 facilities capable of performing total joint replacements.

Key Companies & Market Share Insights

The U.S. orthopedic ambulatory surgery center industry is moderately fragmented and key players are adopting several strategies, including the launch of new centers and raising funds from investors, to strengthen their position in the market. For instance, in May 2022, Academy Orthopedics L.L.C. opened a new facility in northern New Jersey. Some prominent players in the U.S. orthopedic ambulatory surgery center market include:

-

Spectrum Orthopedics

-

Academy Orthopedics L.L.C.

-

Upstate Orthopedics Ambulatory Surgery Center

-

Washington Orthopedic Center

-

Southern California Orthopedic Institute

-

ProOrtho

-

Texas Health Orthopedic Surgery Center

-

Columbia Orthopedic Surgery Center

-

Chatham Orthopedic Surgery Center

-

The Orthopedic Surgery Center Of Arizona

-

HealthPartners

-

Specialty Orthopedics

U.S. Orthopedic Ambulatory Surgery Center Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 15.0 billion

Growth Rate

CAGR of 4.61% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure

Country scope

U.S.

Key companies profiled

Spectrum Orthopedics; Academy Orthopedics L.L.C.; Upstate Orthopedics Ambulatory Surgery Center; Washington Orthopedic Center; Southern California Orthopedic Institute; ProOrtho; Texas Health Orthopedic Surgery Center; Columbia Orthopedic Surgery Center; Chatham Orthopedic Surgery Center; The Orthopedic Surgery Center Of Arizona; HealthPartners; Specialty Orthopedics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Orthopedic Ambulatory Surgery Center Market

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. orthopedic ambulatory surgery center market report based on procedure:

-

Procedure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fracture Repair

-

ACL Reconstruction

-

Knee Replacement

-

Hip Replacement

-

Shoulder Replacement

-

Arthroscopy

-

Foot & Ankle

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. orthopedic ambulatory surgery center market size was estimated at USD 10.1 billion in 2022 and is expected to reach USD 10.9 billion in 2023.

b. The U.S. orthopedic ambulatory surgery center market is expected to grow at a compound annual growth rate of 4.61% from 2023 to 2030 to reach USD 15.0 billion by 2030.

b. The fracture repair segment dominated the U.S. orthopedic ambulatory surgery center market with a share of 37.1% in 2022. This is attributable to the growing cases of fractures in the U.S. and low cost of treatment for fracture repairs in Ambulatory Surgery Centers (ASCs) compared to Hospital-based Outpatient Departments (HOPDs).

b. Some key players operating in the U.S. orthopedic ASC market include Spectrum Orthopedics; Academy Orthopedics L.L.C.; Upstate Orthopedics Ambulatory Surgery Center; Washington Orthopedic Center; Southern California Orthopedic Institute; ProOrtho; Texas Health Orthopedic Surgery Center; Columbia Orthopedic Surgery Center; Chatham Orthopedic Surgery Center; The Orthopedic Surgery Center Of Arizona; HealthPartners; Specialty Orthopedics

b. Key factors that are driving the U.S. orthopedic ASC market include lower cost of orthopedic surgeries in Ambulatory Surgery Centers (ASCs) and rising investment in orthopedic ASCs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."