- Home

- »

- Homecare & Decor

- »

-

U.S. Outdoor Furniture And Kitchen Market Size Report, 2030GVR Report cover

![U.S. Outdoor Furniture And Kitchen Market Size, Share & Trends Report]()

U.S. Outdoor Furniture And Kitchen Market Size, Share & Trends Analysis Report By Product (Outdoor Furniture, Outdoor Kitchen), By Material (Wood, Plastic), By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-054-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

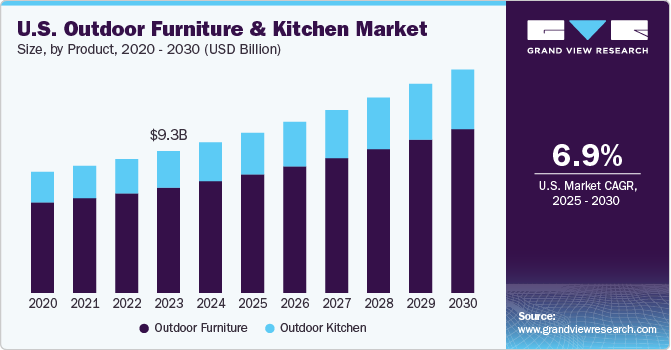

The U.S. outdoor furniture and kitchen market size was estimated at USD 9.84 billion in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2030. The growth of the luxury residential market, coupled with rising disposable incomes and increased spending on home remodeling projects, has significantly boosted the U.S. outdoor furniture & kitchen industry. The U.S. market has seen notable changes as more consumers focus on home improvement projects and creating spaces that reflect their lifestyle preferences. According to Angi’s annual State of Home Spending report, Americans spent an average of USD 13,667 on home upkeep and improvements in 2022, marking a 6% increase from the previous year.

The COVID-19 pandemic had a substantial impact on the U.S. market. At the onset of the pandemic, the manufacturing of non-essential items, including furniture such as sofa sets, beds, and tables, came to a halt due to decreased demand. Consumers were more concerned with hygiene and safety. However, as the pandemic continued, people began spending more time at home and shifted their focus to enhancing their living environments. This resulted in a surge in home remodeling efforts, with homeowners seeking open, airy spaces and investing in outdoor furniture and kitchens to improve their properties.

In response to the growing demand for sustainability, the U.S. outdoor furniture & kitchen industry has seen an increased focus on creating eco-friendly, recyclable, and sustainable products. Many manufacturers are prioritizing the use of materials that align with green practices as consumers become more conscientious about their environmental impact. A significant trend is the rising popularity of customized outdoor furniture and kitchens, which cater to specific architectural designs and improve the aesthetic appeal of living spaces. As more homeowners look to make their homes more meaningful, the demand for high-quality, sustainable outdoor products continues to grow.

Millennials have emerged as a key consumer group in the U.S. outdoor furniture & kitchen industry. This generation, known for being highly educated and environmentally conscious, is leading the charge in demanding homes that offer innovative outdoor spaces, including lush greenery, advanced outdoor kitchens, and integrated amenities. The real estate industry has taken note aligning with millennials' preferences by focusing on the development of homes that cater to these desires. Many millennials now have the financial capacity to invest in high-end properties, which is driving further growth in the U.S. outdoor furniture industry, especially in regions like Washington.

The increasing number of millionaires in the U.S. has contributed to the growth of the U.S. outdoor furniture & kitchen industry. As the economy continues to expand, more consumers have the purchasing power to invest in luxurious outdoor products. Data from the Millionaire Foundry reveals that as of June 2021, there are approximately 18.6 million millionaires in the U.S., representing 7.6% of the adult population. This demographic's growing wealth is fueling demand for high-end outdoor furniture and kitchen items that offer both aesthetic value and functionality.

Innovation remains a key driver in the U.S. outdoor furniture & kitchen industry. Manufacturers are constantly exploring new materials and designs that balance sustainability with cost-effectiveness. The use of eco-label certified furniture is gaining traction as companies increasingly adopt green marketing strategies to appeal to environmentally conscious consumers. These efforts not only contribute to the sustainability of the U.S. outdoor furniture & kitchen industry but also create new opportunities for eco-friendly outdoor products in households across the country. As consumer preferences evolve, the market continues to adapt, presenting new growth prospects.

Product Insights

Outdoor furniture held a market share of about 74% in 2024 in the overall U.S. outdoor furniture & kitchen industry. Consumers have been spending more time at home since the pandemic. Strict lockdowns and movement restrictions encouraged families to utilize their decks and yards. Activities like backyard parties and gatherings have been increasing all over the country. These activities are a primary reason behind the significant rise in demand for outdoor furniture. A 2021 YouGov poll of 17,440 U.S. adults indicates that Americans tend to prefer outdoor dining set-ups (41%), this implies high demand for outdoor furniture.

Demand for outdoor kitchens is projected to grow at a CAGR of 7.5% from 2024 to 2030. This is expected to grow as people seek to create an outdoor living space that combines functionality, convenience, and aesthetics. With advances in technology and design, outdoor kitchens are becoming more affordable and accessible, making them an increasingly popular choice for homeowners.

Material Insights

Wooden outdoor furniture accounted for a share of about 53% of the overall outdoor furniture & kitchen industry in 2023. Wood does not have any creep problem to extent and shape. It is much stronger in load-bearing for both chairs and tables, owing to which this material can support a heavier load without breaking down. Furthermore, wood can be repainted and re-polished after years of usage to bring the luster back. Wooden chairs and tables also require less maintenance. Owing to its advantages, consumers prefer this material furniture.

Demand for plastic outdoor furniture is expected to grow at a CAGR of 7.0% from 2025 to 2030. Plastic tables and chairs are commonly seen in households, offices, commercial establishments, and even in schools and academic institutions. Compared to metal or wooden furniture, plastic furniture is more affordable. They are also stylish and comfortable to sit on, making them ideal for kids who are required to sit for hours doing homework or other in-home activities. Its affordability and versatility are major factors that will boost this segment in the future.

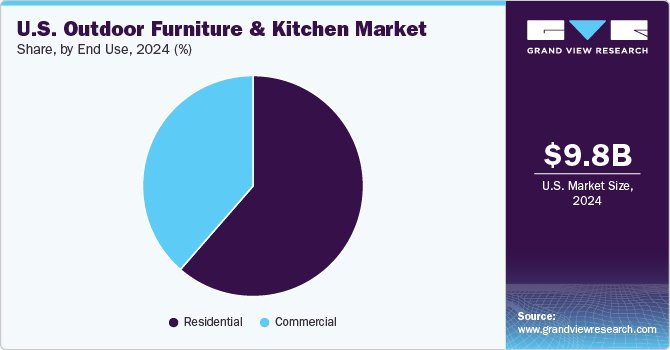

End Use Insights

Residential use of outdoor furniture & kitchen in the U.S. accounted for a share of about 61% in 2024. Outdoor kitchens have quickly become common compared to their earlier use by high-end custom homes. Today, it is becoming common to see families cooking outdoors. With an increase in the size of the house, people are expanding their backyard spaces, and this is mostly utilized as an aesthetic-looking kitchen space, usually with a barbecue and grill setup. This trend has been boding well for residential end-use applications.

Demand for outdoor furniture & kitchen in commercial settings is set to increase at a CAGR of 7.5% from 2025 to 2030. The National Restaurant Association (NRA)'s 2021 State of the Restaurant Industry report shows that 62% of fine dining and 56% of casual dining operators have dedicated more resources to developing and expanding outdoor dining since the start of the COVID-19 pandemic. This trend has been offering strong growth opportunities to the outdoor furniture and kitchen industry in the commercial segment.

Country Insights

California Outdoor Furniture And Kitchen Market Trends

The California outdoor furniture & kitchen market accounted for a share of about 11% of the U.S. region. The market here thrives due to the state’s climate, which allows year-round use of outdoor spaces, making them an extension of the home. The demand for luxurious yet durable materials like stainless steel and granite reflects homeowners' focus on combining style and functionality. This market also benefits from design trends prioritizing seamless indoor-outdoor transitions, emphasizing California’s emphasis on lifestyle-centric home investments.

Colorado Outdoor Furniture And Kitchen Market Trends

The Colorado outdoor furniture & kitchen market is projected to grow at a CAGR of about 10.5% from 2025 to 2030. Demand here is set to rise due to the state's strong culture of outdoor living and entertainment. Homeowners are increasingly investing in outdoor kitchens to boost property equity while creating functional and luxurious spaces that enhance their lifestyle. Colorado’s scenic beauty and favorable climate make outdoor dining and gatherings highly appealing. In addition, the growing focus on energy efficiency and sustainable living further drives the adoption of outdoor cooking setups, aligning with modern consumer preferences.

Key U.S. Outdoor Furniture And Kitchen Company Insights

The U.S. outdoor furniture & kitchen industry is fragmented in nature. The market is characterized by the presence of a diverse array of players-from large corporations to smaller regional/local providers. Some of the leading players in the market are Inter IKEA Holding B.V., Ashley Furniture Industries, Inc., Brown Jordan, Keter Group, and others.

Key U.S. Outdoor Furniture And Kitchen Companies:

- Inter IKEA Holding B.V.

- Ashley Furniture Industries, Inc.

- Brown Jordan

- Keter Group

- Agio International

- Lloyd Flanders, Inc.

- Barbeques Galore

- Century Furniture LLC

- Kimball International Inc.

- Restoration Hardware

Recent Developments

-

In August 2024, POLYWOOD launched a kids' outdoor furniture line, offering Adirondack chairs, rocking chairs, benches, picnic tables, and dining sets. Available in 14 vibrant colors, the collection mirrored the brand's adult designs, emphasizing style, durability, and sustainability. POLYWOOD aimed to foster a love for the outdoors in children with these low-maintenance, weatherproof pieces.

-

In February 2024, RH unveiled 18 outdoor furniture collections for 2024, inspired by diverse styles ranging from Spanish elegance to contemporary and mountain aesthetics. The launch featured collaborations, including the “Lindon” collection by RH and Alex Bernhardt Jr., showcasing teak lounge, dining, and pool furniture in natural and aged finishes.

U.S. Outdoor Furniture And Kitchen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.47 billion

Revenue forecast in 2030

USD 14.60 billion

Growth Rate (Revenue)

CAGR of 6.9% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, state.

State scope

California, Texas, Florida, Pennsylvania, Illinois, Ohio, New Jersey, Arizona, Colorado, Others

Key companies profiled

Inter IKEA Holding B.V., Ashley Furniture Industries, Inc., Brown Jordan, Keter Group, Agio International, Lloyd Flanders, Inc., Barbeques Galore, Century Furniture LLC, Kimball International Inc., Restoration Hardware.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Outdoor Furniture & Kitchen Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. outdoor furniture and kitchen market report by product, material, application, and state.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Outdoor Furniture

-

Seating Sets

-

Loungers

-

Dining Sets

-

Chairs

-

Table

-

Others

-

-

Kitchen

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Plastic

-

Metal

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

-

State Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

California

-

Texas

-

Florida

-

Pennsylvania

-

Illinois

-

Ohio

-

New Jersey

-

Arizona

-

Colorado

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. outdoor furniture and kitchen market was estimated at USD 9.84 billion in 2024 and is expected to reach USD 10.47 billion in 2025.

b. The U.S. outdoor furniture and kitchen market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 14.60 billion by 2030.

b. California state dominated the U.S. outdoor furniture & kitchen market with a share of about 11% in 2024. This is owing to its majority in terms of outdoor kitchen spaces. This high penetration of outdoor kitchen along with favorable climate for outdoor dining is driving the market for outdoor furniture & kitchen in the state.

b. Some key players operating in the U.S. outdoor furniture and kitchen market include Inter IKEA Holding B.V.; Ashley Furniture Industries, Inc.; Brown Jordan; Keter Group; Agio International ; Lloyd Flanders, Inc.; Barbeques Galore ; Century Furniture LLC ; Restoration Hardware; Kimball International Inc.

b. Key factors that are driving the U.S. outdoor furniture and kitchen market growth includes growth of luxury residential market, trend of outdoor parties and barbeques, increase in consumers’ disposable income, rising spending on home remodeling projects, and growing preference for sustainable furniture.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."